Company OverviewVeeva Systems is a leading provider of industry-specific cloud software for the global life sciences industry. The company offers a suite of applications for customer relationship management (CRM), content management, data, and analytics tailored to pharmaceutical and biotechnology companies. Veeva’s software enables clients to streamline regulatory processes, accelerate product time-to-market, and enhance compliance. Founded in 2007, Veeva has grown rapidly by focusing on vertical SaaS—delivering mission-critical solutions to a highly regulated and data-heavy sector. Its clients include the majority of the world’s top 20 pharmaceutical firms.

Founding, Products, and EvolutionVeeva Systems was founded in 2007 by Peter Gassner, who previously held executive roles at Salesforce and PeopleSoft. The company was initially bootstrapped with investment from Emergence Capital, one of the first VCs to back vertical SaaS businesses. Veeva launched with its flagship product, Veeva CRM, built on Salesforce’s Force.com platform and tailored for pharmaceutical field sales. Over time, it expanded into clinical, regulatory, quality, and safety applications through its Veeva Vault platform—a content and data management suite.Headquartered in Pleasanton, California, Veeva now serves over 1,000 customers in the life sciences sector, including Pfizer, Merck, Novartis, and smaller biotech firms. It became a public benefit corporation in 2021, with a long-term focus on balancing stakeholder interests and industry impact.

Market Landscape and Growth ProspectsVeeva operates within the life sciences IT software market—a niche within the broader healthcare technology space. This market is projected to grow from approximately $10 billion in 2023 to over $20 billion by 2030, representing a CAGR of 10%–12%. Key drivers include the increased digitalization of R&D, stricter regulatory environments, and the rise of personalized medicine and decentralized clinical trials.Veeva is especially well-positioned in the Clinical and Regulatory Information Management sub-segments, where digital transformation is accelerating. Cloud adoption in these historically paper-driven processes is still in the early innings, giving Veeva ample room for growth.

Competitive LandscapeKey competitors include IQVIA, Medidata (owned by Dassault Systèmes), Oracle Health Sciences, and smaller cloud-native platforms like Sparta Systems. While IQVIA competes directly with Veeva in CRM and data, Medidata dominates the clinical trial data capture segment, and Oracle offers a broader enterprise suite.However, Veeva’s specialization and end-to-end cloud suite uniquely cater to the life sciences workflow—from R&D through commercialization—setting it apart in depth and integration.

Differentiation and MoatVeeva’s primary differentiation lies in its industry-specific focus, deep domain expertise, and high switching costs. By delivering purpose-built applications aligned to regulatory standards like GxP and 21 CFR Part 11, Veeva embeds itself deeply into customer workflows. Its products are modular but integrated, enabling clients to start with CRM and expand into Vault Clinical, Quality, or Regulatory.Moreover, its public benefit corporation status and long-term alignment with industry values have enhanced trust, especially among biopharma executives concerned with data security and sustainability.

Leadership TeamPeter Gassner (CEO & Founder) – A former executive at Salesforce and PeopleSoft, Gassner architected the Force.com platform before founding Veeva. As CEO since inception, he has steered the company through its IPO and global expansion.Brent Bowman (CFO) – Appointed in 2021, Bowman brings financial leadership from roles at Illumina and Salesforce. He has helped scale Veeva’s financial operations while maintaining profitability and cash flow discipline.Elena Bonfiglioli (Board Member) – With a background in healthcare strategy at Microsoft, Bonfiglioli strengthens Veeva’s health-tech and European market outlook.

Financial Performance (Last 5 Years)Veeva’s revenue has grown from $1.1 billion in FY2020 to $2.3 billion in FY2024, representing a 5-year CAGR of approximately 15%. This growth has been driven by strong adoption of Veeva Vault and consistent expansion in CRM, especially as existing customers increased product usage.Net income rose from $301 million in FY2020 to $577 million in FY2024, reflecting a 5-year CAGR of around 14%. Operating margins have remained strong, typically above 25%, supported by high subscription gross margins.On the balance sheet, Veeva maintains a debt-free position with over $3 billion in cash and short-term investments as of FY2024, giving it ample flexibility for R&D, acquisitions, or stock buybacks. Its free cash flow generation has been consistently strong, with FCF margins exceeding 30% in recent years.

Bull Case for VeevaIndustry Tailwinds: Strong demand for digital transformation in life sciences, especially in clinical trials and regulatory operations.High Switching Costs: Deeply integrated systems make Veeva difficult to replace, leading to high net revenue retention rates (~120%).Expansion Opportunities: Entry into adjacent verticals (e.g., MedTech) and geographies, along with new offerings like Compass (commercial data analytics).

Bear Case for VeevaSalesforce Dependency: Veeva CRM still runs on Salesforce, creating platform risk despite ongoing plans to migrate to Veeva Vault CRM.Competition from Big Tech: Oracle and Microsoft are investing heavily in healthcare cloud, potentially encroaching on Veeva’s turf.Client Consolidation Risk: Large pharmaceutical mergers could reduce the number of enterprise contracts or trigger vendor reassessments.

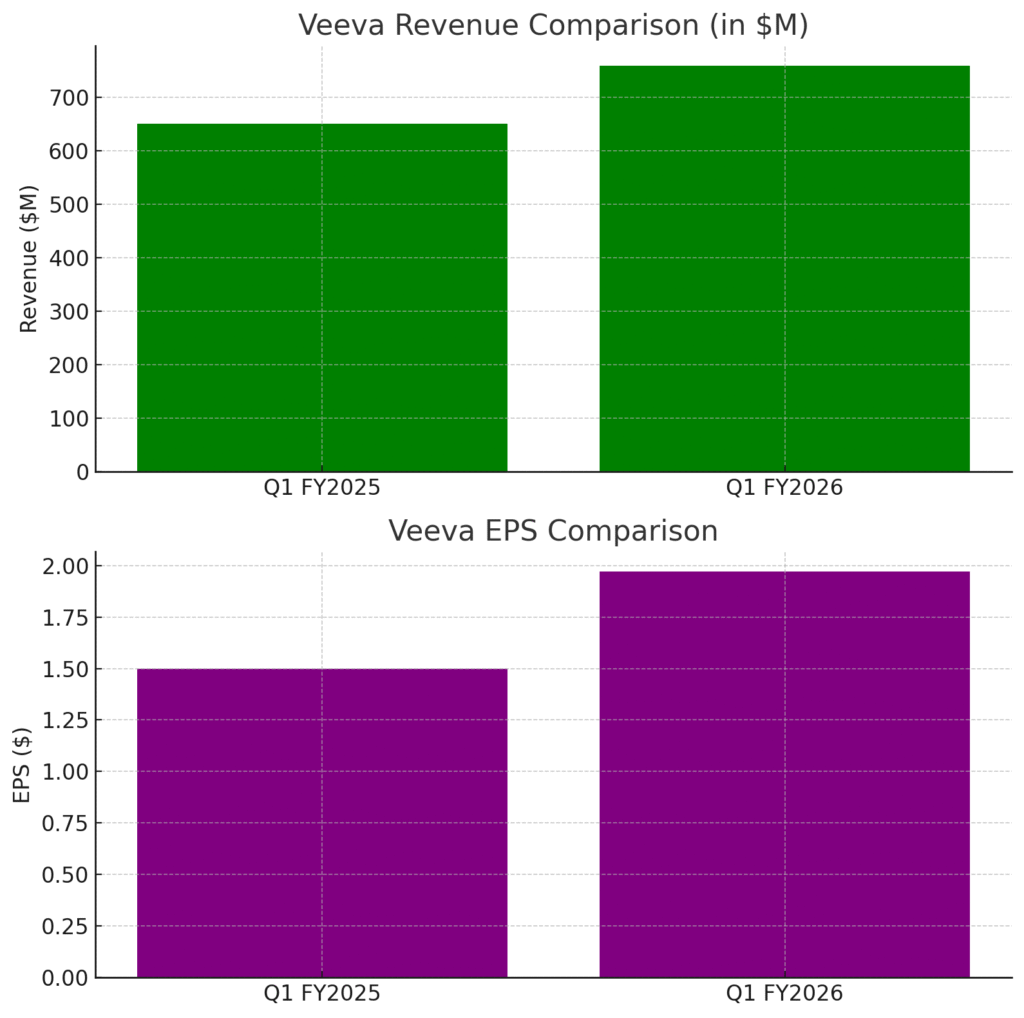

In the first quarter of fiscal year 2026, Veeva reported total revenues of $759.0 million, marking a 17% increase compared to the same quarter last year. Subscription services revenues were $634.8 million, up 19% year-over-year, while services revenues totaled $124 million, a 7% increase. The company’s non-GAAP operating income was $349.9 million, representing 46% of total revenue. Adjusted earnings per share (EPS) stood at $1.97, surpassing analyst expectations of $1.74 and up from $1.50 in the previous year.

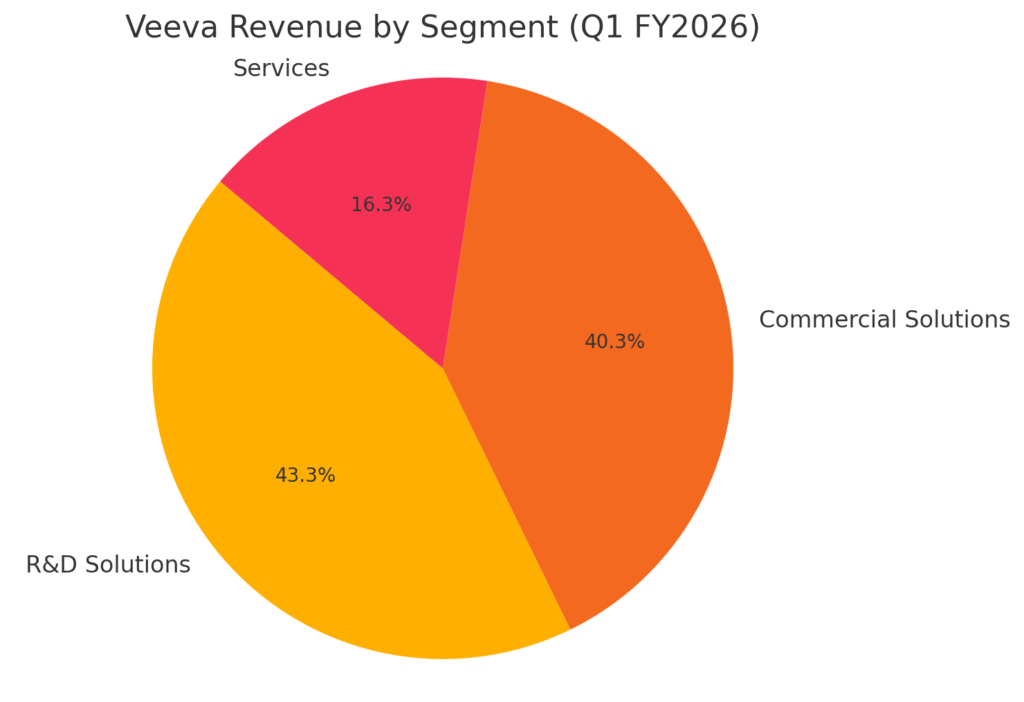

Veeva’s revenue is primarily driven by its subscription services, which accounted for approximately 84% of total revenue in Q1 FY2026. Within this segment, R&D Solutions contributed $329 million, while Commercial Solutions added $306 million. The services segment, encompassing professional services and training, contributed $124 million.

Looking ahead, Veeva has raised its full-year fiscal 2026 revenue guidance to a range of $3.09 billion to $3.10 billion, up from the previous estimate of $3.04 billion to $3.055 billion. The company also anticipates adjusted EPS of $7.63 for the full year. For the second quarter, Veeva expects revenues between $766 million and $769 million, with an adjusted EPS of $1.89 to $1.90.

The stock is consolidating stage 1 on the monthly and weekly chart and has been range bound. On the daily chart it just moved over a key resistance post earnings with a big move higher to $269 range, with the next stop being $280 range, and likely higher to $300 over the next few weeks. We would use this opportunity to trade the stock to the $300 range.