Background

Workday, Inc. (NASDAQ: WDAY) is a leading provider of enterprise cloud applications for finance and human resources.Founded in 2005 by Dave Duffield and Aneel Bhusri, the company offers a suite of software solutions designed to help organizations manage their financial and human capital operations. Headquartered in Pleasanton, California, Workday serves a diverse range of industries across the globe. The company’s platform integrates advanced technologies, including artificial intelligence, to deliver real-time insights and analytics. With a commitment to innovation and customer satisfaction, Workday has established itself as a key player in the enterprise software market.

Recent Earnings

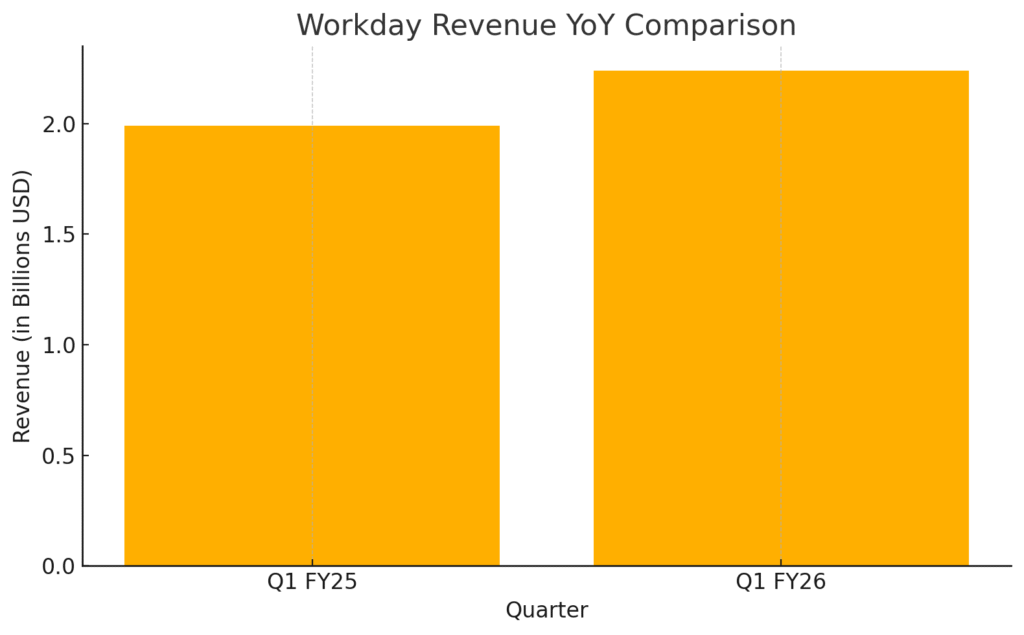

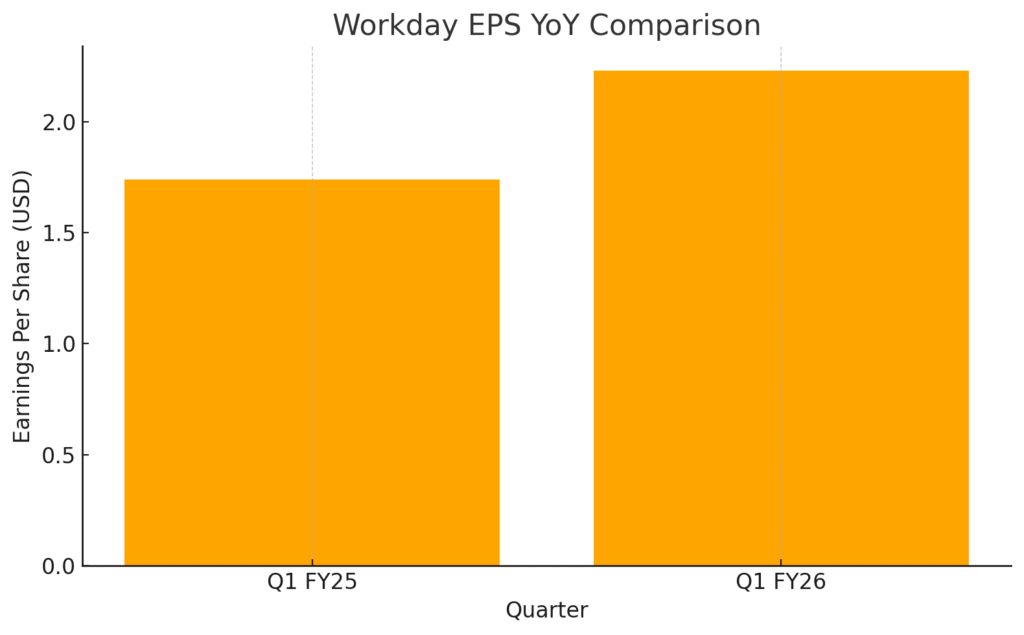

In its fiscal 2026 first quarter, reported on May 22, 2025, Workday announced total revenues of $2.24 billion, marking a 12.6% increase year-over-year. Subscription revenues reached $2.06 billion, up 13.4% from the previous year. The company reported earnings per share (EPS) of $2.23, surpassing the consensus estimate of $1.99. Despite these positive results, Workday’s stock experienced a decline due to lower-than-expected guidance for Q2 subscription revenue. The company projected Q2 subscription revenue of $2.13 billion to $2.14 billion, below analysts’ expectations of $2.15 billion. For the full fiscal year, Workday maintained its guidance for total revenues between $9.9 billion and $10.0 billion.

Founding and Growth

Workday was founded in March 2005 by Dave Duffield and Aneel Bhusri, both former executives at PeopleSoft. The company was established in response to Oracle’s acquisition of PeopleSoft, with the founders aiming to create a new generation of enterprise applications. Initially funded by Duffield and venture capital firm Greylock Partners, Workday launched its first product in 2006. The company went public in October 2012, raising $637 million in its initial public offering. Over the years, Workday has expanded its product offerings through strategic acquisitions, including the purchase of Adaptive Insights in 2018 for $1.55 billion.

Product Offerings and Competitors

Workday’s core products include Human Capital Management (HCM), Financial Management, and Workday Adaptive Planning. These cloud-based applications are designed to provide organizations with real-time data and analytics to support decision-making processes. The company’s platform leverages artificial intelligence and machine learning to enhance user experience and automate routine tasks. Workday faces competition from several major players in the enterprise software market, including Oracle, SAP SuccessFactors, and ADP. These competitors offer similar solutions in HCM and financial management, making the market highly competitive.

Market Landscape

Workday operates in the enterprise cloud applications market, which encompasses solutions for human resources, finance, and planning. The global market for HCM software is projected to grow significantly, driven by the increasing adoption of cloud-based solutions and the need for digital transformation. According to Grand View Research, the North American HR software market alone generated $5.66 billion in revenue in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2024 to 2030.

In addition to HCM, the market for financial management software is also expanding, as organizations seek integrated solutions to manage their financial operations. Workday’s comprehensive suite of applications positions it well to capitalize on these growth opportunities. The company’s focus on innovation and customer-centric solutions enables it to meet the evolving needs of businesses in a rapidly changing technological landscape.

Competitive Differentiation

Workday differentiates itself from competitors through its unified platform that integrates HCM, financial management, and planning applications. This integration allows for seamless data flow and real-time analytics across various business functions. Additionally, Workday’s commitment to user experience, continuous innovation, and customer satisfaction sets it apart in the enterprise software market. The company’s use of artificial intelligence and machine learning enhances its product offerings, providing customers with advanced tools for decision-making and automation.

Management Team

Workday’s leadership team comprises experienced professionals with a deep understanding of the enterprise software industry. Co-founder Aneel Bhusri serves as Executive Chair, bringing strategic vision and industry expertise to the company. Carl Eschenbach, who joined Workday in 2022, serves as CEO, overseeing the company’s operations and growth initiatives. Under their leadership, Workday continues to innovate and expand its market presence.

Financial Performance

Over the past five years, Workday has demonstrated consistent revenue growth, with a five-year CAGR of 18.4%. In fiscal 2025, the company reported total revenues of $8.45 billion, a 16.4% increase from the previous year. Net income for the year was $1.38 billion, reflecting the company’s focus on profitability and operational efficiency. Workday’s balance sheet remains strong, with total assets of $16.5 billion and equity of $8.08 billion as of January 31, 2024.

Bull Case

- Strong revenue growth with a five-year CAGR of 18.4%.

- Robust financial performance with increasing profitability and a strong balance sheet.

- Strategic acquisitions and continuous innovation enhancing product offerings.

Bear Case

- Intense competition from established players like Oracle and SAP, potentially impacting market share.

- Dependence on large enterprise clients may expose the company to revenue fluctuations.

- Economic downturns could affect clients’ IT spending, impacting Workday’s growth.

The stock is in a stage 1 natural consolidation on the monthly chart. The weekly chart is in as stage 2 markup (bullish) but the daily chart post the earnings has a move lower to the $244 range where there is support. The near term move to $236 – $244 should be a good entry for the medium term.