XPeng Inc. (NYSE: XPEV) is a leading Chinese electric vehicle (EV) manufacturer known for its focus on smart mobility and autonomous driving technologies. Founded in 2014, the company designs, develops, and manufactures a range of intelligent EVs, including sedans and SUVs, integrating advanced driver-assistance systems and AI capabilities. XPeng’s product lineup includes models like the P7+, G6, and Mona M03, which have garnered attention for their innovative features and competitive pricing. Headquartered in Guangzhou, China, XPeng has expanded its presence internationally, with offices in the United States and Europe, aiming to capture a share of the global EV market. The company’s commitment to technological advancement positions it as a formidable competitor in the rapidly evolving EV industry.

Recent Earnings and Financial Performance

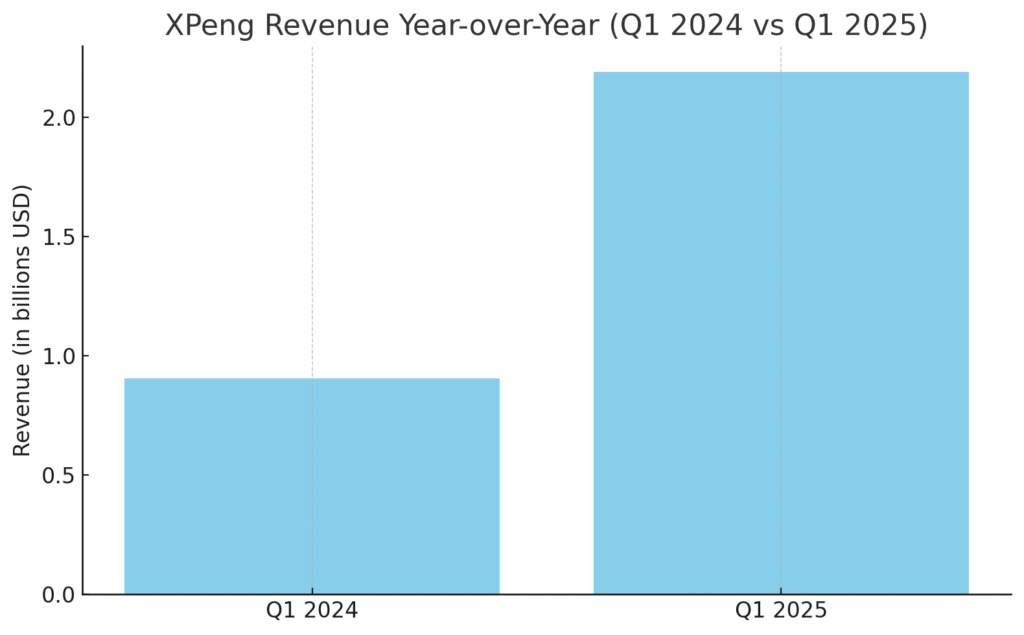

In the first quarter of 2025, XPeng reported a significant year-over-year revenue increase of 141.5%, reaching approximately $2.18 billion. The company delivered 94,008 vehicles during this period, marking a 330.8% increase compared to the same quarter in the previous year. XPeng’s gross margin improved to 15.6%, up from 12.9% a year earlier, while the vehicle margin rose to 10.5% from 5.5%. The net loss narrowed to $0.09 billion, a substantial improvement from the $1.37 billion loss reported in Q1 2024. Looking ahead, XPeng forecasts Q2 2025 deliveries between 102,000 and 108,000 vehicles, representing a 240% increase year-over-year, and expects to achieve profitability by Q4 2025.

Company Background and Product Portfolio XPeng Inc., officially known as Guangzhou Xiaopeng Motors Technology Co., Ltd., was founded in 2014 by He Xiaopeng and Henry Xia. The company has secured funding from prominent investors, including Alibaba Group, and went public on the New York Stock Exchange in 2020, followed by a listing on the Hong Kong Stock Exchange in 2021.XPeng’s product lineup features several smart EVs, such as the P7 and P7+, G6, G7, G9 SUVs, and the Mona M03 sedan.These vehicles are equipped with advanced technologies like the XPILOT driver-assistance system and the Xmart OS, enhancing the driving experience through AI integration. XPeng’s headquarters are located in Guangzhou, with additional offices in Mountain View, California, and Munich, Germany, supporting its international expansion efforts.

Market Landscape and Growth Projections XPeng operates within the global electric vehicle market, which is experiencing rapid growth due to increasing environmental concerns and supportive government policies. The global EV market is projected to reach significant milestones by 2030, with expectations of substantial compound annual growth rates (CAGR). Specifically, the software-defined vehicle (SDV) market, integral to XPeng’s offerings, is anticipated to grow from $213.5 billion in 2024 to $1.23 trillion by 2030, reflecting a CAGR of 34.0%. This growth underscores the increasing demand for vehicles that integrate advanced software and connectivity features, aligning with XPeng’s strategic focus.

Competitive Landscape XPeng faces competition from both domestic and international EV manufacturers. Key competitors include Tesla, NIO, Li Auto, and BYD, each offering a range of electric vehicles with varying features and price points. While Tesla is renowned for its global presence and technological advancements, Chinese competitors like NIO and Li Auto have gained significant market share through localized strategies and innovative offerings. XPeng differentiates itself through its emphasis on smart features, autonomous driving capabilities, and a commitment to integrating AI into its vehicles, positioning it uniquely in the competitive landscape.

Unique Differentiation XPeng distinguishes itself from competitors through its robust integration of artificial intelligence and proprietary technologies. The company has developed its own AI-powered operating system, Xmart OS, and the XPILOT driver-assistance system, enhancing vehicle intelligence and user experience. Additionally, XPeng’s commitment to innovation is evident in its development of the XPENG Turing chip and a 72-billion parameter foundation model, aiming to advance autonomous driving capabilities. These technological investments underscore XPeng’s strategy to lead in the smart EV segment by offering vehicles that are not only electric but also intelligent and connected.

Management Team XPeng’s leadership comprises experienced professionals with backgrounds in technology and automotive industries. He Xiaopeng, co-founder and CEO, brings a wealth of experience from his previous role as co-founder of UCWeb Inc., a mobile internet software company. Fengying Wang serves as the President, contributing her extensive experience in the automotive sector. Brian Gu, Vice Chairman and President, oversees the company’s financial strategy and international expansion, leveraging his background in investment banking and corporate finance.

Financial Performance Overview Over the past five years, XPeng has demonstrated significant growth in revenue and vehicle deliveries. The company’s revenue increased from approximately $2.32 billion in 2019 to $30.68 billion in 2023, reflecting a strong CAGR. This growth is attributed to the successful launch of new models and expansion into international markets. Despite operating losses in earlier years, XPeng has shown improvements in gross margins and a narrowing of net losses, indicating a path toward profitability. The company’s balance sheet reflects substantial investments in research and development, supporting its commitment to innovation and long-term growth.

Bull Case for XPeng Stock Rapid revenue growth and increasing vehicle deliveries position XPeng as a strong player in the EV market. Innovative technologies, including proprietary AI systems and autonomous driving capabilities, differentiate XPeng from competitors.Strategic international expansion and partnerships enhance XPeng’s global presence and market reach.

Bear Case for XPeng Stock Intense competition in the EV market may pressure XPeng’s market share and margins.Regulatory challenges and changes in government subsidies could impact profitability.High R&D expenditures and capital investments may strain financial resources if not managed effectively.

The stock has a bullish cup and handle on the weekly chart with a stage 4 markdown that is reversing. The stock should get to the $24 range after a move lower to the $19 where it would be a good entry for the long term.