Sea Limited (NYSE: SE) is a Singapore-based global consumer internet company operating across three primary segments: e-commerce (Shopee), digital entertainment (Garena), and digital financial services (SeaMoney). Founded in 2009 as Garena, it rebranded to Sea Limited in 2017 to reflect its diversified business model. The company has established a strong presence in Southeast Asia and has expanded into Latin America. Sea Limited went public on the New York Stock Exchange in 2017 and has since grown into one of Southeast Asia’s most prominent tech conglomerates.

In the first quarter of 2025, Sea Limited reported GAAP revenue of $4.8 billion, marking a 29.6% year-over-year increase.The company achieved a net income of $410.8 million, a significant turnaround from a net loss of $23.0 million in the same period the previous year. Adjusted earnings per share (EPS) were $0.65, which fell short of the consensus estimate of $0.93. Adjusted EBITDA more than doubled to $946.5 million from $401.1 million in Q1 2024.

Sea Limited was founded in 2009 by Forrest Li as Garena, initially focusing on digital entertainment. The company rebranded to Sea Limited in 2017 after raising $550 million in funding. Sea operates three main platforms: Garena (digital entertainment), Shopee (e-commerce), and SeaMoney (digital financial services). Garena is known for publishing popular games like Free Fire, Shopee is a leading e-commerce platform in Southeast Asia and Taiwan, and SeaMoney offers digital financial services including payments and loans. The company’s headquarters are located at 1 Fusionopolis Place, Singapore.

Sea Limited operates in the rapidly growing digital economy of Southeast Asia, a region with a population exceeding 670 million. The e-commerce market in Southeast Asia is projected to reach $665.77 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.1% from 2023 to 2030. This growth is driven by increasing internet penetration, a young and tech-savvy population, and rising disposable incomes.

Sea faces competition from various regional and global players. In e-commerce, competitors include Alibaba’s Lazada, PDD Holdings’ Temu, and ByteDance’s TikTok Shop. In digital entertainment, competitors include Tencent and other global gaming companies. Despite the competition, Sea has maintained a strong market position, particularly with Shopee’s dominance in Southeast Asia.

Sea’s unique differentiation lies in its integrated ecosystem that combines e-commerce, digital entertainment, and financial services. This synergy allows the company to cross-leverage user bases and data across platforms, enhancing user engagement and monetization. For example, Garena’s popular games drive traffic to Shopee, while SeaMoney facilitates seamless transactions across both platforms.

The management team is led by founder and CEO Forrest Li, who has been instrumental in steering the company’s growth and diversification. Under his leadership, Sea has expanded its footprint across Southeast Asia and into Latin America.The company’s strategic vision and execution have been key factors in its success.

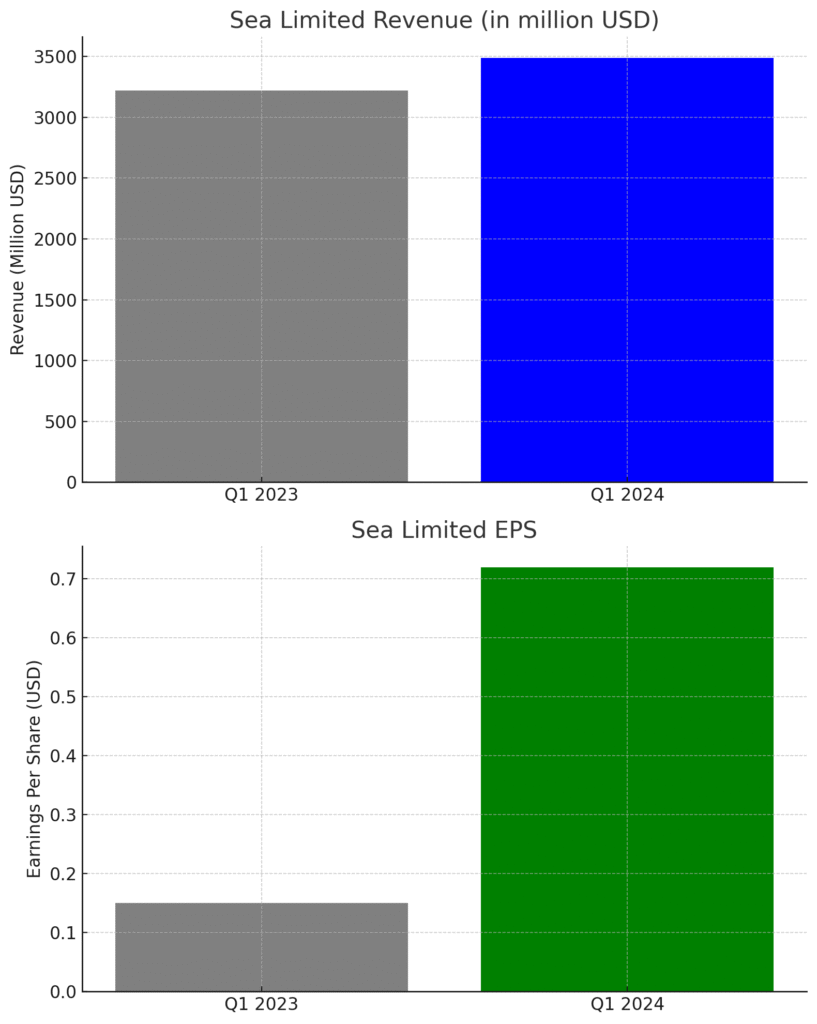

Over the past five years, Sea Limited has demonstrated significant financial growth. Revenue has increased from $2.2 billion in 2018 to $13.1 billion in 2023, reflecting a CAGR of approximately 43%. The company achieved its first annual profit in 2023, with a net income of $162.7 million. This profitability milestone was driven by strong performance across all business segments, particularly Shopee and SeaMoney.

Bull Case for Sea Limited:

- Strong growth in Southeast Asia’s digital economy provides a favorable environment for Sea’s integrated platform.

- Shopee’s dominance in e-commerce and expansion into new markets like Latin America offer significant growth opportunities.

- SeaMoney’s digital financial services complement the e-commerce and gaming platforms, enhancing user engagement and monetization.

Bear Case for Sea Limited:

- Intensifying competition from regional and global players could pressure margins and market share.

- Regulatory challenges in different markets may impact operations and expansion plans.

- Sustaining profitability while investing in growth initiatives remains a critical challenge.