CyberArk Software Ltd. (NASDAQ: CYBR) is a leading cybersecurity firm specializing in identity security and privileged access management (PAM). Founded in 1999 and headquartered in Newton, Massachusetts, CyberArk offers solutions that protect organizations from cyber threats by securing privileged accounts, credentials, and secrets. The company’s product suite includes the CyberArk Identity Security Platform, which provides comprehensive protection across cloud and hybrid environments. CyberArk serves a global customer base across various industries, including finance, healthcare, and government sectors. The company is publicly traded and has established itself as a trusted partner in the cybersecurity landscape.

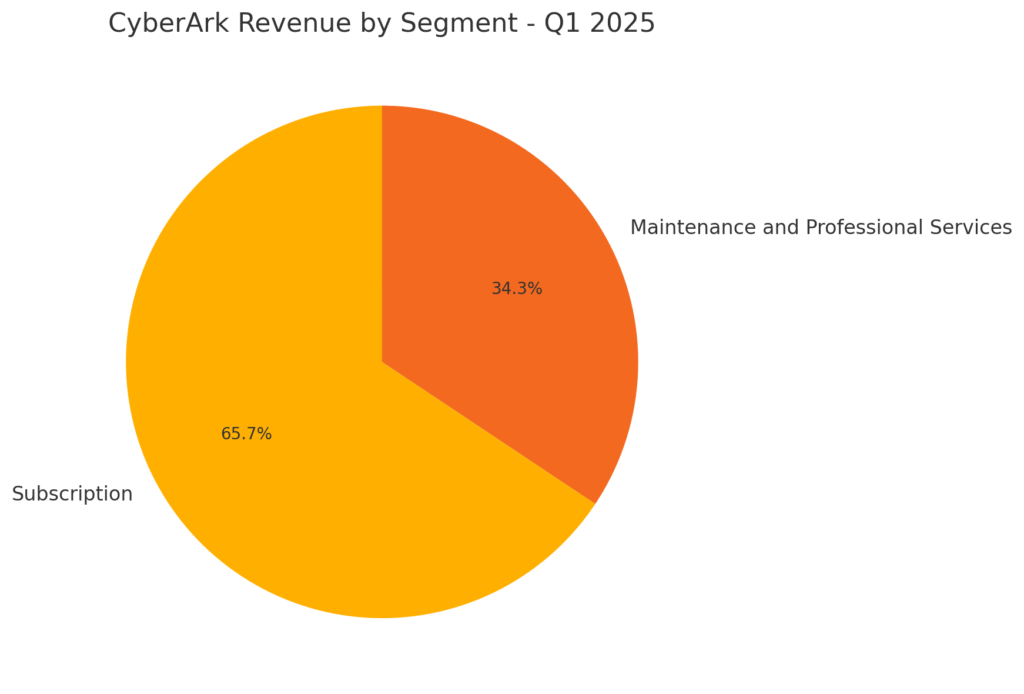

On May 13, 2025, CyberArk reported its first-quarter financial results. The company achieved earnings per share (EPS) of $0.98, surpassing the Zacks Consensus Estimate of $0.79 and improving from $0.75 in the same quarter the previous year.Revenue for the quarter reached $317.6 million, up from $221.55 million year-over-year. Looking ahead, CyberArk provided guidance for the next quarter, projecting EPS between $0.74 and $0.81 and revenue ranging from $312.0 million to $318.0 million. For the full year, the company anticipates EPS between $3.73 and $3.85 and revenue between $1.313 billion and $1.323 billion.

CyberArk was founded in 1999 by Udi Mokady, who played a pivotal role in establishing the company’s vision and direction. The company has raised approximately $59 million in funding from investors such as JVP and Goldman Sachs.CyberArk’s product offerings focus on securing privileged accounts and identities, with solutions like the CyberArk Privileged Access Manager and the CyberArk Identity Security Platform. These products are designed to protect against cyber threats by controlling and monitoring privileged access across IT environments. CyberArk’s headquarters are located in Newton, Massachusetts, and the company operates globally, serving clients across various industries.

The cybersecurity market, particularly the privileged access management (PAM) segment, is experiencing significant growth. The global PAM market is projected to reach $16.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 21.1%. This growth is driven by increasing cyber threats, regulatory compliance requirements, and the adoption of digital transformation initiatives across organizations. CyberArk, as a leading provider in this space, is well-positioned to capitalize on these market trends.

CyberArk operates in a competitive landscape with several notable players. Key competitors include BeyondTrust, Delinea, IBM, Broadcom, Microsoft Entra ID, and Okta. These companies offer various identity and access management solutions, competing with CyberArk in areas such as privileged access management, identity governance, and cloud security. Despite the competition, CyberArk maintains a strong market position due to its specialized focus and comprehensive product offerings.

CyberArk differentiates itself through its deep specialization in privileged access management and identity security. The company’s solutions are designed to address complex security challenges by providing robust controls over privileged accounts and credentials. CyberArk’s commitment to innovation, as evidenced by its continuous product enhancements and strategic acquisitions, further strengthens its competitive edge. This focus allows CyberArk to offer tailored solutions that meet the specific needs of organizations seeking to secure their critical assets.

The management team at CyberArk comprises experienced professionals with a strong background in cybersecurity and business leadership. Matthew Cohen serves as the Chief Executive Officer, bringing extensive experience in driving strategic initiatives and operational excellence. Erica Smith holds the position of Chief Financial Officer, overseeing the company’s financial strategy and operations. Shahar Layani is the Chief Customer Officer, responsible for enhancing customer experiences and ensuring the successful implementation of CyberArk’s solutions.

Over the past five years, CyberArk has demonstrated consistent financial growth. The company’s revenue has increased from $343 million in 2019 to $751.89 million in 2024, reflecting a compound annual growth rate (CAGR) of approximately 17.6%. This growth is attributed to the rising demand for cybersecurity solutions and CyberArk’s ability to expand its customer base. While earnings have experienced fluctuations, the company’s strategic investments and focus on innovation position it for sustained profitability. CyberArk maintains a strong balance sheet, enabling it to invest in research and development, pursue strategic acquisitions, and support its long-term growth objectives.

Bull Case for CyberArk Stock:

- Strong market position in the rapidly growing privileged access management segment, with a projected CAGR of 21.1% through 2030.

- Consistent revenue growth driven by increasing demand for cybersecurity solutions and successful expansion into new markets.

- Strategic acquisitions, such as the planned purchase of Venafi, enhancing product offerings and expanding the total addressable market.

Bear Case for CyberArk Stock:

- Intense competition from established players like IBM, Microsoft, and emerging startups could pressure market share and margins.

- Valuation concerns, with some analyses suggesting the stock may be overvalued based on intrinsic value assessments.

- Potential integration challenges and execution risks associated with large-scale acquisitions, such as the Venafi deal.

The stock is on a stage 4 decline on the monthly and weekly charts and on a reversal stage 2 on the daily chart. The near term support is in the $341 area and resistance in the $393 area. It should head lower before it heads back to the $400 zone.