Executive Summary:

Steven Madden Ltd designs, sources, and markets a wide range of fashion-forward footwear, accessories, and apparel. Starting with chunky platform shoes sold from the trunk of a car, the company’s brands now include Steve Madden, Dolce Vita, Betsey Johnson, and Blondo, among others, and it also licenses brands like Anne Klein.

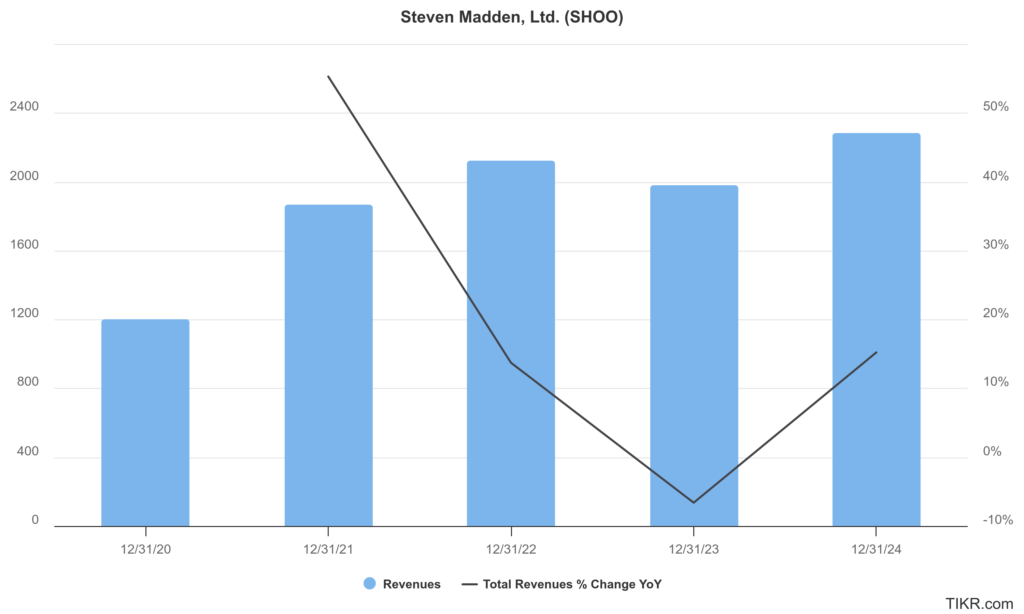

Steven Madden Ltd reported total revenue of $2.28 billion, representing a substantial 15.2% increase compared to the $1.98 billion reported in 2023. The diluted Earnings Per Share (EPS) for the full year 2024 was $2.35, compared to $2.30 in the previous year. Revenue increased by 12.0% to $582.3 million, and the adjusted EPS was $0.55, slightly exceeding the analysts’ consensus estimate of $0.54, while revenue of $582.3 million also surpassed the expected $550.64 million.

Stock Overview:

| Ticker | $SHOO | Price | $20.80 | Market Cap | $1.51B |

| 52 Week High | $50.01 | 52 Week Low | $19.05 | Shares outstanding | 72.58M |

Company background:

Steven Madden Ltd was founded in 1990 by the American shoe designer Steve Madden. Starting with a modest $1,100, Madden began by selling his designs, particularly chunky platform shoes, out of the trunk of his car to small stores in Manhattan. This grassroots approach quickly gained traction, especially after designers like Betsey Johnson featured his shoes in their fashion shows. The company was incorporated in New York on July 9, 1990, and later reincorporated in Delaware in November 1998. In December 1993, while the company thrived, its early association with Stratton Oakmont led to legal challenges for Steve Madden, who was later indicted and served time for securities fraud and money laundering.

The product portfolio of Steven Madden Ltd has expanded significantly since its early days of platform shoes. Today, the company designs, sources, and markets a diverse range of footwear for women, men, and children under various owned brands, including Steve Madden, Steven by Steve Madden, Madden Girl, Freebird by Steven, Stevies, Betsey Johnson, Betseyville, Dolce Vita, Brian Atwood, Report Signature, Report, Big Buddha, Wild Pair, Cejon, Mad Love, and Blondo. Additionally, the company is a licensee for footwear and handbag categories for brands such as Anne Klein and Superga, and it designs and sources products under private label brand names for various retailers. Beyond footwear, Steven Madden also offers handbags, accessories, and apparel, further diversifying its offerings as a lifestyle company. The company operates through wholesale distribution to department stores, mass merchants, and online retailers, as well as through its own direct-to-consumer channels, including brick-and-mortar retail stores and e-commerce websites.

Key competitors of Steven Madden Ltd in the footwear and accessories market include a variety of companies across different price points and styles. Some of the major publicly traded competitors include Crocs (CROX), Wolverine World Wide (WWW), NIKE (NKE), Deckers Outdoor (DECK) (parent company of UGG and Hoka), Skechers U.S.A. (SKX), and Caleres (CAL) (parent company of Famous Footwear and Sam Edelman). Other notable competitors include brands like Michael Kors, Guess, and Coach in the broader fashion and accessories space. These companies compete with Steven Madden across various channels, including wholesale and direct-to-consumer, and in terms of product design, pricing, and brand appeal.

Steven Madden Ltd maintains its principal executive offices and headquarters at 52-16 Barnett Avenue, Long Island City, New York 11104, in the United States. This location serves as the central hub for the company’s operations, encompassing design, marketing, and administrative functions. From its base in New York City, a global fashion capital, Steven Madden oversees its extensive network of wholesale partners, retail stores, e-commerce platforms, and international operations across numerous countries. The Long Island City headquarters is indicative of the company’s roots in the New York fashion scene and its continued presence in a major global market.

Recent Earnings:

Steven Madden Ltd, reported a significant 15.2% increase in revenue, reaching $2.28 billion compared to $1.98 billion in 2023. This growth reflects strong performance across both their wholesale and direct-to-consumer segments. The fourth quarter also showed robust growth, with revenue increasing by 12.0% to $582.3 million from $519.7 million in the same period of the previous year. This performance exceeded analysts’ expectations, which had projected a revenue of $550.64 million for the quarter.

The full year 2024 saw an adjusted diluted Earnings Per Share (EPS) of $2.67, an increase from $2.45 in 2023, representing a growth of 9%. For the fourth quarter, the adjusted EPS was $0.55, which also surpassed the analysts’ consensus estimate of $0.54. It’s worth noting that the reported diluted EPS for the full year was $2.35, slightly higher than the $2.30 reported in the previous year, while the fourth-quarter reported EPS was $0.49, unchanged from the prior year’s comparable quarter.

The wholesale business saw a revenue increase of 13.6% in the fourth quarter, driven by a 1.0% rise in wholesale footwear revenue and a substantial 35.4% increase in wholesale accessories and apparel revenue. The direct-to-consumer segment also performed well, with an 8.4% increase in revenue, fueled by growth in both brick-and-mortar stores and e-commerce. The gross profit margin experienced a slight decline in both the wholesale (30.5% vs. 31.7%) and direct-to-consumer (62.0% vs. 62.7%) segments compared to the same period in 2023, attributed to a greater mix of private label business in wholesale and increased promotional activity in the direct-to-consumer channel.

Steven Madden Ltd anticipates a revenue increase of 17% to 19% for the full year 2025, which includes the expected contribution from the recent acquisition of Kurt Geiger. The company projects a diluted EPS in the range of $2.30 to $2.40 for 2025, which is lower than the adjusted EPS of $2.67 achieved in 2024. The strategic acquisition of Kurt Geiger is expected to strengthen their “accessible luxury” offerings and drive long-term growth, despite potential short-term margin pressures.

The Market, Industry, and Competitors:

Steven Madden Ltd operates within the dynamic and competitive global footwear and accessories market, which is a significant segment of the broader fashion industry. This market encompasses a wide array of products, from athletic and casual footwear to formal shoes, as well as handbags, belts, and other fashion accessories. The industry is influenced by evolving consumer preferences, fashion trends, economic conditions, and technological advancements, including the growth of e-commerce and the increasing demand for sustainable and ethically produced goods. Competition comes from a diverse range of players, including large international brands, specialty retailers, and direct-to-consumer online platforms.

A compound annual growth rate (CAGR) in the range of 4.3% to 6.92% between 2025 and 2030. This growth is expected to be driven by factors such as a rising global population, increasing disposable incomes in emerging economies, and a growing consumer awareness of fashion and personal style. There’s an increasing demand for athleisure and sports-inspired footwear, as well as a rising interest in sustainable and eco-friendly options, which could present both opportunities and challenges for companies like Steven Madden.

Considering these broader market trends, Steven Madden Ltd is positioned to capitalize on the anticipated growth in the footwear and accessories market. The company’s diverse brand portfolio, spanning various price points and styles, allows it to cater to a wide range of consumer segments. The strategic acquisition of Kurt Geiger is also expected to strengthen its presence in the “accessible luxury” segment and provide a platform for further international expansion.

Unique differentiation:

Steven Madden Ltd operates in the highly competitive footwear and accessories market, facing rivalry from a diverse range of companies. These competitors vary in size, target market, and product offerings. Some key competitors include large, well-established footwear and apparel companies like NIKE (NKE), Adidas (ADDYY), and Skechers U.S.A. (SKX), which have significant brand recognition and extensive resources. These companies compete with Steven Madden across various footwear categories, including athletic, casual, and fashion styles.

Steven Madden also faces competition from brands like Nine West (though its parent company has faced financial restructuring), Guess (GES), and previously mentioned Calvin Klein (owned by PVH Corp (PVH)). These brands often target similar demographics and offer comparable styles and price points. Additionally, the rise of fast-fashion retailers like H&M (HNNMY) and Zara (ITX.MC) presents another form of competition, as they can quickly adapt to trends and offer fashionable footwear and accessories at more affordable prices, appealing to price-sensitive consumers.

Steven Madden encounters competition from department stores and online retailers that carry a wide variety of brands, including their private labels. Companies like DSW (DSW Inc.), Nordstrom (JWN), and Macy’s (M) are significant players in the distribution of footwear and accessories, offering consumers numerous choices under one roof or through their e-commerce platforms. The increasing popularity of direct-to-consumer brands and online marketplaces also adds to the competitive landscape, providing consumers with even more options and price points to consider when purchasing footwear and accessories.

Steven Madden Ltd differentiates itself from competitors through a combination of factors that have contributed to its long-standing success in the fashion footwear and accessories market. One key differentiator is its founder-driven, trend-responsive design philosophy. This hands-on approach allows the company to quickly adapt to changing consumer preferences and bring fashionable products to market with speed, a crucial advantage in the fast-paced fashion industry. The company’s “test-and-react” strategy, utilizing their retail stores as a platform to gauge the popularity of new designs before wider wholesale distribution, further enhances this agility and reduces risk.

Steven Madden’s diverse brand portfolio caters to a wide range of consumer segments and price points. Brands like Steve Madden, Dolce Vita, Betsey Johnson, and Blondo each have their distinct identities and target audiences, allowing the company to capture a broader market share than competitors focused on a narrower demographic. The company’s expansion into non-footwear categories such as handbags and apparel, which has seen substantial growth, provides diversification and allows them to capitalize on cross-selling opportunities and evolving consumer lifestyles. The recent acquisition of Kurt Geiger further strengthens their position in the “accessible luxury” segment and expands their international reach, adding another layer of differentiation.

Steven Madden has cultivated a strong multi-channel distribution strategy, encompassing wholesale partnerships with department stores and retailers, as well as a growing direct-to-consumer business through its own retail stores and e-commerce platforms. This balanced approach provides resilience and allows them to connect with consumers through various touchpoints. Their increasing focus on enhancing digital capabilities and the online consumer experience further sets them apart in an evolving retail landscape.

Management & Employees:

Edward Rosenfeld serves as the Chairman and Chief Executive Officer. He has been with the company for a significant period and has played a crucial role in its growth and strategic initiatives, including navigating market trends and overseeing brand development. His leadership is pivotal in setting the overall vision and driving the financial performance of Steven Madden Ltd.

Zine Mazouzi holds the position of Chief Financial Officer. In this role, he is responsible for managing the company’s financial operations, including financial planning, reporting, and investor relations. His expertise is essential for maintaining the company’s financial health and supporting its growth strategies, including acquisitions and expansions.

Steve Madden himself remains deeply involved as the Chief Creative and Design Officer. As the founder, his creative vision and trend forecasting abilities are central to the company’s product development across all its brands. His continued leadership in design ensures that the company stays true to its fashion-forward identity while also innovating with new styles.

Karla Friede holds the position of Executive Vice President and Chief Merchandising Officer. She leads the merchandising strategies across the company’s diverse portfolio of footwear, accessories, and apparel. Her expertise in product selection and market trends ensures that the company’s offerings align with consumer demand and maximize sales.

Financials:

Steven Madden Ltd. has achieved an average annual revenue growth rate (CAGR) of 9.2% during this period, reflecting effective expansion strategies, including international market penetration and product diversification. Revenues increased from approximately $1.6 billion in 2018 to about $2.28 billion by the end of 2024, underscoring the company’s resilience and adaptability in a competitive retail environment.

Earnings growth has been particularly robust, with Steven Madden posting a five-year average annual earnings growth rate of 21.1%. The company’s earnings per share (EPS) grew at a compound annual rate of 6.8% over the same period, indicating that profitability improvements have translated into tangible gains for shareholders. With negative earnings growth of -1.3%, reflecting broader industry challenges and possible short-term headwinds.

The company’s net margin stands at 7.4%, and its return on equity (ROE) is a strong 20.1%, signaling efficient capital allocation and robust operational performance. The company’s total shareholder return (TSR) over the past five years was 25%, with dividends contributing significantly to overall returns, even as the share price growth lagged behind the broader market.

Steven Madden Ltd. has exhibited strong financial health, supported by disciplined growth, profitability, and a resilient balance sheet, positioning it well for future challenges and opportunities.

Technical Analysis:

The stock is in a stage 4 decline on all 3 (monthly, weekly and daily) timeframes and not yet showing a sign of reversal. We would wait for a clear reversal signal to commit to the stock.

Bull Case:

Strong brand portfolio and proven ability to adapt to fashion trends: Steven Madden has a history of successfully identifying and capitalizing on emerging styles, particularly within footwear. The diverse range of brands under its umbrella caters to various consumer segments and price points, providing resilience across different market conditions. The continued creative leadership of Steve Madden himself is seen as a significant asset in maintaining this trend-responsive approach.

Strategic acquisition of Kurt Geiger: This acquisition significantly expands Steven Madden’s presence in the “accessible luxury” market and provides a strong platform for international expansion, particularly in Europe and the Middle East, where Kurt Geiger has a strong foothold. Bulls anticipate that the synergies between the two companies, including leveraging Steven Madden’s sourcing and distribution capabilities with Kurt Geiger’s brand recognition, will drive significant revenue growth and enhance profitability over the long term.

Positive momentum in both the wholesale and direct-to-consumer channels: Recent earnings reports have shown solid growth in both segments, indicating healthy demand for the company’s products. The direct-to-consumer business, including e-commerce, offers higher margins and greater control over the brand experience, and its continued expansion is viewed favorably. Efficient inventory management and a focus on full-price selling in this channel could further boost profitability.

Bear Case:

Ongoing pressures on gross margins: Recent earnings reports have indicated a decline in gross profit margins in both the wholesale and direct-to-consumer segments due to factors like increased promotional activity and a higher mix of private label business in wholesale. If these pressures persist or worsen, they could erode profitability despite revenue growth, making it harder for the company to achieve its earnings targets. Increased tariffs on imported goods also pose a continuous threat to margins.

Macroeconomic headwinds and retail sector challenges: Economic downturns can lead to decreased consumer spending on discretionary items like footwear and accessories. Additionally, the broader retail environment faces challenges such as increasing competition from online retailers, changing shopping behaviors, and potential oversupply in certain categories. These factors could put pressure on sales and profitability.