Executive Summary:

Starbucks Corporation began as a retailer of whole bean coffee, tea, and spices. Inspired by Italian coffee culture, Howard Schultz transformed Starbucks into a coffeehouse serving espresso-based drinks, driving its significant expansion. Today, it stands as the world’s largest coffeehouse chain with over 40,000 stores across 87 countries, offering a variety of hot and cold beverages, food items, and packaged coffees. Starbucks’ mission is “to inspire and nurture the human spirit—one person, one cup and one neighborhood at a time,” emphasizing both coffee quality and community connection.

Starbucks Corporation reported Earnings Per Share (EPS) was $0.69, which exceeded the analysts’ consensus estimate of $0.66, representing a positive surprise of 4.55%. The company’s revenue for the quarter was $9.4 billion, which was flat compared to the previous year but slightly above the analysts’ expectation of $9.3 billion, indicating a revenue surprise of 0.53%.

Stock Overview:

| Ticker | $SBUX | Price | $79.69 | Market Cap | $90.52B |

| 52 Week High | $117.46 | 52 Week Low | $71.55 | Shares outstanding | 1.14B |

Company background:

Starbucks Corporation, established in 1971 in Seattle, Washington, was founded by three partners: Jerry Baldwin, Gordon Bowker, and Zev Siegl. Initially conceived as a retailer of high-quality whole bean coffee, tea, and spices, the first store opened in Seattle’s historic Pike Place Market. The founders were inspired by Alfred Peet, a coffee-roasting entrepreneur, and even sourced their green coffee beans from his company, Peet’s Coffee & Tea, in their early years. The name “Starbucks” was derived from the first mate of the Pequod in Herman Melville’s novel Moby Dick, a nod to Seattle’s maritime history.

In its first decade, Starbucks focused on selling coffee beans and equipment, not yet serving brewed coffee or espresso drinks. The company’s trajectory shifted significantly in the 1980s when Howard Schultz joined as the director of marketing. Inspired by the Italian coffeehouse culture, Schultz envisioned Starbucks as a place for connection and community, a “third place” between home and work. When the original founders decided to sell Starbucks in 1987, Schultz seized the opportunity and acquired the company. He rebranded his existing Il Giornale coffee outlets under the Starbucks name and began an ambitious expansion, introducing espresso-based beverages that would soon become the hallmark of the brand.

The initial funding for Starbucks came from the three founders’ personal investments and a bank loan. Starbucks raised approximately $25 million, which enabled the company to rapidly increase its store count. Over the years, Starbucks has also grown through strategic acquisitions, including The Coffee Connection (gaining the Frappuccino), Seattle’s Best Coffee, and Teavana.

Customers can choose from hot and cold coffee beverages, including espresso drinks, brewed coffee, and iced options. The menu also features tea, smoothies, juices, and Frappuccino blended beverages. Complementing the drinks are a variety of food items such as pastries, sandwiches, salads, and snacks. Starbucks sells whole bean and ground coffee, single-serve coffee products, and merchandise like mugs and brewing equipment for at-home consumption.

It includes established chains like McDonald’s (with McCafé), Dunkin’, and Tim Hortons, which offer coffee and other beverages alongside their food menus. Specialty coffee retailers such as Peet’s Coffee and The Coffee Bean & Tea Leaf also compete in the premium coffee segment. Starbucks encounters competition from large food and beverage companies like Nestlé and Keurig Dr Pepper in the packaged coffee and single-serve market. The headquarters of Starbucks Corporation is located in the Starbucks Center in Seattle, Washington. This building, a former Sears, Roebuck and Co. distribution center, has been the company’s global nerve center since 1997.

Recent Earnings:

Starbucks Corporation’s revenue was $9.4 billion, which remained flat compared to the same quarter in the previous year. Analysts’ expectations of $9.3 billion indicating a modest revenue surprise of 0.53%. The flat revenue growth reflects a challenging environment, with global comparable store sales declining by 4%, driven by a 6% decrease in comparable transactions, although this was partially offset by a 3% increase in the average ticket price.

Starbucks reported an Earnings Per Share (EPS) of $0.69 for the first quarter of fiscal year 2025. The analysts’ consensus estimate of $0.66 represents a positive EPS surprise of 4.55%. This decrease is primarily attributed to heightened investments as part of their “Back to Starbucks” strategy, including increased spending on store partner wages, benefits, and hours, as well as the removal of the extra charge for non-dairy milk customizations.

Starbucks’ global comparable store sales decreased by 4%, with North America and the U.S. experiencing a 4% decline, and international markets also seeing a 4% drop. Notably, comparable store sales in China decreased by 6%. The company continued its global expansion by opening 377 net new stores in the first quarter, bringing the total store count to 40,576 worldwide. The U.S. Starbucks Rewards loyalty program saw a 1% year-over-year increase in 90-day active members, reaching 34.6 million. The operating margin contracted by 390 basis points year-over-year to 11.9%, primarily due to the aforementioned investments and deleverage.

Emphasized the “Back to Starbucks” strategy aimed at re-introducing the brand and restoring long-term growth. The focus is on enhancing store operations, investing in partners, and evolving the customer promise.

The Market, Industry, and Competitors:

Starbucks Corporation operates within the global coffeehouse and specialty coffee market, which is a dynamic and competitive segment of the broader food and beverage industry. This market includes coffee shops, cafes, and related retail operations that serve hot and cold beverages, along with food items and packaged coffee. The industry is influenced by factors such as changing consumer preferences for specialty drinks, the increasing demand for convenience and on-the-go options, and a growing emphasis on ethical sourcing and sustainability. Competition comes from large international chains, regional coffee houses, quick-service restaurants with coffee offerings, and even the at-home coffee consumption market.

A compound annual growth rate (CAGR) in the range of 3.5% to 6.83% for the coffee shop market. This growth is driven by factors like increasing urbanization, rising disposable incomes in developing economies, and the expansion of coffee culture globally. The overall global coffee market, which includes retail and foodservice, is also expected to grow, with estimates ranging from a CAGR of around 4.7% to 6.2% between 2024/2025 and 2030.

Considering these broader market growth expectations and Starbucks’ established global presence, it’s reasonable to anticipate that Starbucks will also experience growth towards 2030. Factors like the expansion of their loyalty programs, the introduction of innovative beverages and food items, and continued global store expansion, particularly in high-growth markets, will likely contribute to Starbucks’ revenue growth in the coming years.

Unique differentiation:

Starbucks Corporation operates in a highly competitive global coffeehouse market. Its main competitors can be broadly categorized into several groups. These include Dunkin’ (formerly Dunkin’ Donuts), which has a strong presence in the United States and is known for its more affordable pricing and broader menu beyond just coffee. Costa Coffee, a British multinational chain, is a significant competitor, particularly in Europe and Asia. Tim Hortons, a Canadian-based chain with a substantial presence in Canada and parts of the U.S., also competes directly with Starbucks, especially in North America.

Starbucks faces strong competition from quick-service restaurants (QSRs) that have expanded their coffee offerings. McDonald’s, with its McCafé brand, has become a major player by leveraging its extensive global network and competitive pricing. These QSRs often appeal to customers looking for convenience and affordability. The rise of smaller, independent coffee shops and specialty coffee chains presents another layer of competition. These establishments often focus on unique coffee blends, artisanal brewing methods, and a more personalized, local experience, catering to coffee enthusiasts seeking higher quality and a different atmosphere than the larger chains.

Starbucks also competes indirectly with packaged coffee brands sold in grocery stores and through other retail channels, as well as with the growing trend of at-home coffee brewing. Companies like Nestlé (Nespresso, Nescafé), Keurig Dr Pepper, and J.M. Smucker Company (Folgers, Dunkin’ retail coffee) vie for consumers’ at-home coffee consumption. The competitive landscape is constantly evolving, with new players emerging and existing ones adapting their strategies to capture market share and cater to changing consumer preferences for coffee, convenience, and experience.

The “Third Place” Experience: Starbucks has strategically positioned itself as the “third place” between home and work – a welcoming and comfortable environment where people can relax, socialize, work, or study. This concept goes beyond just selling coffee; it’s about creating an atmosphere with comfortable seating, Wi-Fi, music, and a consistent ambiance across its stores. This focus on the in-store experience encourages customers to linger and build a routine around visiting Starbucks, fostering loyalty that transcends the beverage itself. Competitors may offer seating, but Starbucks has intentionally designed its spaces to be a destination.

Premium Brand and Product Quality: Starbucks has built a strong brand image associated with high-quality coffee and a premium experience. This starts with sourcing and roasting specialty-grade Arabica beans, often emphasizing ethical and sustainable practices. The company offers a wide variety of customizable beverages, including espresso-based drinks, teas, and its signature Frappuccinos, catering to diverse tastes. While some competitors focus on lower prices or broader menus beyond coffee, Starbucks centers its value proposition on the quality and customization of its coffee offerings, allowing it to command a higher price point.

Global Brand Recognition and Consistency: Starbucks has achieved remarkable global brand recognition, with its iconic green siren logo instantly recognizable worldwide. This strong brand equity provides a significant advantage when entering new markets. Furthermore, the company strives for consistency in its product quality and store experience across its thousands of locations. While adapting menus to local tastes is important, the core Starbucks experience remains relatively uniform, building trust and familiarity for customers wherever they are. This global consistency in brand and quality is a significant differentiator compared to smaller regional chains or independent coffee shops.

Management & Employees:

Brian Niccol, who serves as the Chairman and Chief Executive Officer. He assumed this role in September 2024, bringing experience from his previous position as Chairman and CEO of Chipotle.

Brady Brewer, the Chief Executive Officer for Starbucks International. He is responsible for the performance and growth of Starbucks markets outside of North America.

Mike Grams joined as the Chief Stores Officer, responsible for the North America retail teams and store performance.

Michelle Burns, the Executive Vice President for Global Coffee and Sustainability, focusing on the core product and ethical sourcing.

Deb Hall Lefevre, the Executive Vice President and Chief Technology Officer.

Tressie Lieberman, the Executive Vice President and Global Chief Brand Officer.

Sanjay Shah serves as the Executive Vice President and Chief Supply Chain Officer, ensuring the smooth operation of Starbucks’ extensive supply network.

Financials:

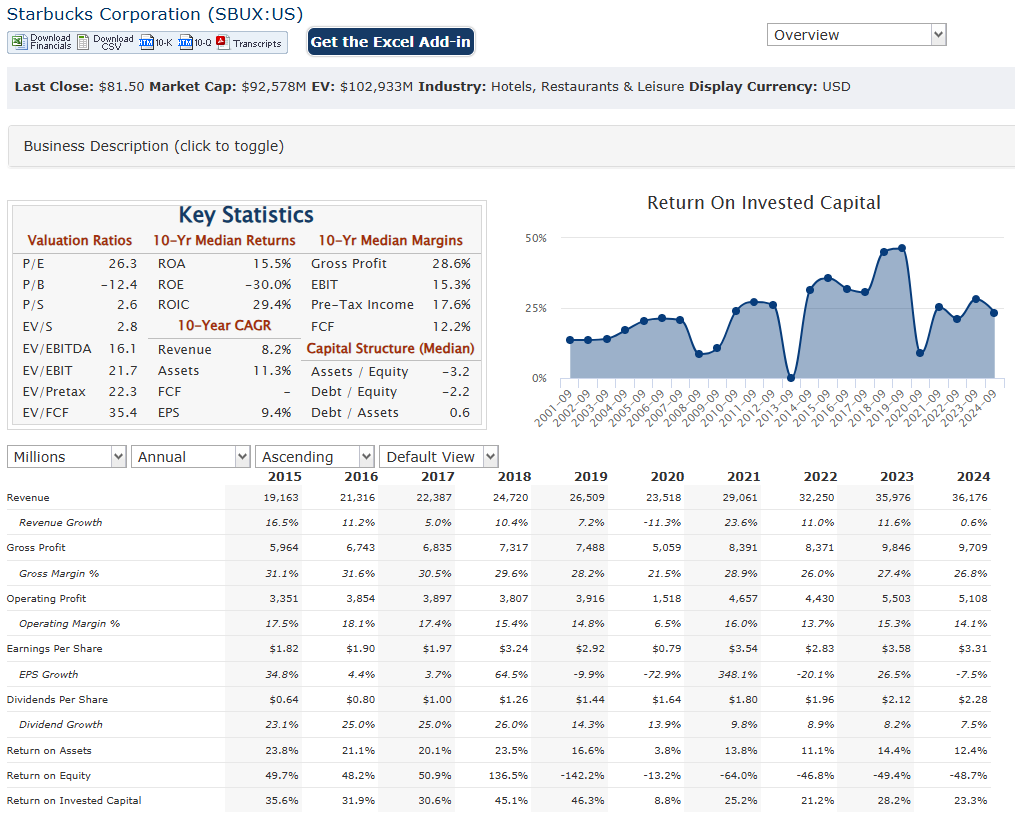

Starbucks Corporation has net revenues rising from $23.5 billion in FY2020 to $36.18 billion in FY2024. This represents a compound annual growth rate (CAGR) of approximately 11.3%, driven by global store expansion and comparable sales increases. FY2023 revenues reached $35.98 billion before climbing to $36.18 billion in FY2024, reflecting consistent post-pandemic recovery. The company added over 5,000 global stores between 2022 and 2024, reaching 38,038 locations by FY2023’s end.

Net income stood at $928 million in FY2020, rebounding to $4.2 billion in FY2021. Q1 FY2025 showed challenges with flat $9.4 billion revenues and a 4% global comparable sales decline, indicating potential margin pressures despite long-term growth.

The company funds expansion through a mix of operating cash flows and debt, with consistent dividend payouts highlighted in recent announcements. Store operating expenses as a percentage of revenues have fluctuated between 43%-52% across regions, reflecting labor and supply chain dynamics.

Recent quarters show evolving strategies, including digital engagement growth (34.6 million U.S. Rewards members in Q1 FY2025) and international focus, particularly in China where comparable sales fell 6% in early FY2025.

Technical Analysis:

The stock is in a bearish stage 4 markdown on both the monthly and weekly charts. The daily chart shows a stage 1 consolidation and will be range bound in the $70 – $90 area. Not a stock we want to invest in the near term.

Bull Case:

Global Growth Opportunities, Especially in China: While China has presented recent challenges due to economic conditions and increased competition, it remains a significant long-term growth market for Starbucks. With a relatively lower store penetration compared to North America, there’s substantial room for expansion. As the Chinese economy recovers and Starbucks adapts its strategies to the local market, this region could become a major driver of revenue and earnings growth. The company’s plans to reach 55,000 global stores by 2030, with a significant portion of that growth expected to come from international markets, including China, underpin this potential.

Strong Brand Loyalty and Pricing Power: Starbucks possesses one of the most recognizable and powerful consumer brands globally. This brand strength allows for a degree of pricing power and customer loyalty, even in a competitive environment. The Starbucks Rewards program boasts a large and growing active membership, providing a valuable platform for personalized marketing and driving repeat visits. This loyal customer base provides a relatively stable revenue stream and the ability to implement price increases to offset costs, supporting profitability over the long term.

Digital Capabilities and Innovation: Starbucks has been proactive in building its digital capabilities, including its mobile app for ordering, payments, and loyalty programs. These digital tools enhance customer convenience and provide valuable data insights for targeted marketing and menu innovation. Continuous menu innovation, including cold beverages and food offerings, caters to evolving consumer preferences and expands the addressable market. Further leveraging technology to improve store efficiency and the partner experience can also contribute to improved profitability.

Bear Case:

Execution Risks of Turnaround Strategy: The “Back to Starbucks” strategy, while intended to revitalize the company, carries execution risks. It will require significant investment and time to implement successfully. There’s no guarantee that these initiatives will resonate with customers or translate into improved financial performance. If the turnaround efforts falter or take longer than expected to yield results, investor confidence could wane.

Economic Uncertainties and Consumer Discretionary Spending: Starbucks relies on consumer discretionary spending, which can be vulnerable during economic downturns. If economic conditions worsen, consumers may cut back on non-essential purchases like specialty coffee, impacting Starbucks’ sales and profitability. A global recession could further exacerbate these headwinds.

Brand Perception and Social Issues: Starbucks, as a prominent global brand, can be susceptible to reputational risks arising from social or political issues. Boycotts or negative sentiment related to the company’s stances or actions could impact sales and brand loyalty in certain markets.