Executive Summary:

NET Power Inc. is a clean energy technology company focused on developing and licensing its unique NET Power Cycle, designed to produce electricity from natural gas with near-zero atmospheric emissions. The company’s technology centers around a novel oxy-combustion process that captures CO2, aiming to provide a low-cost, reliable, and environmentally friendly power generation solution. NET Power has demonstrated its technology at its La Porte, Texas, facility and is progressing towards commercialization, including the development of its first utility-scale plant in the Permian Basin.

Net Power Inc. reported its earnings per share as −0.46. They ended 2024 with over $530 million in cash, cash equivalents, and investments.

Stock Overview:

| Ticker | $NPWR | Price | $2.31 | Market Cap | $501.63M |

| 52 Week High | $14.28 | 52 Week Low | $1.97 | Shares outstanding | 77.06M |

Company background:

NET Power Inc. is an innovative energy technology company focused on revolutionizing power generation by significantly reducing atmospheric emissions. The company’s core technology, the NET Power Cycle, is a unique oxy-combustion process designed to produce electricity from natural gas while capturing nearly all CO2 emissions. Founded in 2010, the company’s roots date back to the work of Rodney Allam and 8 Rivers Capital, an energy technology firm, which developed the initial concept. The “Allam Cycle” forms the basis of NET Power’s technology. The headquarters of Net Power Inc. is located in Durham, North Carolina.

Funding for NET Power has come from a variety of sources, including strategic investments from major industry players. Key investors have included companies like Occidental, Baker Hughes, and SK Group, reflecting the industry’s interest in the company’s potential. These investments have been crucial in enabling NET Power to develop and demonstrate its technology, particularly at its demonstration plant in La Porte, Texas. This funding is now being used to further the development of their first commercial-scale plant, located in the Permian basin.

NET Power’s primary product is its proprietary NET Power Cycle, which aims to provide a cleaner and more efficient way to generate electricity from natural gas. The company’s business model centers on licensing this technology to enable the construction and operation of clean power plants. While the clean energy sector is evolving rapidly, key competitors include companies developing carbon capture and storage (CCS) technologies and other advanced power generation solutions. Net Power’s technology is unique in its goal to provide reliable, dispatchable power from natural gas with near-zero emissions.

Recent Earnings:

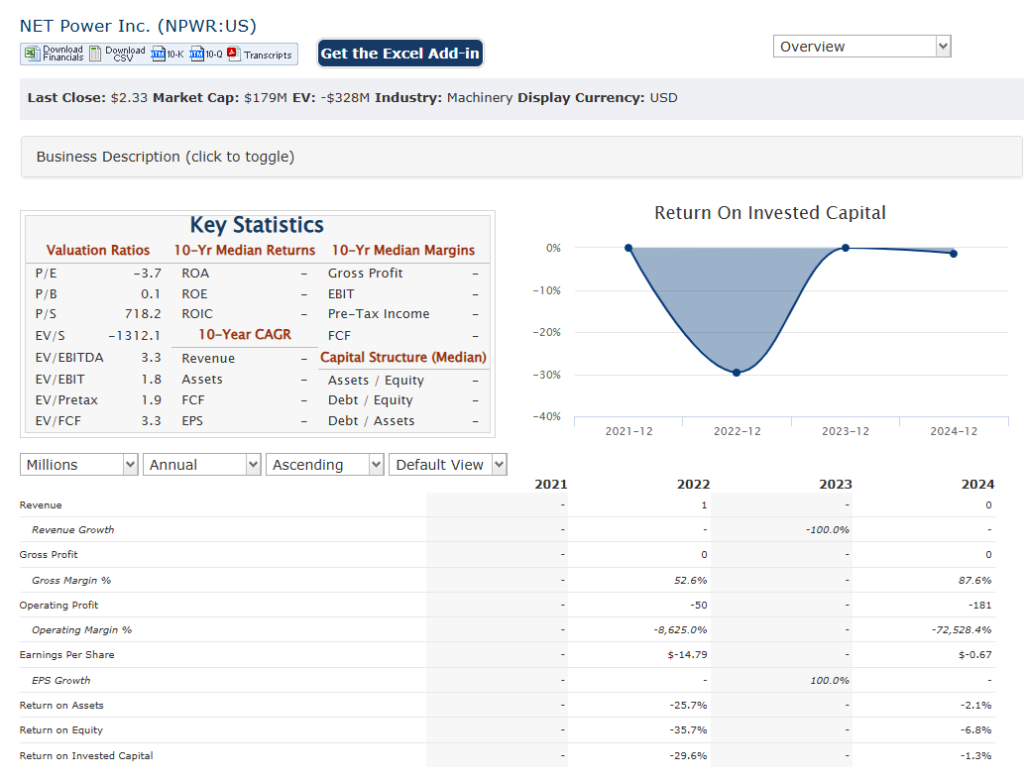

The company reported an EPS of −0.67, which was below analyst expectations of −0.12. This discrepancy led to a substantial drop in the company’s stock price, indicating investor concern. The company’s focus at this time is heavily on development, and therefore revenue is not the most important metric.

Net Power ended 2024 with a strong cash position of $533 million, providing them with financial flexibility for ongoing development and strategic initiatives. The company is also experiencing a cash burn.

Their developments include the completion of the Front-End Engineering and Design (FEED) for Project Permian. The company is now focused on value engineering and design optimization to reduce costs. Net Power is also pursuing a modular multi-unit plant design to enhance efficiency and scalability. The company has also made progress in its testing facility in La Porte, Texas, achieving 140 fired hours of operation.

The company has revised its estimated total installed costs for Project Permian to $1.7 billion to $2.0 billion, reflecting increased costs due to inflation and supply chain challenges. They are also focusing on securing strategic partnerships to aid in commercialization. The company’s focus is to make its technology the lowest cost clean, firm power available.

The Market, Industry, and Competitors:

NET Power Inc. operates in the clean energy technology sector, focusing on transforming natural gas into clean, reliable, and low-cost energy. The company leverages its patented technology to capture over 97% of CO2 emissions during power generation, aligning with global efforts to combat climate change. NET Power targets competitive power markets in North America, particularly regions with natural gas availability and CO2 storage capabilities. Its innovative approach positions it to address the growing demand for sustainable energy solutions amidst increasing electrification and environmental concerns.

The company plans to deploy dozens of utility-scale plants annually by the early 2030s, driven by its strategic supply chain partnerships and a growing project backlog. Management estimates that the Total Addressable Market (TAM) in North America could support 800-1,000 NET Power plants between 2028 and 2040. Even capturing just 5% of this TAM could generate approximately $2 billion in annual sales by 2030, with potential for further expansion to $5-10 billion in revenue over the next decade. Analysts forecast a compound annual growth rate (CAGR) of nearly +982% in stock price from its current levels by 2030, underscoring investor optimism about its long-term prospects.

The company’s growth expectations are supported by macroeconomic tailwinds, including increasing global demand for clean baseload power and policy incentives favoring sustainable energy technologies. NET Power’s first utility-scale plant, Project Permian, is scheduled to begin operations between late 2027 and early 2028, marking a pivotal step toward commercialization. If successful, this project could validate its technology at scale and unlock further opportunities across diverse markets and industries.

Unique differentiation:

NET Power Inc. operates in the competitive landscape of clean energy technology, where various companies are developing solutions for carbon capture and clean power generation. Direct competitors include those developing advanced carbon capture technologies, particularly for natural gas power plants. Companies like Carbon Engineering and Climeworks, while focused on direct air capture, also contribute to the broader carbon capture market, influencing the development and adoption of CCS technologies. Additionally, traditional engineering, procurement, and construction (EPC) companies that are now expanding into CCS and clean energy solutions pose competition in the construction and deployment of these plants.

NET Power faces indirect competition from developers of other clean energy sources, such as solar and wind power, as well as those pursuing hydrogen-based energy solutions. While these technologies offer alternative paths to decarbonization, NET Power’s focus on providing dispatchable, baseload power from natural gas with near-zero emissions differentiates it. Companies specializing in advanced gas turbine technologies and those developing alternative combustion processes also compete in the broader power generation market.

- The Allam Cycle: NET Power utilizes the Allam Cycle, a novel oxy-combustion process that integrates carbon capture directly into the power generation process. This inherent integration is a significant differentiator, as it aims to capture nearly all CO2 emissions without requiring separate, add-on carbon capture systems. This process allows for the production of electricity from natural gas with near-zero atmospheric emissions, offering a potentially cleaner and more efficient alternative to traditional natural gas power plants.

- Dispatchable Baseload Power: Unlike many renewable energy sources like solar and wind, which are intermittent, NET Power’s technology is designed to provide dispatchable, baseload power. This means it can provide a reliable and consistent source of electricity, which is crucial for grid stability. This is a key difference from many renewable energy competitors, and allows Net power to provide a service that can be used to stabilize power grids.

- Focus on Natural Gas: While many clean energy companies focus on renewable sources or hydrogen, NET Power leverages existing natural gas infrastructure. This approach could potentially facilitate a smoother transition to cleaner energy by utilizing existing resources. By focusing on natural gas, they are aiming to provide a cleaner method of using an already abundant energy source.

Management & Employees:

Thomas (Cam) Sewell: Serves as the Chief Executive Officer. He brings a wealth of experience in the energy industry, with a background in developing and commercializing energy technologies. His leadership is focused on driving the company’s commercialization efforts and establishing strategic partnerships.

Rodney Allam: Is the Chief Technology Officer and the inventor of the Allam Cycle, the core technology behind NET Power. He is a key figure in the company’s technological development and innovation.

Keith Maxwell: Serves as the Chief Operating Officer. He is responsible for overseeing the company’s operational activities, including the development and construction of its power plants. His background includes experience in large-scale project management within the energy industry.

Financials:

NET Power Inc. has been focused on developing its innovative clean energy technology. The company’s financial reports highlight its progress in technology development and strategic partnerships, but revenue growth has been minimal due to its pre-commercialization phase. The company’s earnings per share (EPS) have been negative, reflecting the substantial investments required to advance its technology. NET Power has ended 2024 with over $530 million in cash, cash equivalents, and investments. This liquidity provides the company with the necessary resources to continue optimizing its technology and pursuing strategic partnerships.

As NET Power moves closer to commercializing its technology, particularly with projects like Project Permian, it is expected to see significant growth in both revenue and earnings. The company’s strategic initiatives, such as the modular multi-unit feasibility study, are designed to drive cost reductions and increase scalability, which could positively impact future financial performance.

NET Power’s financial strategy involves leveraging its strong liquidity position to navigate the challenges of commercializing new technology. The company faces risks related to cost control, regulatory hurdles, and strategic partnerships, but its focus on innovation and scalability positions it for potential long-term growth. NET Power’s technology could become increasingly relevant, potentially leading to improved financial performance.

Technical Analysis:

The stock is in a bearish stage 4 markdown in all time frames. Avoid for now.

Bull Case:

Unique and Potentially Disruptive Technology: The NET Power Cycle, with its Allam Cycle technology, offers a distinct approach to natural gas power generation with near-zero emissions. If successfully commercialized, this technology could become a cornerstone of future clean energy infrastructure. The ability to provide dispatchable, baseload power with carbon capture differentiates NET Power from intermittent renewable sources, addressing a critical need for grid stability.

Growing Demand for Clean Energy: The global push for decarbonization and the increasing adoption of ESG standards create a favorable market environment for NET Power’s technology. Government incentives and policies supporting carbon capture and clean energy solutions could further accelerate the company’s growth.

Bear Case:

Financial Risks: Developing and deploying large-scale power plants requires substantial capital investment, and NET Power’s financial stability is dependent on securing ongoing funding. Cost overruns, delays, or lower-than-expected revenue could strain the company’s financial resources. The cash burn rate of the company is a concern.

Regulatory and Policy Uncertainties: Changes in government regulations or policies related to carbon capture and clean energy could impact NET Power’s business prospects. The long term viability of carbon capture technology is still being debated, and changes in public opinion could damage the companies prospects.