Executive Summary:

Hyatt Hotels Corporation is a global hospitality company. It has since grown into a multinational enterprise managing and franchising luxury and business hotels, resorts, and vacation properties worldwide. Hyatt’s portfolio encompasses a diverse range of brands, catering to various travel preferences, from luxury experiences to essential stays. With a focus on caring for people, Hyatt emphasizes creating a distinct guest experience and fostering a culture of inclusivity.

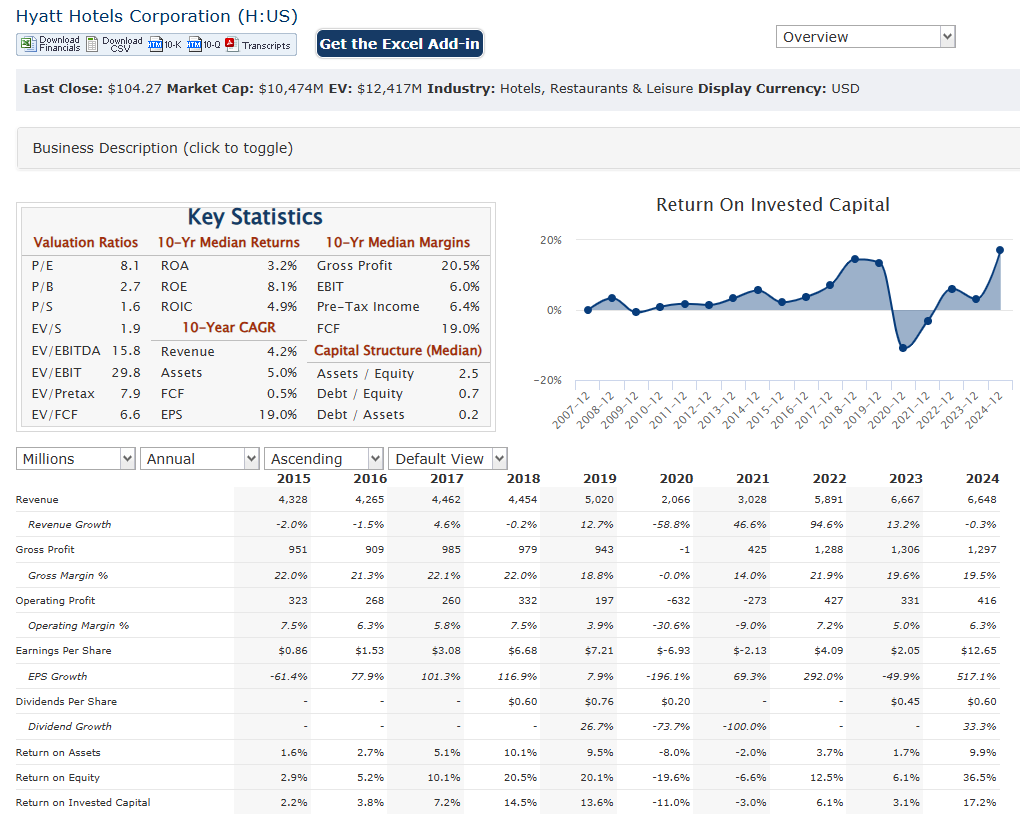

Hyatt Hotels Corporation reported a diluted EPS of $12.65, and adjusted diluted EPS of $3.66. The full year revenue for 2024 was $6.648B. In their fourth quarter 2024 results, they reported a diluted EPS of $(0.58) and an adjusted diluted EPS of $0.42.

Stock Overview:

| Ticker | $H | Price | $104.19 | Market Cap | $9.94B |

| 52 Week High | $168.20 | 52 Week Low | $102.74 | Shares outstanding | 41.92M |

Company background:

Hyatt Hotels Corporation is a prominent global hospitality company with a rich and evolving history. It originated in 1957 when Jay Pritzker purchased the Hyatt House motel near Los Angeles International Airport. From this single acquisition, the Pritzker family, notably Jay and his brother Donald, propelled Hyatt’s growth, transforming it into a major player in the hotel industry. Hyatt’s headquarters are located in Chicago, Illinois.

Hyatt’s portfolio is diverse, encompassing a wide range of hotel and resort brands designed to cater to various travel needs and preferences. These brands span the spectrum from luxury offerings like Park Hyatt and Alila, to lifestyle brands such as Andaz and Thompson Hotels, and all-inclusive brands like Hyatt Ziva and Hyatt Zilara. They also have classic brands such as the Grand Hyatt and Hyatt regency lines, and essential brands like Hyatt place and Hyatt house. This broad range of products allows Hyatt to serve a wide demographic of travelers.

In the competitive hospitality landscape, Hyatt faces competition from other major hotel chains, including:

- Marriott International

- Hilton Worldwide Holdings

- InterContinental Hotels Group (IHG)

Hyatt has continued to grow through strategic aquisitions, and brand expansions.

Recent Earnings:

Hyatt Hotels Corporation revenue reached $6.648 billion. They reported that comparable system-wide hotels RevPAR growth was 5.0% in the fourth quarter and 4.6% for the full year of 2024, compared to the same periods in 2023.

Hyatt reported a diluted EPS of $12.65, and an adjusted diluted EPS of $3.66. For the fourth quarter of 2024, the diluted EPS was $(0.58), and the adjusted diluted EPS was $0.42.

For 2025, it includes projections for comparable system-wide hotels RevPAR growth of 2.0% to 4.0%. Net rooms growth of 6.0% to 7.0%. Net income between $190 million and $240 million. Adjusted EBITDA between $1,100 million and $1,150 million. Hyatt has also been very active in aquisitions, this is a large part of their growth strategy.

The Market, Industry, and Competitors:

Hyatt Hotels Corporation operates in the global hospitality industry, encompassing hotels, resorts, and vacation properties across 69 countries. With over 1,350 properties, Hyatt serves a diverse clientele, including corporate travelers, leisure tourists, and specialty market accounts such as government and educational organizations. The company manages and franchises a wide range of luxury brands such as Park Hyatt and Grand Hyatt, alongside lifestyle-focused brands like Andaz and Thompson Hotels. Hyatt’s portfolio also includes all-inclusive resorts under brands like Hyatt Ziva and Secrets Resorts & Spas. Its strategy emphasizes expanding high-end offerings while maintaining an asset-light model to drive profitability.

The global hospitality market is poised for significant growth, with projections estimating a compound annual growth rate (CAGR) of 18.8% from 2025 to 2030. This expansion is driven by increasing demand for leisure travel among millennials and Gen Z consumers, coupled with the rising popularity of premium experiences in hotels and resorts. By 2030, the market size is expected to reach $2.214 trillion globally, with hotels being the fastest-growing segment. In the United States alone, the hospitality sector is projected to grow at a CAGR of 18.6%, reaching $692 billion by 2030. Hyatt’s strategic initiatives, including its record pipeline of 129,000 rooms and targeted growth in regions like India (aiming for 100 hotels by 2030), position it to capitalize on this robust market expansion.

The company has demonstrated strong momentum through acquisitions like Apple Leisure Group and Dream Hotel Group, which have diversified its portfolio further into lifestyle and resort segments. Its focus on asset-light operations is expected to enhance free cash flow significantly, with analysts projecting a 25% growth in FCF per share through 2025.

Unique differentiation:

Hyatt Hotels Corporation operates in a highly competitive global hospitality market, facing strong competition from several major players. Among them, Marriott International and Hilton Worldwide Holdings stand out as the most significant competitors. These companies boast extensive portfolios of diverse hotel brands, catering to a wide range of traveler preferences and budgets, much like Hyatt itself. Their global presence and well-established loyalty programs provide them with substantial market advantages.

Another key competitor is InterContinental Hotels Group (IHG). IHG also has a broad spectrum of hotel brands, ranging from luxury to budget-friendly options, and a strong global footprint. These major competitors, along with others like Accor and Wyndham, create a dynamic and challenging environment for Hyatt. To remain competitive, Hyatt must continually focus on differentiating its brand offerings, enhancing guest experiences, and strategically expanding its global presence. Hyatt accomplishes this through, aquisitions, and focusing on the higher end of the hotel market.

Emphasis on Luxury and Lifestyle: Hyatt has strategically focused on cultivating a strong presence in the luxury and lifestyle segments of the hospitality market. Brands like Park Hyatt, Andaz, and Alila cater to discerning travelers seeking unique and high-end experiences. This focus allows Hyatt to capture a valuable segment of the market.

“World of Hyatt” Loyalty Program: Hyatt’s “World of Hyatt” loyalty program is designed to cultivate strong customer relationships by providing personalized experiences and rewards. This program is known for its focus on rewarding frequent, high-value guests, which helps to foster customer loyalty.

Strategic Acquisitions and Growth: Hyatt has recently been very active in aquisitions, particularly in the all inclusive resort sector. This allows Hyatt to very quickly expand its offerings, and grow its customer base.

Management & Employees:

Thomas J. Pritzker: He serves as the Executive Chairman of the Board of Directors. He has a long history with the company and the Pritzker family’s involvement in Hyatt. He has also held leadership positions in other Pritzker family business interests.

Mark S. Hoplamazian: He is the President and Chief Executive Officer. He has been in this role since December 2006. He has extensive experience with the Pritzker organization, which has been crucial to Hyatt’s growth.

Financials:

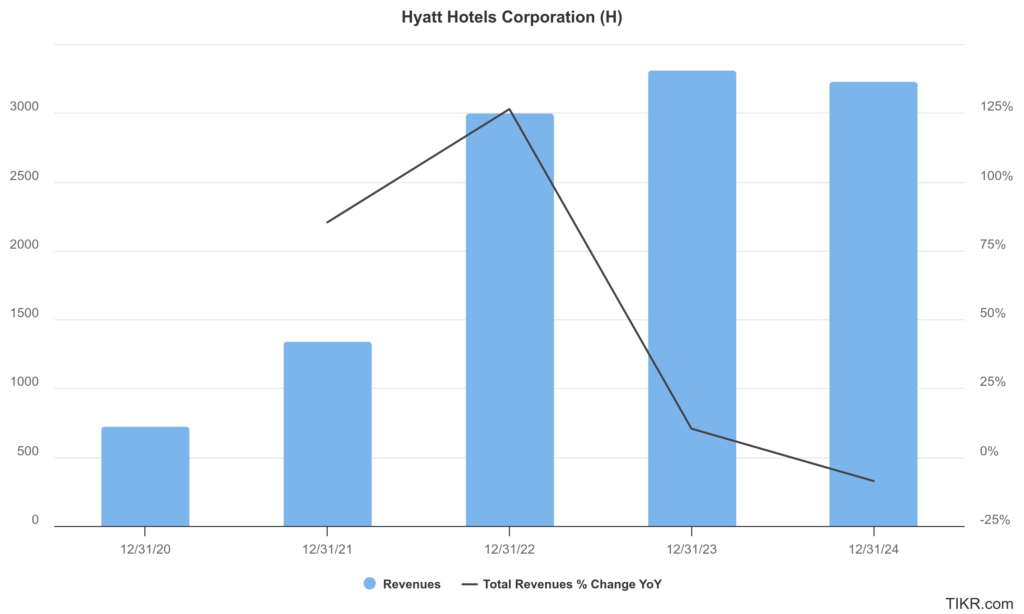

Hyatt Hotels Corporation has annual revenue that grew from $780 million in 2020 to $3.3 billion in 2024, reflecting a compound annual growth rate (CAGR) of 6% over five years. This growth trajectory includes a sharp rebound from the pandemic-induced downturn, with revenue increasing by 126% in 2022 and 85% in 2021, following a steep decline of nearly 70% in 2020. Revenue contracted by 8.67% in 2024 compared to the prior year, signaling potential challenges in maintaining consistent growth.

Hyatt reported a net income of $1.3 billion in 2024, a substantial increase from $220 million in 2023 and losses during earlier pandemic years. The company’s adjusted EBITDA reached $1.1 billion in 2024, highlighting robust operational recovery. Hyatt’s earnings growth has been transformative, transitioning from losses to profitability, which has supported a shareholder return CAGR of 22% during this period.

The company reported total assets of $13.3 billion and total liabilities of $9.5 billion, with shareholder equity standing at $3.8 billion. However, its debt-to-equity ratio increased significantly from 40.6% to 98.8% over the last five years, reflecting higher leverage due to acquisitions and expansion efforts. While interest coverage remains healthy at 7.3x EBIT, operating cash flow covers only 16.8% of its debt obligations.

Technical Analysis:

The stock is in a stage 4 bearish markdown on all 3 stages. Given the overall softness in the economy and travel spending slowing we would not be interested in a position in the next few months.

Bull Case:

Growth Through Strategic Acquisitions: Hyatt’s active approach to acquisitions, particularly in the all-inclusive resort sector, significantly expands its market reach and diversifies its offerings. This strategy can lead to increased revenue and market share.

Recovery of Travel and Tourism: The global travel and tourism industry is expected to continue its recovery, with increasing demand for leisure and business travel. Hyatt is well-positioned to benefit from this trend.

Operational Metrics: Hyatt has shown positive movement in operational metrics such as RevPAR growth. Continued growth in these metrics strengthens the companies financial footings.

Bear Case:

Geopolitical Instability: Global geopolitical events, such as political unrest, terrorism, or pandemics, can disrupt travel patterns and significantly affect the hospitality industry.

Dependence on High-End Travel: While Hyatt’s focus on luxury and lifestyle segments can be a strength, it also creates vulnerability. If high-end travel demand weakens, Hyatt could experience a disproportionate impact.

Slower than expected recovery: While travel is recovering, if the recovery slows, or reverses, Hyatt would be negatively impacted.