Executive Summary:

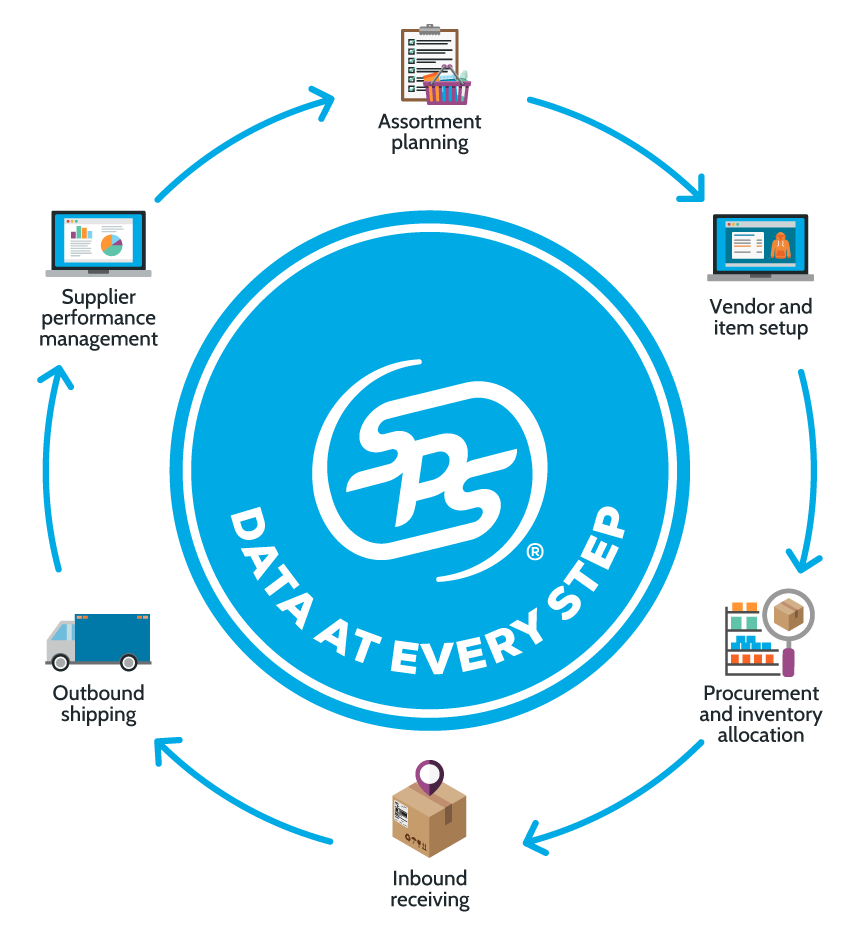

SPS Commerce Inc. is a cloud-based supply chain management solutions provider, facilitating connections between retailers, suppliers, and logistics firms. The company offers a platform that streamlines data exchange, optimizes inventory, and enhances supply chain visibility. SPS Commerce provides a suite of solutions, including fulfillment, analytics, and assortment tools, designed to improve operational efficiency and meet consumer demands. The company aims to automate and standardize communication within the retail supply chain, fostering collaboration and driving sales.

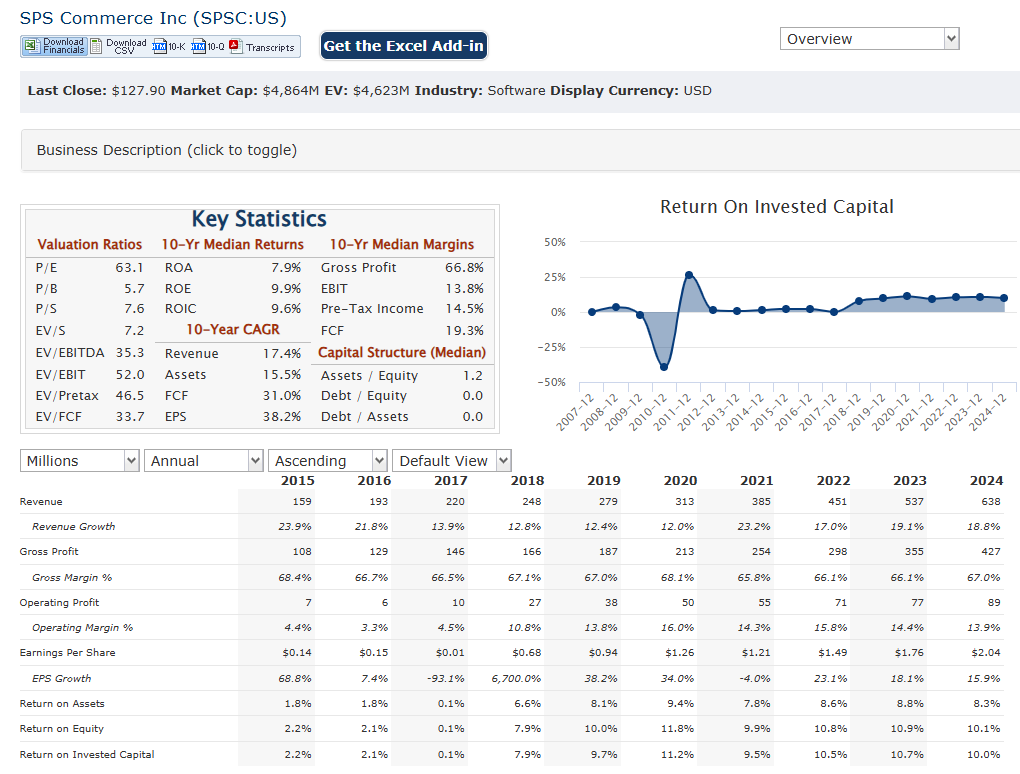

SPS Commerce Inc. reported revenue of $637.8 million, representing a 19% increase over the previous year. Revenue was $170.9 million, reflecting an 18% year-over-year growth. The full-year 2024 net income per diluted share was $2.04, up from $1.76 in 2023. The net income per diluted share was $0.46. SPS commerce has given revenue guidance of between 178.5 million dollars and 180 million dollars. For the full year of 2025, SPS commerce has given revenue guidance of between 758 million dollars and 763 million dollars.

Stock Overview:

| Ticker | $SPSC | Price | $124.88 | Market Cap | $4.75B |

| 52 Week High | $218.61 | 52 Week Low | $121.52 | Shares outstanding | 38.03M |

Company background:

SPS Commerce Inc. is a prominent provider of cloud-based supply chain management solutions, playing a crucial role in connecting retailers, suppliers, and logistics providers. Originally founded in 1987 as St. Paul Software, the company underwent a transformation and rebranding to SPS Commerce in 2001. Its headquarters are located in Minneapolis, Minnesota, from which it manages its extensive global operations.

The company’s core offerings revolve around a cloud-based platform that facilitates the electronic exchange of data, streamlining processes such as order fulfillment, inventory management, and data analytics.

- EDI (Electronic Data Interchange) solutions: for the electronic exchange of business documents.

- Assortment solutions: for product information management.

- Analytics solutions: for gaining insights from sales and inventory data.

- Sourcing solutions: to help find and onboard trading partners.

SPS Commerce operates within a competitive landscape that includes other supply chain management and EDI providers. Key competitors include companies that offer similar cloud-based solutions for supply chain integration and optimization. SPS Commerce has distinguished itself by focusing on a very large retail network and providing very full-service support to its customers. SPS commerce has also grown through strategic acquisitions, to expand its offerings.

SPS Commerce has experienced consistent growth, driven by the increasing demand for efficient supply chain solutions in the retail industry. The company’s focus on cloud-based technology and its extensive network of trading partners have positioned it as a leader in its field.

Recent Earnings:

SPS Commerce Inc. recently reported its revenue reached $637.8 million, marking a 19% increase compared to the previous year. Revenue was $170.9 million, demonstrating an 18% year-over-year growth. This consistent growth underscores the company’s ability to expand its market presence and capitalize on the increasing demand for supply chain management solutions.

SPS Commerce reported a full-year 2024 net income per diluted share of $2.04, up from $1.76 in 2023. The fourth-quarter net income per diluted share was $0.46. This performance indicates that the company’s financial results are often in line with or surpass market forecasts, bolstering investor confidence.

SPS Commerce continues to focus on operational metrics that drive its long-term success. Key operational drivers include the expansion of its trading partner network and the continued adoption of its cloud-based platform. The company’s ability to onboard new customers and expand its service offerings contributes to its sustained growth. SPS Commerce has provided forward guidance for 2025. For the first quarter of 2025, the company projects revenue to be between $178.5 million and $180 million. For the full year 2025, revenue is expected to range from $758 million to $763 million.

The Market, Industry, and Competitors:

SPS Commerce Inc. operates within the rapidly evolving market of cloud-based supply chain management solutions, specifically focusing on retail network optimization. This market is driven by the increasing complexity of modern supply chains, the need for real-time data visibility, and the growing demand for seamless integration between retailers, suppliers, and logistics providers. The digitization of retail, accelerated by e-commerce growth, has further intensified the need for efficient and automated supply chain processes. The market is also heavily influenced by the increasing importance of EDI (Electronic Data Interchange), API integration, and analytics tools, which SPS Commerce provides. These solutions are vital for businesses aiming to enhance operational efficiency, reduce costs, and improve customer satisfaction in a competitive landscape.

Factors contributing to this growth include the continuous expansion of e-commerce, the increasing adoption of AI and machine learning in supply chain management, and the rising demand for real-time data analytics. Industry analysts project a significant Compound Annual Growth Rate (CAGR) for this market, with some estimates ranging from 12% to 17% through 2030. This growth is underpinned by the ongoing need for businesses to optimize their supply chains to meet the demands of a dynamic and interconnected global marketplace.

Unique differentiation:

SPS Commerce operates in a competitive landscape within the cloud-based supply chain management and EDI solutions market. Key competitors include companies that offer similar services aimed at streamlining data exchange and optimizing supply chain operations. These competitors range from large enterprise software providers to specialized EDI and supply chain visibility platforms. Companies like OpenText and IBM offer comprehensive enterprise solutions that include EDI and supply chain management capabilities, posing competition due to their established market presence and broad service portfolios. Additionally, smaller, more specialized companies like TrueCommerce and DiCentral focus specifically on EDI and related services, directly competing with SPS Commerce’s core offerings.

SPS Commerce also faces competition from companies that provide niche solutions within specific aspects of the supply chain, such as inventory management or logistics optimization. The competitive landscape is further intensified by the ongoing development of in-house solutions by large retailers and suppliers, which aim to address their specific supply chain needs. However, SPS Commerce differentiates itself through its extensive retail network, comprehensive service offerings, and strong customer support, which are key factors in maintaining its competitive edge. The ability to provide a full service solution, and a large network of connected companies, helps to set SPS Commerce apart from the competition.

Extensive Retail Network: SPS Commerce boasts a very large, established retail network. This network effect is a significant advantage, as it simplifies connections and transactions between a vast number of retailers, suppliers, and logistics providers. This large network greatly reduces the complexity of onboarding new trading partners.

Cloud-Based Focus: SPS Commerce was a pioneer in cloud-based EDI solutions. This focus on cloud technology provides scalability, flexibility, and ease of use, which are crucial in today’s dynamic retail environment.

Omnichannel Capabilities: The company’s solutions are designed to support omnichannel retail, enabling seamless integration across various sales channels. This is increasingly important as retailers strive to provide consistent customer experiences across online and offline platforms.

Management & Employees:

Chad Collins: He is the Chief Executive Officer and a member of the board of directors. He joined SPS Commerce in October 2023. Previously, he was the Global Chief Executive Officer of Körber Supply Chain Software.

Jamie Thingelstad: He is the Executive Vice President and Chief Technology Officer. He has been with SPS Commerce since 2013. He leads the growth and development of the company’s technology platform.

Mike Svatek: He is the Chief Product Officer. He is responsible for leading the product vision and execution.

Financials:

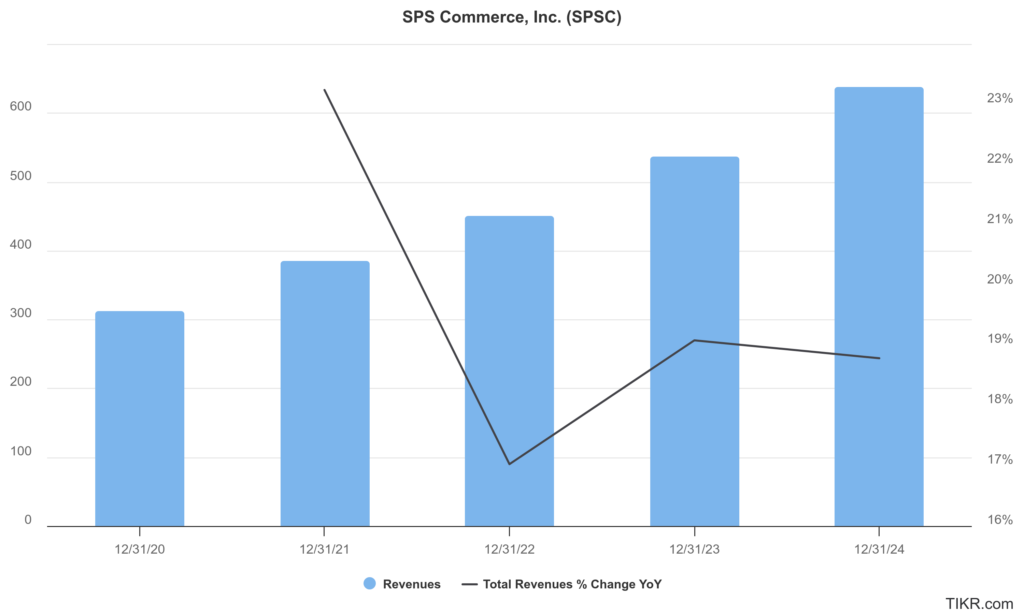

SPS Commerce Inc. has revenue grew from $312.6 million in 2020 to $637.8 million in 2024, reflecting a compound annual growth rate (CAGR) of approximately 19.5%. This growth was fueled by expanding demand for its cloud-based supply chain management solutions and its ability to capture market share within the software industry.

Similarly, earnings have shown steady improvement, increasing from $45.59 million in 2020 to $77.05 million in 2024, with a CAGR of about 14%. This growth highlights the company’s operational efficiency and ability to scale profitably despite increasing expenses related to research and development and general administrative costs. SPS Commerce’s net profit margin remained strong at 12.1% as of 2024, although slightly lower than the previous year’s margin of 12.3%.

The company has maintained healthy cash flows and low debt levels, enabling it to reinvest in growth initiatives such as product innovation and market expansion. Return on equity (ROE) stood at 9% as of 2024, which, while modest, indicates a sustainable approach to leveraging shareholder capital.

Its strong revenue and earnings growth trajectory, supported by effective cost management and strategic investments. The company is well-positioned for continued success in the evolving software landscape.

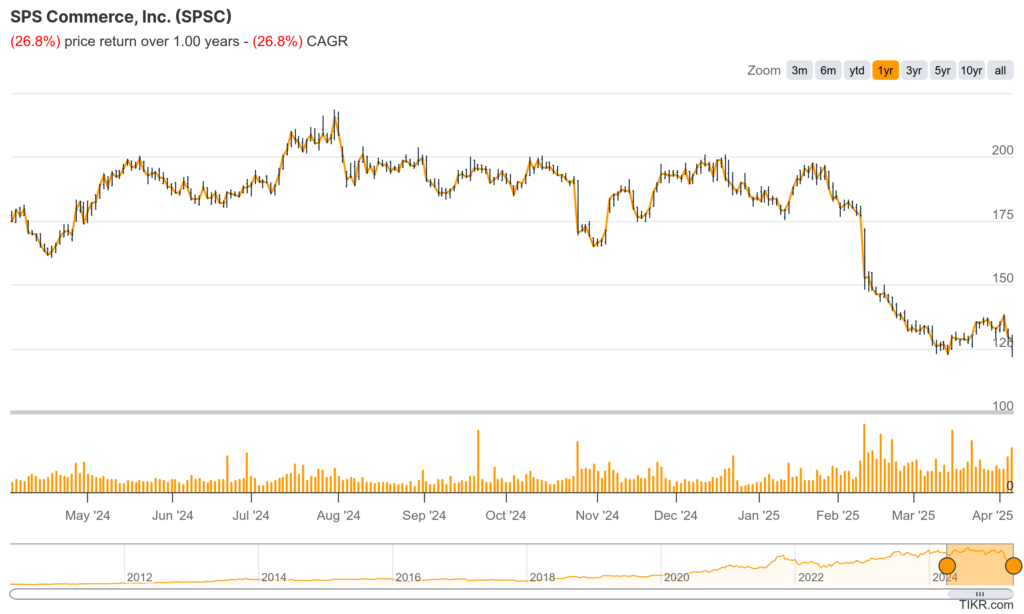

Technical Analysis:

The stock is in a stage 4 bearish markdown on the monthly and weekly charts with a bear flag on the daily chart as well. The stock should get to $112 – $117 horizon and then likely lower to the $90s in the short-to-medium term.

Bull Case:

Recurring Revenue Model: SPS Commerce’s cloud-based subscription model provides a predictable and recurring revenue stream, which is highly valued by investors. This model enhances the company’s financial stability and predictability.

Expanding Market Opportunity: The market for supply chain management solutions is expected to continue growing, driven by factors such as e-commerce expansion, increasing global trade, and the need for greater supply chain visibility. This presents a significant opportunity for SPS Commerce to expand its market share.

Technological Advancement: SPS commerce continues to advance it’s platform, and implement new technologies. This helps to retain current customers, and attract new ones.

Bear Case:

Valuation Concerns: SPS Commerce often trades at a high valuation, reflecting its strong growth prospects. However, this premium valuation could make the stock vulnerable to significant declines if growth slows or if market sentiment shifts.

Economic Downturn: A broader economic downturn could negatively impact retail spending and supply chain activity, reducing demand for SPS Commerce’s services. This could result in slower revenue growth and lower profitability.

Integration Risks: SPS Commerce has grown through acquisitions, and future acquisitions could pose integration challenges. Poor integration could disrupt operations and negatively impact financial performance.