Executive Summary:

Constellation Brands Inc. is a leading international producer and marketer of beer, wine, and spirits. The company is particularly known for its iconic imported beer brands, including the Corona and Modelo families. Constellation Brands also holds a diverse portfolio of fine wine and craft spirits brands, such as The Prisoner Wine Company and Robert Mondavi. With a focus on building brands that resonate with consumers, the company emphasizes innovation and responsiveness to market trends.

Constellation Brands, the consensus EPS forecast for the quarter is $2.31. The reported EPS for the same quarter last year was $2.26.

Stock Overview:

| Ticker | $STZ | Price | $183.71 | Market Cap | $33.2B |

| 52 Week High | $274.87 | 52 Week Low | $160.46 | Shares outstanding | 180.71M |

Company background:

Constellation Brands Inc. major player in the beverage alcohol industry since its humble beginnings. The company was founded in 1945 by Marvin Sands in the Finger Lakes region of New York, initially operating as Canandaigua Industries, focusing on selling bulk wine. Its headquarters are now located in Rochester, New York.

Constellation Brands boasts a diverse portfolio of well-known beer, wine, and spirits brands. Notably, it holds the exclusive U.S. rights to popular Mexican beer brands like Corona and Modelo. The company owns a variety of wine labels, including Robert Mondavi and Kim Crawford, and spirits brands such as Svedka Vodka.

In the competitive beverage alcohol market, Constellation Brands faces strong competition from other industry giants.

- Diageo: A multinational beverage alcohol company.

- Anheuser-Busch InBev: A leading global brewer.

- Molson Coors Beverage Company: Another major player in the brewing industry.

- Pernod Ricard: A French wine and spirits company.

- Brown-Forman: An American owned spirits and wine company.

These companies vie for market share, driving innovation and marketing strategies within the industry. Constellation brands has also made considerable investments into the cannabis market through their stake in Canopy growth.

Constellation Brands has achieved significant growth through strategic acquisitions and a focus on high-end brands. The company’s ability to adapt to changing consumer trends and effectively market its products has been crucial to its success.

Recent Earnings:

Constellation Brands, Inc. achieved revenues of $2.14 billion for the quarter, marking an increase from $2 billion in the same period the previous year and surpassing analyst expectations compiled by Visible Alpha. This growth was largely attributed to an 11% rise in beer sales, reaching $1.7 billion, while wine and spirits sales declined by 6% year-over-year to $436.4 million.

Constellation Brands reported adjusted EPS of $2.26, exceeding the anticipated $2.10 per share. This positive earnings performance was a highlight of the quarter, reflecting the company’s ability to outperform expectations despite challenges in the wine and spirits segment. Constellation Brands reported EPS of $3.25, which fell short of the forecasted $3.33, leading to a significant stock price drop.

The company’s wine and spirits division, however, faced challenges due to unfavorable wholesale conditions and destocking in international markets, partially offset by growth in direct-to-consumer (DTC) channels. Constellation Brands has projected continued growth in fiscal year 2025, with beer sales expected to grow between 7% and 9%, while wine and spirits sales are anticipated to range from a 0.5% decline to a 0.5% increase.

Constellation Brands updated its fiscal year 2025 EPS projections to a range of $13.40 to $13.80, slightly adjusting from previous estimates due to reduced growth assumptions for revenues and operating profit. The company raised its free cash flow projection to between $1.6 and $1.8 billion, reflecting a focus on operational efficiency and cash generation. The company’s commitment to maintaining a strong beer margin range of 39% to 40% underscores its operational focus amidst economic uncertainties.

The Market, Industry, and Competitors:

Constellation Brands, Inc. operates primarily in the alcoholic beverages market, producing and marketing beer, wine, and spirits. Beer accounts for the majority of its revenue, contributing over $8.1 billion in sales in 2023, while wine and spirits continue to see declining sales. Constellation Brands also has a significant presence in premium wine and craft spirits markets, featuring brands like Kim Crawford and Robert Mondavi Winery.

Constellation Brands is expected to see solid growth driven by its beer segment, which has been forecasted to achieve annual net sales growth of 7-9% over the medium term. This growth is supported by high consumer demand for flagship brands like Modelo Especial and Corona Extra. The wine and spirits segment is projected to grow at a slower pace of 1-3% annually. Industry-wide forecasts suggest the beer market will grow at a CAGR of 4.76% from 2024 to 2029, while the wine market is expected to expand at a CAGR of 4.28%.

Constellation Brands anticipates cumulative operating cash flows of $15-17 billion by fiscal 2028 and continues to target low double-digit annual diluted EPS growth (excluding Canopy Growth impacts). The company’s focus on its high-margin beer business positions it well for sustained growth compared to broader industry trends.

Unique differentiation:

Constellation Brands operates in a highly competitive global alcoholic beverage market, facing significant competition from established industry giants. Key competitors include Anheuser-Busch InBev, Diageo, and Molson Coors Beverage Company. Anheuser-Busch InBev, the world’s largest brewer, competes directly with Constellation Brands in the beer segment, particularly in the mass-market and imported beer categories. Diageo, a multinational beverage alcohol company, is a major competitor in the spirits and wine segments, with a diverse portfolio of premium brands. Molson Coors also presents strong competition in the beer sector, particularly in North America. These competitors vie for market share through extensive marketing campaigns, product innovation, and strategic acquisitions, creating a dynamic and challenging environment for Constellation Brands.

Beyond these major players, Constellation Brands also faces competition from regional and niche players. In the wine segment, companies like E. & J. Gallo Winery and Treasury Wine Estates pose significant competition, offering a wide range of wine products across various price points. In the spirits sector, Pernod Ricard and Brown-Forman are key competitors, with established brands and strong distribution networks. The rise of craft breweries and distilleries also presents a challenge, as consumers increasingly seek unique and locally produced beverages. To maintain its competitive edge, Constellation Brands focuses on building strong brands, innovating its product portfolio, and effectively marketing its products to targeted consumer segments.

Focus on High-Growth Segments: Constellation Brands has demonstrated a keen ability to identify and capitalize on high-growth segments, particularly within the beer market. Their strategic emphasis on Mexican import brands, like Modelo and Corona, has yielded exceptional results, outpacing many competitors. This focused approach allows them to concentrate resources and expertise where they can achieve the greatest returns.

Premiumization and Brand Building: The company has a strong track record of building and acquiring premium brands that resonate with consumers. This focus on high-end products allows them to command higher price points and margins, contributing to their profitability. They are very focused on consumer trends, and innovating to meet those trends.

Strategic Acquisitions and Portfolio Management: Constellation Brands has a history of making strategic acquisitions that complement its existing portfolio. Their ability to integrate these acquisitions effectively and manage a diverse range of brands is a key strength. They also have a venture capital portion of their company, so they are looking to invest in up and coming brands.

Management & Employees:

Bill Newlands: He serves as the President and Chief Executive Officer. He is responsible for providing strategic leadership and working with the board of directors to establish long-range goals, strategies, plans, and policies.

Jim Sabia: He is the Executive Vice President and President of the Beer Division. He leads the company’s significant beer business segment.

Mallika Monteiro: She is the Executive Vice President, Managing Director, Beer Brands.

Michael McGrew: He is the Executive Vice President, Chief Communications, ESG & Diversity Officer.

Financials:

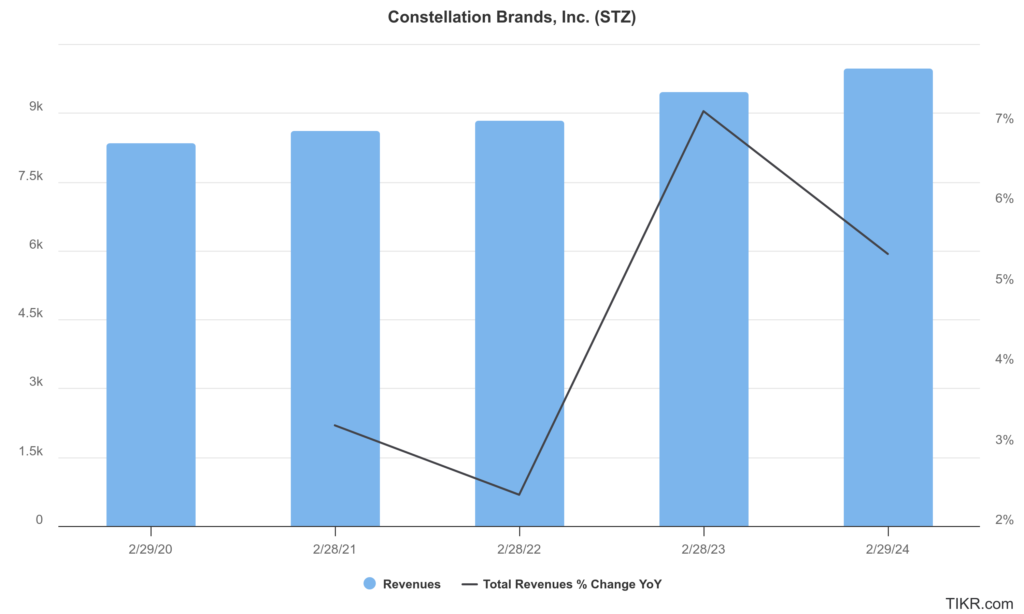

Constellation Brands, Inc. reported revenues of approximately $10.2 billion, reflecting a modest growth rate of about 4% compared to the previous year. This growth trajectory aligns with a compound annual growth rate (CAGR) of approximately 4% over the past five years, indicating steady but unspectacular revenue expansion.

The net income for fiscal year 2024 was reported at $1.727 billion, an increase from a net loss of $71 million in fiscal year 2023. A sharp decline from the prior year’s net income of nearly $2 billion, highlighting the volatility in its earnings performance.

The company maintained a debt-to-EBITDA ratio of approximately 3.19x, indicating a manageable level of leverage relative to its earnings before interest, taxes, depreciation, and amortization. Around $1.5 billion in fiscal year 2024, although it marked a decline from previous years due to increased capital expenditures and operational costs.

While Constellation Brands has demonstrated resilience in revenue generation and has made strides in managing its debt levels, its earnings volatility underscores challenges that may affect future performance.

Technical Analysis:

The stock is in a stage 4 bearish decline on the monthly chart and aiming a slight recovery in stage 1 consolidation (neutral) on the daily and weekly charts. However the chart pattern is a bear flag which indicates a move lower to the $170s

Bull Case:

Dominance in the High-Growth Mexican Beer Segment: Constellation Brands’ ownership of the U.S. distribution rights for Modelo and Corona gives it a significant advantage. These brands continue to experience exceptional growth, outpacing competitors in the premium beer market. The strong brand loyalty and increasing demand for these products are expected to drive revenue and earnings growth.

Premiumization Strategy: The company’s focus on premium brands across its beer, wine, and spirits portfolio aligns with the trend of consumers seeking higher-quality beverages. This strategy allows Constellation Brands to command higher price points and margins, boosting profitability.

Potential Growth in Adjacent Markets: Although their cannabis investment has had some volatility, if that market were to mature, they are well positioned to take advantage of that growth.

Bear Case:

Dominance in the High-Growth Mexican Beer Segment: Constellation Brands’ ownership of the U.S. distribution rights for Modelo and Corona gives it a significant advantage. These brands continue to experience exceptional growth, outpacing competitors in the premium beer market. The strong brand loyalty and increasing demand for these products are expected to drive revenue and earnings growth.

Premiumization Strategy: The company’s focus on premium brands across its beer, wine, and spirits portfolio aligns with the trend of consumers seeking higher-quality beverages. This strategy allows Constellation Brands to command higher price points and margins, boosting profitability.

Effective Portfolio Management: Their ability to strategically manage and optimize their portfolio, including potential divestitures of underperforming assets, allows them to focus on their most profitable segments.