Executive Summary:

Target Corporation is a major American retail corporation operating a chain of discount department stores and hypermarkets across the United States. The company offers various general merchandise, including clothing, home goods, electronics, and groceries. Known for its focus on trend-forward merchandise at lower costs.

Target Corporation reported diluted earnings per share (EPS) of $2.41. Net sales for the fourth quarter were $30.9 billion, a decrease of 3.1% compared to the same period in the previous year. Target’s diluted EPS was $8.86.

Stock Overview:

| Ticker | $TGT | Price | $104.79 | Market Cap | $47.74B |

| 52 Week High | $181.86 | 52 Week Low | $101.76 | Shares outstanding | 455.58M |

Company background:

Target Corporation, a prominent American retail giant, traces its origins back to 1902 with the establishment of the Dayton Dry Goods Company in Minneapolis, Minnesota, by George Dayton. The company initially focused on department store retailing. The Target brand itself was introduced in 1962 as a discount store concept, aiming to offer stylish and affordable merchandise to a broader customer base.

The company has grown organically through its own revenues and strategic expansions. Its growth has been fueled by reinvesting profits and adapting to market demands, rather than relying heavily on initial external funding rounds common in newer startups.

Target offers a vast array of products across various categories. These include apparel and accessories for men, women, and children, home goods such as furniture, décor, and kitchenware, electronics and entertainment products, groceries and household essentials, beauty and personal care items, and seasonal merchandise. Target has also developed several private label brands, such as Cat & Jack (kids’ clothing), Good & Gather (food), and Threshold (home goods), which are popular among consumers. Their product strategy emphasizes a balance of national brands and exclusive, trend-forward private label offerings at competitive prices.

Its primary competitors include Walmart, the largest retailer in the United States, known for its everyday low prices and broad product selection. Amazon also poses a threat with its vast online marketplace and increasing physical retail presence. Other key competitors include department stores like Macy’s and Kohl’s, as well as specialty retailers in specific categories like home goods (e.g., Bed Bath & Beyond, though facing challenges) and grocery stores. Target differentiates itself through its focus on design, brand image, and a curated shopping experience.

The corporate headquarters of Target Corporation remains in Minneapolis, Minnesota. This location has been central to the company’s operations since its inception as the Dayton Dry Goods Company. The continued presence of its headquarters in Minneapolis reflects the company’s deep roots and long-standing commitment to the region.

Recent Earnings:

Target Corporation reported net sales of $30.9 billion. A decrease of 3.1% compared to the same period in the previous year, it’s important to note that the prior year’s fourth quarter included an extra week in its reporting period.

Target reported diluted earnings per share (EPS) of $2.41 for the fourth quarter. Target’s diluted EPS reached $8.86. The company effectively navigated the economic landscape and delivered on its profitability goals.

The company highlighted a continued focus on inventory management and supply chain efficiency. Target offered its outlook for the upcoming fiscal year. The company typically provides expectations for sales growth, profitability margins, and capital expenditures. The company’s focus on operational efficiency and its forward-looking guidance will be crucial in shaping investor sentiment and its strategic direction in the coming year.

The Market, Industry, and Competitors:

Target Corporation operates within the highly competitive retail market, primarily focusing on consumer staples and general merchandise. Target has a market capitalization of approximately $53 billion and generates annual revenues exceeding $107 billion. The U.S. retail market was valued at around $4.55 trillion in 2021, with expectations for growth of over 3% annually through 2026. Target holds a modest market share of about 5.1%, competing against major players like Walmart and Amazon, which together control a significant portion of the market. To enhance its market presence, Target plans to open over 300 new stores within the next decade, with a focus on large-format locations that can also serve as fulfillment centers for online orders.

Looking ahead to 2030, Target has set ambitious goals to drive an additional $15 billion in sales growth. This growth strategy includes investments in enhancing its brick-and-mortar stores, expanding its digital capabilities, and improving supply chain efficiency through AI-driven inventory management systems. The company aims to increase its third-party digital marketplace sales from approximately $1 billion in 2024 to over $5 billion by the end of the decade, reflecting a strong push toward e-commerce and diversified product offerings.

Unique differentiation:

Target Corporation operates in a highly competitive retail landscape, facing a diverse range of competitors across various product categories. Its primary direct competitor is Walmart, the largest retailer in the United States. Walmart competes on price, offering a wide assortment of products at everyday low prices, and has a vast physical store presence and a significant online operation. Both companies target a broad consumer base, making them direct rivals in areas like groceries, general merchandise, and apparel.

Another significant competitor is Amazon, which has rapidly expanded its retail footprint and offers an unparalleled selection of products online. Amazon’s strong e-commerce platform and its growing physical retail presence, including Amazon Go and Amazon Fresh stores, pose a significant threat across all of Target’s product categories. Target also competes with traditional department stores like Macy’s and Kohl’s, particularly in apparel, home goods, and beauty. While these department stores often focus on a slightly different demographic or offer a more curated selection, they still vie for similar consumer spending.

In the grocery segment, it competes with dedicated grocery chains like Kroger and local supermarkets. In the electronics and home improvement categories, it goes up against retailers like Best Buy and Home Depot, respectively. The key differentiator for Target lies in its brand image, which emphasizes a more stylish and trend-forward merchandise selection compared to some of its mass-market competitors, coupled with a focus on a more curated shopping experience.

Target Corporation distinguishes itself from its competitors through a unique blend of brand image, curated merchandise, and a focus on the shopping experience. While many mass retailers compete primarily on price and broad selection, Target has cultivated a reputation for offering stylish and trend-forward products at affordable prices. This “cheap chic” positioning resonates with a consumer base that values both value and design, setting it apart from the more utilitarian image often associated with competitors like Walmart.

Target places a strong emphasis on its private label brands. These in-house brands, such as Cat & Jack for kids’ clothing, Good & Gather for food, and Threshold for home goods, are often designed with a focus on quality and style, creating a unique product offering that customers can only find at Target. This strategy allows Target to control product design and pricing, offering exclusive merchandise that differentiates it from retailers carrying primarily national brands.

Target invests in creating a more appealing and engaging shopping experience. Its store layouts, visual merchandising, and overall atmosphere are often perceived as more modern and aesthetically pleasing compared to some of its mass-market rivals. This focus on the customer experience, from the store environment to its marketing and branding, contributes to a stronger emotional connection with its target demographic, fostering brand loyalty that goes beyond just price.

Management & Employees:

Brian Cornell: Chairman of the Board and Chief Executive Officer. He has been instrumental in shaping Target’s strategy and leading its transformation in recent years.

Michael Fiddelke: Chief Financial Officer. He oversees the company’s financial planning, reporting, and analysis.

Christina Hennington: Executive Vice President and Chief Growth Officer. She is responsible for driving the company’s growth strategies across various areas.

Jill Sando: Executive Vice President and Chief Merchandising Officer. She leads the teams responsible for product assortment and merchandising strategies.

Financials:

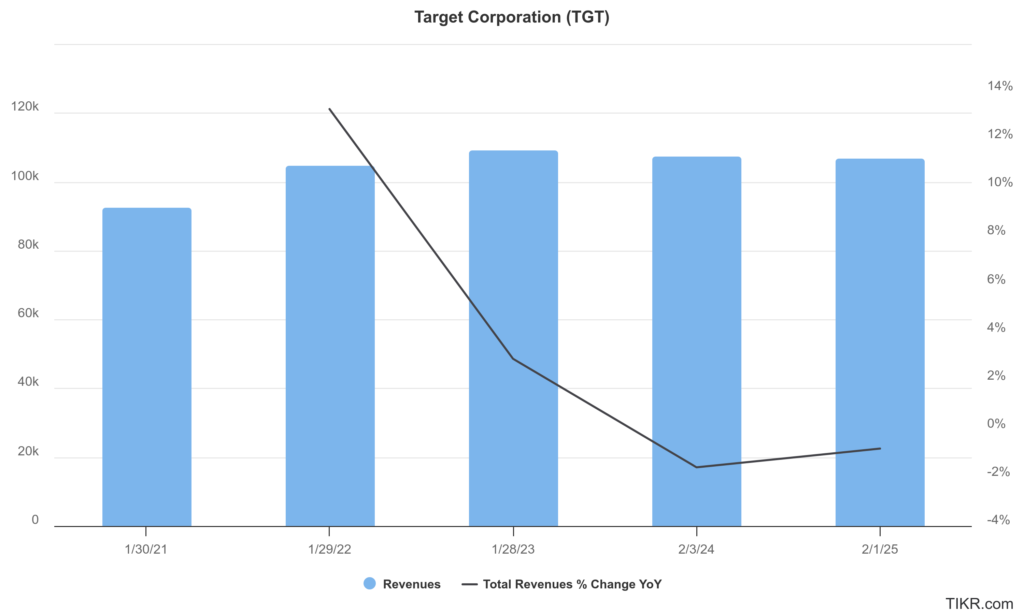

Target Corporation has reported revenues of approximately $78.1 billion, which surged to about $106.6 billion in 2025. This growth trajectory reflects a compound annual growth rate (CAGR) of approximately 6.41%. The company’s revenue growth can be attributed to its strategic investments in e-commerce, store expansions, and enhanced customer experiences, which have collectively attracted a broader consumer base and increased sales across various product categories.

Target’s net income was around $4.37 billion in 2020 but saw a decline to approximately $4.09 billion by 2025, translating to a negative CAGR of about -1.3%. Target has continued to focus on efficiency improvements and cost management strategies to stabilize its profit margins.

The company reported total assets of approximately $55.4 billion, with total liabilities amounting to around $38.3 billion. This results in a healthy equity position of about $17.1 billion, indicating that Target is well-capitalized to support its growth initiatives and withstand market fluctuations. The company’s liquidity remains strong, with sufficient cash reserves and manageable debt levels, enabling it to navigate potential economic uncertainties effectively.

The company’s strategic focus on innovation and customer engagement continues to drive revenue growth, while efforts to optimize operations will be crucial for improving profitability moving forward. Target is positioned to leverage its strengths in both physical and digital retail spaces.

Technical Analysis:

The stock is in a stage 4 bearish markdown on monthly chart and in a stage 1 neutral, consolidation stage on the weekly chart. The daily chart is stage 4 markdown as well (Bearish) and is looking for support in the $88 or earlier zone from its current $100 range.

Bull Case:

Robust Omnichannel Capabilities: Target has made significant investments in its omnichannel infrastructure, including its website, mobile app, and in-store pickup and delivery services. This allows for a seamless and convenient shopping experience, catering to the evolving consumer preference for online and hybrid shopping models. Further optimization and growth in this area can drive increased sales and market share.

Strategic Inventory Management and Cost Control: Target has demonstrated an ability to adapt its inventory management strategies, as seen in its recent efforts to manage excess inventory. Continued focus on efficient supply chain management and cost control measures can improve profitability and resilience in the face of economic headwinds.

Dividend and Shareholder Returns: Target has a history of returning value to shareholders through dividends and share buybacks. Continued profitability and strong cash flow generation can support further increases in these shareholder returns, making the stock more attractive to investors seeking income and capital appreciation.

Bear Case:

Supply Chain Disruptions and Inflationary Pressures: While Target has made efforts to improve its supply chain, global disruptions and inflationary pressures on raw materials and transportation costs can still impact its cost of goods sold and overall profitability. Inability to effectively manage these pressures could lead to lower margins.

E-commerce Profitability and Competition: While Target has invested heavily in its e-commerce platform, achieving the same level of profitability as its physical stores can be challenging due to higher fulfillment and shipping costs. Competition from Amazon and other online retailers puts pressure on pricing and delivery expectations.

Geopolitical and Global Economic Uncertainty: Broader geopolitical events and global economic instability can create uncertainty and volatility in consumer behavior and supply chains, impacting Target’s performance.