Executive Summary:

Monster Beverage Corporation is a prominent American beverage company, primarily known for its extensive range of energy drinks. The company transitioned to focus on energy drinks, leading to its current identity. Their product portfolio includes a diverse selection of energy drinks, such as the widely popular Monster Energy line, alongside other beverages. The company has also expanded its portfolio through acquisitions, including ventures into craft beer and other beverage sectors.

Monster Beverage Corporation achieved record net sales of $1.81 billion, surpassing the analyst estimate of $1.79 billion, showing a 4.7% increase from the previous year. The adjusted earnings per share (EPS) came in at $0.38.

Stock Overview:

| Ticker | $MNST | Price | $56.21 | Market Cap | $54.7B |

| 52 Week High | $61.03 | 52 Week Low | $43.32 | Shares outstanding | 973.16M |

Company background:

Monster Beverage Corporation, originally known as Hansen’s, has a rich history dating back to 1935 in Southern California. Initially, it was founded by Hubert Hansen and his three sons as a juice company, catering to the health-conscious market with fresh, natural juices. The company navigated through various ownership changes and expansions over the decades, eventually shifting its focus towards the burgeoning energy drink market. This strategic pivot, primarily driven by the success of the Monster Energy drink line, transformed the company into the global beverage giant it is today.

Monster Beverage Corporation’s growth was primarily organic, driven by the explosive popularity of its Monster Energy line. While not traditionally a venture-funded startup, their strategic partnership with Coca-Cola in 2015 was a pivotal moment. Coca-Cola acquired a 16.7% equity stake in Monster, transferring its energy drink business to Monster and becoming Monster’s preferred distribution partner. This deal significantly expanded Monster’s distribution network and global reach, acting as a major catalyst for its continued expansion. The company’s product portfolio is dominated by the Monster Energy line, which includes a vast array of flavors and formulations, catering to diverse consumer preferences. Beyond its flagship energy drinks, Monster has diversified its offerings through acquisitions, including ventures into alcoholic beverages, such as craft beer and hard seltzers, and other non-energy drink lines.

Key competitors in the energy drink market include Red Bull, which is considered a dominant player, and PepsiCo, with its Rockstar and Mountain Dew Energy brands. Other competitors include smaller, regional energy drink companies and private-label brands. The competition is intense, with companies constantly innovating and launching new products to capture market share. Monster Beverage Corporation’s headquarters are located in Corona, California, in the United States. This location serves as the central hub for the company’s operations, overseeing its global business activities.

Recent Earnings:

Monster Beverage Corporation reported record net sales of $1.81 billion, representing a 4.7% increase compared to the same period last year. Which had projected around $1.79 billion. The growth reflects the continued demand for Monster’s energy drink products, particularly in international markets. The adjusted earnings per share (EPS) for the quarter came in at $0.38, falling short of the consensus analyst estimate of $0.40. This deviation from EPS expectations suggests that while revenue growth remained strong, profitability faced some headwinds.

Monster Beverage experienced increased operating expenses, which contributed to the EPS shortfall. This rise in expenses could be attributed to various factors, including increased marketing and promotional spending, higher raw material costs, and logistical challenges. The company also reported on its progress in expanding its distribution network, particularly in emerging markets, which is a key strategic focus. In terms of product innovation, Monster continued to introduce new flavors and formulations to maintain consumer interest and drive sales.

Monster Beverage’s management expressed optimism about the company’s long-term growth prospects. They emphasized their commitment to expanding their product portfolio, both organically and through strategic acquisitions. The company aims to further penetrate international markets and capitalize on the growing demand for energy drinks and other beverage categories. However, specific financial guidance for the upcoming quarters was not provided in detail, leading some analysts to express caution regarding near-term profitability. Monster Beverage’s executives conveyed confidence in their ability to navigate these challenges and deliver sustainable value to shareholders.

The Market, Industry, and Competitors:

Monster Beverage Corporation operates in the global energy drink market, a dynamic and rapidly evolving segment of the broader beverage industry. This market is characterized by intense competition, driven by consumer demand for products that provide an energy boost, enhanced focus, and improved performance. The energy drink sector has seen significant growth in recent years, fueled by changing lifestyles, increasing urbanization, and the growing popularity of fitness and sports activities. Consumers, particularly younger demographics, are drawn to energy drinks for their functional benefits and the perceived lifestyle associations. The market is also witnessing a trend towards healthier energy drink options, with reduced sugar content, natural ingredients, and functional additives.

A compound annual growth rate (CAGR) ranging from 7% to 9% through 2030. Factors contributing to this growth include the rising popularity of energy drinks in emerging markets, the introduction of innovative product formulations, and the increasing adoption of energy drinks as a daily beverage choice. The global energy drinks market is expected to reach a market value of over $100 billion by 2030, driven by the expanding consumer base and the continuous introduction of new products. Monster Beverage Corporation is well-positioned to capitalize on this growth, leveraging its strong brand recognition, extensive distribution network, and ongoing product innovation.

Unique differentiation:

Monster Beverage Corporation operates in a highly competitive segment of the beverage industry, facing challenges from both established giants and emerging brands. A primary competitor is Red Bull, a dominant force in the energy drink market known for its strong brand recognition and global presence. Red Bull’s extensive marketing, often associated with extreme sports and events, creates a powerful brand image that resonates with consumers. Another major competitor is PepsiCo, which owns the Rockstar Energy brand, providing broad distribution networks and resources. PepsiCo’s reach allows for widespread product availability, posing a significant challenge to Monster’s market share.

Monster also competes with other significant beverage companies that have entered the energy drink space. For example, The Coca-Cola Company, while being a distribution partner, also has competing products in the energy drink market. Furthermore, there are rising competitors like Celsius Holdings Inc., which has seen rapid growth in the fitness-focused energy drink sector. These competitors create a dynamic market where innovation, marketing, and distribution are crucial for maintaining and growing market share. T

Extensive Product Portfolio and Innovation: Monster has built a vast and diverse product portfolio within the energy drink category. They consistently introduce new flavors, formulations, and product lines, catering to a wide range of consumer preferences and needs. This continuous innovation keeps the brand relevant and appealing to a dynamic market, setting them apart from competitors with narrower offerings.

Focus on the Energy Drink Category: Unlike some competitors that diversify across various beverage categories, Monster’s primary focus has remained on energy drinks. This specialization has allowed them to develop deep expertise and a strong brand presence within this specific market segment. This focused approach has proven to be a successful strategy.

Management & Employees:

Rodney C. Sacks: Co-Chief Executive Officer and Chairman. He has been a pivotal figure in the company’s transformation and growth, particularly in the energy drink sector.

Hilton H. Schlosberg: Co-Chief Executive Officer and Vice Chairman. He plays a crucial role in the company’s financial management and strategic planning.

Financials:

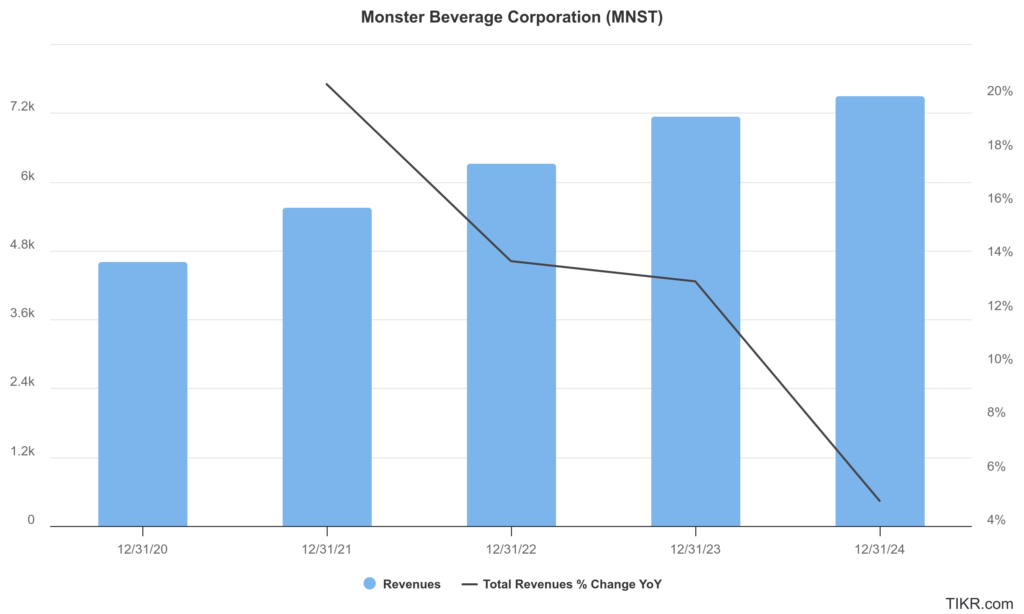

Monster Beverage Corporation has revenue increased from approximately $4.6 billion to about $7.5 billion, reflecting a compound annual growth rate (CAGR) of approximately 12.98%. The company reported revenue of $7.49 billion, marking a consistent upward trend year-over-year.

Monster’s net income rose from around $1.41 billion in 2020 to approximately $1.51 billion in 2024, resulting in a CAGR of about 1.72%. It indicates that the company has maintained profitability amidst increasing sales. The earnings per share (EPS) also reflects this stability, with an increase from $1.33 in 2020 to around $1.50 in 2024.

Total assets amounted to approximately $7.72 billion, with total liabilities at about $2.84 billion. The company has effectively managed its debt levels, maintaining a healthy ratio of total liabilities to total assets, which suggests prudent financial management. The equity position is strong as well, with total stockholders’ equity reported at around $4.88 billion. This combination positions the company well for future growth opportunities in the competitive beverage market.

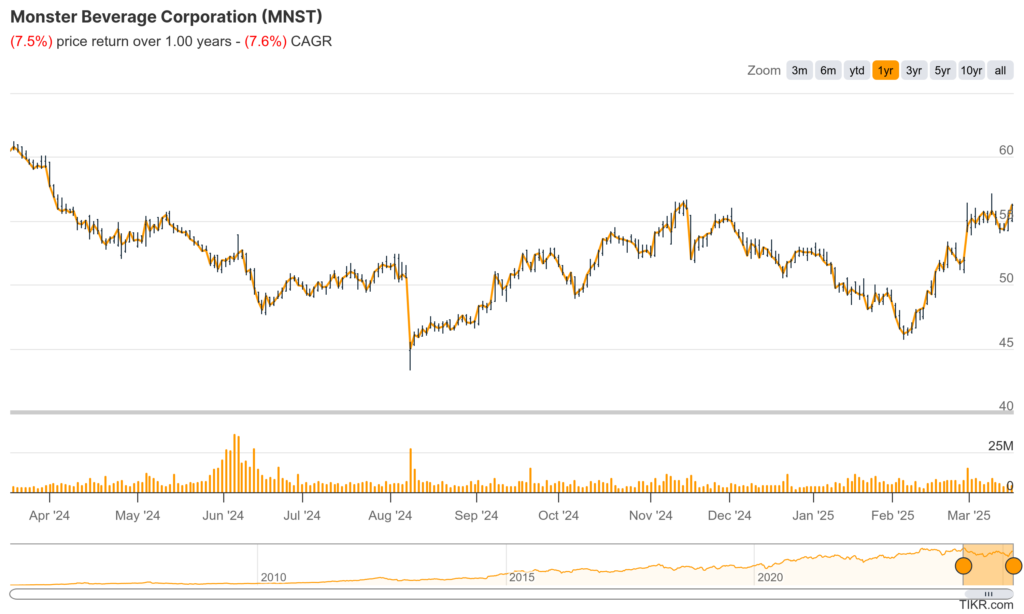

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly and weekly charts, but is in a stage 2 (bullish) on the daily chart. The near term outlook looks positive to the $57 range with lots of resistance at that level. Given the multiple resistance zones we are recommending any purchase in the stock until it moves higher than the $57 zone.

Bull Case:

Global Expansion: Monster has significant opportunities to expand its market share in international markets. Energy drink consumption is growing globally, and Monster’s partnership with Coca-Cola provides a robust distribution network to capitalize on this trend.

Strategic Partnerships: The ongoing strategic partnership with Coca-Cola continues to be a very strong asset. This partnership strengthens distribution, and helps with global reach.

Bear Case:

Intense Competition: The energy drink market is highly competitive, with major players like Red Bull and PepsiCo, as well as emerging brands, vying for market share. Increased competition could lead to pricing pressures and reduced profitability.

Health Concerns and Regulatory Risks: Energy drinks have faced scrutiny regarding their health effects, particularly among younger consumers. Increased regulatory oversight or changes in consumer preferences due to health concerns could negatively impact sales.

Dependence on Energy Drink Category: While diversification is occurring, Monster is still heavily reliant on the energy drink category. Any significant downturn in this market could have a substantial impact on the company’s performance.