Executive Summary:

Restaurant Brands International Inc. (RBI) is a major player in the global quick-service restaurant industry. RBI owns and operates four prominent brands: Tim Hortons, Burger King, Popeyes, and Firehouse Subs. RBI focuses on leveraging the strengths of its individual brands while benefiting from the scale and shared resources of the parent company.

Restaurant Brands International Inc. (RBI) reported adjusted earnings per share (EPS) of $0.81, and revenue of $2.3 billion. With analysts anticipating $0.79 EPS.

Stock Overview:

| Ticker | $QSR | Price | $65.74 | Market Cap | $29.72B |

| 52 Week High | $81.55 | 52 Week Low | $59.67 | Shares outstanding | 324.99M |

Company background:

Restaurant Brands International Inc. (RBI) stands as a prominent global force in the quick-service restaurant (QSR) industry. It was formed in 2014 through the merger of Burger King and Tim Hortons, creating a powerhouse of well-established brands. RBI expanded its portfolio by acquiring Popeyes and later Firehouse Subs. Therefore, RBI’s founding is based on the merging of existing large brands, rather than a traditional startup scenario.

RBI’s core business revolves around its four iconic brands: Tim Hortons, known for its coffee and baked goods; Burger King, famous for its burgers; Popeyes, recognized for its flavorful fried chicken; and Firehouse Subs specializing in subs.The company’s business model heavily relies on franchising, enabling it to expand its reach and presence across numerous countries.

RBI’s key competitors include other major QSR companies such as McDonald’s, Yum! Brands (which owns KFC, Pizza Hut, and Taco Bell), and Starbucks. These companies compete for market share in the fast-food and beverage sectors, both domestically and internationally. RBI’s headquarters are located in Toronto, Ontario, Canada.

Recent Earnings:

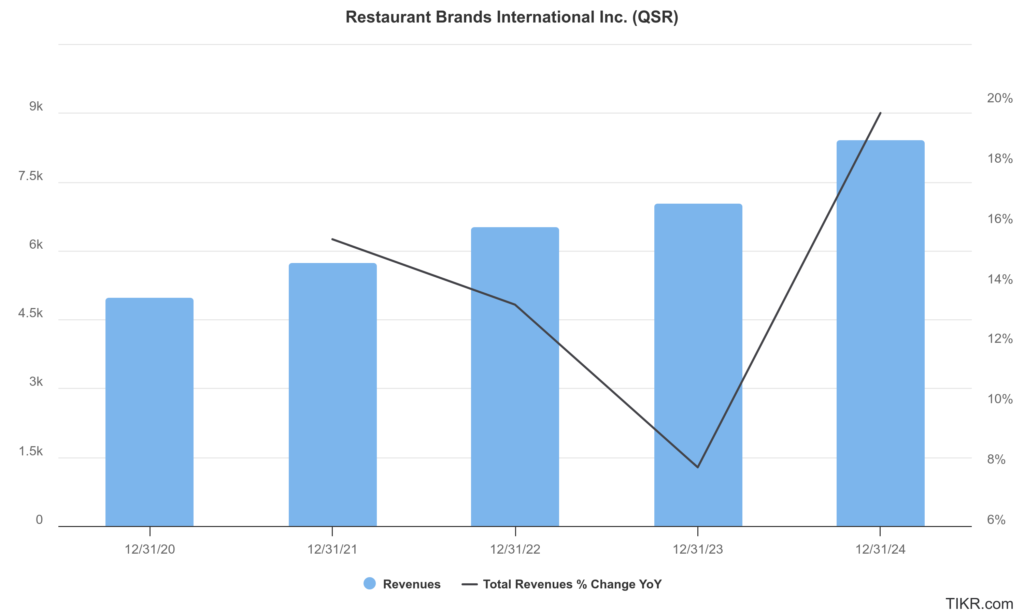

Restaurant Brands International Inc. (RBI), achieved a global system-wide sales growth of 5.6% in the fourth quarter and 5.4% for the entire year, with comparable sales increasing by 2.5% in Q4, driven by a 4.7% rise in the INTL segment. Total revenues for 2024 reached $8.406 billion, marking a significant increase from $7.022 billion in 2023.

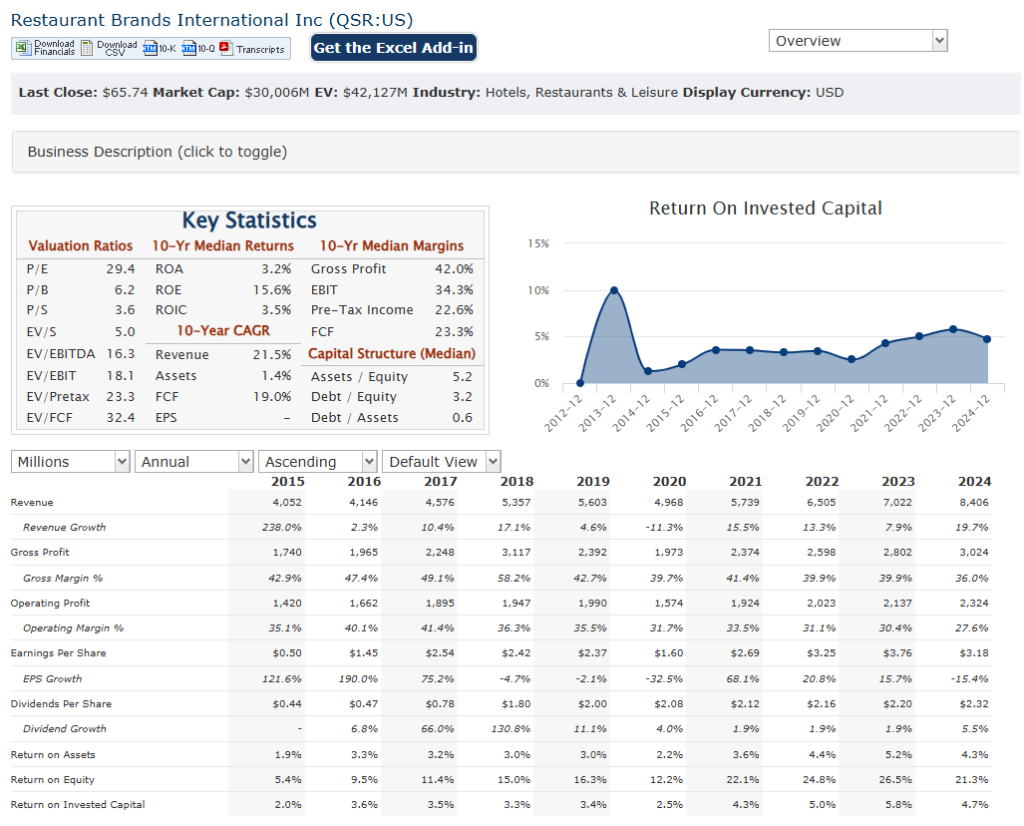

The revenue growth was accompanied by a 17.9% year-over-year increase in income from operations, reaching $2.419 billion in 2024 compared to $2.051 billion in 2023. Net income declined to $1.445 billion from $1.718 billion in the previous year, partly due to unfavorable foreign exchange movements. The company also reported a diluted earnings per share (EPS) of $3.18 for 2024, down from $3.76 in 2023. RBI demonstrated resilience in its operational metrics, with a net restaurant growth of 3.4% and a total system restaurant count of 32,125 by the end of 2024.

RBI’s performance reflects a challenging environment with currency fluctuations impacting revenue and profitability. RBI’s ability to navigate these challenges while maintaining growth in key segments suggests a positive outlook, although the decline in net income may have fallen short of some expectations.

RBI highlighted significant growth in its INTL segment, with system-wide sales increasing by 10.0% for the year. The company also emphasized its commitment to returning value to shareholders, with approximately $1 billion in capital returned in 2024. RBI has set a target dividend of $2.48 per common share and partnership exchangeable unit. The company’s forward guidance includes expectations for segment G&A expenses between $650 million and $670 million, adjusted interest expense between $500 million and $520 million, and consolidated capital expenditures of $400 million to $450 million. RBI also outlined long-term goals, including comparable sales growth of 3%+, net restaurant growth of 5%+, and system-wide sales growth of 8%+ from 2024 to 2028.

The Market, Industry, and Competitors:

Restaurant Brands International Inc. (RBI) operates in the global fast food and quick service restaurant (QSR) market, which is experiencing significant growth driven by changing consumer lifestyles and preferences for convenience. The QSR market was valued at approximately $316.1 billion in 2024 and is projected to reach $384 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.3% from 2024 to 2030. RBI, as a major player in this market, benefits from trends such as urbanization and the increasing demand for quick, affordable meals.

The global QSR market is expected to continue its expansion, with the overall market size projected to reach around $410.1 billion, according to some estimates. RBI, with its brands like Burger King, Tim Hortons, Popeyes, and Firehouse Subs, is well-positioned to capitalize on this growth. Including opening at least 7,000 new restaurants internationally and reaching $60 billion in system-wide sales by 2028.

The global QSR market is anticipated to grow at a CAGR of approximately 5.8% from 2022 to 2030, driven by factors such as menu innovation, digital ordering, and delivery services. RBI’s own growth strategy includes targets for comparable sales growth of 3%+, net restaurant growth of 5%+, and system-wide sales growth of 8%+ over the next five years.

Unique differentiation:

- McDonald’s: As the world’s largest restaurant chain, McDonald’s is a major competitor across various segments, particularly in the burger market, directly challenging Burger King. Their vast global presence, brand recognition, and extensive menu offerings pose a consistent competitive threat.

- Yum! Brands: Yum! Brands, with its portfolio of KFC, Taco Bell, and Pizza Hut, competes with RBI across various food categories. Their strong presence in the chicken, Mexican, and pizza segments creates direct competition for Popeyes and other RBI brands.

- Starbucks: While RBI’s Tim Hortons competes in the coffee and breakfast market, Starbucks is a large competitor in this market. They have a massive global presence and are a very strong competitor.

These competitors engage in intense competition for market share, customer loyalty, and brand recognition. Factors such as menu innovation, pricing strategies, marketing campaigns, and digital capabilities play crucial roles in this competitive landscape. RBI must continuously adapt and innovate to maintain its position in this dynamic market.

Restaurant Brands International Inc. (RBI) differentiates itself from competitors through a combination of factors, primarily centered around its diverse portfolio of iconic brands and its strategic approach to franchising.

- Diverse Brand Portfolio: RBI owns a collection of distinct and well-established brands: Tim Hortons, Burger King, Popeyes, and Firehouse Subs. This diversification allows RBI to capture a broad range of consumer preferences across different food categories (coffee, burgers, chicken, sandwiches). This is a strong point of differentiation, as few competitors have such a widely varied and strong collection of brands. Each brand maintains its unique identity and target audience, while benefiting from the shared resources and global scale of RBI. This allows for both individual brand strength, and the strength of a large parent company.

- Franchise-Centric Model: RBI’s heavy reliance on a franchise-based business model enables rapid global expansion and efficient capital utilization. This approach fosters strong partnerships with franchisees, who possess local market expertise. This franchise heavy model allows RBI to grow very quickly, and with less direct capital investment than many of its competitors.

RBI’s differentiation lies in its ability to manage a diverse portfolio of established brands while maximizing efficiency through its franchise model and global scale.

Management & Employees:

Patrick Doyle: serves as the Executive Chairman. He brings a wealth of leadership experience, having previously served as the CEO of Domino’s Pizza.

Joshua Kobza: holds the position of Chief Executive Officer. He is responsible for the overall strategic direction and performance of RBI. He has held various leadership roles within RBI, giving him a deep understanding of the company’s operations and brands.

Financials:

Restaurant Brands International Inc. (RBI) has total revenues that have consistently increased, driven by system-wide sales growth and strategic acquisitions. RBI reported total revenues of $8.406 billion, up from $7.022 billion in 2023, reflecting a compound annual growth rate (CAGR) of approximately 7.5% over the two years.

The company’s income from operations has shown significant increases, with a 17.9% year-over-year growth in 2024. RBI reported a net income of $1.445 billion, down from $1.718 billion in 2023. RBI’s earnings per share (EPS) have generally trended upward, with a diluted EPS of $3.18 in 2024 compared to $3.76 in 2023.

The company has maintained a significant debt level, with a total debt of approximately $13.4 billion as of the end of 2023. RBI has also focused on managing its leverage, achieving a net leverage ratio of 4.6x by the end of 2024. RBI’s ability to balance debt with growth investments has been crucial in maintaining its competitive edge in the global QSR market.

The company’s focus on operational improvements, marketing efforts, and modernizing its brand images aligns with broader industry trends. RBI’s commitment to returning value to shareholders, as evidenced by its dividend payments and share repurchases, underscores its confidence in its financial performance and strategic direction.

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly chart. A reversal into stage 2 (bullish) on the weekly chart and a stage 4 markdown (bearish) on the daily chart indicate a near term move lower to the $63 – $64 zone after which a reversal is possible but we would wait for a confirmed reversal.

Bull Case:

Operational Improvements and Digital Growth: RBI’s focus on operational efficiencies, including supply chain optimization and cost management, can drive improved profitability. The company’s investment in digital technologies, such as mobile ordering, delivery services, and loyalty programs, enhances customer experience and drives sales growth.

Franchise Model Advantages: RBI’s franchise-heavy business model generates consistent revenue streams and allows for efficient capital deployment. Franchisees’ local market knowledge and entrepreneurial drive contribute to brand growth and operational excellence.

Potential for Increased Shareholder Returns: RBI has a history of returning value to shareholders through dividends. Continued growth in earnings and free cash flow could lead to increased dividend payouts. Strategic initiatives, such as brand revitalization and menu innovation, can drive increased sales and profitability, leading to higher stock valuations.

Bear Case:

Franchise-Related Risks: RBI’s heavy reliance on franchising exposes it to risks associated with franchisee relationships. Disagreements over pricing, marketing, and operational standards can lead to conflicts and impact brand consistency. Economic downturns can negatively affect franchisee profitability, potentially leading to store closures and reduced royalty payments.

Economic Headwinds: Global economic uncertainty, including inflation and rising interest rates, can impact consumer spending and restaurant traffic. Increased input costs, such as food and labor, can also squeeze margins. Also, geopolitical events can seriously effect the global supply chain, and effect RBI.