Executive Summary:

The Wendy’s Company is a major American fast-food corporation, best known for its Wendy’s restaurant chain. The company operates through a mix of company-owned and franchised restaurants worldwide. Wendy’s is recognized for its signature square hamburger patties, Frosty desserts, and menu focused on quality ingredients.

The Wendy’s Company reported total revenues of $574.3 million and an adjusted earnings per share of $0.25. Wendy’s saw global systemwide sales growth of 5.4% in the fourth quarter. Wendy’s provided fiscal 2025 guidance, projecting adjusted earnings per share of $0.98 to $1.02.

Stock Overview:

| Ticker | $WEN | Price | $15.25 | Market Cap | $3.06B |

| 52 Week High | $20.65 | 52 Week Low | $13.72 | Shares outstanding | 200.49M |

Company background:

The Wendy’s Company is a prominent American fast-food chain with a rich history. It was founded by Dave Thomas in 1969, with the first restaurant opening in Columbus, Ohio. Thomas’s vision was to provide high-quality hamburgers, a concept that differentiated Wendy’s from its competitors. The company is named after Thomas’s daughter, Melinda Lou “Wendy” Thomas. The company’s headquarters are located in Dublin, Ohio.

Wendy’s is known for its distinctive square hamburger patties, a feature that sets it apart in the fast-food industry. In addition to hamburgers, the menu includes a variety of items such as chicken sandwiches, French fries, and the popular Frosty dessert. The company operates through a combination of company-owned and franchised restaurants, extending its reach both domestically and internationally.

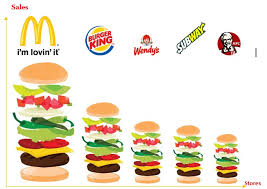

In the competitive fast-food market, Wendy’s faces strong competition from major players such as McDonald’s and Burger King. These companies vie for market share by offering similar products and services, engaging in marketing campaigns, and adapting to changing consumer preferences. Wendy’s strives to maintain its competitive edge through menu innovation, quality ingredients, and a focus on customer service.

Recent Earnings:

Wendy’s reported total revenues of $574.3 million for the fourth quarter of 2024. The increase in revenue was attributed to growth in franchise fees, company-operated restaurant sales, advertising funds revenue, and franchise royalty revenue. Global systemwide sales grew 5.4% in the fourth quarter.

Adjusted earnings per share (EPS) for the fourth quarter of 2024 were $0.25. For the full year 2024, the adjusted EPS was $1.00.

Wendy’s generally exceeded analyst expectations for both revenue and adjusted EPS in the fourth quarter. This positive performance contributed to a favorable market reaction.

Global systemwide sales growth is projected to be between 2% and 3%. Adjusted EPS is expected to range from $0.98 to $1.02. Adjusted EBITDA is expected to range from $550 million to $560 million. The company also updated its capital allocation policy, including a new target dividend payout ratio and plans for share repurchases.

The Market, Industry, and Competitors:

The Wendy’s Company operates within the highly competitive quick-service restaurant (QSR) market, a segment of the broader food service industry. This market is characterized by intense competition among major players, with factors such as price, convenience, and product innovation driving consumer choices. The QSR market is influenced by evolving consumer trends, including increasing demand for digital ordering and delivery, as well as a growing focus on healthier food options. Wendy’s, like its competitors, is adapting to these trends by investing in technology, expanding its digital presence, and refining its menu offerings.

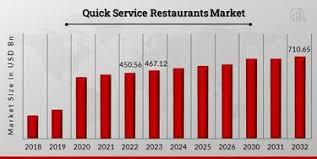

The QSR market is expected to experience continued growth, driven by factors such as increasing urbanization, rising disposable incomes, and the ongoing demand for convenient food options. Reports indicate varied growth expectations, with some focusing on the overall food service market. The global fast food market there are also growth projections. The global fast food market is projected to grow at a CAGR of roughly 4.00% between 2023 and 2030. Wendy’s, with its focus on quality and innovation, aims to capitalize on this growth by expanding its restaurant footprint, enhancing its digital capabilities, and continuing to provide compelling menu choices.

Unique differentiation:

The Wendy’s Company operates in the fiercely competitive quick-service restaurant (QSR) market, where it faces significant competition from well-established and aggressive rivals. Two of its primary competitors are McDonald’s and Burger King. McDonald’s, the world’s largest restaurant chain, boasts a vast global presence and a diverse menu, offering a wide range of products from burgers and fries to breakfast items and desserts. Its sheer scale and brand recognition provide a formidable challenge to Wendy’s. Burger King, another major player, is known for its flame-grilled burgers and a strong emphasis on value offerings. Both McDonald’s and Burger King engage in intense marketing campaigns, menu innovation, and price competition, requiring Wendy’s to constantly adapt and differentiate itself.

Wendy’s also competes with other QSR chains specializing in burgers and chicken, such as Five Guys, which emphasizes high-quality ingredients, and Chick-fil-A, known for its chicken sandwiches and customer service. The increasing popularity of fast-casual restaurants, like Shake Shack, presents a growing challenge, as these establishments offer a higher-quality dining experience and often command premium prices. The competitive landscape also includes regional players and emerging fast-food concepts, all vying for a share of the consumer’s wallet.

- Fresh, Never Frozen Beef: A cornerstone of Wendy’s brand is its commitment to using fresh, never frozen beef for its hamburger patties. This emphasis on quality distinguishes them from many competitors who rely on frozen products.

- Square Hamburger Patties: The distinctive square shape of Wendy’s hamburger patties is a readily recognizable brand identifier. This shape isn’t just for show; it’s designed to protrude beyond the bun, visually reinforcing the idea of a more substantial burger.

- Focus on Quality: Wendy’s has put an emphasis on higher quality ingredients, and overall product quality, in comparison to some of its competitors. This has helped them to create a perception of a premium fast food option.

Kirk Tanner: President and Chief Executive Officer. He leads the overall strategic vision and day-to-day operations of the company.

Matthew Spessard: Executive Vice President and Chief Financial Officer. He oversees the company’s financial operations, including accounting, financial planning, and investor relations.

Abigail Pringle: President, International and Chief Development Officer. She leads the development and expansion of Wendy’s international business and oversees franchise development.

Scott Roach: President, U.S. He is responsible for the operations and performance of Wendy’s restaurants in the United States.

Financials:

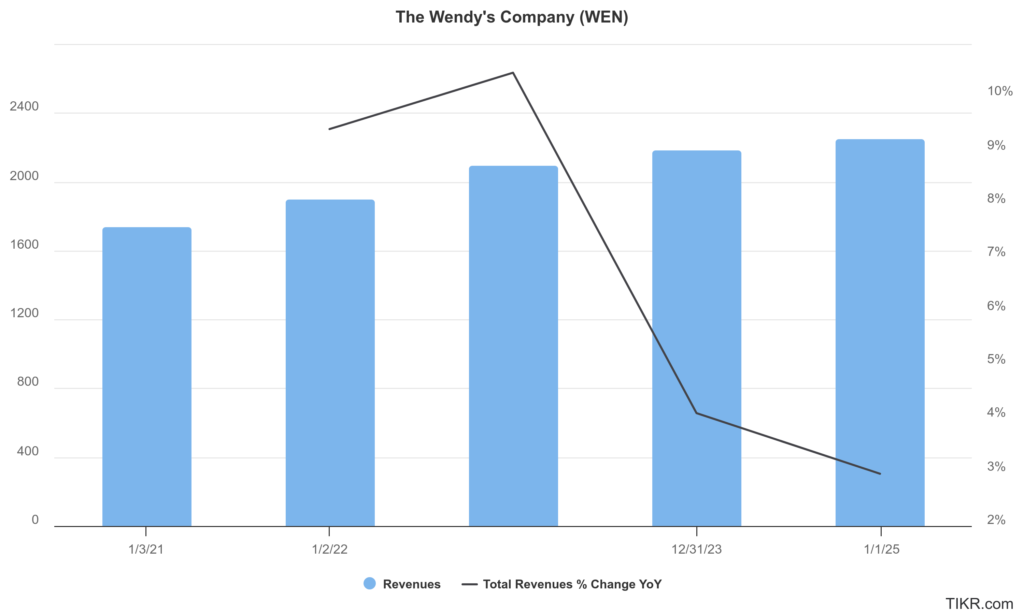

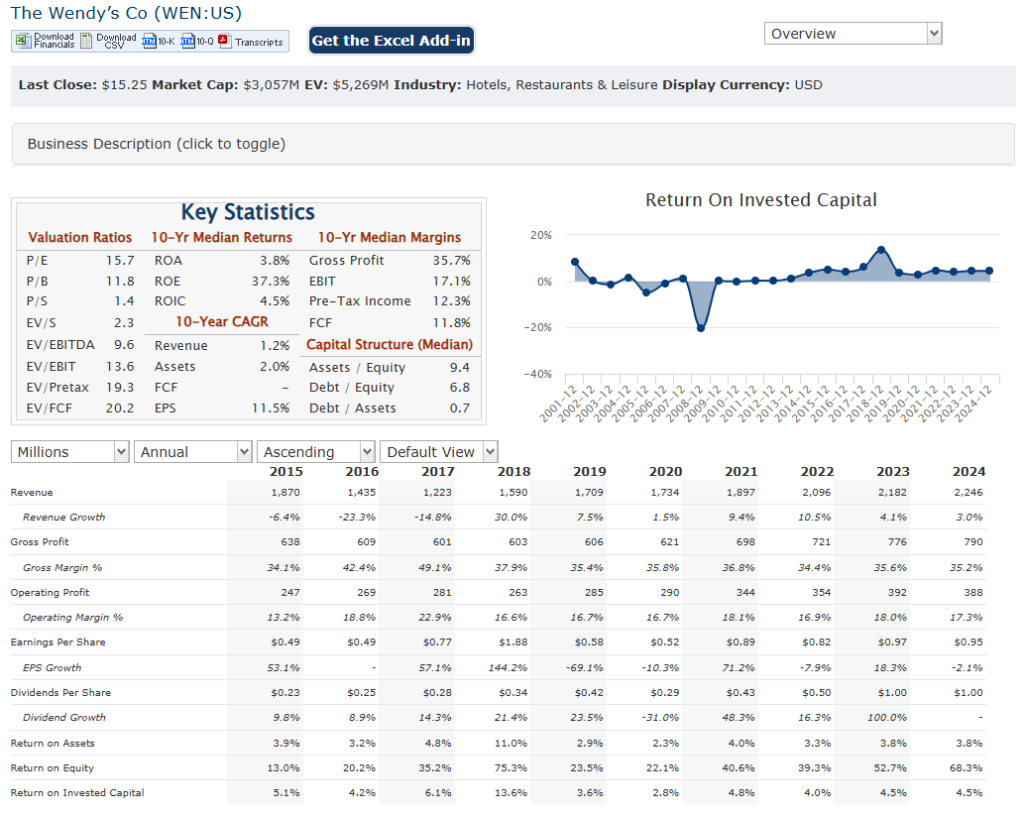

Wendy’s Co. has reported revenue increased from approximately $1.733 billion to $2.181 billion, reflecting a notable expansion in its business operations. This growth is further highlighted by the Compound Annual Growth Rate (CAGR), which stands at about 5.91% over this period, indicating a consistent increase in revenue year-over-year.

Earnings grew from $117.832 million in 2020 to $194.357 million in 2024, showcasing a substantial increase in profitability. The earnings CAGR over this period is approximately 13.33%, which is more than double the revenue CAGR, indicating that the company has been successful in improving its profitability alongside revenue growth.

The company has maintained a strong cash position, with cash and cash equivalents fluctuating over the years. Total assets have also increased, reflecting investments in property, plant, and equipment, as well as goodwill and intangible assets. The company’s liabilities have been managed effectively, with a focus on maintaining a healthy balance between short-term and long-term obligations.

The company’s ability to maintain a strong financial foundation while expanding its operations positions it well for future growth and competitiveness in the fast-food industry. The financial metrics indicate effective management of resources and strategic decision-making to enhance profitability and sustainability.

Technical Analysis:

The stock is in a stage 4 decline on the monthly chart and in a stage 1 consolidation on the weekly chart (neutral). The daily chart is in a stage 2 markup (reversal, bullish) but a lot of resistance in the $16 zone indicates a move to consolidation likely in the short term and move back to the $15s.

Bull Case:

Menu Innovation and Brand Strength: Wendy’s has a history of successful menu innovations, and continued development of appealing new products can attract customers and drive sales growth. The company’s brand recognition and reputation for quality, particularly its “fresh, never frozen” beef, provide a solid foundation.

Expansion and Franchise Growth: Wendy’s has opportunities for growth through expansion, both domestically and internationally. Successful expansion, particularly in underpenetrated markets, can significantly increase revenue. Effective franchise management is also a very important driver of revenue.

Shareholder Returns: Wendy’s commitment to returning value to shareholders through dividends and share repurchases can make the stock more attractive to investors. A clear and consistent capital allocation strategy can increase investor confidence.

Bear Case:

Rising Operating Costs: Increasing labor costs, commodity prices, and supply chain disruptions can put pressure on Wendy’s profit margins. These factors could lead to higher menu prices, potentially deterring price-sensitive customers.

Execution Risks in Digital Transformation: While Wendy’s is investing in digital technologies, there are execution risks associated with these initiatives. Failure to effectively implement mobile ordering, delivery partnerships, or loyalty programs could result in lost market share to competitors with more advanced digital capabilities.

Changing Consumer Preferences: Shifts in consumer preferences towards healthier eating options, plant-based diets, or alternative dining experiences could pose a challenge to Wendy’s traditional menu offerings. The company’s ability to adapt to these evolving trends will be crucial.