Executive Summary:

Ziff Davis, Inc. is a prominent digital media and internet company. It operates a diverse portfolio of leading brands spanning technology, shopping, gaming, entertainment, connectivity, health, cybersecurity, and martech sectors. Ziff Davis is known for its strategic mergers and acquisitions, which have expanded its reach and offerings. It owns well-known brands like IGN, RetailMeNot, and Ookla (Speedtest.net). The company is committed to growth through its M&A program, and also places importance on things such as ESG reporting.

Ziff Davis released its revenues, which reached $412.8 million, showing a 5.9% increase compared to Q4 2023. The adjusted diluted EPS for Q4 2024 was $2.58, a 10.7% increase from $2.33 in Q4 2023. Ziff Davis also gave forward-looking guidance for 2025.

Stock Overview:

| Ticker | $ZD | Price | $39.98 | Market Cap | $1.71B |

| 52 Week High | $67.52 | 52 Week Low | $37.62 | Shares outstanding | 42.84M |

Company background:

Ziff Davis, Inc. has a long and evolving history, beginning in 1927. It was founded by William Bernard Ziff Sr. and Bernard George Davis, initially focusing on publishing, with early successes in aviation and then pulp fiction magazines. Over time, the company transitioned and adapted to the changing media landscape, particularly embracing technology-focused publications. The company headquarters is located in New York City, U.S.

The company’s trajectory shifted significantly with its move into technology-related publications, which became a core part of its identity. Publications like PC Magazine” established Ziff Davis as a leading authority in the tech world. Ziff Davis has continued to evolve, transitioning from print to digital media and internet services. Key products and services now span a wide range of digital sectors, including technology, shopping, gaming, entertainment, connectivity, health, cybersecurity, and martech. Brands under the Ziff Davis umbrella include well-known names like IGN, RetailMeNot, and Ookla’s Speedtest.net.

Ziff Davis operates in highly competitive digital markets. Key competitors vary depending on the specific sector. For example, in the gaming media space, competitors include companies like IGN’s direct competitors. In the cybersecurity and connectivity sectors, they compete with a wide range of technology companies offering similar services. This M&A program is a large part of their business model.

Recent Earnings:

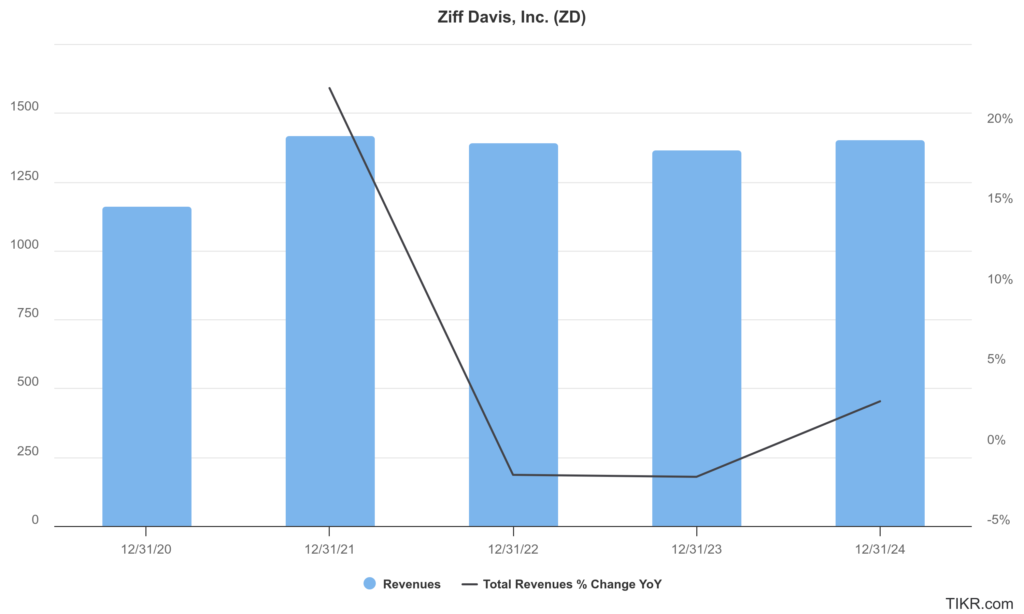

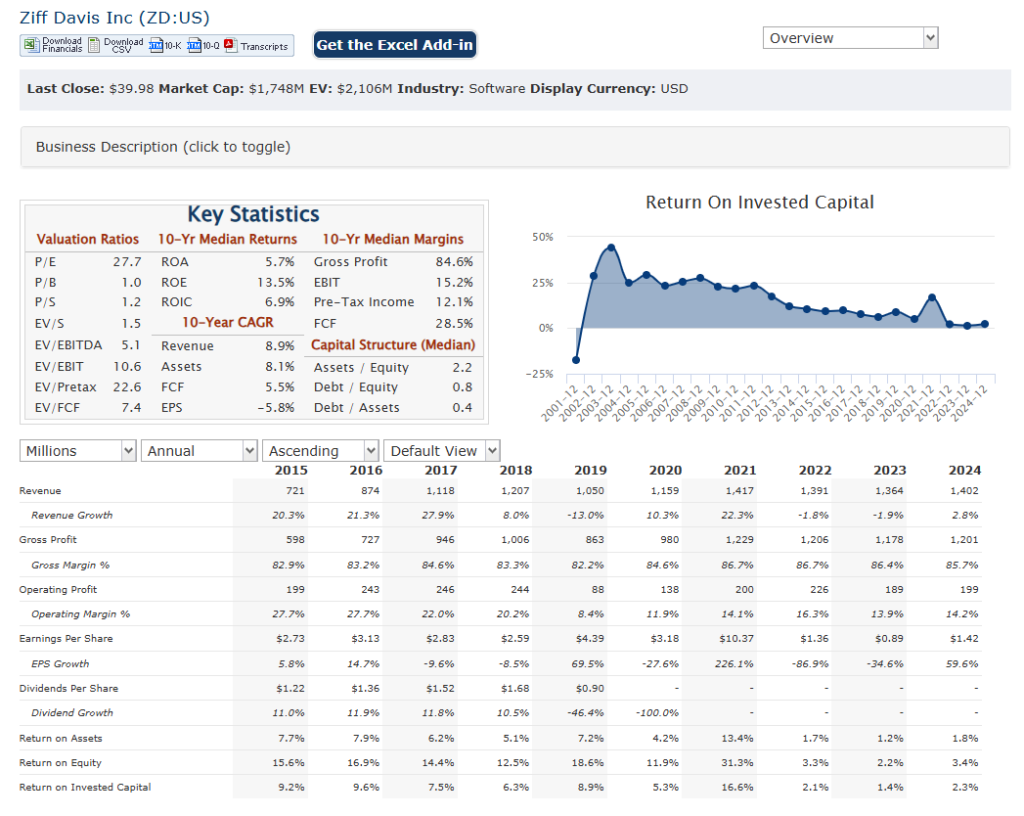

Ziff Davis reported Q4 2024 revenues of $412.8 million, representing a 5.9% increase compared to the same period in 2023. For the full year 2024, revenues reached $1.40 billion, a 2.8% increase year-over-year. When comparing these results to analyst expectations, there were some variations. Ziff Davis’s adjusted diluted EPS of $2.58 in Q4 2024 beat analyst estimates, the revenue figures fell slightly short of some forecasts.

The company’s adjusted diluted EPS for Q4 2024 was $2.58, a 10.7% increase from $2.33 in Q4 2023. For the full year, adjusted diluted EPS was $6.62, up 6.9% from the previous year. To better reflect the company’s diverse operations, Ziff Davis has implemented a new segment reporting structure, dividing its business into five key areas: Technology & Shopping, Gaming & Entertainment, Health & Wellness, Connectivity, and Cybersecurity & Martech.

The company projects revenue growth of 2.9% to 7.2%, adjusted EBITDA growth of 2.3% to 9.8%, and adjusted diluted EPS growth of 2.3% to 10%. Ziff Davis also emphasized its ongoing commitment to mergers and acquisitions, as well as its focus on leveraging AI innovations and maintaining a disciplined capital allocation strategy.

The Market, Industry, and Competitors:

Ziff Davis Inc. operates in a diverse digital media and internet services market, encompassing technology, gaming, entertainment, health and wellness, and cybersecurity sectors. The company’s portfolio includes prominent brands such as PCMag, IGN, Mashable, and retailMeNot, offering a wide range of digital content, advertising solutions, and e-commerce platforms. This diversified approach allows Ziff Davis to capture multiple revenue streams, including advertising, sponsorships, and subscription services, positioning it competitively in the evolving digital landscape.

Ziff Davis is forecasted to experience significant earnings and revenue growth. Analysts predict a 30% annual earnings growth rate and a 4.3% annual revenue growth rate. This growth is supported by the company’s strategic acquisitions and its strong brand recognition across various digital media verticals. For instance, its technology publishing segment, which includes PCMag and IGN, contributes significantly to its revenue.

Ziff Davis is poised to benefit from the expanding global affiliate marketing market, which is projected to reach $36.9 billion by 2030. The company’s potential to penetrate emerging technology content markets, such as AI technology reviews, offers further growth prospects. The company’s diversified portfolio and strategic growth initiatives are expected to support its continued success in the digital media and internet services market.

Unique differentiation:

Ziff Davis operates in a competitive landscape that varies across its diverse portfolio of digital media and internet services. In the technology and shopping sectors, competitors include large digital publishers and e-commerce platforms that provide similar content and services. In the realm of tech reviews and comparisons, they compete with sites like CNET, owned by Red Ventures, and other online tech publications. In the shopping space, they face competition from major e-commerce platforms and affiliate marketing networks.

In the gaming and entertainment sector, Ziff Davis, through its IGN brand, competes with other major gaming media outlets, such as GameSpot, owned by Fandom, and other dedicated gaming websites and platforms. These competitors vie for audience attention through reviews, news, and original content. In the connectivity space, particularly with Ookla’s Speedtest.net, they face competition from other internet speed-testing services and network analysis companies. In the cybersecurity and martech sectors, they compete with a wide range of specialized software and service providers, as well as larger technology companies offering comprehensive digital solutions. Ziff Davis has to constantly innovate and deliver high-quality content and services to maintain its competitive edge across all of its business segments.

Strategic and Active Mergers and Acquisitions (M&A) Program: Ziff Davis has a very disciplined and repeatable M&A process. This allows them to quickly and effectively expand their portfolio into diverse, yet strategically aligned, digital sectors. This is a very large part of their business model, and they have a proven track record. This approach allows them to quickly enter and gain significant market share in various verticals, diversifying their revenue streams and mitigating risks.

Focus on Digital Content and Services: Ziff Davis has successfully transitioned from traditional print media to digital platforms, establishing itself as a leader in online content and services. They are able to leverage their already existing brand recognition, and apply that to new digital aquisitions.

Data Driven Approach: They utilize data to inform their decisions, and to provide valuable information to their customers. A great example of this is Ookla, and its speedtest data.

Management & Employees:

Vivek Shah: President & Chief Executive Officer. He leads Ziff Davis, overseeing its portfolio of digital media and internet brands across various sectors.

Steve Horowitz: President, Technology & Shopping. He oversees the businesses within the Ziff Tech & Shopping Group.

Nate Simmons: President, Cybersecurity & Martech. He leads the company’s cybersecurity and marketing technology division.

Yael Prough: President, Gaming & Entertainment. She is in charge of Ziff Davis’s gaming and entertainment section, which includes IGN.

Financials:

Ziff Davis Inc. revenue has shown a decline from $1.49 billion in 2020 to $1.40 billion in 2024, resulting in a negative Compound Annual Growth Rate (CAGR) of approximately 1.51%. This decrease reflects challenges in maintaining consistent revenue growth across its diverse digital media and internet services segments.

Earnings decreased from $150.67 million in 2020 to $63.05 million in 2024, leading to a substantial negative CAGR of about 19.57%. This decline indicates difficulties in maintaining profitability, possibly due to increased competition in the digital media space or rising operational costs.

Ziff Davis with cash and short-term investments fluctuating over the years. For instance, in 2020, the company had approximately $243.32 million in cash and short-term investments, which decreased to about $50.59 million by the end of 2024. This reduction could be due to strategic investments or debt repayment efforts. The company’s long-term debt and liabilities have also varied, indicating ongoing financial management efforts to balance growth initiatives with financial stability.

The company remains a significant player in its sectors. Its strategic focus on digital content and e-commerce affiliate marketing could provide opportunities for future growth, especially if it can leverage emerging trends and technologies effectively.

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly chart; on a stage 1 consolidation (neutral) on the weekly chart and on a reversal stage 2 (bullish) on the daily chart. There is a lot of resistance at multiple points between $39 and $48, so this is an easy stock to avoid for now.

Bull Case:

Diversified Portfolio: The company’s diverse portfolio across technology, shopping, gaming, entertainment, connectivity, health, cybersecurity, and martech provides resilience against market fluctuations. This diversification allows them to capitalize on growth opportunities in multiple sectors.

Strong Digital Presence: Ziff Davis has successfully transitioned to a digital-first model, with a strong presence in online content and services. The increasing demand for digital content and services is expected to benefit the company.

Data and Analytics: The data that Ziff Davis collects, and provides to its customers, is a very valuable asset. This data can be used to improve current products, and also inform future business decisions.

Bear Case:

M&A Integration Risks: While Ziff Davis has a strong M&A track record, integrating acquired companies can be complex and costly. There’s always a risk of integration failures, cultural clashes, or underperformance of acquired assets.

Digital Advertising Challenges: Changes in digital advertising trends, such as increased privacy regulations and the rise of ad blockers, could negatively impact Ziff Davis’s advertising revenue. Furthermore, the reliance on digital advertising revenues, leaves the company vulnerable to any downturn in that market.

Interest Rate Risk: Ziff Davis uses debt as a part of its M&A strategy. Increased interest rates could increase the cost of that debt, and therefore decrease profitability.