Executive Summary:

Ulta Beauty is a leading U.S. retailer specializing in cosmetics, fragrances, skincare, and haircare products, offering a diverse range from prestige to mass-market brands. The company distinguishes itself by combining retail sales with in-store salon services, creating a comprehensive beauty destination. Ulta Beauty’s business model emphasizes a strong value proposition through its loyalty program and various promotions, catering to a broad customer base. Beauty strives to be a premier beauty destination, focusing on customer experience and a wide product assortment.

Ulta Beauty reported earnings per share (EPS) of approximately $7.05, with revenue expectations around $3.46 billion. The EPS expected to be down roughly 12.8%, and revenue was also expected to be lower by around 2.8% from the year prior.

Stock Overview:

| Ticker | $ULTA | Price | $359.72 | Market Cap | $16.68B |

| 52 Week High | $574.76 | 52 Week Low | $318.17 | Shares outstanding | 46.37M |

Company background:

Ulta Beauty, Inc. is a prominent U.S. beauty retailer that has established itself as a one-stop destination for a wide range of beauty products and services. Founded in 1990 by Richard E. George and Terry Hanson, the company initially launched as Ulta3, with a vision to provide a diverse selection of beauty products at various price points. The company’s headquarters are located in Bolingbrook, Illinois.

Ulta Beauty’s core business revolves around offering an extensive array of cosmetics, fragrances, skincare, and haircare products, encompassing both prestige and mass-market brands. A key differentiator is their integration of in-store salon services, providing customers with a comprehensive beauty experience. Their product offerings include items from well-known brands, as well as their own private label, the Ulta Beauty Collection. The company’s business model emphasizes customer loyalty through its Ulta Beauty Rewards program, along with various promotional activities.

In the competitive beauty retail landscape, Ulta Beauty faces competition from various sources. Key competitors include:

- Sephora

- Department store beauty counters

- Drugstore chains

- Online retailers like Amazon Ulta Beauty distinguishes itself through its broad product selection, combined retail and salon services, and strong customer loyalty initiatives. The company maintains a significant physical presence across the United States, complemented by a robust e-commerce platform, ensuring accessibility for its customers.

Recent Earnings:

Ulta Beauty consensus anticipates earnings per share (EPS) of approximately $7.05, with revenue expectations around $3.46 billion. The expected EPS is projected to be down roughly 12.8%, and revenue is also anticipated to be lower by approximately 2.8% compared to the previous year. This downward trend is a key factor that investors will be closely monitoring.

Ulta Beauty meets, exceeds, or falls short of these projections will impact investor sentiment. Factors influencing these results include consumer spending trends, competitive pressures, and the company’s operational performance. Operational metrics, such as comparable sales growth, store traffic, and online sales, provide insights into the company’s underlying performance.

The company’s expectations for future performance, including revenue projections, profitability targets, and strategic initiatives. Investors will be looking for indications of how the company plans to navigate the current economic environment and maintain its competitive edge.

The Market, Industry, and Competitors:

Ulta Beauty operates within the dynamic and competitive beauty retail market, a sector characterized by evolving consumer preferences, technological advancements, and a growing emphasis on personalized experiences. This market encompasses a wide range of products, including cosmetics, skincare, haircare, and fragrances, as well as salon services. The industry is influenced by various factors, such as social media trends, influencer marketing, and the increasing demand for clean and sustainable beauty products.

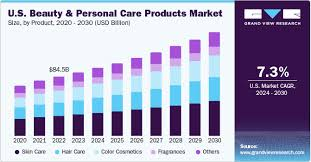

The global beauty and personal care market is expected to experience continued growth, driven by factors such as rising disposable incomes, increasing awareness of personal grooming, and the expanding influence of social media. Projections indicate that this market could reach substantial values by 2030. It is generally anticipated that the beauty market will maintain a healthy growth trajectory. CAGR’s ranging from 5-7.5% through 2030, with some specialty areas seeing even higher growth. Ulta Beauty, with its diverse product offerings, salon services, and strong customer loyalty programs, is well-positioned to capitalize on this growth. The company will need to adapt to changing consumer preferences and maintain its competitive edge in the face of increasing competition from both traditional and online retailers.

Unique differentiation:

Ulta Beauty operates in a highly competitive landscape, facing challenges from a variety of retailers, both online and brick-and-mortar. A primary competitor is Sephora, which also specializes in prestige beauty products and offers in-store services. Sephora’s strong brand recognition, exclusive partnerships with high-end brands, and innovative store concepts pose a significant challenge to Ulta’s market share. Additionally, department store beauty counters, such as those found in Macy’s and Nordstrom, remain relevant, particularly for consumers seeking luxury brands and personalized consultations. These department stores often have established customer bases and offer loyalty programs that rival Ulta’s.

Ulta also faces competition from drugstore chains like CVS and Walgreens, which offer a wide range of mass-market beauty products at accessible price points. Online retailers, most notably Amazon, further intensify the competition, providing vast product selections and convenient delivery options. Direct-to-consumer (DTC) beauty brands also present a growing challenge, bypassing traditional retail channels and building direct relationships with consumers through online platforms and social media.

Blending Prestige and Mass-Market Products: Ulta Beauty successfully integrates a wide range of beauty products, from high-end prestige brands to accessible mass-market options, all under one roof. This caters to a diverse customer base with varying budgets and preferences, a strategy that sets it apart from retailers that typically focus on one segment.

Integrating Salon Services: The inclusion of full-service salons within its stores provides a unique and comprehensive beauty experience. This allows customers to not only purchase products but also receive professional services, creating a “one-stop beauty destination.” This combination of retail and service is a significant differentiator.

Omnichannel Presence: Ulta Beauty has effectively created a strong Omnichannel experience. This includes strong brick and mortar locations, with a very robust online presence. This allows customers to shop in whatever way is most convenient to them.

Management & Employees:

Kecia Steelman, President and Chief Executive Officer: She is responsible for setting the company’s long-term strategic vision and maintaining its corporate culture. She has held various leadership roles within Ulta Beauty, demonstrating extensive experience in retail operations.

Monica Arnaudo, Chief Merchandising Officer: She is responsible for the company’s merchandising strategies, overseeing the selection and presentation of products. Her extensive experience in the beauty industry contributes to Ulta Beauty’s product offerings.

Amiee Bayer-Thomas, Chief Retail Officer: She is responsible for all aspects of Ulta Beauty’s store and services operations. This includes oversight of the stores, and store growth.

Financials:

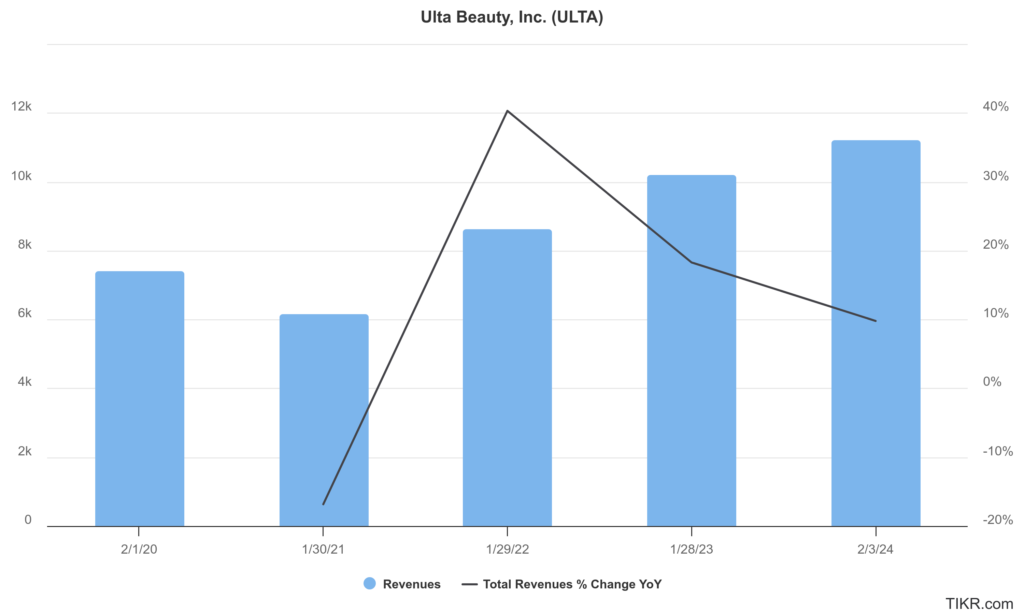

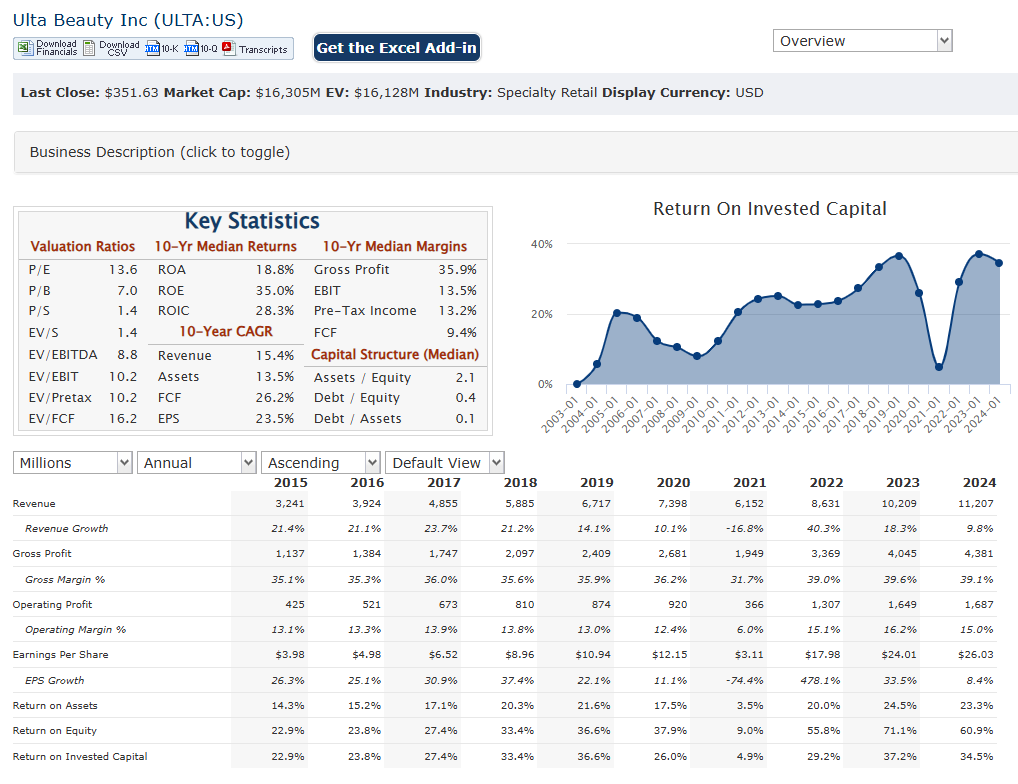

Ulta Beauty Inc. revenue has increased steadily, with a compound annual growth rate (CAGR) of approximately 8.49%. This growth is largely attributed to strategic expansions, including the opening of new stores and enhancements in their e-commerce platform. Net sales increased by 1.7% to $2.53 billion, primarily due to contributions from new stores, despite a decline in other revenue streams.

. The company has experienced substantial increases in earnings per share (EPS), reflecting its ability to maintain profitability alongside revenue expansion. The EPS growth has been notable, with year-over-year increases, particularly after recovering from the challenges faced during the early years of the pandemic.

The company has managed its capital expenditures effectively, investing in growth initiatives while maintaining a healthy cash flow. The free cash flow (FCF) has remained positive, indicating the company’s ability to generate cash beyond its operational needs. This financial health is crucial for supporting ongoing expansion and strategic investments. Ulta Beauty’s leverage and debt management have been prudent, allowing it to maintain a stable financial foundation.

Ulta Beauty’s profitability margins have been strong, with EBITDA margins ranging around 15% to 18% over the past few years. The return on equity (ROE) has also been impressive, highlighting the company’s efficiency in generating returns for shareholders.

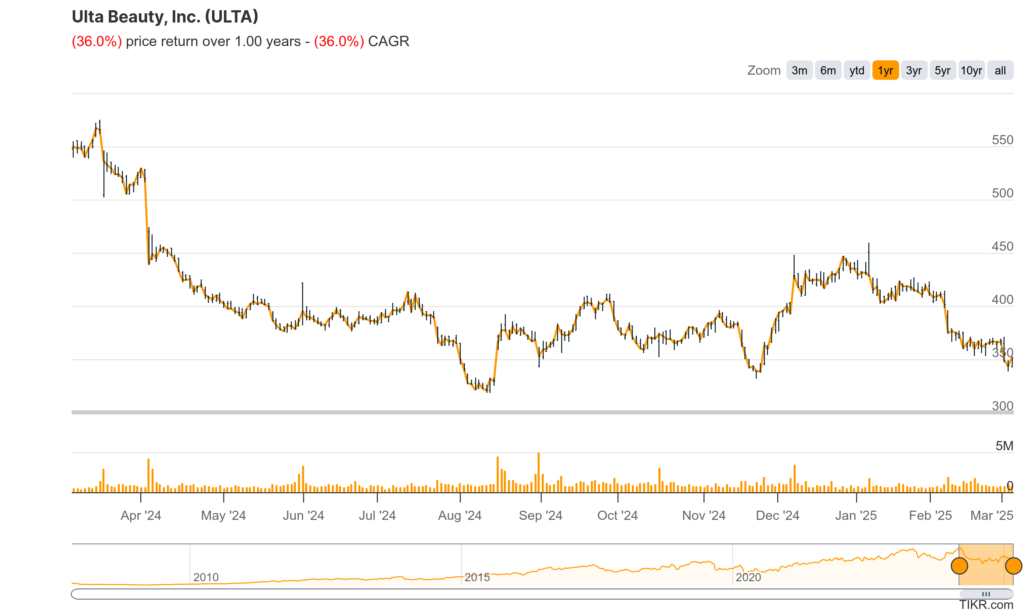

Technical Analysis:

The stock is in a stage 4 decline on the monthly and weekly charts. The daily char is attempting a reversal in the stage 4 (Bearish) with support at $318 range, but it could reverse earlier. We would wait for a confirmed reversal.

Bull Case:

Differentiated Business Model: Ulta’s unique blend of prestige and mass-market beauty products, combined with in-store salon services, creates a “one-stop shop” experience that attracts a broad customer base. This differentiation sets it apart from competitors and fosters customer loyalty.

Expanding “Beauty Enthusiast” market: Ulta beauty is geared to capture the “beauty enthusiast” customer. This is a very large market, and Ulta is well positioned to continue to gain market share within this market.

Bear Case:

Economic Downturn and Consumer Spending: A significant economic downturn could lead to reduced consumer spending on discretionary items, including beauty products. While the beauty industry has shown some resilience, a severe recession could impact Ulta’s sales and profitability.

Margin Pressure: Rising costs, including labor, supply chain, and marketing expenses, could put pressure on Ulta’s profit margins. Increased promotional activity and discounting to attract customers could also negatively impact margins.

Dependence on Discretionary Spending: Ulta relies heavily on consumers’ discretionary spending. When consumers tighten their budgets, spending on non-essential items like high-end beauty products and salon services tends to decrease.