Executive Summary:

Caesars Entertainment, Inc. is a prominent casino and entertainment company with a wide-ranging portfolio of properties. Its core business encompasses casino gaming, including both physical locations and a growing online presence with sports betting and iGaming. Caesars provides extensive hospitality services, featuring hotels, restaurants, and diverse entertainment venues. The company operates under well-known brands like Caesars, Harrah’s, and Horseshoe, managing a substantial number of properties across the United States.

Caesars Entertainment, Inc. reported revenue of approximately $2.8 billion, slightly below the prior year’s $2.83 billion. However, they achieved a net income of $11 million, an improvement from the prior year’s net loss of $72 million. In terms of EPS, Caesars reported $0.05 in Q4.

Stock Overview:

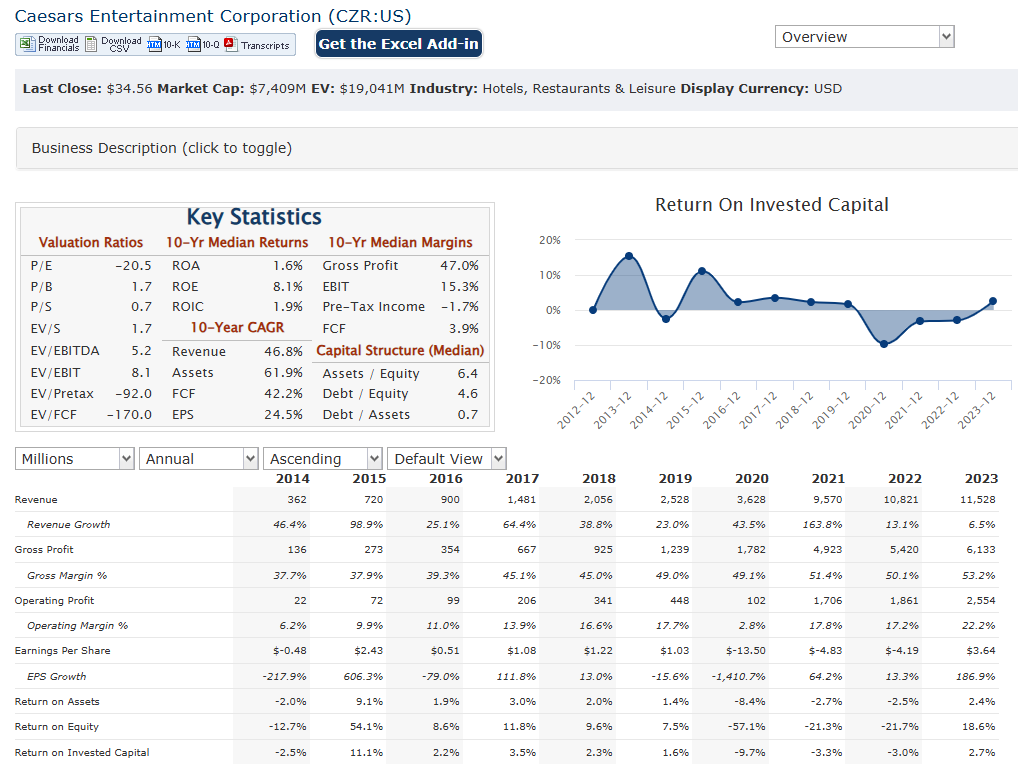

| Ticker | $CZR | Price | $34.56 | Market Cap | $7.33B |

| 52 Week High | $45.93 | 52 Week Low | $30.78 | Shares outstanding | 212.48M |

Company background:

Caesars Entertainment, Inc. traces back to the establishment of the Eldorado Hotel in Reno, Nevada, which opened in 1973. Key figures in its early development include Don Carano and his family. The company’s growth accelerated through strategic expansions and acquisitions, notably the 2020 acquisition of Caesars Entertainment Corporation by Eldorado Resorts, which then adopted the Caesars Entertainment name. This transformation significantly broadened its portfolio and market presence.

Caesars Entertainment’s core business revolves around providing diverse entertainment and hospitality experiences. Its products and services include:

- Casino gaming: This encompasses both physical casino operations and a growing online presence with sports betting and iGaming.

- Hospitality: The company offers a wide range of hotel accommodations, dining options, and entertainment venues.

- Entertainment: They provide various shows, events, and attractions at their properties.

- The company operates under well known brands such as Caesars, Harrah’s, and Horseshoe.

Caesars Entertainment faces strong competition from other major players in the gaming and hospitality industry.

- MGM Resorts International

- Las Vegas Sands Corp.

- Boyd Gaming Corporation.

These companies compete for market share in both land-based and online gaming, as well as in the broader hospitality sector. Caesars Entertainment’s headquarters are located in Reno, Nevada. This location serves as the base for the company’s operations and strategic decision-making.

Recent Earnings:

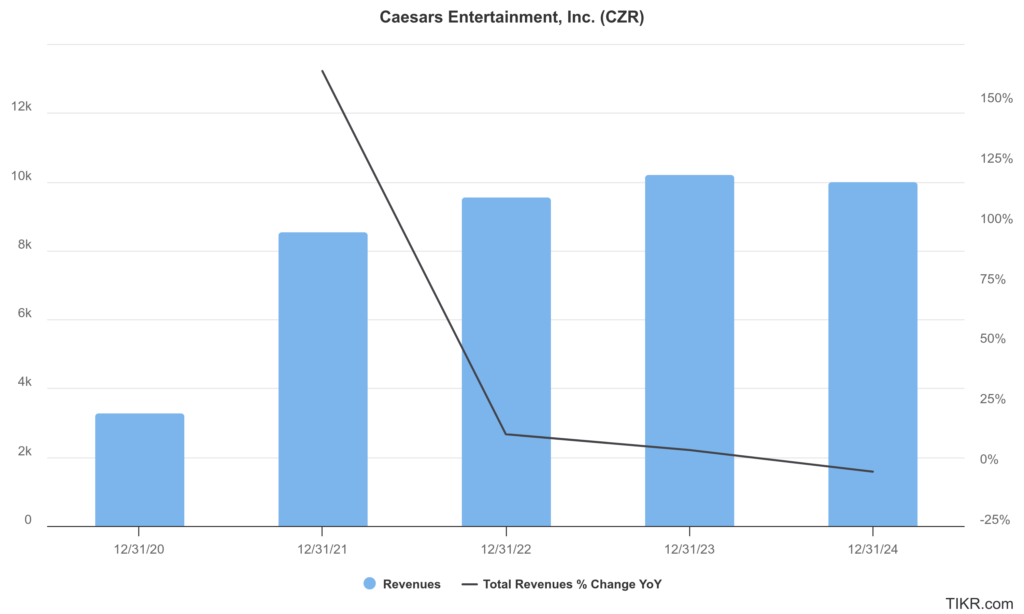

Revenue and Growth: Caesars reported revenue of approximately $2.8 billion. This figure was slightly below the $2.83 billion recorded in the same period of the previous year. The company’s revenue totaled $11.2 billion, also showing a slight decrease from the $11.5 billion generated in 2023.

EPS and Growth: Caesars achieved a net income of $11 million, a significant improvement compared to the net loss of $72 million in the prior-year period. The company’s earnings per share (EPS) for the fourth quarter was $0.05.

Caesars anticipates a stable operating environment in its brick-and-mortar operations. The company expects strong net revenue and Adjusted EBITDA growth in its digital segment. The company is focusing on operational efficiency and growth in its digital segment.

The Market, Industry, and Competitors:

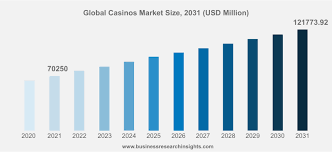

Caesars Entertainment Inc. operates in the gaming and hospitality industry, primarily in the United States. The company is a major player in several sectors, including non-hotel casinos, casino hotels, and online gambling services. It owns, leases, or manages properties across 18 states, offering a diverse range of gaming, entertainment, and hospitality amenities under brands such as Caesars, Harrah’s, Horseshoe, and Eldorado. Caesars Entertainment’s share in the casino hotels industry accounts for approximately 12.8% of total industry revenue.

International expansion into emerging markets like Asia and Latin America could significantly boost revenue. Additionally, diversification of offerings through online gaming, sports betting, and entertainment venues can attract a broader customer base. Technology integration will also play a crucial role in enhancing customer experiences and operational efficiency.

Caesars Entertainment has experienced a significant revenue CAGR of 41.2% over the past five years. This growth reflects the company’s successful integration of new properties and expansion into digital gaming segments. Maintaining this growth trajectory will depend on effectively executing its strategic plans, particularly in international markets and digital services. Caesars’ diversified offerings and strategic initiatives position it well for continued growth in the gaming and hospitality sector

Unique differentiation:

- MGM Resorts International: This is one of Caesars’ most prominent rivals. MGM Resorts also boasts a vast portfolio of resorts and casinos, particularly in Las Vegas and other major markets. They compete directly with Caesars in attracting customers to their physical casinos, as well as in the rapidly expanding online gaming and sports betting arena.

- Las Vegas Sands Corp.: While Las Vegas Sands has a strong international presence, they also remain a competitor within the overall gaming and hospitality market. They are known for their luxury resorts, and compete for the high end customer.

- PENN Entertainment: PENN Entertainment has also become a major player, especially with their expansion into online sports betting and iGaming. They are a large competitor in the digital gaming space.

The competitive landscape is further complicated by the rise of online-only gaming and sports betting platforms, such as DraftKings and FanDuel, which are also vying for market share. Caesars Entertainment must continuously adapt its strategies to remain competitive in both the traditional and digital realms of the gaming industry.

Broad Portfolio and Omnichannel Approach: Caesars possesses a diverse portfolio of properties across the United States, offering a wide range of gaming, hospitality, and entertainment experiences. They have made considerable strides in developing their digital presence, with a strong focus on online sports betting and iGaming. This “omnichannel” approach allows them to cater to a wider audience and adapt to evolving consumer preferences.

Historical Legacy and Diversified Entertainment: Caesars has a very long and storied history within the gaming industry. That provides them with a level of prestige that other companies strive for. They are well known for the entertainment that they provide within their properties, ranging from high end shows, to well known restaurants. This helps them to draw in customers that may not only be interested in the gaming aspects of their business.

Management & Employees:

Gary Carano: Serves as the Executive Chairman of the Board.

Thomas Reeg: He holds the position of Chief Executive Officer (CEO), responsible for the overall management and strategic vision of the company.

Anthony Carano: Serves as President and Chief Operating Officer (COO).

Financials:

Caesars Entertainment Inc. has experienced significant financial transformations, particularly following its merger with Eldorado Resorts in 2020. This period saw a substantial increase in net sales, driven by the integration of new properties and expansion into digital gaming segments. In 2021, Caesars reported net sales of approximately $9.57 billion, marking a significant leap from $2.53 billion in 2019. This growth trend continued, with net sales reaching $11.53 billion by 2023, reflecting a compound annual growth rate (CAGR) of about 41.2% over the five-year period.

Earnings growth has been more volatile, with Caesars experiencing net losses in several years due to high interest expenses and operational challenges. However, the company managed to turn a profit in 2023 with a net income of $786 million, following significant losses in previous years. The earnings CAGR over this period is challenging to calculate due to the variability in net income, but the trend shows improvement as the company stabilizes its operations and reduces debt. Despite these fluctuations, Caesars has been focusing on enhancing profitability through strategic investments in digital gaming and optimizing operational efficiency.

Caesars’ balance sheet reflects the impact of its merger and subsequent growth strategies. The company has a substantial debt burden, with interest payments consistently exceeding $2 billion annually. However, efforts to reduce leverage and improve cash flow are underway, with plans to utilize increased free cash flow in 2025 for further debt reduction. This strategic approach aims to strengthen Caesars’ financial position and support long-term sustainability.

Looking ahead, Caesars is positioned for continued growth, particularly in its digital segment, which has shown strong revenue increases. The company’s focus on reducing capital expenditures and interest expenses is expected to enhance profitability and cash flow. Despite challenges in certain markets, such as regional operations, Caesars’ diversified portfolio and strategic initiatives are key to maintaining its competitive edge in the gaming and hospitality industry. The company’s ability to adapt to market conditions and capitalize on emerging trends will be crucial for sustaining growth and improving financial performance in the coming years.

Technical Analysis:

Bull Case:

Digital Growth Potential:

- Caesars’ digital segment, including online sports betting and iGaming, represents a significant growth opportunity. As more states legalize online gambling, Caesars is well-positioned to capitalize on this expanding market.

- The company’s investment in its digital platform and its ability to leverage its established brand recognition in the online space are crucial drivers of this growth.

Strong Brand and Customer Loyalty:

- The Caesars brand is a powerful asset, and its Caesars Rewards loyalty program is a major competitive advantage. This program helps to retain customers and drive repeat business across both its physical and digital platforms.

- The company’s extensive network of physical properties provides a solid foundation for its business, and its ability to offer a seamless omnichannel experience enhances customer engagement.

Focus on Debt Reduction and Free Cash Flow:

- Caesars’ management has emphasized its commitment to reducing debt and generating strong free cash flow. This financial discipline is expected to improve the company’s financial health and create value for shareholders.

- Increased free cash flow can be used for further investments, share buybacks, or dividend payments, all of which can positively impact the stock price.

Las Vegas Recovery and Regional Stability:

- Caesars has a significant presence in Las Vegas, and the continued recovery of the Las Vegas tourism market is a positive catalyst for the company.

- Stable performance in its regional casino markets also contributes to the company’s overall financial strength.

Analyst Optimism:

- Many analysts are optimistic about Caesars’ future prospects, particularly its digital segment and its ability to generate free cash flow.

Bear Case:

High Debt Load:

- Caesars carries a substantial amount of debt, which can create financial vulnerability, especially in a downturn. Interest payments can strain cash flow, limiting the company’s ability to invest in growth initiatives or weather economic challenges.

Competition in the Digital Space:

- The online sports betting and iGaming market is fiercely competitive, with established players like DraftKings and FanDuel, as well as other major casino operators, vying for market share. Caesars faces the risk of failing to capture a significant portion of this market, or of incurring high costs to compete.

Regulatory Risks:

- The gaming industry is subject to regulatory changes, which can impact the company’s operations and profitability. Changes in gaming laws or tax rates could create significant headwinds.

Economic Downturn:

- Consumer spending on entertainment and leisure activities is sensitive to economic conditions. A recession or economic slowdown could reduce customer traffic to Caesars’ properties and negatively impact its revenue.

Operational Challenges:

- While Caesars has made progress in its digital segment, operational challenges, such as technological glitches or customer service issues, could hinder its growth.

Las Vegas Market Volatility:

- While the Las Vegas market has been recovering, it is subject to large swings in demand. Any future downturns in travel or entertainment spending could impact the profitability of Caesars Las Vegas properties.

Dependence on Sports Betting:

- While showing growth, dependence on the sports betting market can be risky. Sporting events can have unpredictable outcomes, that can heavily effect the profitablity of this market.