Executive Summary:

Lululemon Athletica is a Canadian-American athletic apparel retailer founded in 1998. It is known for its high-quality, technically advanced apparel, footwear, and accessories. Lululemon has a strong focus on community building and creating a positive impact. Lululemon is the official outfitter for Team Canada for the 2024 Paris Olympic and Paralympic Games.

Lululemon Athletica reported an EPS of $2.87, exceeding analysts’ consensus estimate of $2.69. Quarterly revenue rose 9.1% year-over-year to $2.40 billion, also surpassing analyst estimates of $2.36 billion.

Stock Overview:

| Ticker | $LULU | Price | $366.72 | Market Cap | $46.54B |

| 52 Week High | $480.94 | 52 Week Low | $226.01 | Shares outstanding | 116.67M |

Company background:

Lululemon Athletica, a prominent player in the athletic apparel market, was founded in 1998 by Chip Wilson in Vancouver, British Columbia, Canada. The first store opened in November 2000, and the brand quickly gained popularity for its innovative fabrics, flattering designs, and focus on community building. While Lululemon has never received any external funding, its initial growth was fueled by the success of its retail locations and a strong connection with the yoga and fitness community.

Lululemon offers a wide range of athletic apparel, footwear, and accessories for both men and women. Their product lines cover various activities, including yoga, running, training, and everyday wear. They are particularly known for their high-performance leggings, such as the Align and Wunder Under collections, which have become iconic pieces in the activewear market. Lululemon also offers accessories like yoga mats, bags, headwear, and a growing selection of footwear. Their focus on technical fabrics, functional design, and fashionable aesthetics has contributed to their premium brand image.

Lululemon faces competition from a variety of athletic wear companies. Key competitors include Nike, Under Armour, Adidas, and Athleta. These brands offer similar product categories and target a similar demographic, though each has its own unique strengths and market positioning. Lululemon differentiates itself through its focus on technical innovation, community building, and a premium brand experience. The company has also expanded its offerings to include more lifestyle and casual wear, further blurring the lines with traditional fashion retailers.

Lululemon’s headquarters are located in Vancouver, British Columbia, Canada. The company manages its global operations, including product design, manufacturing, marketing, and retail sales. Lululemon has a significant retail presence, with hundreds of stores across North America, Europe, Asia, and Australia. The company continues to expand its international reach and explore new product categories to support its growth trajectory in the competitive athletic apparel market.

Recent Earnings:

Lululemon Athletica reported revenue reaching $2.40 billion, a 9.1% increase year-over-year. This growth was driven by continued strength in both their athletic apparel and footwear segments. Earnings per share (EPS) also exceeded expectations, coming in at $2.87 compared to analysts’ consensus estimate of $2.69. This represents a solid beat and demonstrates the company’s ability to drive profitability.

Both revenue and EPS surpassed estimates, indicating that the company’s strategies are resonating with consumers and investors. This strong performance reflects Lululemon’s ability to innovate in product development, maintain its premium brand image, and effectively execute its growth strategies. The company’s success in navigating a dynamic retail landscape is evident in these results.

their performance indicators such as comparable store sales, gross margin, and inventory turnover were also closely watched by investors. These metrics provide insights into the efficiency of Lululemon’s operations and its ability to manage costs and optimize its supply chain.

The company will continue to invest in its growth initiatives, including international expansion, product innovation, and enhancing the customer experience. Lululemon’s “Power of Three ×2” growth plan, which aims to double revenue to $12.5 billion by 2026, will likely remain a key focus area.

The Market, Industry, and Competitors:

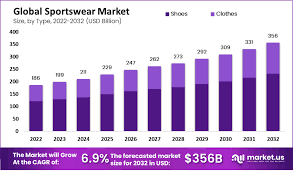

Lululemon Athletica operates within the global athletic apparel and footwear market, a sector characterized by consistent growth driven by increasing health and fitness awareness, rising disposable incomes, and the growing popularity of athleisure. This market encompasses a wide range of products, from performance-oriented sportswear to everyday casual wear, catering to diverse consumer preferences and activities. The market’s expansion is further fueled by technological advancements in fabric and design, as well as the increasing influence of social media and influencer marketing. Lululemon specifically targets the premium segment of this market, focusing on high-quality, technically advanced products and a strong brand experience.

A healthy Compound Annual Growth Rate (CAGR). Projections often fall within the range of 5% to 8% CAGR through 2030. This growth is expected to be propelled by several factors, including the continued expansion of e-commerce, the rising popularity of outdoor activities, and the increasing adoption of active lifestyles in emerging markets. Lululemon, with its strong brand recognition and innovative product offerings, is well-positioned to capitalize on these trends and potentially outpace the overall market growth. The increasing focus on sustainability and ethical manufacturing practices is expected to shape the market, with consumers increasingly favoring brands that prioritize these values.

Unique differentiation:

Lululemon Athletica faces stiff competition within the athletic apparel and footwear market, with several major players vying for consumer attention and market share. Among its most prominent competitors are Nike, Adidas, and Under Armour. These established brands possess resources, extensive distribution networks, and strong brand recognition, making them formidable rivals. Nike, in particular, dominates the overall sportswear market, offering a vast range of products across various sports and fitness categories. These companies engage in intense competition with Lululemon, particularly in areas such as product innovation, marketing campaigns, and retail expansion.

Beyond these giants, Lululemon also competes with specialized athletic apparel brands like Athleta (owned by Gap Inc.) and smaller, emerging players. Athleta, with its focus on women’s activewear, directly competes with Lululemon’s core demographic. The rise of direct-to-consumer (DTC) brands and the increasing popularity of athleisure have introduced new competitors offering niche products and unique brand experiences. These competitors challenge Lululemon’s market share and force the company to continually innovate and differentiate itself.

- Premium Quality and Technical Innovation: Lululemon places a strong emphasis on high-quality, technically advanced fabrics and designs. They invest heavily in research and development to create innovative materials that offer superior performance, comfort, and durability. This focus on technical excellence sets them apart from brands that may prioritize lower costs. Proprietary fabrics, like Luon and Nulu, have become synonymous with the brand, contributing to a perception of premium quality.

- Community Focus and Brand Experience: Lululemon fosters a strong sense of community by hosting in-store events, yoga classes, and other fitness-related activities. This community-centric approach builds brand loyalty and creates a unique customer experience that goes beyond simply selling products. They work to create a lifestyle brand, not just an apparel brand.

Management & Employees:

Calvin McDonald, Chief Executive Officer: Previously served as president and CEO of Sephora Americas. He is focused on scaling the organization, innovation, and enhancing customer engagement.

Celeste Burgoyne, President of Americas & Global Guest Innovation: She is responsible for the performance of the americas locations, and also for global guest innovation.

Martha (Marti) Morfitt, Chair of the Board: Holds a principal position at River Rock Partners, Inc.

David Mussafer, Lead Director: Is the chairman and managing partner of Advent International L.P.

Financials:

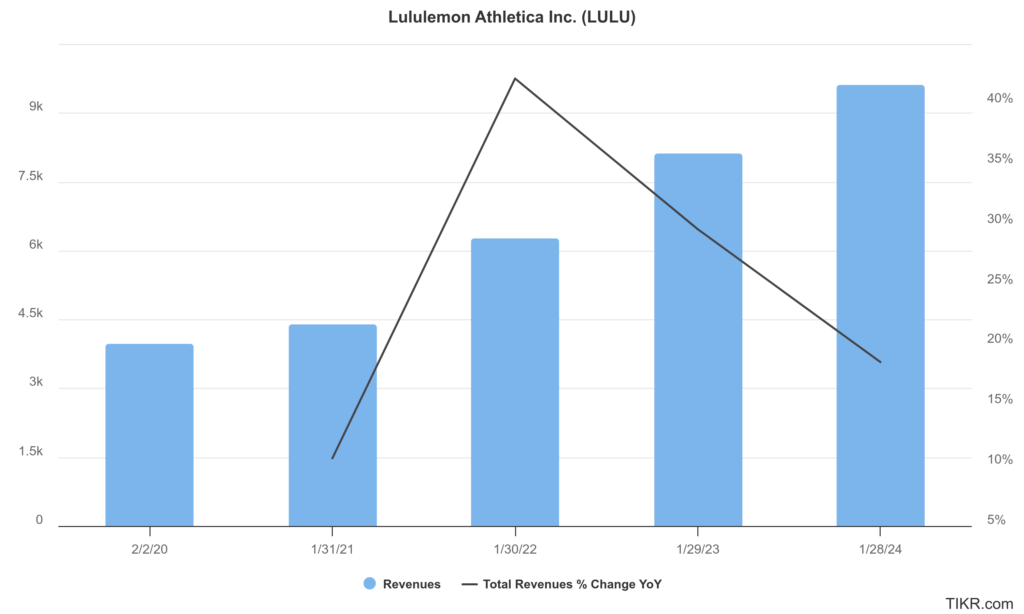

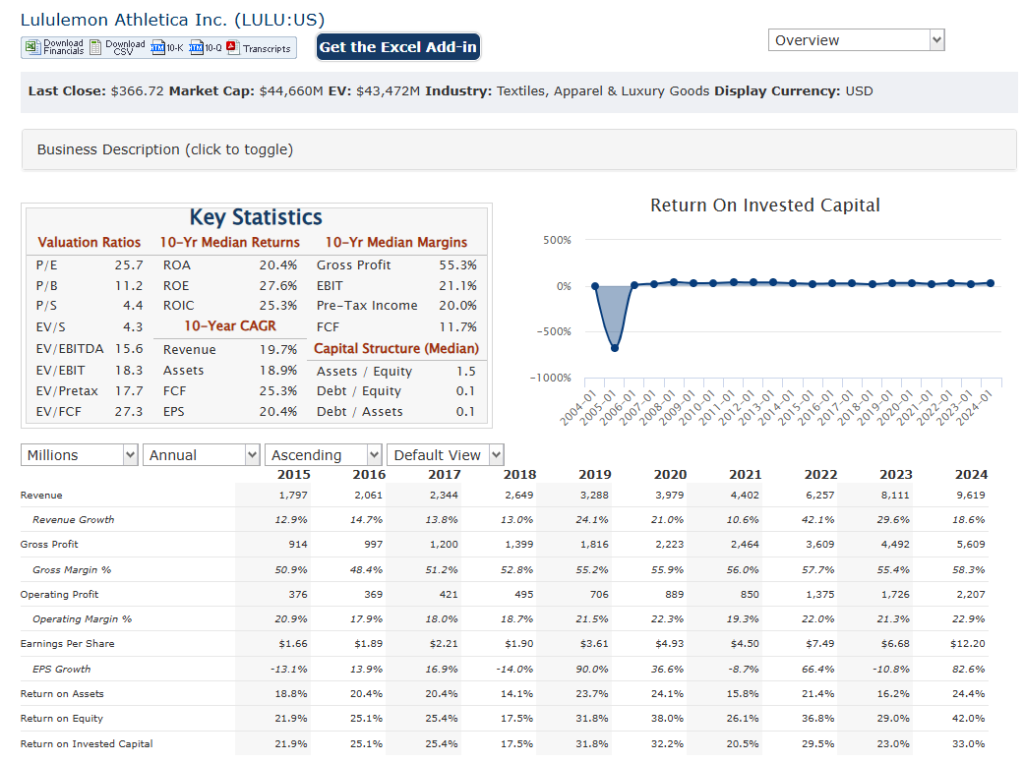

lululemon athletica has revenue has increased from approximately $3.98 billion in 2020 to $9.62 billion in 2024, reflecting a compound annual growth rate (CAGR) of about 24.7%. This growth is attributed to the company’s successful expansion into new markets, strong brand loyalty, and strategic product offerings.

EPS was around $4.93, rising to $12.20 in 2024, indicating an increase in profitability. The earnings CAGR over this period has been substantial, reflecting the company’s ability to maintain high margins and effectively manage costs.

The company has consistently generated strong free cash flow, which has enabled it to invest in strategic expansions and maintain a solid financial foundation. lululemon has managed its capital expenditures effectively, balancing growth investments with financial discipline.

lululemon has maintained strong margins, with EBITDA margins ranging around 25-27% over the past few years. The company’s return on equity (ROE) has also been impressive, reflecting efficient use of shareholder capital.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly and weekly chart, and is reversing off a decline stage 4 on the daily chart, which indicates a consolidation is likely in the near term in the $350 – $387 zone. The mover over $387 would be a good position for the longer term.

Bull Case:

Growth Opportunities:

- Product Diversification: The company is expanding its product offerings beyond its core yoga apparel, including men’s wear, footwear, and other categories, which broadens its potential customer base.

- “Power of Three ×2” Growth Plan: The company’s strategic plan to double revenue by 2026 provides a clear roadmap for future growth.

Athleisure Trend: The athleisure trend continues to be a powerful force in the apparel market, and Lululemon is well-positioned to capitalize on this trend. The continued blending of athletic wear with everyday fashion provides a large market for lululemon to operate within.

Bear Case:

Consumer Spending Slowdown: Lululemon is susceptible to fluctuations in consumer spending. An economic downturn or recession could lead to reduced discretionary spending, impacting demand for its products.

Supply Chain Disruptions: Global supply chain disruptions, such as those caused by geopolitical events or pandemics, could impact Lululemon’s ability to source materials and manufacture products, leading to inventory shortages and lost sales.

Fashion and Trend Risks: Athleisure trends can be fickle. Changes in consumer preferences or the emergence of new fashion trends could impact demand for Lululemon’s products. If consumers move away from the high end athleisure trend, lululemon could see a large decrease in sales.