Executive Summary:

Nike, Inc. is a global leader in athletic footwear, apparel, and equipment, headquartered near Beaverton, Oregon. The company is renowned for its innovative products, iconic “Swoosh” logo, and “Just Do It” slogan. Nike markets its products under various brands, including its own, Air Jordan, and Converse. Nike employs over 83,000 people worldwide and remains a dominant force in the sports and fashion industries.

Nike reported diluted earnings per share (EPS) of $0.78, which was down compared to the same quarter in the previous year. Revenue for the quarter was $12.4 billion, also showing a decrease year-over-year.

Stock Overview:

| Ticker | $NKE | Price | $77.23 | Market Cap | $114.23B |

| 52 Week High | $106.62 | 52 Week Low | $68.62 | Shares outstanding | 1.18B |

Company background:

Nike, Inc. was founded on January 25, 1964, as Blue Ribbon Sports by Phil Knight, a former track athlete at the University of Oregon, and his coach, Bill Bowerman. The company operated as a distributor for Onitsuka Tiger (now ASICS) shoes. The partnership dissolved in 1971, leading Knight and Bowerman to launch their own brand, Nike, named after the Greek goddess of victory.

The early funding for Blue Ribbon Sports came from Phil Knight’s initial investment and loans. Nike is primarily known for its athletic footwear, apparel, and equipment. Their product portfolio spans a wide range of sports, including running, basketball, soccer, and training. The company also owns several subsidiaries, including Air Jordan, Converse, and Hurley International. Innovation in footwear technology, such as Air cushioning and Flyknit, has been a key driver of Nike’s success.

Nike’s main competitors include other major sportswear companies like Adidas, Under Armour, Puma, and ASICS. These companies compete fiercely in the global market for athletic wear, constantly striving to innovate and capture market share. Competition extends beyond product development to marketing and endorsements, with brands often vying for partnerships with prominent athletes and celebrities.

Nike’s world headquarters are located near Beaverton, Oregon, within the Portland metropolitan area. This sprawling campus houses various offices, research facilities, and training centers, serving as the central hub for the company’s global operations.

Recent Earnings:

Nike reported revenue for the quarter reached $12.4 billion, reflecting an 8% decrease compared to the same period in the previous year. This decline was attributed to challenges across various segments, including Nike Direct sales and digital revenue.

EPS for the second quarter was reported at $0.78, also down compared to the prior year. This decrease in profitability further underscores the challenges Nike faced during the quarter. Nike experienced declines in key areas such as Nike Direct revenues, which were down 13%, and Nike Brand Digital sales, which decreased by 21%. Gross margin decreased by 100 basis points to 43.6%, indicating pressure on profitability.

The company emphasized its focus on accelerating its pace and reigniting brand momentum through sport. This suggests a strategic emphasis on innovation and strengthening its connection with consumers through athletic performance.

The Market, Industry, and Competitors:

Nike Inc. operates within the highly competitive athletic footwear and apparel market, which is characterized by rapid innovation, strong brand loyalty, and significant consumer engagement. The company primarily targets a demographic of males and females aged 15 to 40 years, focusing on urban centers globally. This demographic is particularly inclined toward sports and fitness, as well as fashion trends. Nike employs a multifaceted market segmentation strategy that includes geographic, demographic, psychographic, and behavioral factors to cater to diverse consumer needs effectively. The brand’s strong presence in North America, Europe, and Asia-Pacific allows it to leverage regional preferences while maintaining a robust global supply chain.

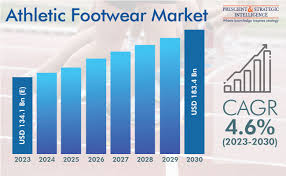

The footwear market is projected to grow, with an expected compound annual growth rate (CAGR) of approximately 4.6% from 2024 to 2030. This growth is driven by evolving consumer preferences for comfort, durability, and aesthetics in footwear, alongside the influence of social media and celebrity endorsements on fashion trends. Nike’s strategic investments in its product lines and marketing initiatives are anticipated to position the company favorably within this expanding market.

The company has demonstrated resilience and adaptability in various markets. Its revenue share from China has shown remarkable growth with a CAGR of 18.3% from 2017 to 2021. As Nike continues to enhance its digital presence and expand its product offerings tailored for different regions, it is well-positioned to meet the demands of an increasingly health-conscious and fashion-forward consumer base.

Unique differentiation:

Nike faces intense competition from a variety of established global brands in the athletic footwear, apparel, and equipment market. One of its most significant rivals is Adidas, a German multinational corporation that is the second-largest sportswear manufacturer in the world. Adidas offers a wide range of products, including footwear, apparel, and accessories, and has a strong presence in both sports and lifestyle segments. The competition between Nike and Adidas is fierce, with both companies vying for market share through innovative products, strategic marketing campaigns, and endorsements from prominent athletes and celebrities.

Another major competitor for Nike is Under Armour, a relatively newer entrant to the market that has quickly gained popularity with its focus on performance-driven apparel and footwear. Under Armour has carved out a niche for itself by emphasizing technology and innovation in its products, particularly in areas like moisture-wicking fabrics and athletic performance tracking. Other notable competitors for Nike include Puma, ASICS, New Balance, and Skechers, each with its own strengths and target markets.

- Brand Power and Emotional Connection: Nike has cultivated an incredibly strong and aspirational brand image. The “Just Do It” slogan and the iconic Swoosh logo are instantly recognizable and resonate with consumers on an emotional level. Nike doesn’t just sell products; it sells a feeling of empowerment, inspiration, and achievement. This emotional connection is a key differentiator, fostering brand loyalty that goes beyond product features.

- Innovation and Technology: Nike consistently invests heavily in research and development, pushing the boundaries of athletic footwear and apparel technology. From Air cushioning to Flyknit technology, Nike has pioneered numerous innovations that enhance performance and comfort. This commitment to innovation keeps them at the forefront of the industry and provides a tangible advantage over competitors.

- Marketing and Endorsements: Nike excels at marketing and storytelling. Their campaigns are often visually stunning and emotionally engaging, featuring top athletes and celebrities who embody the brand’s values. Strategic partnerships with influential figures across sports, music, and fashion amplify Nike’s message and reach a vast audience.

Management & Employees:

Mark Parker serves as the Executive Chairman. He has been with Nike for decades, playing a crucial role in the company’s innovation and growth. His leadership has been instrumental in shaping Nike’s brand and product strategy.

Elliott Hill is the President & CEO. He has a long history with Nike, having held various senior leadership positions across different regions and functions. His experience in consumer and marketplace operations makes him well-suited to lead the company.

Matthew Friend is the EVP & Chief Financial Officer. He is responsible for the company’s financial planning, analysis, and reporting, as well as overseeing various operational aspects. His background in finance and investment banking provides a strong foundation for managing Nike’s financial health.

Financials:

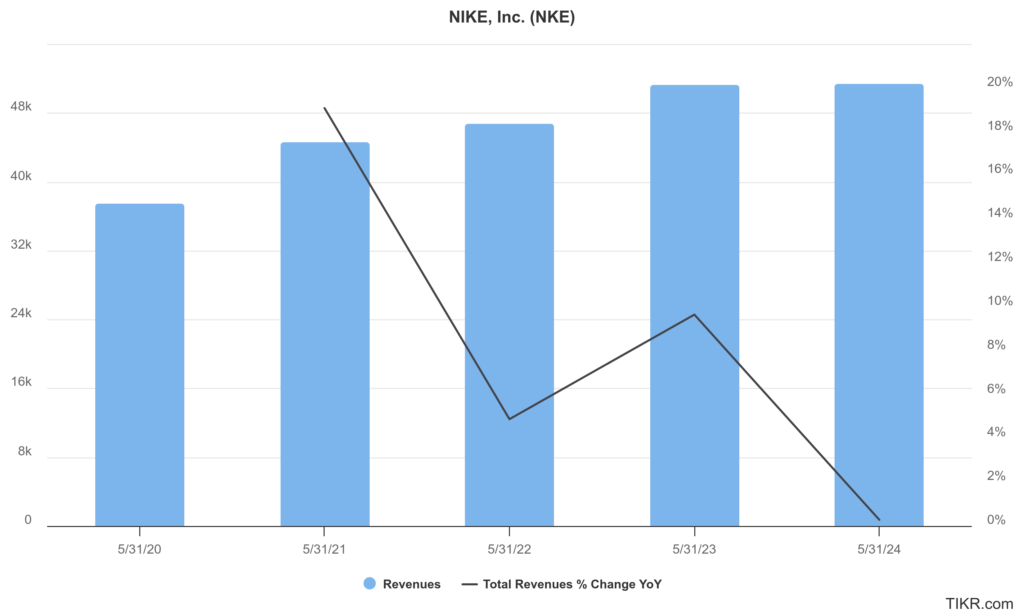

Nike Inc. has reported net sales of approximately $37.4 billion, which increased to $51.4 billion in fiscal year 2023, reflecting a compound annual growth rate (CAGR) of about 17.8%. With revenues projected to decline to around $46 billion, marking an 8% decrease year-over-year for the second quarter of FY25 compared to the same period in FY24.

The company’s net income was approximately $1.5 billion in fiscal year 2020, which increased to around $1.9 billion by fiscal year 2023, indicating a CAGR of about 8%. Nike’s net income fell significantly in FY25, with projections showing a drop to approximately $1.2 billion for the second quarter. This decline in earnings reflects the broader challenges faced by the company, including increased competition and a shift towards digital sales channels that have not yet fully compensated for traditional retail losses.

The company reported cash and equivalents of approximately $9.8 billion, although this was a slight decrease from the previous year. Inventories remained stable at around $8 billion. Nike’s net debt shifted from a positive position in prior years to approximately $2 billion in FY25 due to increased borrowings aimed at supporting operations amidst declining revenues. This situation underscores the company’s strategic focus on maintaining liquidity while navigating transitional market conditions.

Technical Analysis:

The stock is on a stage 4 decline (bearish) on the monthly and weekly charts. The daily chart is trying a reversal at the $67 zone but a lot of resistance in the $80s and $90s zone exists. The stock should head there before a lower move.

Bull Case:

Digital Transformation and Direct-to-Consumer: Nike’s investments in its digital platform and direct-to-consumer strategy are expected to pay off in the long run. By strengthening its online presence and building closer relationships with consumers, Nike can enhance its profitability and control its brand narrative.

Dividend and Shareholder Returns: Nike has a history of returning value to shareholders through dividends and share repurchases. This can be an attractive aspect for investors seeking both growth and income.

Bear Case:

Supply Chain Disruptions: Global supply chain disruptions, such as those caused by geopolitical events or pandemics, can significantly impact Nike’s ability to manufacture and deliver its products. This can lead to lost sales and damage the company’s reputation.

Direct-to-Consumer Challenges: While Nike’s direct-to-consumer strategy has shown promise, it also faces challenges. Building a strong online presence, managing logistics, and competing with other online retailers require significant investments and expertise. If Nike fails to execute its direct-to-consumer strategy effectively, it could lose ground to competitors.

Valuation Concerns: Nike’s stock is often considered to be richly valued, meaning that its price may already reflect high expectations for future growth. If the company fails to meet these expectations, the stock price could decline.