Executive Summary:

DexCom, Inc. is a leading company in developing and manufacturing continuous glucose monitoring (CGM) systems for diabetes management. Its products, like the Dexcom G6 and G7, provide real-time glucose readings to help patients and healthcare providers make informed decisions. DexCom has partnerships with insulin pump manufacturers and digital health platforms to integrate its CGM technology into comprehensive diabetes management solutions. The company’s focus on innovation and user-centric design has made it a popular choice among people with diabetes.

DexCom, Inc. reported total revenue of at least $1.113 billion, an 8% increase compared to the same period in 2023. This growth was driven by a 17% surge in international revenue, reaching approximately $310 million, while U.S. revenue grew by 4% to about $803 million. Preliminary revenue is estimated to be $4.032 billion, representing an 11% increase from 2023.

Stock Overview:

| Ticker | $DXCM | Price | $83.87 | Market Cap | $32.76B |

| 52 Week High | $142.00 | 52 Week Low | $62.34 | Shares outstanding | 390.6M |

Company background:

DexCom, Inc. is a leading developer, manufacturer, and distributor of continuous glucose monitoring (CGM) systems for diabetes management. Founded in 1999 by Scott Glenn, John Burd, Lauren Otsuki, Ellen Preston, and Bret Megargel, the company is headquartered in San Diego, California. DexCom’s primary products are its line of CGM systems, including the Dexcom G6 and the newer Dexcom G7. These systems consist of a small sensor worn on the body that continuously measures glucose levels and transmits the data to a receiver or smartphone app. This allows patients and healthcare providers to track glucose levels in real time, make informed treatment decisions, and reduce the need for traditional fingerstick glucose testing.

The CGM market is competitive, with key players including Abbott Laboratories (maker of the FreeStyle Libre system) and Medtronic. These companies offer their own CGM systems and related diabetes management solutions. DexCom differentiates itself through its focus on accuracy, user-friendly design, and integration with insulin pumps and other diabetes management tools.

DexCom has established itself as a major player in the diabetes technology space, driven by its innovative products and commitment to improving the lives of people with diabetes. The company continues to invest in research and development to enhance its CGM technology and expand its offerings.

Recent Earnings:

DexCom, Inc. reported total revenue of at least $1.113 billion, representing an 8% increase compared to the same period in 2023. This growth was fueled by 17% surge in international revenue, reaching approximately $310 million, while U.S. revenue grew by 4% to about $803 million. Preliminary revenue is estimated to be $4.032 billion, reflecting an 11% increase from 2023.

DexCom anticipated revenue of $4.60 billion. This projection represents a 14% growth compared to 2024. The company expects growth to be driven by factors such as increased CGM access, the continued rollout of Stelo (DexCom’s new glucose biosensor), further international expansion, and overall market dynamics. DexCom also forecasts a 2025 non-GAAP gross profit margin of 64-65% and an operating margin of approximately 21%.

The Market, Industry, and Competitors:

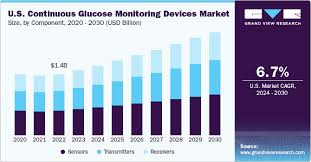

DexCom operates in the rapidly expanding continuous glucose monitoring (CGM) market, a segment of the broader diabetes management device market. This market is driven by the increasing prevalence of diabetes globally, rising awareness of the benefits of CGM technology, and advancements in sensor accuracy and user-friendly design. CGM systems offer significant advantages over traditional blood glucose meters, providing real-time glucose readings, trend arrows, and alerts to help patients and healthcare providers make informed decisions and better manage diabetes.

The rising geriatric population, increasing adoption of sedentary lifestyles, and growing awareness about diabetes management are fueling this growth. By 2030, the market is projected to reach substantial figures, with various research reports estimating CAGRs ranging from 6.5% to 10% or even higher. This growth trajectory indicates a strong demand for CGM systems, driven by their ability to improve glycemic control, reduce the risk of complications, and enhance the quality of life for people with diabetes. DexCom, with its focus on innovation and user-centric design, is well-positioned to capitalize on this market expansion.

Unique differentiation:

DexCom operates in a competitive market for continuous glucose monitoring (CGM) systems, where it faces off against several established players. The most significant competitor is Abbott Laboratories, which offers the FreeStyle Libre line of CGM systems. Abbott has a strong presence in the diabetes care market and has been aggressively expanding its CGM offerings, often vying with DexCom for market share. Another major competitor is Medtronic, a large medical device company that also develops and manufactures CGM systems and related diabetes management solutions. While Medtronic has a long history in the diabetes space, it has faced challenges in keeping pace with the advancements and user experience offered by DexCom and Abbott.

DexCom also faces competition from other companies in the diabetes technology space. These include Insulet Corporation, which focuses on insulin pumps and has partnered with DexCom to integrate its CGM technology, and Senseonics, which offers implantable CGM systems. There are emerging players and smaller companies developing innovative CGM technologies and solutions, further intensifying the competitive landscape. DexCom maintains its competitive edge through its focus on accuracy, user-friendly design, and integration with other diabetes management tools, as well as its continuous investment in research and development to enhance its CGM systems.

Accuracy and Reliability: DexCom’s CGM systems, particularly the G6 and G7, are known for their high accuracy and reliability. This is crucial for people with diabetes who rely on real-time glucose data to make informed decisions about their treatment.

Integration: DexCom’s CGM systems seamlessly integrate with other diabetes management tools, such as insulin pumps and digital health platforms. This allows for a more comprehensive and personalized approach to diabetes management.

Continuous Innovation: DexCom is committed to ongoing research and development, constantly striving to improve its products and introduce new features. This commitment to innovation helps DexCom stay ahead of the competition and meet the evolving needs of people with diabetes.

Management & Employees:

Kevin Sayer: Chairman, President & Chief Executive Officer. Sayer has been with DexCom since 2007 and has served in various leadership roles, including Chief Operating Officer and Chief Financial Officer, before becoming CEO in 2015. He has extensive experience in the medical device industry, having held positions at Biosensors International Group, Specialty Laboratories, and MiniMed.

Jacob S. Leach: Chief Operating Officer & Executive Vice President. Leach was appointed COO in 2022 and is responsible for overseeing DexCom’s global operations. He has been with the company since 2018 and has held various leadership positions in areas such as research and development and technology.

Girish Naganathan: Executive Vice President & Chief Technology Officer. Naganathan joined DexCom in 2022 and is responsible for leading the company’s technology and innovation efforts. He has extensive experience in the technology industry, having previously worked at companies like Qualcomm and Google.

Financials:

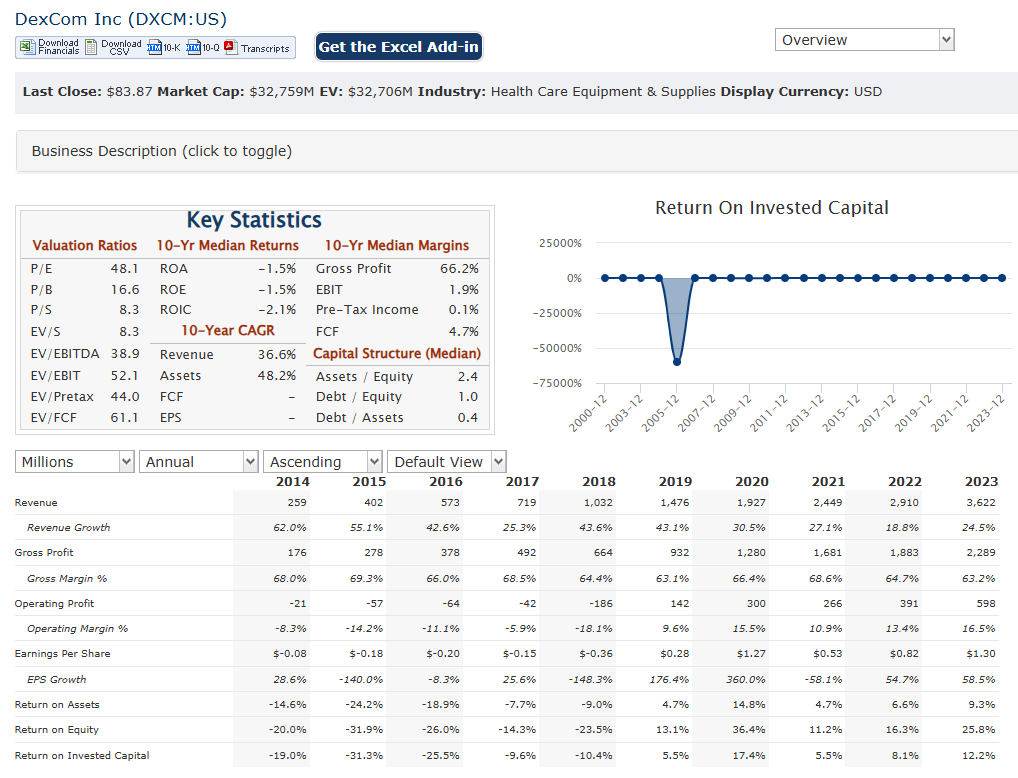

DexCom Inc. has earnings have grown at an average annual rate of 24.2%, outpacing the medical equipment industry’s growth of 12.5%. DexCom’s revenues have also seen impressive growth, with an average rate of 20.4% per year. This growth is reflected in the company’s return on equity, which stands at 34.4%, and net margins of 17.2%.

Total revenue of at least $1.113 billion, an 8% increase year-over-year. U.S. revenue reached approximately $803 million (4% growth), while international revenue hit $310 million (17% growth). For 2024, preliminary revenue totaled $4.032 billion, representing an 11% increase from 2023. DexCom expects revenue of $4.60 billion, targeting 14% growth. The company anticipates a non-GAAP gross profit margin of 64-65% and an operating margin of 21% for 2025.

The company’s revenue CAGR (Compound Annual Growth Rate) over the past 5 years is 28.6%. This consistent growth and profitability reflect DexCom’s strong position in the medical equipment industry.

The company has high-quality earnings and a growing profit margin. DexCom’s net profit margins (17.2%) are higher than the previous year (11.1%). The company’s earnings growth over the past year (80.6%) exceeds its 5-year average (24.2% per year), and it also surpasses the medical equipment industry’s growth of 18%.

Technical Analysis:

The stock is on a reversal on the monthly and weekly charts, but a slow stage 2 (bullish) and on the daily chart the stock is showing a stage 3 (neutral) and reversal at the $89 zone. The stock should head back to $89 from $82 – $84 range, but expect it to be range bound with earnings just released.

Bull Case:

Increased Insurance Coverage and Reimbursement: Expanding insurance coverage and favorable reimbursement policies for CGM systems are crucial for wider adoption. Positive developments in this area, making CGM more accessible and affordable, would benefit DexCom.

Potential for Acquisitions: DexCom’s strong financial position allows for potential acquisitions of smaller companies with innovative technologies or complementary products. This could accelerate growth and expand DexCom’s offerings.

Aging Population: The global population is aging, and older adults are at higher risk of developing diabetes. This demographic trend is expected to further drive demand for CGM systems.

Bear Case:

Pricing Pressure: As the CGM market matures and more players enter, there could be increased pressure on pricing. Insurance companies and other payers may seek to negotiate lower prices, which could impact DexCom’s margins.

Reimbursement Challenges: Changes in healthcare policies or reimbursement practices could negatively impact the adoption of CGM systems. If insurance coverage for CGM is reduced or if reimbursement rates decline, it could make DexCom’s products less accessible and affordable, affecting sales.

Manufacturing or Supply Chain Issues: Any disruptions to DexCom’s manufacturing processes or supply chain could lead to product shortages or delays, negatively impacting revenue and customer satisfaction. Quality control issues could also damage the company’s reputation and lead to product recalls.