Executive Summary:

Clarivate Plc is a global leader in providing insights and analytics to accelerate the pace of innovation. With a rich heritage built on renowned brands, including Web of Science, Cortellis, Derwent, and CompuMark, Clarivate powers the research lifecycle from idea to commercialization. The company serves customers worldwide across academia, government, life sciences and healthcare, and intellectual property sectors.

Clarivate Plc adjusted EPS was $0.19, compared to $0.21 in the same quarter of the previous year. Revenues for the quarter were $622.2 million, down 3.9% from the previous year.

Stock Overview:

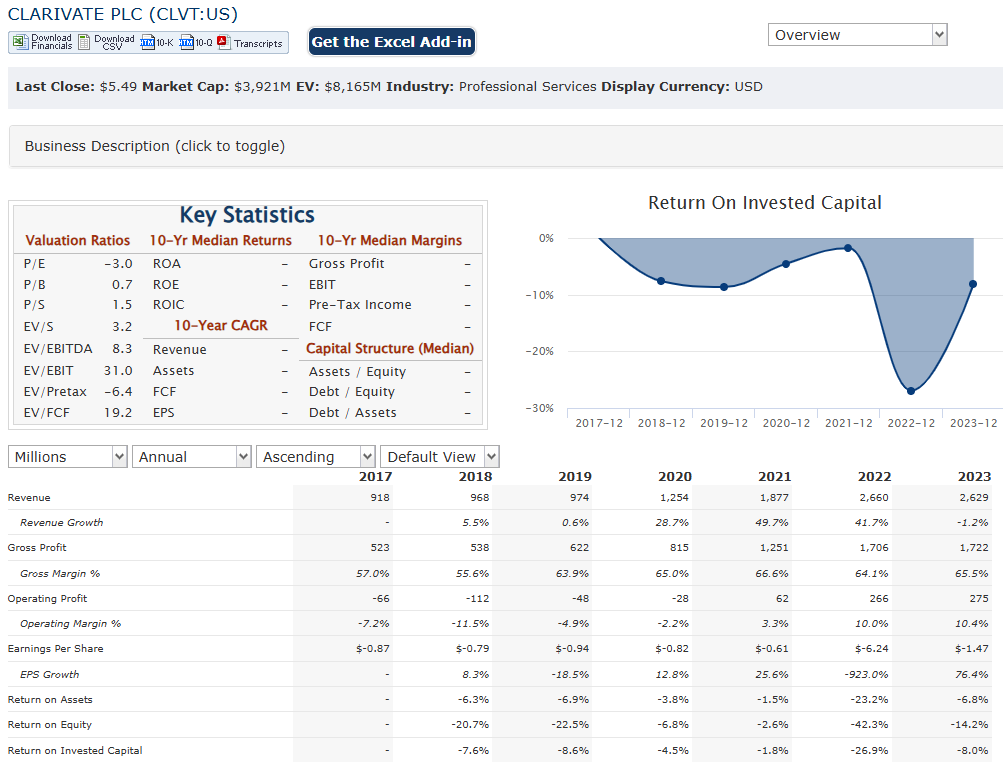

| Ticker | $CLVT | Price | $5.49 | Market Cap | $3.9B |

| 52 Week High | $9.61 | 52 Week Low | $4.25 | Shares outstanding | 710.4M |

Company background:

Clarivate Plc is a global information and analytics company that provides subscription-based services focused on scientific, academic, and intellectual property research. Clarivate was formed through a series of acquisitions and mergers, its roots can be traced back to the Institute for Scientific Information (ISI), founded by Eugene Garfield in 1960. ISI pioneered citation indexing and is best known for creating the Science Citation Index. ISI evolved and was acquired by various companies, eventually becoming part of Thomson Reuters’ Intellectual Property & Science business.

Clarivate’s core offerings revolve around providing data, analytics, and workflow solutions to researchers, academics, and intellectual property professionals. Their products include the Web of Science, a comprehensive citation index; Cortellis, a suite of life science intelligence solutions; Derwent, a patent data and analytics provider; and CompuMark, a trademark research and brand protection platform. These tools help users discover, protect, and commercialize innovations. They serve a wide range of sectors, including academia, government, pharmaceuticals, biotechnology, and legal.

Clarivate operates in a competitive landscape with other information and analytics providers. Key competitors include RELX Group (specifically its LexisNexis and Elsevier divisions), Wolters Kluwer, and IHS Markit. These companies offer similar services in various specialized markets, including legal, scientific, and financial information. Competition is based on factors such as data quality, breadth of coverage, analytical tools, and user experience.

Clarivate Plc is headquartered in Philadelphia, Pennsylvania, USA. The company has a global presence with offices and operations in numerous countries around the world, reflecting its international customer base and the global nature of research and innovation.

Recent Earnings:

Clarivate Plc reported revenues of $622.2 million, a 3.9% decrease compared to the same period last year. This decline was primarily attributed to the divestiture of Valipat and lower transactional sales across all segments. Organic revenue also decreased by 2.6%, with subscription revenue growth of 0.6% being offset by declines in recurring and transactional revenue.

Clarivate reported a net loss of $65.6 million, compared to a net income of $12.3 million in the same quarter of the previous year. This translates to a net loss per diluted share of $0.09. Adjusted EPS was $0.19, down 9.5% from $0.21 in the prior year.

Net cash provided by operating activities increased by 24.2% to $202.9 million, and free cash flow rose by 24.2% to $126.3 million, primarily due to the timing of working capital. The company also made progress in debt reduction, with total debt outstanding decreasing by $58.8 million as of September 30, 2024.

Clarivate is focused on executing its Value Creation Plan, which aims to drive profitable growth through increased subscription and recurring revenue, enhanced sales execution, and accelerated innovation.

The Market, Industry, and Competitors:

Clarivate Plc operates in the global information and analytics market, focusing on sectors such as Academia and Government, Intellectual Property (IP), and Life Sciences and Healthcare. The company provides a range of services, including research analytics, content aggregation, and workflow solutions powered by artificial intelligence. Its diverse offerings cater to various clients, including academic institutions, government bodies, and pharmaceutical companies, positioning Clarivate as a critical player in supporting innovation and research across multiple industries.

The company has identified eleven potential blockbuster drugs poised for commercial success, projected to exceed $1 billion in annual sales by 2030. This focus on high-value therapeutic areas, including obesity and oncology, combined with an emphasis on emerging markets like China, suggests strong growth prospects. Analysts anticipate a robust Compound Annual Growth Rate (CAGR) in the life sciences segment as Clarivate continues to enhance its analytics capabilities and expand its global footprint.

The integration of advanced technologies and a commitment to delivering comprehensive intelligence solutions are likely to bolster Clarivate’s market position and financial performance leading up to 2030.

Unique differentiation:

Clarivate Plc operates in a competitive market for information and analytics, where it faces challenges from several established players. One of its main competitors is RELX Group, a global provider of information and analytics for professional and business customers. RELX, with its LexisNexis and Elsevier divisions, offers a wide range of services in legal, scientific, and healthcare sectors, overlapping with Clarivate’s offerings in these areas. This competition is intense, with both companies constantly innovating and expanding their product portfolios to stay ahead.

Another key competitor for Clarivate is Wolters Kluwer, a multinational information and solutions provider. Wolters Kluwer focuses on providing information, software, and services to professionals in the health, tax and accounting, risk and compliance, and legal sectors. While their focus areas may differ slightly from Clarivate’s, there is still significant overlap, particularly in the legal and regulatory information space. This leads to competition in acquiring customers and developing solutions that meet the evolving needs of professionals in these fields.

Clarivate also faces competition from companies like IHS Markit, which provides information and analytics to businesses and governments, and smaller, niche players specializing in specific areas like patent analytics or life sciences information. The competitive landscape is constantly evolving, with companies vying for market share through strategic partnerships, acquisitions, and the development of innovative solutions.

Rich Heritage and Strong Brands: Clarivate’s roots trace back to the Institute for Scientific Information (ISI) and its founder Eugene Garfield, the pioneer of citation indexing. This legacy gives Clarivate a strong foundation and credibility in the academic and scientific community. Its portfolio includes renowned brands like Web of Science, Cortellis, Derwent, and CompuMark, which are recognized and trusted by researchers and professionals worldwide.

Comprehensive and Integrated Solutions: Clarivate offers a wide range of products and services that cover the entire research lifecycle, from idea generation to commercialization. This comprehensive approach allows customers to access a suite of integrated tools and data, streamlining their workflows and enhancing their efficiency. For example, researchers can use Web of Science to discover relevant literature, Cortellis to analyze life science trends, and Derwent to protect their inventions.

Management & Employees:

Matti Shem Tov is the Chief Executive Officer. He was appointed to this role in August 2024, bringing over 30 years of global leadership experience in software, data, and analytics. He previously served as CEO of ProQuest and has a strong background in driving innovation and growth.

Jonathan Collins is the Executive Vice President and Chief Financial Officer. He is responsible for the company’s financial strategy and operations.

Andrew Snyder is the Chairman of the Board. He has been a member of the Board since 2021 and became Chairman in 2022. He is also the CEO of Cambridge Information Group, a family-owned investment firm.

Financials:

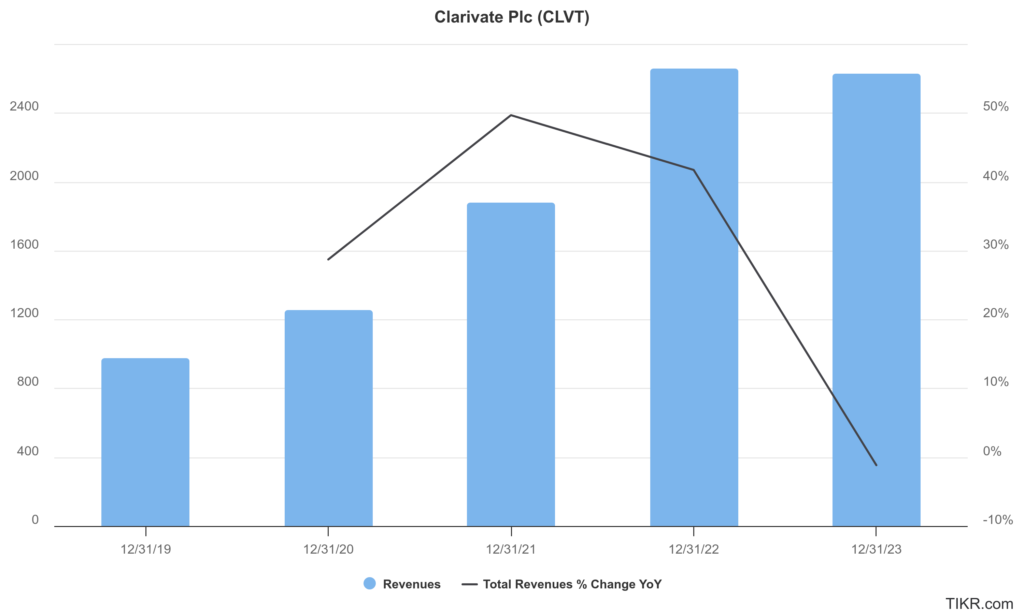

Clarivate Plc has reported a notable increase in net revenues, reaching approximately $1.25 billion, which marked a 28.7% growth compared to the previous year. This upward trajectory continued into 2021, with revenues climbing to about $1.55 billion, driven by strong demand for its analytics and information services. Clarivate faced challenges as revenues fell to $622.2 million in Q3 2024, representing a 3.9% decline year-over-year, indicating a shift in market dynamics and potential overreliance on transactional revenue streams.

A net loss of $106.3 million in 2020, Clarivate improved its adjusted net income to $289.1 million in the same year, showcasing a substantial recovery driven by higher revenues and operational efficiencies. The company reported a net loss of $65.6 million, which highlights ongoing challenges in maintaining profitability amidst declining revenues. The compound annual growth rate (CAGR) for earnings over this period has been inconsistent due to these fluctuations, but the initial recovery post-2020 was promising.

Clarivate’s total debt increased following strategic acquisitions, reaching approximately $3.55 billion by the end of 2020. This rise was primarily due to term loans taken to finance acquisitions such as CPA Global and DRG. The company’s cash and cash equivalents improved notably during this period, reflecting enhanced free cash flow generation capabilities post-acquisition integration efforts.

Clarivate Plc exhibited robust growth in revenue and earnings during its initial post-IPO years through strategic acquisitions and market demand for analytics services, recent financial results indicate challenges that necessitate strategic adjustments to ensure sustainable growth and profitability moving into the future.

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly and weekly charts, and is in a stage 1 (neutral) consolidation phase in the daily chart. The near term range bound nature of the stock indicates a move between $4.7 and $5.8

Bull Case:

Strong Underlying Assets and Market Position: Clarivate possesses a valuable portfolio of well-established brands and data assets, including Web of Science, Cortellis, Derwent, and CompuMark. These platforms are essential tools for researchers, academics, and intellectual property professionals, providing Clarivate with a solid foundation and competitive advantage in the market.

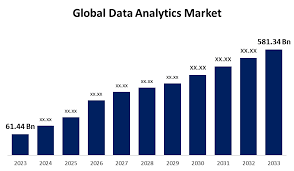

Growing Demand for Information and Analytics: The global market for information and analytics is expected to continue its growth trajectory, driven by factors such as increasing research and development spending, the rise of big data, and the growing importance of intellectual property. Clarivate, with its comprehensive suite of solutions, is well-positioned to capitalize on this trend.

Bear Case:

Execution Risks: Clarivate’s new Value Creation Plan aims to drive growth and improve profitability. There are execution risks associated with implementing this plan. The company needs to successfully streamline its operations, enhance sales execution, and accelerate innovation to achieve its goals. Failure to effectively execute these initiatives could lead to continued underperformance.

Valuation Concerns: While some analysts believe the stock is undervalued, others may have concerns about the company’s current valuation, especially considering its recent financial performance and the challenges it faces. If the company fails to meet expectations, the stock price could potentially decline.