Executive Summary:

PayPal Holdings, Inc. is a multinational financial technology company based in the United States that operates an online payment system in most countries. It processes online payments for online vendors, auction sites, and other commercial users, charging a fee for its services. PayPal offers a range of payment solutions, including person-to-person payments, and its services are used by consumers and merchants worldwide for online and in-person transactions.

PayPal Holdings, Inc. reported its EPS of $1.12, surpassing the consensus analyst estimate of $1.11. Revenue for the quarter reached $8.28 billion, slightly below the analyst expectation of $8.29 billion.

Stock Overview:

| Ticker | $PYPL | Price | $91.81 | Market Cap | $92.04B |

| 52 Week High | $93.66 | 52 Week Low | $55.77 | Shares outstanding | 1B |

Company background:

PayPal Holdings, Inc. is a leading global financial technology company that facilitates online payments and money transfers. Founded in 1998 as Confinity by Max Levchin, Peter Thiel, Luke Nosek, and Ken PayPal initially focused on enabling secure online payments. The company gained traction with the rise of e-commerce and online auctions, particularly through its integration with eBay.

PayPal’s core products include its namesake online payment platform, which allows individuals and businesses to send and receive money online. Other key offerings include Venmo, a popular peer-to-peer payment app, and Braintree, a payment processing platform for businesses. PayPal has expanded its services beyond traditional online payments to include features like credit and debit cards, cryptocurrency support, and buy now, pay later options.

PayPal’s key competitors in the digital payments space include companies like Visa, Mastercard, Stripe, Square, and Amazon Pay. These companies compete with PayPal in areas such as online payment processing, point-of-sale solutions, and mobile payment services. PayPal maintains a strong global presence, with operations in numerous countries worldwide. The company’s headquarters is located in San Jose, California.

Recent Earnings:

Revenue for the quarter reached $8.28 billion, slightly below the analyst expectation of $8.29 billion. This represents a year-over-year revenue growth of approximately 6%.

Earnings Per Share (EPS) came in at $1.12, surpassing the consensus analyst estimate of $1.11.

Total payment volume increased 9% to $422.6 billion, while payment transactions increased 6% to 6.6 billion. Active accounts decreased 0.4% to 429 million, although they increased slightly on a sequential basis.

The company also expressed confidence in its ability to continue to improve profitability and drive shareholder value.

The Market, Industry, and Competitors:

PayPal Holdings Inc. operates within the rapidly expanding digital payments and e-commerce market, which is projected to exceed $6 trillion globally. The company provides a comprehensive technology platform that facilitates online and in-person payments for consumers and merchants alike, leveraging a robust two-sided network that connects 426 million active accounts across 200 markets. Key services include payment processing through various brands such as PayPal, Venmo, Braintree, and Xoom, which cater to diverse consumer needs ranging from person-to-person transactions to merchant services.

A compound annual growth rate (CAGR) of approximately 8% for its revenue over the next several years. This follows a historical CAGR of 16% over the past eight years, indicating a robust trajectory despite market maturation. The anticipated growth is driven by the increasing adoption of digital payment solutions, expansion into new markets, and strategic partnerships aimed at enhancing service offerings. PayPal’s ongoing efforts to innovate its platform—such as integrating cryptocurrency transactions and improving checkout processes—are likely to attract more users and merchants, further solidifying its market presence as a leader in the digital payments sector.

Unique differentiation:

Traditional credit card companies like Visa and Mastercard pose a significant threat, leveraging their established global networks and merchant relationships. These companies are actively expanding their digital offerings, including mobile payment solutions and online platforms, to compete more directly with PayPal.

Fintech companies like Stripe, Square, and Adyen are also major competitors. These companies offer innovative payment processing solutions, often with a focus on specific industries or customer segments. They are known for their cutting-edge technology, developer-friendly platforms, and competitive pricing models.

Large technology companies like Amazon and Apple are increasingly entering the digital payments space. Amazon Pay offers a convenient payment option for Amazon customers, while Apple Pay has gained significant traction with its mobile wallet and contactless payment capabilities.

- Diverse Product Ecosystem: PayPal offers a comprehensive suite of products beyond traditional online payments, including:

- Venmo: A popular peer-to-peer payment app, particularly among younger demographics.

- Braintree: A robust payment processing platform for businesses of all sizes.

- Credit and Debit Cards: Expanding into credit and debit card offerings enhances customer engagement and loyalty.

- Cryptocurrency Support: Enabling cryptocurrency transactions positions PayPal at the forefront of evolving payment technologies.

- Buy Now, Pay Later (BNPL) Options: Offering flexible financing options caters to changing consumer preferences.

- By leveraging these differentiators, PayPal aims to maintain its competitive edge and continue to innovate in the dynamic digital payments landscape.

Management & Employees:

Alex Chriss: President and CEO

Jamie Miller: EVP, Chief Financial Officer

John Kim: EVP, Chief Product Officer

Suzan Kereere: President, Global Markets

Financials:

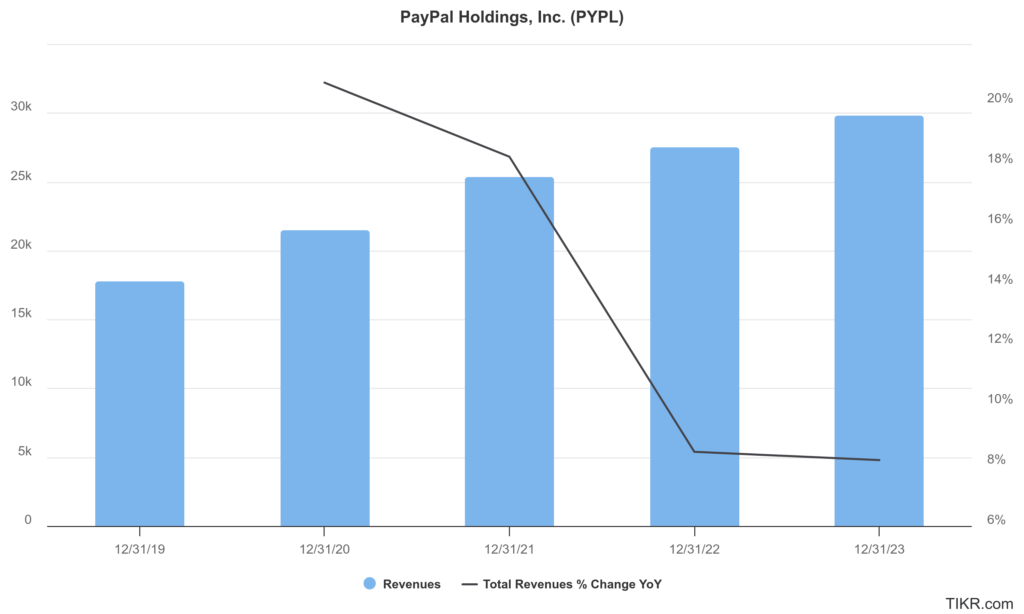

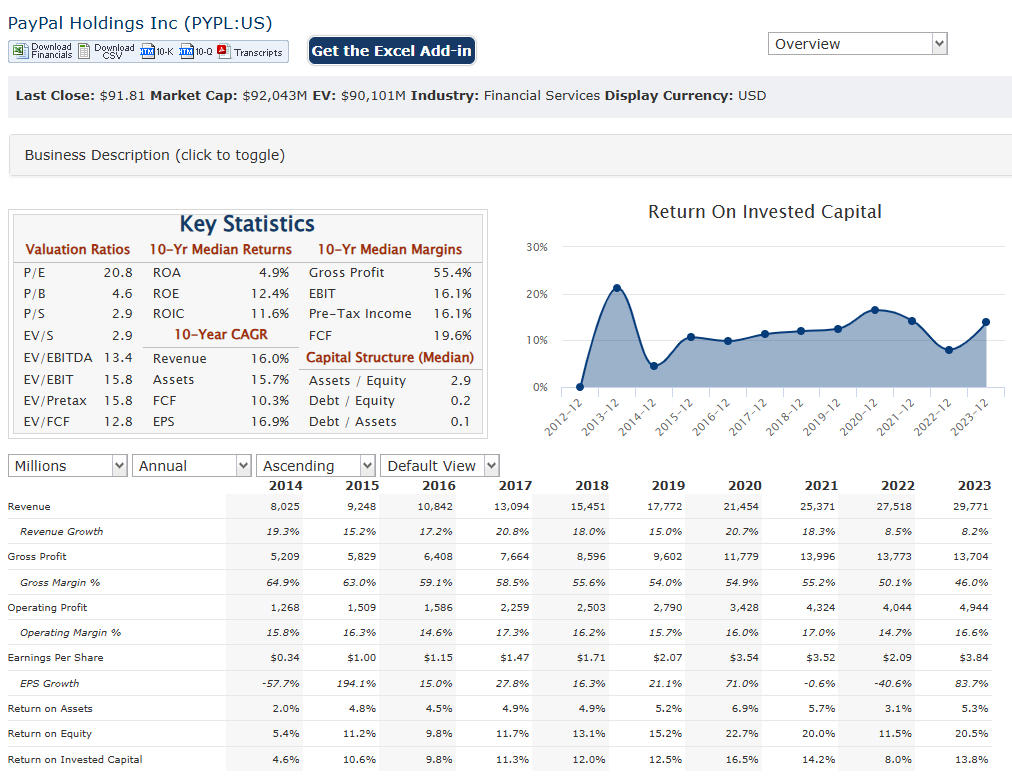

PayPal Holdings Inc. has reported revenues of approximately $17.77 billion, which increased to $29.77 billion in 2023, reflecting a compound annual growth rate (CAGR) of about 10.1% during this period. The revenue growth trajectory included significant increases of 20.72% in 2020 and 18.26% in 2021, although the pace slowed in subsequent years, with increases of 8.46% in 2022 and 8.19% in 2023. This steady growth can be attributed to PayPal’s expanding user base and its continuous innovation in payment solutions, including mobile payments and cryptocurrency integration.

Net income rose from $2.46 billion in 2019 to approximately $4.25 billion in 2023, achieving a CAGR of around 12.5% over the five-year span. However, the earnings growth was not linear; for instance, net income saw a significant drop of 41.98% in 2022 due to increased competition and market pressures but rebounded with a 75.53% increase in 2023.

The company had a net debt position of approximately -$10.76 billion, indicating a strong cash position relative to its liabilities. By 2023, this shifted to about $595 million, reflecting changes in capital structure and operational cash flows that have allowed PayPal to maintain liquidity while investing in growth initiatives. The company’s ability to manage its debt effectively while pursuing strategic investments is critical for sustaining its competitive edge and supporting future expansion efforts.

With ongoing innovations and strategic initiatives aimed at enhancing user experience and expanding market reach, the company is well-positioned for continued growth as it approaches the next phase of its business evolution.

Technical Analysis:

The stock is in a stage 1 consolidation (neutral) on the monthly & weekly chart. The daily chart is in a stage 4 markdown (Bearish) but could move higher as a cup and handle forms. The near term outlook looks positive to the move higher to the $93 – $99 zone.

Bull Case:

Expanding Global Reach: PayPal’s extensive global network and user base create a powerful network effect. As e-commerce continues to grow internationally, PayPal is well-positioned to capitalize on this expansion.

Diverse Product Ecosystem: The company’s diverse product offerings, including Venmo, Braintree, credit and debit cards, cryptocurrency support, and Buy Now, Pay Later options, provide multiple avenues for growth and revenue generation.

Attractive Valuation: After a period of decline, PayPal’s stock may currently be undervalued relative to its growth potential and market position.

Bear Case:

Increased Regulatory Scrutiny: The fintech sector faces increasing regulatory scrutiny, which could impact PayPal’s operations and profitability.

Economic Headwinds: A potential economic downturn could negatively impact consumer spending and online commerce, which could adversely affect PayPal’s transaction volumes and revenue.

Integration Challenges: Successfully integrating new products and services, such as cryptocurrency and BNPL options, while maintaining a seamless user experience can be challenging and may require significant investments.