Executive Summary:

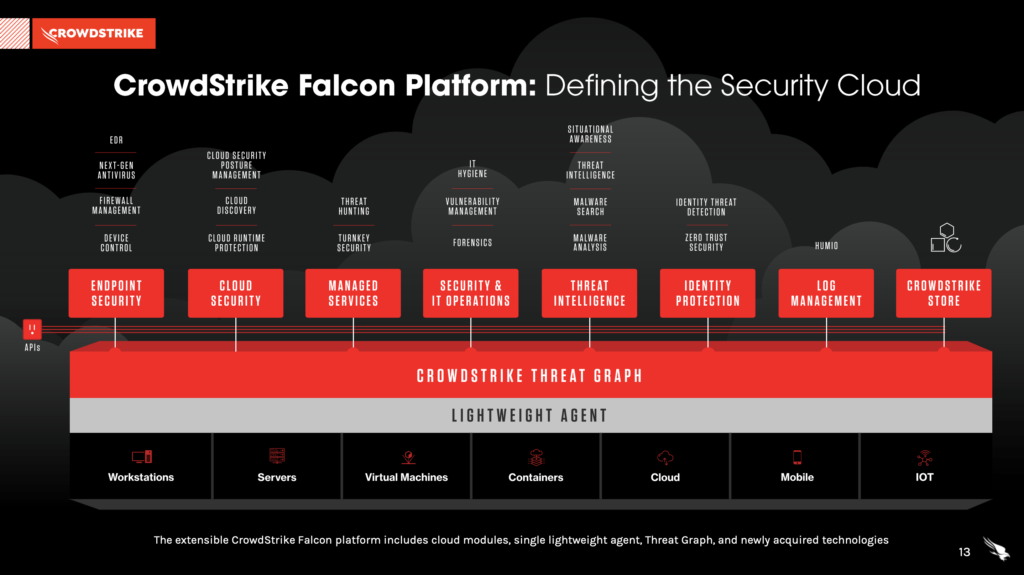

CrowdStrike Holdings Inc. is a global cybersecurity company that offers cloud-delivered protection for endpoints, cloud workloads, identity, and data. The company’s flagship product, the Falcon platform, is designed to consolidate cybersecurity functions and stop breaches. CrowdStrike’s Falcon platform leverages a single lightweight-agent architecture with integrated cloud modules spanning multiple security markets, including corporate workload security, managed security services, security and vulnerability management.

CrowdStrike Holdings Inc. reported its revenue reached $1.01 billion, surpassing analyst expectations, with a year-over-year growth of 28.52%. Net income was -$16.82 million.

Stock Overview:

| Ticker | $CRWD | Price | $363.38 | Market Cap | $89.5B |

| 52 Week High | $398.33 | 52 Week Low | $200.81 | Shares outstanding | 233.85M |

Company background:

CrowdStrike Holdings Inc. is a global cybersecurity company that provides cloud-delivered protection for endpoints, cloud workloads, identity, and data. Founded in 2011 by George Kurtz, Dmitri Alperovitch, and George Kurtz, the company is headquartered in Austin, Texas. CrowdStrike’s flagship product, the Falcon platform, is designed to consolidate cybersecurity functions and stop breaches. The Falcon platform leverages a single lightweight-agent architecture with integrated cloud modules spanning multiple security markets, including corporate workload security, managed security services, security and vulnerability management, and more. The company offers 27 cloud modules on its Falcon platform via a software-as-a-service (SaaS) subscription-based model.

In 2011, the company raised $14 million in Series A funding led by Accel Partners. This was followed by a $41 million Series B round in 2013, led by Warburg Pincus. In 2014, CrowdStrike raised $100 million in Series C funding, led by Google Capital. The company went public in 2019, raising $612 million in its initial public offering.

CrowdStrike’s key competitors in the cybersecurity market include Microsoft, Cisco, Symantec, McAfee, and Palo Alto Networks. The company competes with these companies in the areas of endpoint security, cloud security, and threat intelligence.

CrowdStrike’s headquarters is located in Austin, Texas. The company also has offices in North America, Europe, the Middle East, Africa, and Asia Pacific.

Recent Earnings:

CrowdStrike Holdings Inc. reported its revenue reached $1.01 billion, exceeding analyst expectations with a year-over-year growth of 28.52%. CrowdStrike’s revenue growth demonstrates continued market traction for its cybersecurity solutions.

Annual Recurring Revenue (ARR) reached $4.02 billion, reflecting strong customer demand and retention. CrowdStrike continued to expand its customer base, adding a significant number of new subscribers across various industries.

The company expects revenue to be in the range of $1.045 billion to $1.055 billion, representing a year-over-year growth of approximately 25%. They focus on innovation, expanding its customer base, and providing comprehensive cybersecurity solutions positions it well for continued success in the evolving threat landscape.

The Market, Industry, and Competitors:

CrowdStrike operates in the rapidly growing cybersecurity market, which is driven by the increasing sophistication of cyber threats, the rise of remote work, and the growing reliance on cloud computing. The market is highly competitive, with major players including Microsoft, Cisco, Symantec, McAfee, and Palo Alto Networks. CrowdStrike’s focus on cloud-delivered security and its innovative Falcon platform have positioned it well to capitalize on the growing demand for cybersecurity solutions.

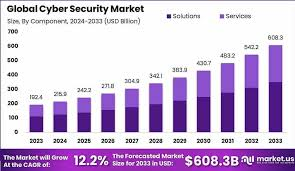

The global cybersecurity market is projected to reach $345 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of around 12%. This growth is driven by several factors, including the increasing adoption of cloud computing, the rise of the Internet of Things (IoT), and the growing number of cyberattacks.

CrowdStrike is well-positioned to benefit from the growth of the cybersecurity market. CrowdStrike’s focus on cloud-delivered security aligns with the broader industry trend toward cloud computing.

Unique differentiation:

Microsoft: A dominant force in the technology industry, Microsoft offers a suite of security products, including Microsoft Defender for Endpoint, which directly competes with CrowdStrike’s Falcon platform. Microsoft’s extensive customer base and strong brand recognition give it a significant advantage.

Cisco: Another major player in the networking and security space, Cisco offers a comprehensive portfolio of security products, including endpoint security, network security, and cloud security. Cisco’s strong presence in enterprise networks provides it with a solid foundation for expanding its security offerings.

Palo Alto Networks: A leading provider of next-generation firewalls and security platforms, Palo Alto Networks has been expanding its endpoint security offerings to compete more directly with CrowdStrike.

SentinelOne: A newer entrant to the market, SentinelOne has gained traction with its AI-powered endpoint protection platform. The company is known for its innovative approach to threat detection and response.

Single-agent architecture: CrowdStrike’s Falcon platform utilizes a single lightweight agent to provide comprehensive security across endpoints, cloud workloads, and identities. This simplifies deployment and management for customers.

Cloud-native platform: The Falcon platform is built on a cloud-native architecture, enabling real-time threat detection, rapid response, and scalability.

Artificial intelligence (AI) and machine learning (ML) powered: CrowdStrike leverages AI and ML extensively to detect and respond to threats, including malware, ransomware, and other sophisticated attacks.

Focus on threat intelligence: CrowdStrike maintains a global threat intelligence network, providing customers with real-time insights into emerging threats and attack patterns.

Management & Employees:

George Kurtz: Co-Founder, CEO

Shawn Henry: Chief Security Officer

Adam Meyers: Senior Vice President, Counter Adversary Operations

Elia Zaitsev: Chief Technology Officer

Thomas Etheridge: Chief Global Professional Services Officer

Financials:

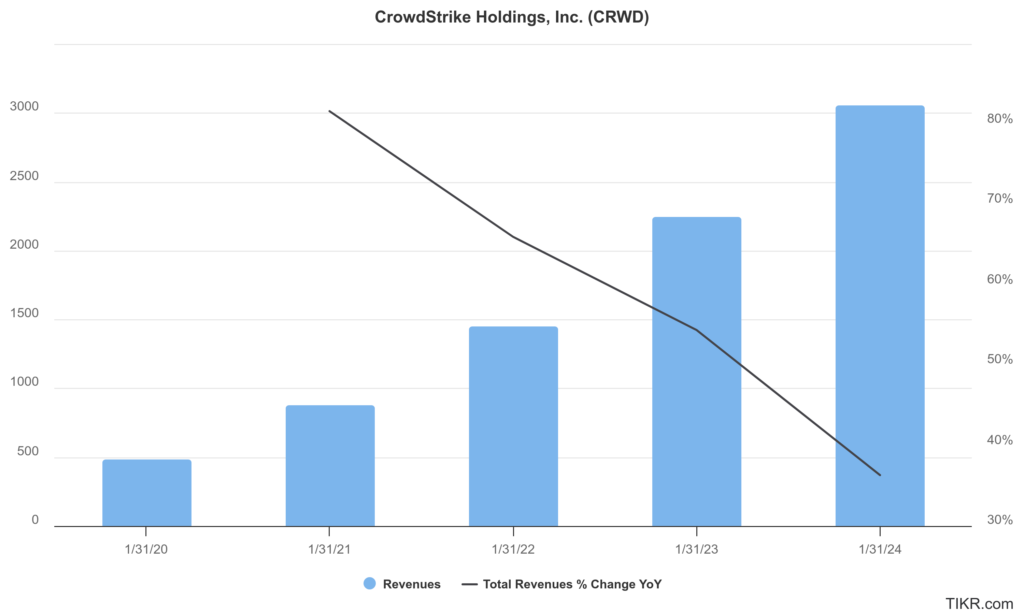

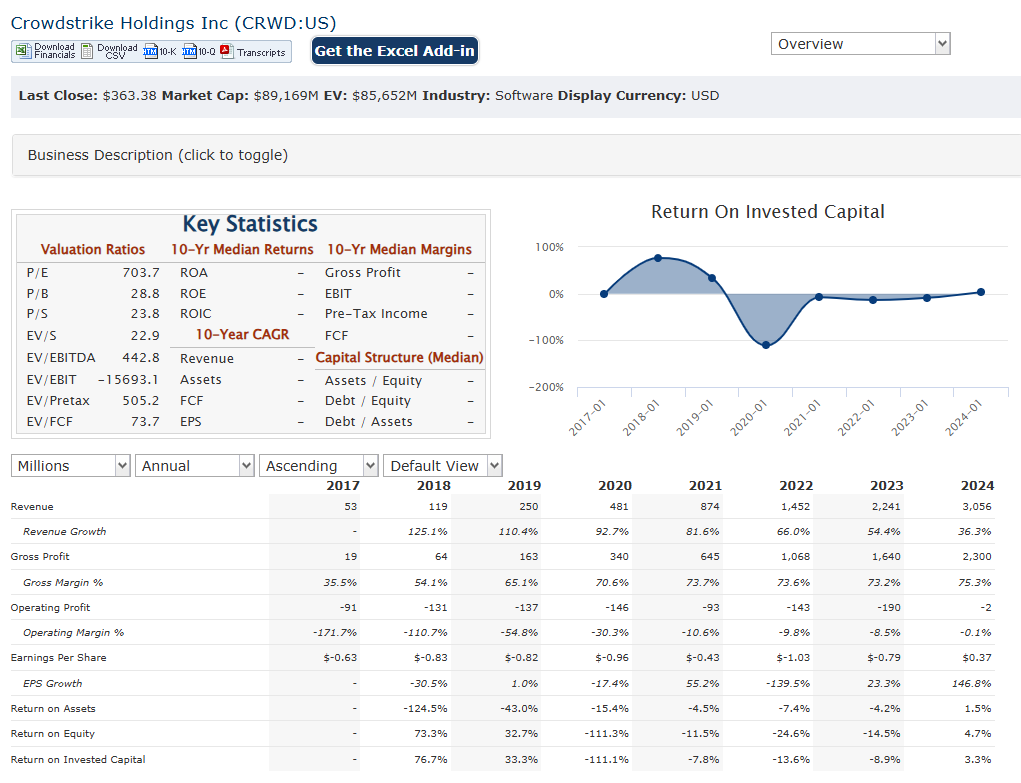

CrowdStrike Holdings Inc. has reported a total revenue of approximately $3.44 billion, reflecting a remarkable year-over-year growth of 34% compared to fiscal 2023. This growth trajectory is indicative of a compound annual growth rate (CAGR) of around 36%, driven by an increase in annual recurring revenue (ARR), which reached $3.44 billion by the end of fiscal 2024. The net new ARR also showed strong performance, growing to $282 million, marking a 27% increase year-over-year.

CrowdStrike achieved its first positive GAAP net income of $89.3 million in fiscal 2024, a significant turnaround from a loss of $183.2 million in the previous fiscal year. This translates to a GAAP net income per share of $0.37, compared to a loss of $0.79 in fiscal 2023. Non-GAAP net income also saw substantial growth, reaching $751.8 million, up from $368.4 million in fiscal 2023, resulting in a non-GAAP net income per share increase from $1.54 to $3.09.

The company generated net cash from operations amounting to $1.166 billion and free cash flow of approximately $938 million, both representing increases from the prior year. This strong cash position enables CrowdStrike to invest in further innovation and expansion while maintaining a solid liquidity profile. They showcases its successful strategy in the cybersecurity market, marked by impressive revenue and earnings growth alongside effective cost management and operational efficiency.

Technical Analysis:

The stock is in a stage 2 markup on the monthly chart (bullish) and similar on the weekly chart. The daily chart is in a stage 3 consolidation phase (neutral). The near term stock outlook is a move to $334 where it should reverse back to the $380 range, where it should break the resistance.

Bull Case:

Strong Growth Potential: The cybersecurity market is experiencing rapid growth, driven by the increasing sophistication of cyber threats, the rise of remote work, and the growing reliance on cloud computing. CrowdStrike’s focus on cloud-delivered security and its innovative Falcon platform position it well to capitalize on this growth.

Innovative Technology: CrowdStrike’s Falcon platform leverages artificial intelligence (AI) and machine learning (ML) to proactively identify and stop cyber threats. The company’s continuous innovation in this area gives it a competitive edge.

Bear Case:

Dependence on Subscription Revenue: CrowdStrike’s revenue is heavily reliant on subscription fees. A significant decline in customer retention or subscription renewals could negatively impact the company’s financial performance.

Emerging Threats: The evolving threat landscape requires continuous innovation and adaptation. If CrowdStrike fails to keep pace with emerging threats and technologies, its competitive advantage could erode.