Executive Summary:

Chipotle Mexican Grill is a large chain of fast-casual restaurants known for their customizable burritos, bowls, tacos, and salads. They emphasize using fresh, high-quality ingredients, often sourced from local and sustainable farms. The company has faced challenges, including food safety issues and competition, but continues to be a popular choice for consumers seeking a fast-casual dining option.

Chipotle Mexican Grill reported its revenue of $2.8 billion, a 13% increase year-over-year. Earnings per share (EPS) came in at $0.27, exceeding analyst estimates by 8%.

Stock Overview:

| Ticker | $CMG | Price | $57.37 | Market Cap | $78.17B |

| 52 Week High | $69.26 | 52 Week Low | $45.62 | Shares outstanding | 1.36B |

Company background:

Chipotle Mexican Grill is a prominent fast-casual restaurant chain founded in 1993 by Steve Ells. Ells, inspired by a trip to Mexico, envisioned a restaurant serving high-quality, fresh Mexican food in a fast-casual setting. The company’s initial funding came from private investors, and it quickly gained popularity for its customizable menu featuring burritos, bowls, tacos, and salads. Chipotle’s emphasis on using fresh, locally sourced ingredients, along with its commitment to sustainable practices, has resonated with health-conscious consumers.

Chipotle’s menu is centered around a simple assembly line where customers choose their preferred protein (chicken, steak, carnitas, sofritas, or barbacoa), rice, beans, and a variety of salsas, toppings, and cheeses. This customizable approach allows for a wide range of flavor combinations and caters to diverse dietary preferences. The company has also expanded its menu to include items like quesadillas and lifestyle bowls.

Chipotle faces competition from various sources, including other fast-casual Mexican chains like Qdoba and Moe’s Southwest Grill, as well as traditional fast-food restaurants offering value meals and delivery services. The rise of delivery platforms like Uber Eats and DoorDash has increased competition from both within and outside the restaurant industry. Chipotle continues to innovate with new menu items, digital ordering platforms, and loyalty programs to maintain its competitive edge.

Chipotle Mexican Grill is headquartered in Newport Beach, California. The company has experienced significant growth since its inception and currently operates numerous restaurants across the United States and in several international markets.

Recent Earnings:

Chipotle Mexican Grill reported its revenue for the quarter reached $2.8 billion, marking a 13% year-over-year increase. Earnings per share (EPS) for the quarter came in at $0.27, exceeding analyst estimates by 8%. Chipotle’s comparable restaurant sales growth, a key metric for the industry, increased by 6%. This growth was driven by a combination of higher average check size and an increase in transactions.

Chipotle continued to focus on its digital initiatives, including its loyalty program and mobile ordering platforms. The company also emphasized its commitment to using fresh, high-quality ingredients and sustainable practices.

Chipotle reaffirmed its guidance for restaurant openings and reiterated its commitment to long-term growth. The company continues to invest in its digital infrastructure, expand its restaurant footprint, and explore new menu innovations to drive future growth.

The Market, Industry, and Competitors:

Chipotle Mexican Grill Inc. operates in the quick-service restaurant (QSR) sector, specifically within the fast-casual dining segment. This market is characterized by its focus on high-quality, customizable meals that cater to health-conscious consumers. Chipotle’s unique selling proposition lies in its commitment to using fresh, responsibly sourced ingredients, which appeals to a demographic that values sustainability and ethical food practices. The company primarily targets millennials and Generation Z, who are increasingly seeking healthier dining options that align with their lifestyle choices.

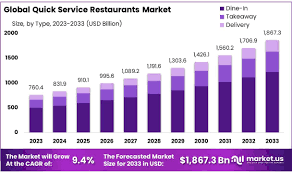

Chipotle is expected to experience strong growth within the QSR industry, which is projected to see a compound annual growth rate (CAGR) of approximately 6-9.5% from 2022 to 2027. This growth is driven by rising consumer demand for healthier fast-casual dining options and Chipotle’s strategic expansion into international markets, such as the Middle East. The company’s emphasis on digital sales—accounting for over 37% of its total revenue—further positions it well for future growth as consumer preferences shift towards online ordering and delivery services.

Unique differentiation:

Chipotle faces competition from various sources within the fast-casual and broader restaurant industries. Direct competitors include other Mexican-focused chains like Qdoba Mexican Eats, Moe’s Southwest Grill, and Baja Fresh. These competitors often emulate Chipotle’s model, offering customizable burritos, bowls, and tacos with similar ingredient choices.

Chipotle also faces competition from other fast-casual chains that focus on different cuisines but cater to similar consumer preferences. These include popular brands like Panera Bread, Sweetgreen, and Shake Shack. Additionally, traditional fast-food restaurants like McDonald’s, Burger King, and Wendy’s are increasingly offering more premium menu items and delivery options, posing a competitive threat to Chipotle.

The rise of third-party delivery platforms like Uber Eats and DoorDash has increased competition from a wider range of restaurants, including local eateries and smaller chains. These platforms provide consumers with a vast array of dining options, making it easier to discover and order food from competitors.

Focus on Fresh, High-Quality Ingredients: Chipotle emphasizes using fresh, locally sourced ingredients, often raised without antibiotics or hormones. This resonates with health-conscious consumers and sets them apart from competitors that may rely on processed or frozen ingredients.

Customizable Menu: Chipotle’s assembly-line style allows customers to create personalized meals, catering to diverse dietary preferences and tastes. This level of customization is a key differentiator in the fast-casual space.

“Food with Integrity” Philosophy: Chipotle has built a strong brand identity around its commitment to sustainable and ethical sourcing practices. This resonates with consumers who prioritize social and environmental responsibility.

Management & Employees:

The Chipotle Mexican Grill management team is led by Scott Boatwright, who serves as the Chief Executive Officer and a member of the Board of Directors.

- Jack Hartung, President and Chief Strategy Officer

- Carlos Londono, Vice President and Head of Supply Chain

- Chris Brandt, Chief Brand Officer

Financials:

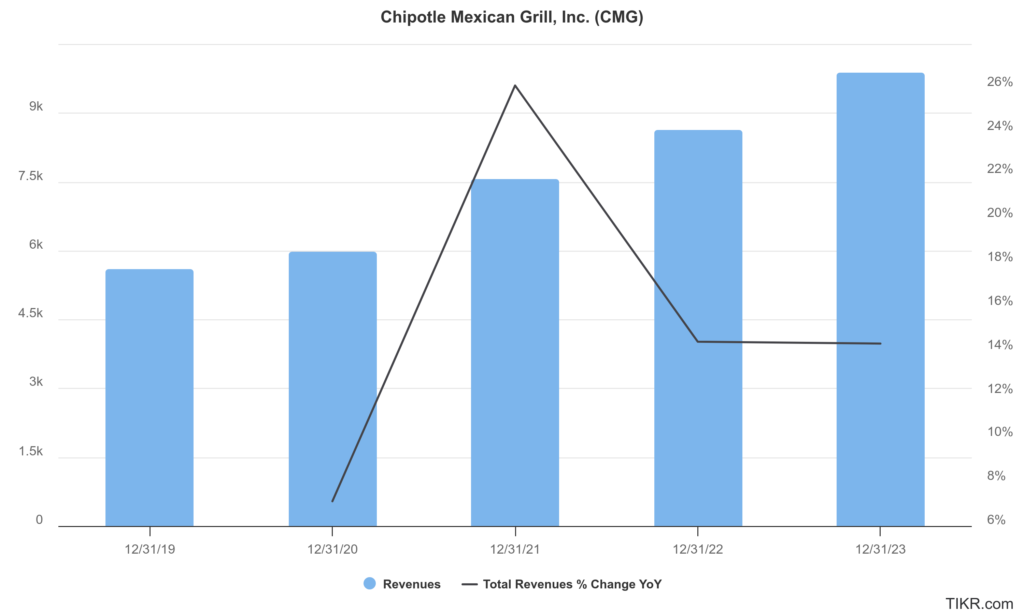

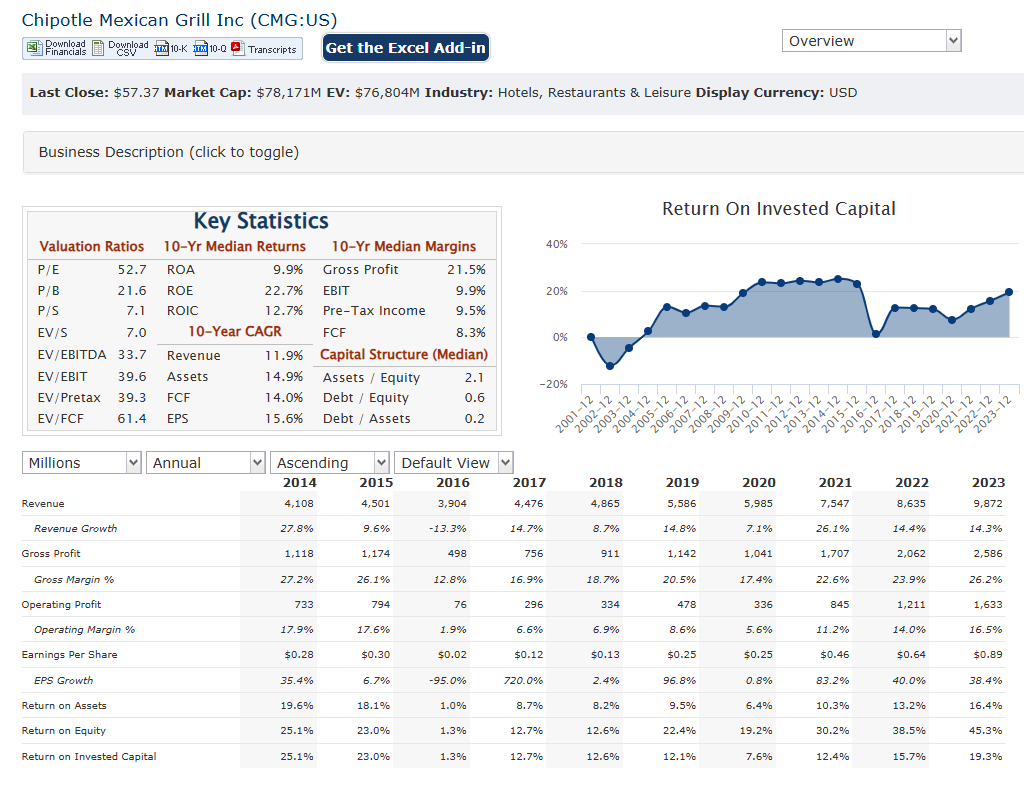

Chipotle Mexican Grill Inc. has reported total revenues of approximately $5.586 billion, which increased to $9.872 billion in 2023, reflecting a compound annual growth rate (CAGR) of about 14.33% during this period. The revenue growth has been driven by an increase in comparable restaurant sales, which rose by 7.9% in 2023 alone, alongside strategic expansion efforts that included the opening of new locations and enhancements to digital ordering capabilities.

The diluted earnings per share (EPS) rising from $32.04 in 2022 to $44.34 in 2023, representing a remarkable increase of 38.4% year-over-year. The company’s operating margin improved from 13.4% in 2022 to 15.8% in 2023, indicating enhanced operational efficiency and profitability. This upward trend in earnings is further supported by a consistent focus on cost management and optimizing restaurant-level operating margins, which reached 26.2% in 2023.

The company reported net debt of approximately $561 million, reflecting a decrease from previous years and highlighting its strong cash flow generation capabilities. The free cash flow for 2023 was recorded at around $1.223 billion, an increase of nearly 44.87% compared to the prior year.

With strategic plans for expansion and a commitment to enhancing customer experience through digital innovations, the company is well-positioned for sustained growth.

Technical Analysis:

The stock is in a stage 4 decline on the monthly chart and has support at $55. The weekly chart is bearish as well. The daily chart is showing early signs of a reversal, but the volume indicates the stock might head lower again to retest the $55 zone.

Bull Case:

Digital Initiatives: Chipotle’s robust digital platform, including its loyalty program and mobile ordering capabilities, enhances the customer experience and drives repeat business. The company’s digital initiatives also provide valuable data that can be used to personalize offers and improve operations.

Resilience in Challenging Times: Chipotle has demonstrated its resilience in the face of economic downturns and industry challenges. The company’s strong brand and operational efficiency have enabled it to navigate difficult periods and emerge stronger.

Bear Case:

Food Costs and Supply Chain Disruptions: Rising food costs and potential supply chain disruptions could squeeze profit margins and impact the company’s ability to maintain its commitment to high-quality ingredients.

Potential for Food Safety Incidents: While Chipotle has made significant strides in improving its food safety protocols, the risk of future food safety incidents remains a concern for investors. Such incidents could severely damage the company’s reputation and negatively impact sales.