Executive Summary:

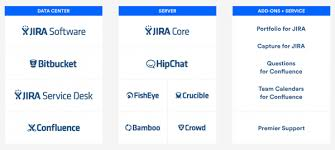

Atlassian Corporation is an Australian software company that develops products for software developers, project managers, and other software development teams. Its flagship product is Jira, a team planning and project management platform. Atlassian also offers Confluence, a team content creation and sharing solution, and Bitbucket, a team code sharing and management software.

Atlassian Corporation reported its revenue reached $1.188 billion, marking a 21% year-over-year increase. Subscription revenue grew 33% to $1.132 billion. The GAAP operating margin was -3%, and the non-GAAP operating margin was 23%.

Stock Overview:

| Ticker | $TEAM | Price | $242.02 | Market Cap | $63.43B |

| 52 Week High | $287.97 | 52 Week Low | $135.29 | Shares outstanding | 161.46M |

Company background:

Atlassian Corporation is an Australian software company that develops and sells products for software developers, project managers, and other software development teams. Founded in 2002 by Mike Cannon-Brookes and Scott Farquhar, two students from the University of New South Wales, Atlassian initially bootstrapped its operations with a modest $10,000 credit card loan.

The company’s flagship product is Jira, a comprehensive platform for project tracking, issue tracking, and agile software development. Other key products include Confluence, a collaborative workspace for teams to create, share, and organize information, and Bitbucket, a Git-based code hosting and collaboration service.

Atlassian’s primary competitors include Microsoft (with products like Azure DevOps and Teams), ServiceNow, and Salesforce. The company has a strong presence in the enterprise software market, serving a wide range of customers, from small startups to large multinational corporations. Atlassian is headquartered in Sydney, Australia, with offices in various locations across the United States, Europe, and Asia.

Recent Earnings:

Atlassian Corporation reported its revenue reached $1.188 billion, marking a 21% year-over-year increase. Subscription revenue, the company’s primary revenue driver, grew 33% to $1.132 billion. This strong subscription revenue growth reflects the increasing demand for Atlassian’s cloud-based offerings and the company’s success in transitioning customers to its subscription model.

The company reported a GAAP operating loss of $32 million for the quarter. This was primarily due to increased investments in research and development, sales and marketing, and product innovation. The non-GAAP operating margin remained healthy at 23%. Cash flow from operations was $80 million, and free cash flow was $74 million, demonstrating the company’s ability to generate cash despite ongoing investments.

Atlassian achieved total revenue of $4.4 billion, a 23% increase year-over-year. Subscription revenue grew 34% to $4.2 billion. The company also reported key operational metrics, including customer growth and expansion within existing customer accounts, which continued to demonstrate strong momentum in the business.

The company expects revenue to be in the range of $1.235 billion to $1.245 billion, representing a year-over-year growth rate of approximately 21%.

The Market, Industry, and Competitors:

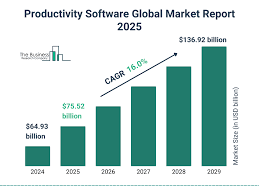

Atlassian Corporation operates primarily in the software development, IT service management, and work management sectors. The company has established a presence in these markets with its suite of products, including Jira, Confluence, and Trello. These tools facilitate collaboration and project management across various teams and industries, making Atlassian a key player in the growing demand for software solutions that streamline workflows and enhance productivity. The total addressable market (TAM) for Atlassian is estimated at $67 billion, growing at an annual rate of 13% as organizations increasingly adopt digital transformation strategies to improve their operational efficiencies and collaboration capabilities.

The company’s focus on transitioning customers from on-premises solutions to cloud-based offerings is expected to accelerate as enterprises seek scalable and flexible software solutions. With a historical compound annual growth rate (CAGR) of approximately 35% over the past decade, Atlassian’s revenue growth is anticipated to continue robustly as it captures a larger share of the market through product innovation and enterprise expansion efforts. The integration of advanced technologies, such as AI-powered features, further enhances its competitive edge, allowing Atlassian to meet the evolving needs of its customer base effectively.

Unique differentiation:

Atlassian faces stiff competition from several major players in the enterprise software market. Microsoft is a competitor with its Azure DevOps platform, which offers a suite of tools for software development, including project management, version control, and testing. Microsoft also poses a threat with its collaboration tools like Microsoft Teams, which can encroach on some of the functionality offered by Atlassian’s Confluence.

Other key competitors include ServiceNow, a leading provider of IT service management software, and Salesforce, a major player in the customer relationship management (CRM) space. ServiceNow’s platform can be used for IT service management, project management, and other business processes, while Salesforce offers a range of tools for sales, marketing, and customer service that can overlap with some of Atlassian’s offerings.

Atlassian competes with smaller, more specialized players such as GitLab, a web-based DevOps platform, and Asana, a project management and team collaboration tool. These companies often focus on specific niches or offer more specialized features, providing alternative options for customers seeking solutions tailored to their unique needs.

Deeply Integrated Suite: Atlassian offers a suite of interconnected products that work seamlessly together. This allows teams to manage their entire software development lifecycle, from planning and tracking to development, testing, and deployment, all within a single ecosystem.

Focus on Developer Experience: Atlassian prioritizes the needs of developers with products designed to be user-friendly, flexible, and customizable. This developer-centric approach fosters strong customer loyalty and drives organic growth.

Management & Employees:

Mike Cannon-Brookes: Co-founder and former Co-CEO.

Scott Farquhar: Co-founder and former Co-CEO.

Anu Bharadwaj: President.

Rajeev Rajan: Chief Technology Officer.

Stan Shepard: General Counsel.

Financials:

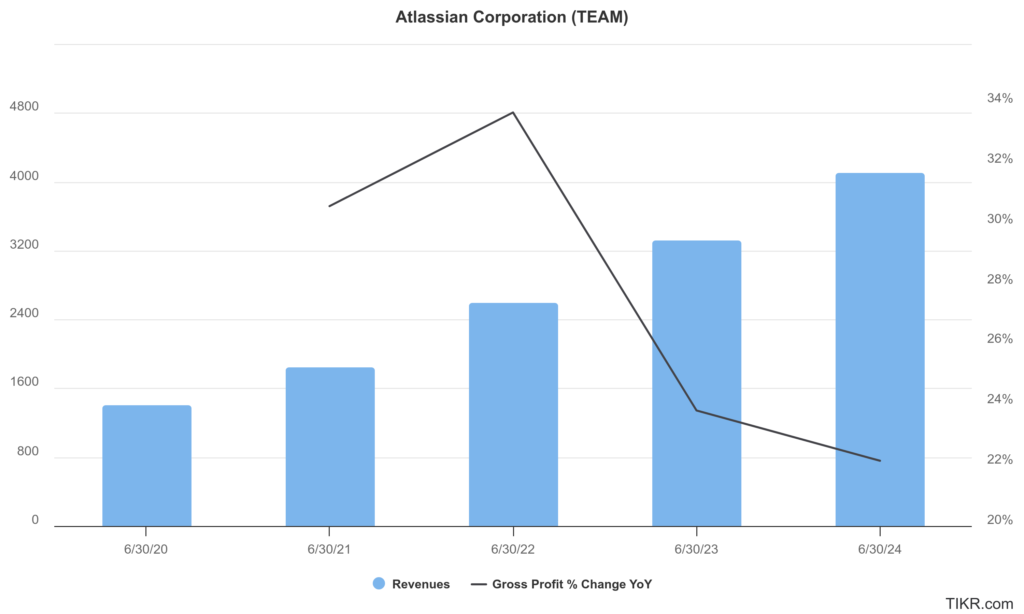

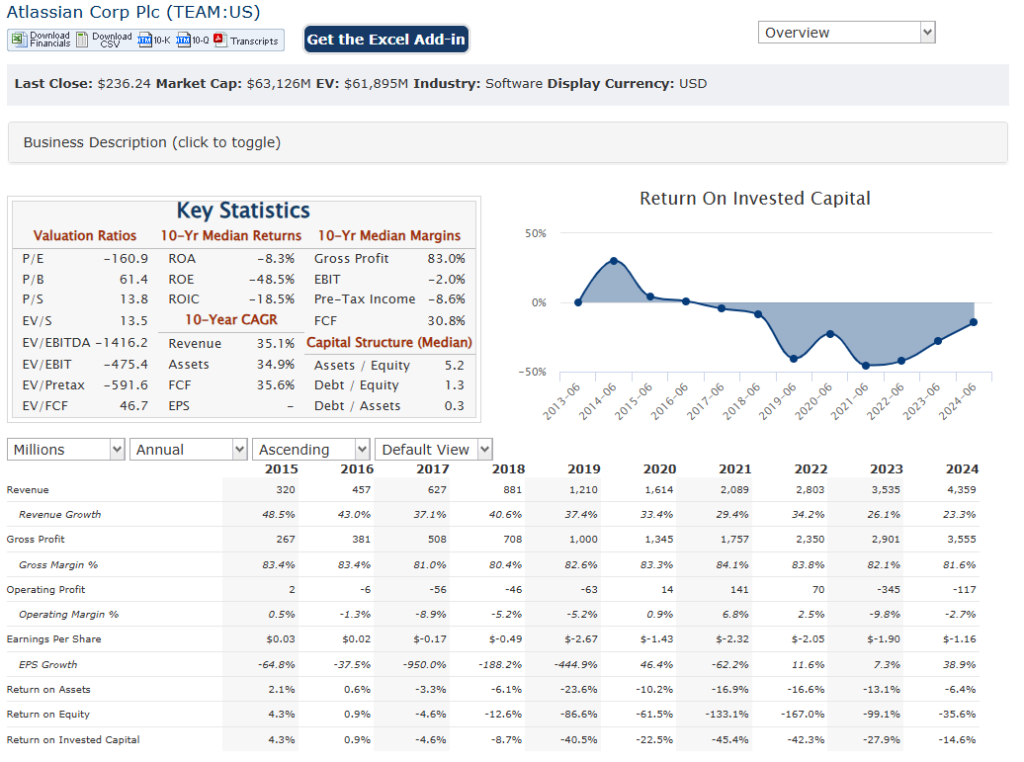

Atlassian Corporation has reported revenue of approximately $1.6 billion, which increased to $4.4 billion in fiscal year 2024, reflecting a compound annual growth rate (CAGR) of about 29%. This growth trajectory has been driven by a robust demand for its collaboration and productivity software, particularly as organizations increasingly adopt remote work and digital transformation strategies. The company’s subscription revenue has also surged, with a year-over-year increase of 34% reported.

Atlassian’s net loss decreased from $486.8 million in fiscal year 2023 to $300.5 million in fiscal year 2024, indicating an improvement in profitability despite continuing losses. The company reported cash and cash equivalents totaling approximately $2.3 billion, complemented by marketable securities. This strong liquidity supports Atlassian’s growth initiatives and positions it well to navigate potential market challenges. Atlassian’s net debt has consistently improved, moving from a net debt position of approximately -$591 million in fiscal year 2020 to -$1.19 billion in fiscal year 2024, reflecting an overall strengthening of its financial health.

The company projects continued revenue growth into fiscal year 2025, with anticipated total revenue ranging between $1.149 billion and $1.157 billion for the first quarter alone. This outlook underscores Atlassian’s commitment to leveraging its innovative solutions to capture market opportunities and drive long-term shareholder value.

Technical Analysis:

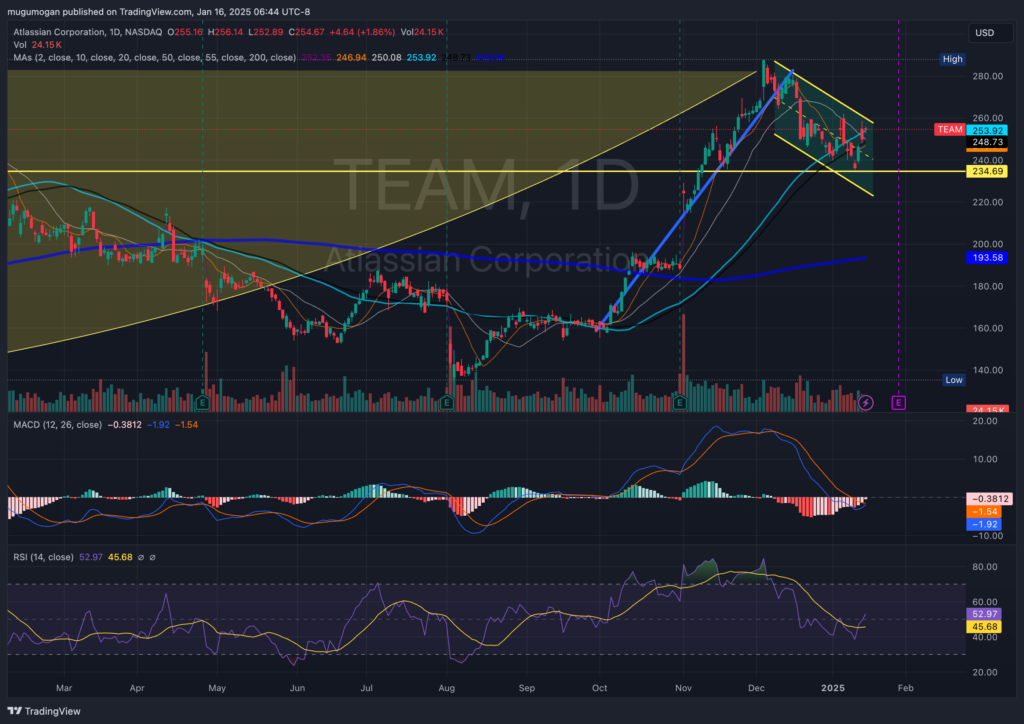

The monthly chart is in a cup and handle (bullish) and the weekly chart has a bull flag (very bullish). The daily chart has stage 4 (bearish) for the near term – with support at $230 range, this is a good stock for the medium to long term.

Bull Case:

Innovation and Product Development: Atlassian continues to invest heavily in research and development, introducing new features, integrating AI capabilities, and expanding its product offerings to meet the evolving needs of its customers. This ongoing innovation helps the company maintain its competitive edge and attract new customers.

Large Market Opportunity: The enterprise software market is vast and continues to grow at a rapid pace, driven by factors such as digital transformation, cloud computing, and the increasing adoption of agile development methodologies. This provides significant opportunities for Atlassian to expand its market share and capitalize on the growing demand for its products and services.

Bear Case:

Execution Risk: Successfully integrating acquisitions, expanding into new markets, and delivering on product innovation initiatives all carry inherent execution risks. Failure to successfully execute on these strategic priorities could negatively impact the company’s growth trajectory.

Valuation Concerns: Some analysts believe that Atlassian’s stock is currently overvalued relative to its historical performance and future growth prospects. This could lead to downward pressure on the stock price if the company fails to meet or exceed market expectations.