Executive Summary:

Lululemon Athletica Inc. is a Canadian-based multinational retailer of athletic apparel. The company initially focused on yoga wear but has since expanded its product line to include a wide range of athletic and casual clothing for men, women, and children. Lululemon’s success is attributed to its high-quality fabrics, innovative designs, and emphasis on creating a strong brand community.

Lululemon Athletica Inc. reported an EPS of $2.87, surpassing analysts’ expectations of $2.69. Revenue for the quarter reached $2.40 billion, exceeding analyst estimates of $2.36 billion.

Stock Overview:

| Ticker | $LULU | Price | $392.92 | Market Cap | $49.86B |

| 52 Week High | $491.30 | 52 Week Low | $226.01 | Shares outstanding | 116.67M |

Company background:

Lululemon Athletica Inc. is a Canadian-based multinational retailer of athletic apparel. It was founded in 1998 by Chip Wilson in Vancouver, British Columbia. Wilson, a former ski instructor and surfboard shaper, initially opened a single store in Vancouver, focusing on selling yoga pants and other yoga wear. Lululemon’s success can be attributed to its high-quality fabrics, innovative designs, and emphasis on creating a strong brand community.

The company has expanded since its inception, now offering a wide range of athletic and casual clothing for men, women, and children. Its product line includes sports bras, leggings, tops, shorts, jackets, hoodies, and accessories such as yoga mats and water bottles. Lululemon’s products are known for their technical fabrics, which are designed to be both comfortable and functional for a variety of activities.

Lululemon has a strong global presence, with over 700 stores worldwide and a robust online platform. The company has faced challenges, such as product recalls and competition from other athletic apparel brands, but it has consistently demonstrated resilience and a commitment to innovation.

Some of Lululemon’s key competitors include Nike, Adidas, Under Armour, and Gymshark. These companies also offer a wide range of athletic apparel and compete with Lululemon in terms of product quality, design, and brand image.

Lululemon’s headquarters are located in Vancouver, British Columbia, Canada.

Recent Earnings:

Revenue for the quarter reached $2.40 billion, surpassing analyst estimates of $2.36 billion. This represents a 9.1% year-over-year increase, driven by strong international growth and continued momentum in its core product categories.

Earnings per share (EPS) came in at $2.87, surpassing analysts’ expectations of $2.69. This significant EPS growth reflects the company’s ability to control costs and leverage its strong revenue performance.

Comparable sales increased 4%, driven by a combination of store traffic and average order value growth. Direct-to-consumer revenue remained a key driver, with e-commerce sales continuing to expand.

The company also reiterated its commitment to long-term growth and innovation, including investments in new product categories and experiences for its customers.

The Market, Industry, and Competitors:

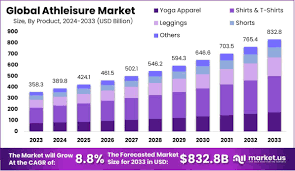

Lululemon Athletica Inc. operates primarily within the athleisure market. The company specializes in high-quality athletic apparel for various activities, particularly yoga, running, and training. The global athleisure market was valued at approximately $358 billion and is projected to reach $662.56 billion by 2030, reflecting a compound annual growth rate (CAGR) of 8.3–9.3% from 2024 to 2030. Lululemon’s target demographic includes health-conscious consumers aged 18-45, with a notable expansion into men’s apparel, which now constitutes about 25% of its sales.

The company aims to expand its international presence, particularly in emerging markets, and enhance its direct-to-consumer e-commerce capabilities. With a current market penetration of approximately 2.7% within a total addressable market worth $197.35 billion, substantial room remains for growth. Lululemon’s focus on product innovation and sustainability aligns with evolving consumer preferences, positioning it well for sustained growth in the competitive athletic apparel landscape.

Unique differentiation:

Nike: A global leader in athletic footwear and apparel, Nike offers a wide range of products for various sports and activities, including yoga, running, and training. Nike’s strong brand recognition and extensive distribution network pose a significant challenge to Lululemon.

Adidas: Another major player in the athletic apparel market, Adidas competes with Lululemon in the yoga and training apparel categories. Adidas has a strong presence in international markets and is known for its innovative designs and collaborations with popular brands and designers.

Under Armour: While primarily known for its performance apparel, Under Armour has expanded into the yoga and training apparel categories in recent years. Under Armour’s focus on innovation and technological advancements in fabrics presents a competitive threat to Lululemon.

Athleta: A subsidiary of Gap Inc., Athleta is a direct competitor to Lululemon, offering a range of athletic apparel for women. Athleta has a strong retail presence and leverages Gap’s extensive distribution network to reach a wide customer base.

Other emerging brands: Several smaller, emerging brands, such as Alo Yoga, Beyond Yoga, and Gymshark, are also gaining traction in the athletic apparel market. These brands often focus on specific niches, such as yoga or high-intensity training, and are known for their stylish designs and social media presence.

- High-quality, innovative fabrics: Lululemon invests heavily in research and development to create proprietary fabrics that offer superior performance, comfort, and durability. These include moisture-wicking, quick-drying, and four-way stretch technologies.

- Focus on fit and design: Lululemon’s products are designed to fit and flatter a wide range of body types, with a strong emphasis on flattering silhouettes and attention to detail.

- Premium pricing and positioning: Lululemon’s products are positioned as premium offerings, commanding higher price points than many competitors. This premium positioning reinforces the brand’s image as a high-quality, aspirational brand.

Management & Employees:

Calvin McDonald: Chief Executive Officer & Director

Celeste Burgoyne: President, Americas & Global Guest Innovation

André Maestrini: Executive Vice President, International

Nicole Neuburger: Chief Brand & Product Activation Officer

Financials:

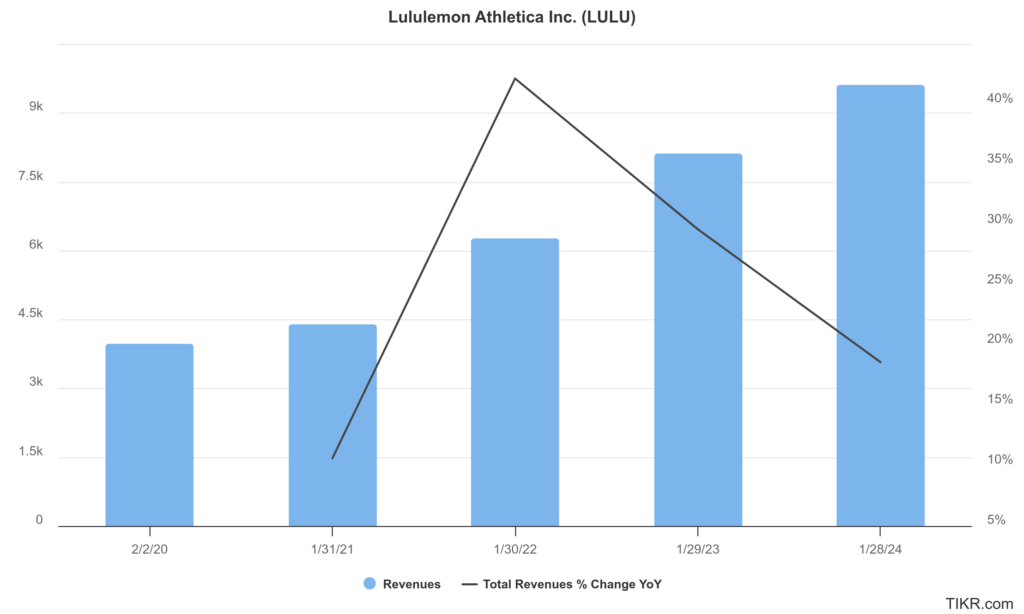

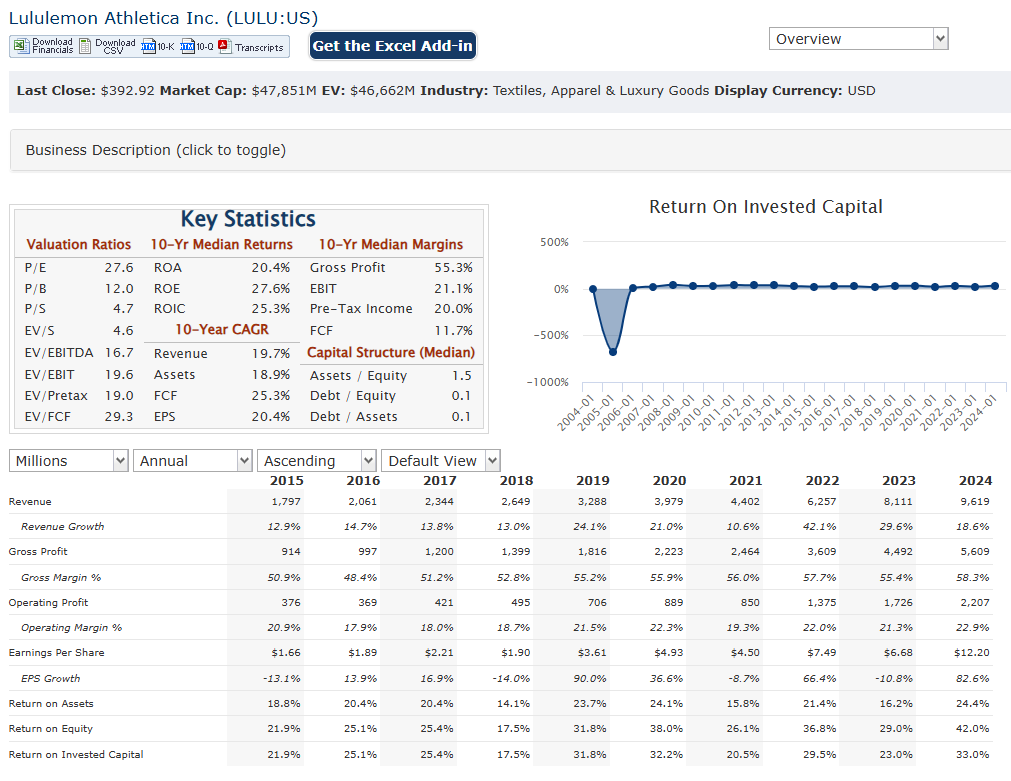

Lululemon Athletica Inc. has reported revenues of approximately $9.619 billion, marking a substantial increase from $8.111 billion in 2023 and $6.257 billion in 2022. This translates to a compound annual growth rate (CAGR) of around 26% from 2020 to 2024. Lululemon’s strong brand positioning in the athleisure market and its successful expansion into new product categories and international markets.

With net income reaching approximately $1.736 billion for the twelve months ending October 31, 2024, representing a dramatic increase of 73.48% year-over-year. This follows a net income of $855 million in 2023 and $975 million in 2022, resulting in a CAGR of about 61% from 2020 to 2024. The company’s ability to maintain healthy profit margins—net profit margins were reported at 14.55%—indicates effective cost management and operational efficiency.

The company’s total assets were approximately $5.5 billion, reflecting its investments in inventory and expansion initiatives. The return on equity (ROE) stood impressively at 42%, showcasing the company’s effectiveness in generating profits from shareholders’ equity. Lululemon’s liquidity remains strong, supported by healthy cash reserves that enable it to navigate market fluctuations and invest in future growth opportunities effectively.

Lululemon Athletica Inc. with continued focus on innovation, expansion, and strategic marketing initiatives, the company is well-positioned for sustained growth in the coming years.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly chart and a bull flag pattern on the weekly chart on a stage 2 is bullish as well. The daily chart is indicating a move back to $412 zone with resistance at $434. This is a good stock for a long term entry at the gap fill zone of $345

Bull Case:

Continued Growth Potential: Lululemon has a significant opportunity for continued growth, both domestically and internationally. The company can expand its store footprint, penetrate new markets, and introduce new product categories to drive revenue growth.

Innovation and Product Development: Lululemon consistently invests in research and development to create innovative products that meet the evolving needs of its customers. This focus on innovation helps the company stay ahead of the competition and maintain its market leadership.

Positive Industry Trends: The global athletic apparel market is expected to continue to grow in the coming years, driven by factors such as health and wellness trends, technological advancements in fabrics, and the increasing popularity of athleisure. This provides a favorable backdrop for Lululemon’s continued success.

Bear Case:

Valuation Concerns: Lululemon’s stock has historically traded at a premium valuation. If the company fails to meet high growth expectations or if investor sentiment shifts, the stock could experience significant declines.

Supply Chain Disruptions: Global supply chain issues and inflationary pressures could impact Lululemon’s ability to source materials, manufacture products, and deliver goods to customers on time. These disruptions could lead to higher costs and lower profitability.

Changing Consumer Preferences: Consumer preferences are constantly evolving, and Lululemon needs to adapt to stay relevant. If the company fails to innovate and cater to changing consumer demands, it could lose market share to competitors.