Executive Summary:

Lennar Corporation is a leading homebuilder in the United States, constructing and selling single-family homes across various markets. The company also offers a range of financial services to its homebuyers, including mortgage financing and title insurance. In addition to its core homebuilding business, Lennar has diversified into the multifamily housing sector, developing and managing rental properties. The company has a strong presence in several key markets throughout the country and continues to expand its operations through strategic acquisitions and organic growth.

Lennar Corporation reported net earnings of $1.1 billion, with earnings per diluted share of $4.06. Revenue for the quarter was $9.95 billion, missing analysts’ estimates of $10.13 billion. The quarter’s earnings per share (EPS) was $4.06, down from $4.82 in the same period last year.

Stock Overview:

| Ticker | $LEN | Price | $138.00 | Market Cap | $37.3B |

| 52 Week High | $193.80 | 52 Week Low | $135.21 | Shares outstanding | 238.8M |

Company background:

Lennar Corporation is a leading homebuilder in the United States, founded in 1954 by Leonard Miller and Arnold Rosen in Miami, Florida. The company began as a small local builder and has since grown into a national powerhouse through a combination of organic growth and strategic acquisitions. Lennar’s core business involves constructing and selling single-family homes across various price points and styles, catering to a wide range of buyers.

Lennar has diversified its operations to include a range of complementary businesses. These include Lennar Mortgage, which provides financing options to homebuyers, and Lennar Title, which offers title insurance services. The company has also ventured into the multifamily housing sector, developing and managing rental properties. This diversification helps mitigate the homebuilding industry’s cyclical nature and provides a more stable revenue stream.

Lennar’s key competitors in the homebuilding market include D.R. Horton, PulteGroup, and NVR, Inc. These companies compete with Lennar on various fronts, including price, product offerings, and market share. Lennar differentiates itself through its innovative homebuilding practices, such as its “Everything’s Included” program, which incorporates a wide range of upgrades and features as standard in its homes.

Lennar Corporation is headquartered in Miami, Florida, and operates in numerous markets across the United States. The company has a strong presence in key growth areas, such as the Sun Belt states, and continues to expand its operations through strategic acquisitions and new community developments.

Lennar’s success can be attributed to several factors, including its strong brand recognition, its efficient operations, and its ability to adapt to changing market conditions. As the housing market continues to evolve, Lennar is well-positioned to capitalize on future growth opportunities and maintain its position as a leading player in the industry.

Recent Earnings:

Lennar Corporation reported its net earnings of $1.1 billion, with earnings per diluted share of $4.06. Revenue for the quarter was $9.95 billion, missing analysts’ estimates of $10.13 billion. Earnings per share (EPS) for the quarter was $4.06, down from $4.82 in the same period last year. The company received 16,895 net new orders, a 2.7% decline from the previous year, missing the estimate of 19,174 orders.

Lennar’s revenue for the quarter declined by 1.8% compared to the same period last year, primarily due to a decrease in home deliveries. The company delivered 18,946 homes in the quarter, down 7% from the previous year. The decline in deliveries was attributed to higher mortgage rates and rising construction costs, which have put pressure on affordability and impacted demand for new homes.

The company maintained a healthy balance sheet with a significant cash reserve and no borrowings under its credit facility. Lennar also continued to repurchase shares, demonstrating its confidence in its long-term growth prospects.

The company’s new order backlog declined by 22% year-over-year, reflecting the challenging market conditions. Lennar’s cancellation rate improved slightly, indicating that the company is becoming more selective in its sales process. The company anticipates that higher interest rates will continue to weigh on affordability and that supply chain disruptions will persist. The company expects that demographic trends, such as the formation of new households, will continue to drive demand for new homes.

The company is also focusing on its higher-margin businesses, such as its multifamily development segment. Lennar believes that these initiatives will help to improve its profitability and position the company for long-term growth.

The Market, Industry, and Competitors:

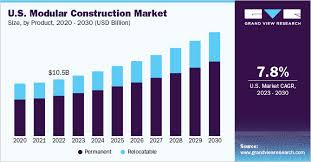

Lennar Corporation operates in the highly competitive U.S. homebuilding market. This market is characterized by cyclical trends influenced by factors like interest rates, economic growth, and consumer confidence. Demand for new homes is driven by demographic factors such as household formation, population growth, and migration patterns.

The U.S. homebuilding market is expected to experience continued growth, albeit at a moderate pace. Several factors are expected to drive this growth, including a strong underlying demand for housing, driven by demographic trends such as millennial household formation and population growth. The ongoing trend of urbanization and suburbanization is expected to continue, creating demand for new housing in both urban and suburban areas.

The compound annual growth rate (CAGR) for the U.S. homebuilding market over the next decade is projected to be around 5-8%. This growth rate is expected to be driven by a combination of factors, including population growth, household formation, and economic expansion.

Unique differentiation:

- D.R. Horton: The largest homebuilder in the United States, known for its broad geographic reach and diverse product offerings.

- PulteGroup: A major player with a focus on building communities and offering a wide range of home styles.

- NVR, Inc.: Known for its luxury homebuilding segment and its focus on efficient construction practices.

- KB Home: Specializes in energy-efficient homes and offers a more technology-focused approach to homebuilding.

These competitors compete with Lennar on various fronts, including price, product offerings, market share, and geographic reach. The homebuilding industry is characterized by intense competition, with companies constantly striving to differentiate themselves through innovative products, efficient operations, and strong customer service.

“Everything’s Included” Program: This signature program bundles a wide range of upgrades and features, such as stainless steel appliances, granite countertops, and upgraded flooring, into the base price of the home. This simplifies the buying process for consumers and eliminates the need for costly and time-consuming negotiations over upgrades.

Diversification: Lennar has diversified its operations beyond traditional homebuilding, expanding into the multifamily housing sector with its Lennar Multifamily division. This diversification helps to mitigate the cyclical nature of the homebuilding industry and provides a more stable revenue stream.

Management & Employees:

Stuart Miller: Executive Chairman and Co-Chief Executive Officer

Jon Jaffe: Co-Chief Executive Officer and President

Mark Sustana: Vice President, General Counsel & Secretary

Financials:

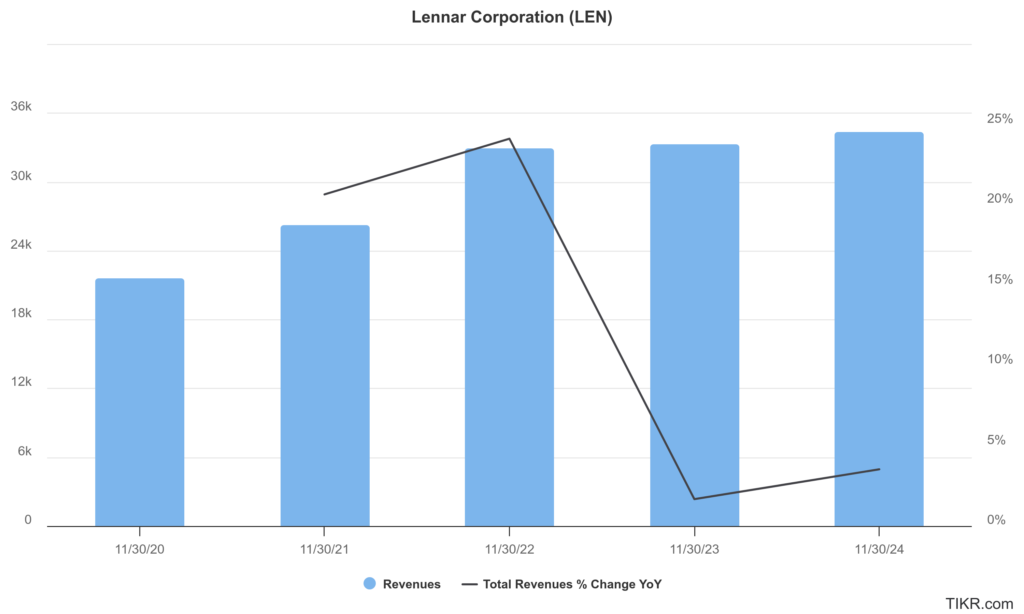

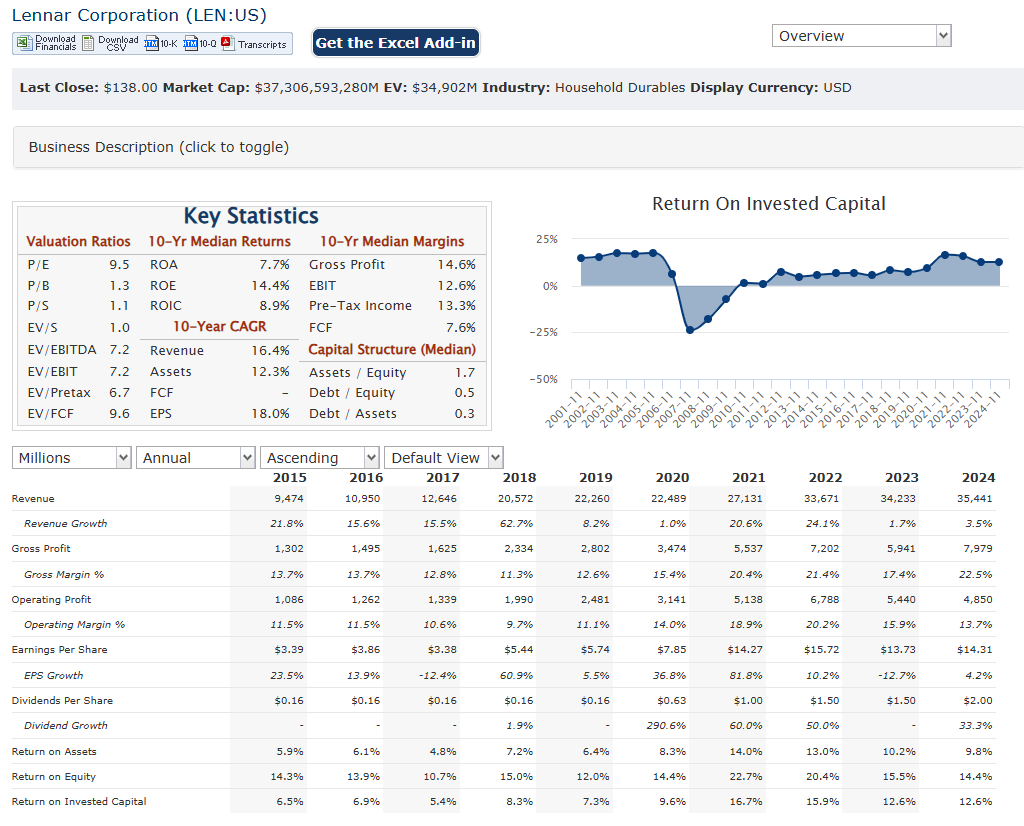

Lennar Corporation, reported total revenues of approximately $35.4 billion, reflecting a compound annual growth rate (CAGR) of about 11.9% since 2019. This growth trajectory has been supported by strong demand in the housing market, with new orders increasing by 11% year-over-year to 76,951 homes in 2024, despite a slight decline in new orders in the fourth quarter compared to the previous year.

Earnings have also demonstrated impressive growth, with net earnings attributable to Lennar reaching $3.9 billion for the fiscal year 2024, translating to earnings per diluted share of $14.31. Lennar’s earnings have grown at an average annual rate of 14.9%. This consistent performance has allowed the company to maintain a solid return on equity of 15.4% and a net profit margin of approximately 11.4%.

The company reported cash and cash equivalents of $4.7 billion and no outstanding borrowings under its $2.9 billion revolving credit facility. The company’s debt-to-total capital ratio stood at a conservative 7.5%, reflecting prudent financial management amidst fluctuating market conditions. This strong balance sheet positions Lennar well for future investments and acquisitions, such as its recent agreement to acquire Rausch Coleman Homes.

Lennar Corporation’s financial performance illustrates a strong growth trajectory in both revenue and earnings, supported by a solid balance sheet and strategic management decisions. The company continues to navigate challenges within the housing market while positioning itself for future opportunities through acquisitions and maintaining operational efficiency.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly chart, but a bearish stage 4 on the weekly chart and a head and shoulder pattern on the daily played out to the negative (bearish) with support in the $125 – $131 zone. The best is to wait for the reversal before we consider a position, but the stock should do well next year with more home construction and sales expected, but with higher interest rates the moves should not be much higher.

Bull Case:

Stronger-Than-Expected Economic Growth: A robust economy could lead to increased consumer confidence and job growth, driving demand for housing.

Favorable Demographic Trends: The ongoing trend of millennial household formation and population growth continues to support long-term demand for housing.

Successful Execution of Strategic Initiatives: Lennar’s focus on operational efficiency, cost control, and expanding its multifamily business could drive profitability and shareholder value.

Bear Case:

Persistently High Interest Rates: If interest rates remain elevated for an extended period, it will continue to make mortgages more expensive, reducing affordability and suppressing demand for new homes.

Economic Recession: A potential economic downturn could lead to job losses, lower consumer confidence, and a decline in housing demand.

Rising Construction Costs: Continued inflationary pressures on building materials and labor costs could squeeze profit margins for homebuilders.