Executive Summary:

MSCI Inc. is a leading global provider of investment decision support tools and services. The company offers a range of products and services, including equity, fixed income, and real estate indices, portfolio analysis tools, ESG and climate solutions, and more. MSCI’s industry-leading research-enhanced solutions provide valuable insights to clients across the investment process, helping them make informed decisions and improve transparency in the market.

MSCI Inc. reported an EPS of $3.86, surpassing analysts’ expectations of $3.77. Revenue for the quarter came in at $724.71 million, slightly exceeding the consensus estimate of $714.59 million.

Stock Overview:

| Ticker | $MSCI | Price | $601.25 | Market Cap | $47.12B |

| 52 Week High | $642.45 | 52 Week Low | $439.95 | Shares outstanding | 78.37M |

Company background:

MSCI Inc., an acronym for Morgan Stanley Capital International, is a prominent global provider of investment decision support tools and services. Founded in 1968 by Henry M. Fernandez, MSCI emerged from a collaboration with Morgan Stanley to provide comprehensive investment research and analytics. The company has since grown to become a leading player in the industry, offering a wide range of products and services to institutional investors, asset managers, and other market participants.

MSCI’s core offerings include a diverse array of equity, fixed income, and real estate indices. These indices serve as benchmarks for investment funds, ETFs, and other financial products worldwide. MSCI provides advanced portfolio analysis tools, risk management solutions, and ESG (Environmental, Social, and Governance) ratings and analytics. These tools empower investors to make informed decisions, assess portfolio performance, and identify investment opportunities that align with their specific goals and risk tolerance. The company’s key competitors include FTSE Russell, S&P Dow Jones Indices, and Bloomberg Index Services. MSCI is headquartered in New York City, USA.

Recent Earnings:

- MSCI reported revenue of $724.71 million for the quarter, surpassing the consensus estimate of $714.59 million. This represents a modest year-over-year growth, demonstrating the company’s ability to maintain momentum in a dynamic market environment.

- The company reported earnings per share (EPS) of $3.86, which surpassed the analyst consensus of $3.77. This positive surprise reflects MSCI’s strong operational performance and cost management.

- MSCI’s including customer retention and new business wins, remained strong during the quarter. The company’s focus on delivering high-quality products and services, coupled with its strong client relationships, contributed to these positive results.

- MSCI reiterated its guidance for revenue growth in the mid-single digits and adjusted EPS growth in the high-single digits. This outlook reflects the company’s confidence in its ability to continue delivering solid financial performance.

The Market, Industry, and Competitors:

MSCI Inc. operates primarily in the investment research and analytics market, providing essential services such as stock indexes, portfolio risk assessment, and performance analytics to institutional investors and hedge funds. The firm is renowned for its comprehensive suite of indexes, including the MSCI Emerging Markets Index and the MSCI All Country World Index, which collectively benchmark over $15.6 trillion. MSCI’s offerings are crucial for investment decision-making processes, enabling clients to navigate global markets effectively. The company also focuses on Environmental, Social, and Governance (ESG) metrics, reflecting a growing trend among investors toward sustainable investing practices.

MSCI is expected to experience significant growth driven by the increasing demand for data-driven investment strategies and risk management tools. Analysts project a Compound Annual Growth Rate (CAGR) of approximately 10% for the firm through 2030. This growth is supported by MSCI’s ongoing innovations in index development and analytics services, as well as its strategic focus on expanding its ESG offerings. As institutional investors increasingly seek to integrate ESG factors into their portfolios, MSCI’s capabilities in this area position it well for future expansion in a rapidly evolving market landscape.

Unique differentiation:

MSCI Inc. faces competition from several key players in the investment decision support tools and services market. One of its primary competitors is FTSE Russell, a leading global index provider. FTSE Russell offers a wide range of equity, fixed income, and commodity indices, as well as data and analytics solutions. Another significant competitor is S&P Dow Jones Indices, which provides a comprehensive suite of indices, benchmarks, and analytics tools. S&P Dow Jones Indices is known for its flagship indices, such as the S&P 500 and the Dow Jones Industrial Average.

MSCI also competes with other data and analytics companies, such as Bloomberg and Refinitiv. These companies offer a broad range of financial data, news, and analysis tools, which can be used by investors to make informed decisions. While these competitors may offer overlapping products and services, MSCI’s strong brand reputation, deep industry expertise, and innovative solutions help it differentiate itself in the market.

1. Comprehensive Product Suite: MSCI offers a comprehensive suite of products and services, covering a wide range of asset classes, geographies, and investment styles. This breadth allows MSCI to cater to a diverse client base and provide end-to-end solutions for investment decision-making.

2. Deep Industry Expertise: MSCI has a long history and deep expertise in the investment research and analytics industry. Its experienced professionals have a thorough understanding of market dynamics, regulatory frameworks, and investor needs. This knowledge enables MSCI to develop innovative products and provide valuable insights to its clients.

3. Rigorous Research Methodology: MSCI is committed to rigorous research and data-driven analysis. The company employs advanced methodologies and proprietary models to assess risk, performance, and ESG factors. This focus on data-driven insights helps MSCI deliver accurate and reliable information to its clients.

Management & Employees:

Henry A. Fernandez: Chairman and Chief Executive Officer

C.D. Baer Pettit: President and Chief Operating Officer & Responsible for the company’s day-to-day operations and execution of strategic initiatives.

Jigar Thakkar: Chief Technology Officer and Head of Engineering & Leads the company’s technology and engineering teams, driving innovation and digital transformation.

Financials:

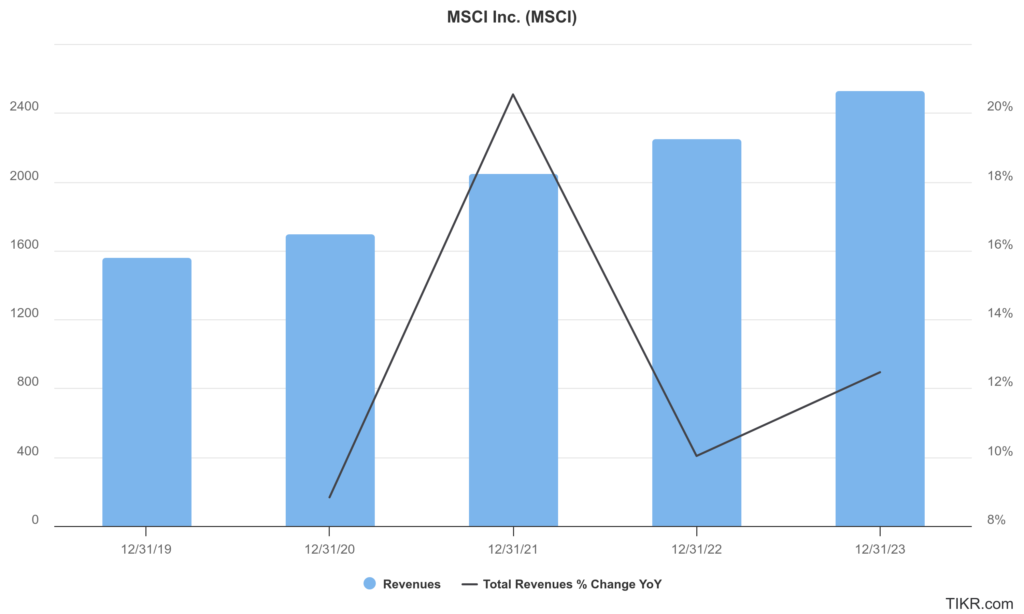

MSCI Inc. has reported operating revenues of approximately $2.803 billion, reflecting a year-over-year increase of 16.05% from $2.529 billion in 2023. This upward trajectory in revenue has been consistent, with a notable CAGR of around 14.9% from 2019 to 2024, driven primarily by strong demand for its index and analytics solutions. The recurring subscription revenues and asset-based fees have contributed to this growth, as institutional investors increasingly rely on MSCI’s offerings for investment decision-making.

The diluted earnings per share (EPS) reached $10.15, up from $9.32 in the previous year, marking an increase of 8.9%. MSCI has achieved a CAGR of approximately 8% in earnings per share, underscoring its ability to enhance profitability alongside revenue expansion. The adjusted EBITDA margin has remained strong, averaging around 62% during this time frame.

The company reported total assets of approximately $4 billion and total liabilities of about $1 billion, resulting in a healthy debt-to-equity ratio that reflects prudent financial management. Furthermore, MSCI’s commitment to returning capital to shareholders is evident through its ongoing share repurchase programs and consistent dividend payments. MSCI Inc.’s financial performance over the last five years showcases a resilient business model poised for continued success in the investment analytics industry.

Technical Analysis:

The stock is in a stage 2 markup (Bullish) on the monthly chart and in the same stage on the weekly chart, with resistance at the $616 range. The daily chart is bearish flag pattern however with a short term move to the $616 zone, but the stock will head back to the $585 zone, before it can move higher again. There is a lot of resistance in the all-time-high zone of $670s

Bull Case:

Strong Growth Prospects:

- Expanding Product Offerings: MSCI continues to innovate and expand its product suite, including ESG and climate solutions, private assets, and fixed income indices. This diversification drives revenue growth and attracts a wider client base.

- Increasing Demand for Data and Analytics: The growing complexity of financial markets and the rising importance of data-driven decision-making fuel demand for MSCI’s products and services.

Attractive Valuation:

- Reasonable Valuation: Despite its strong growth prospects, MSCI’s valuation is relatively reasonable compared to its peers.

- Potential for Multiple Expansion: As the company continues to execute its growth strategy and deliver strong financial performance, there is potential for multiple expansion, driving further stock price appreciation.

Dividend Growth:

- Consistent Dividend Growth: MSCI has a history of increasing its dividend, reflecting its strong financial performance and commitment to shareholder returns.

Bear Case:

Economic Downturn:

- A global economic downturn could lead to reduced investment activity and a decline in demand for MSCI’s products and services. This could negatively impact revenue growth and profitability.

Regulatory Risks:

- Changes in regulations, particularly those related to ESG and climate reporting, could increase compliance costs and impact MSCI’s business model.

Client Concentration Risk:

- MSCI relies on a relatively small number of large institutional clients. A loss of key clients or a decline in their investment activity could negatively impact revenue and earnings.