Executive Summary:

DoorDash, Inc. is a leading food delivery platform that connects customers with local restaurants and businesses. The company offers on-demand food delivery services, allowing users to order their favorite meals and have them delivered right to their doorstep. DoorDash has a wide range of restaurants and businesses available on its platform, catering to various cuisines and dietary preferences.

DoorDash Inc. reported an EPS of $0.38, surpassing analysts’ expectations of $0.21. Revenue for the quarter reached $2.71 billion, a 25% year-over-year increase.

Stock Overview:

| Ticker | $DASH | Price | $178.37 | Market Cap | $74.09B |

| 52 Week High | $181.30 | 52 Week Low | $93.33 | Shares outstanding | 388.98M |

Company background:

DoorDash, a leading on-demand food delivery service, was founded in 2013 by Stanford University students Tony Xu, Andy Fang, Stanley Tang, and Evan Moore. The company initially started as a platform to help local businesses deliver food, but it quickly expanded to include a wider range of services.

DoorDash has raised funding from investors, including SoftBank Vision Fund, Sequoia Capital, and DST Global. This funding has enabled the company to invest in technology, expand its operations, and acquire other businesses.

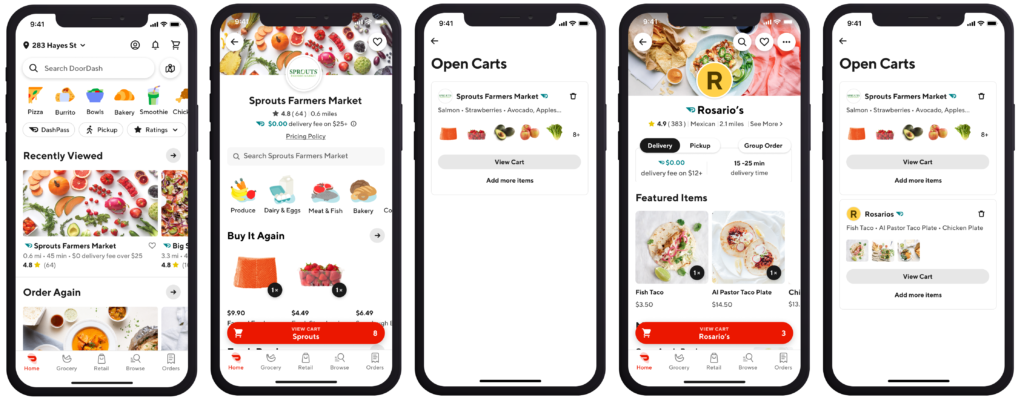

DoorDash’s core product is its food delivery service, which allows customers to order food from local restaurants and have it delivered to their homes or offices. The company has also expanded into other areas, such as grocery delivery, convenience store delivery, and alcohol delivery. DoorDash offers a suite of tools and services for merchants to manage their online orders and delivery operations.

DoorDash’s primary competitors in the food delivery market include Uber Eats, Grubhub, and Postmates. These companies offer similar services and compete for market share in various cities and regions.

DoorDash is headquartered in San Francisco, California, and operates in numerous cities across the United States, Canada, and Australia.

Recent Earnings:

- Revenue: DoorDash reported revenue of $2.71 billion for the quarter, marking a 25% year-over-year increase. This growth was primarily driven by a 19% increase in Marketplace Gross Order Volume (GOV), which reached $20 billion.

- Growth vs. Expectations: The reported revenue exceeded analysts’ expectations, who had projected $2.66 billion.

- EPS: DoorDash achieved an EPS of $0.38 for the quarter, surpassing analysts’ estimates of $0.21.

- Operational Metrics: Total orders increased by 18% year-over-year to 643 million, driven by both new customer acquisition and increased engagement from existing customers.

- Forward Guidance: DoorDash expects revenue to be in the range of $2.75 billion to $2.85 billion.

The Market, Industry, and Competitors:

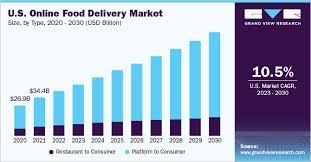

DoorDash operates in the rapidly growing online food delivery market. This market has been experiencing significant growth due to factors such as increasing urbanization, busy lifestyles, and the rising popularity of online ordering.

The global online food delivery market is expected to reach $618.36 billion by 2030, growing at a CAGR of 9.0% – 10.5% from 2025 to 2030. This growth is driven by factors such as increasing smartphone penetration, the expansion of e-commerce, and the growing middle class in emerging economies.

DoorDash is well-positioned to capitalize on this growth opportunity due to its strong brand recognition, extensive network of restaurants and delivery partners, and innovative technology platform. The company has been investing in expanding its services to new markets, diversifying its offerings, and improving its delivery efficiency. DoorDash aims to maintain its leading position in the online food delivery market and drive sustainable growth.

Unique differentiation:

DoorDash faces stiff competition from several key players in the food delivery market. Uber Eats is a major competitor, leveraging its extensive network of drivers and strong brand recognition to attract customers. Grubhub is another significant player, particularly in urban areas, with a strong focus on restaurant partnerships. Instacart, while primarily known for grocery delivery, has expanded into food delivery and poses a threat, especially in markets where it has a strong presence.

Other notable competitors include Postmates and Doordash. These companies offer similar services and compete for market share by offering unique features, competitive pricing, and strategic partnerships. Regional players and smaller startups are emerging in various markets, further intensifying competition.

DoorDash must continue to innovate, invest in technology, and strengthen its relationships with restaurants and customers. By focusing on customer experience, expanding its service offerings, and optimizing its delivery operations, DoorDash aims to solidify its position as a leading player in the food delivery industry.

1. Extensive Merchant Network and Local Focus: DoorDash has built a strong network of local and national restaurants, offering a diverse range of cuisines and options. This extensive network allows them to cater to a wide range of customer preferences and provides a competitive advantage over other platforms.

2. Diverse Service Offerings: Beyond food delivery, DoorDash has expanded its services to include grocery delivery, convenience store items, and alcohol delivery. This diversification allows them to capture a larger market share and cater to a broader customer base.

3. Dasher Loyalty and Flexibility: DoorDash has a strong focus on its delivery drivers, known as Dashers. The company offers flexible work hours and competitive pay, attracting a dedicated workforce. This, in turn, leads to efficient deliveries and improved customer satisfaction.

Management & Employees:

Tony Xu: Co-founder and CEO, oversees the company’s overall strategy and vision.

Andy Fang: Co-founder and Head of Consumer Engineering, leads the development of DoorDash’s technology and user experience.

Keith Yandell: Chief Business and Legal Officer, responsible for legal affairs, corporate development, and partnerships.

Financials:

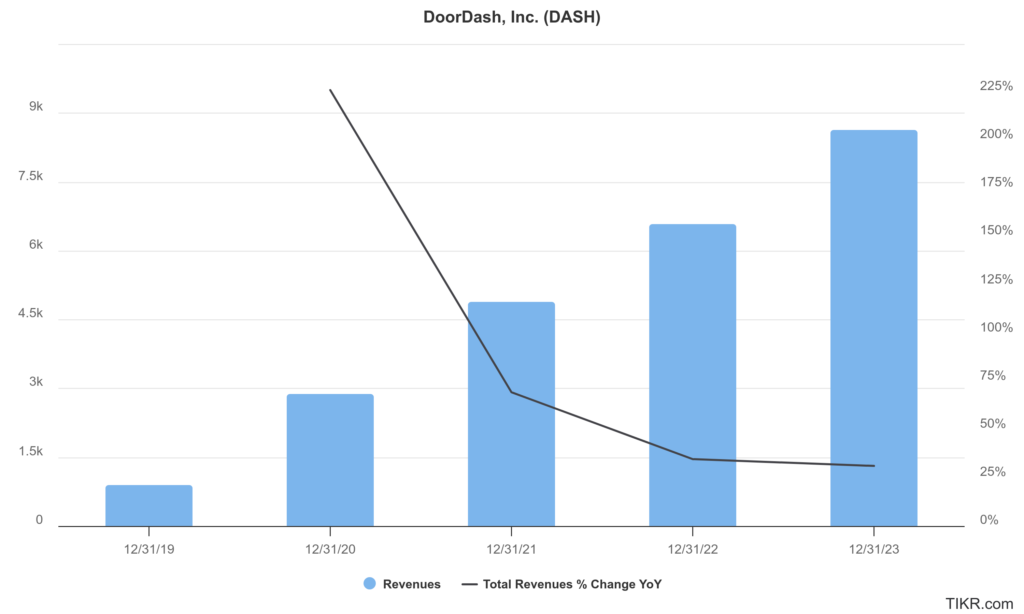

DoorDash Inc. has revenue is approximately $885 million, which surged to $8.63 billion by 2023, representing a compound annual growth rate (CAGR) of about 35.4%. This growth trajectory was particularly pronounced during the pandemic when demand for food delivery services skyrocketed. The company reported a 31% increase in revenue in 2023 alone, indicating continued strong performance even as pandemic-related restrictions have eased.

The company has consistently reported net losses over the years, with a notable loss of $558 million in 2023, an improvement from a loss of $1.36 billion in 2022. DoorDash’s earnings have declined at an average annual rate of approximately -7.1%, contrasting sharply with industry trends where many companies saw positive earnings growth. DoorDash achieved GAAP net income profitability in Q3 2024, signaling a potential turnaround in its financial health.

The company reported a strong cash position with nearly $6 billion available to support future initiatives and potential shareholder returns. The net debt levels have shown fluctuations but remained manageable, allowing DoorDash to maintain operational flexibility while pursuing expansion into new verticals such as grocery delivery.

The company’s strategic investments and market leadership position suggest that it is well-placed to capitalize on future opportunities, potentially leading to improved financial metrics and sustained growth in food delivery.

Technical Analysis:

The stock is a stage 2 markup (Bullish) on the monthly chart with a cup and handle bullish pattern, that has played out well. The weekly chart is in stage 2 (bullish) as well, but the daily chart is in stage 4 markdown (Bearish) and should find support in the $150 – $162 zone. We would be buyers on the reversal.

Bull Case:

1. Strong Market Position: DoorDash holds a dominant position in the US food delivery market, with a significant market share. This strong position provides a solid foundation for future growth.

2. Growing Market Opportunity: The food delivery market continues to expand rapidly, driven by factors like increasing urbanization, busy lifestyles, and the convenience offered by online ordering. This presents a significant growth opportunity for DoorDash.

3. Scalability and Efficiency: DoorDash’s technology platform and efficient operations enable it to scale its business and improve profitability. As the company continues to grow, it can leverage economies of scale to reduce costs and increase margins.

Bear Case:

1.Rising Costs: DoorDash faces rising costs, including labor costs, fuel prices, and regulatory fees. These increased costs can negatively impact profitability and limit growth potential.

2. Economic Uncertainty: Economic downturns can lead to reduced consumer spending, which could negatively impact demand for food delivery services. This could result in lower revenue and profitability for DoorDash.

3. Reliance on Third-Party Drivers: DoorDash’s reliance on third-party drivers can lead to challenges in maintaining consistent service quality and controlling costs. Issues such as driver shortages or increased labor costs could negatively impact the company’s operations.