Executive Summary:

Digital Realty Trust Inc. is a real estate investment trust (REIT) specializing in data center solutions. The company focuses on acquiring, developing, and operating data centers globally, offering colocation and interconnection services to a diverse range of businesses. Their data centers provide essential infrastructure for industries like cloud computing, finance, healthcare, and technology, enabling them to store, process, and transmit critical data securely and efficiently.

Digital Realty Trust Inc. reported an EPS of $0.09, missing analyst expectations of $1.67. Its quarterly revenue of $1.43 billion exceeded analyst estimates, rising 2.1% year-over-year.

Stock Overview:

| Ticker | $DLR | Price | $185.04 | Market Cap | $61.38B |

| 52 Week High | $198.00 | 52 Week Low | $130.00 | Shares outstanding | 331.71M |

Company background:

Digital Realty Trust Inc., a real estate investment trust (REIT), was founded in 2004. The company was initially backed by GI Partners, a private equity firm.

As a leading data center solutions provider, Digital Realty offers a range of services, including colocation and interconnection. These services enable businesses to house their IT infrastructure within secure, high-performance data centers, while also facilitating seamless connectivity to other networks and cloud providers. The company’s data centers are strategically located across the globe, catering to diverse industries such as technology, finance, healthcare, and media.

Digital Realty faces competition from other data center REITs and infrastructure providers. Notable competitors include Equinix, CyrusOne, and CoreSite Realty. Digital Realty’s strong global footprint, extensive network, and focus on customer-centric solutions have positioned it as a major player in the industry. The company’s headquarters are located in Austin, Texas, USA.

Recent Earnings:

Digital Realty Trust Inc. reported revenue reaching $1.43 billion, marking a 2% year-over-year increase. This positive growth trajectory reflects the increasing demand for data center solutions across various industries.

The company’s EPS of $0.09 fell short of analyst expectations of $1.67. This discrepancy can be attributed to several factors, including increased operating expenses and higher interest rates. Digital Realty’s strong revenue growth and operational metrics highlight its resilience in the evolving data center landscape.

Digital Realty achieved an occupancy rate of 83.9%, up from 82.8% in the same quarter last year. The company also reported an increase in its development pipeline, with 644 megawatts under construction. This expansion underscores Digital Realty’s commitment to meeting the growing demand for data center capacity.

Digital Realty has raised its core FFO per share outlook for 2024 to a range of $6.65 to $6.75. This upward revision reflects the company’s confidence in its ability to capitalize on the strong demand for data center solutions and its robust operational performance.

The Market, Industry, and Competitors:

Digital Realty Trust operates in the data center market, a rapidly growing industry driven by the increasing demand for data storage, processing, and transmission. As businesses across various sectors, from technology and finance to healthcare and media, rely heavily on digital infrastructure, the need for robust and scalable data centers is paramount.

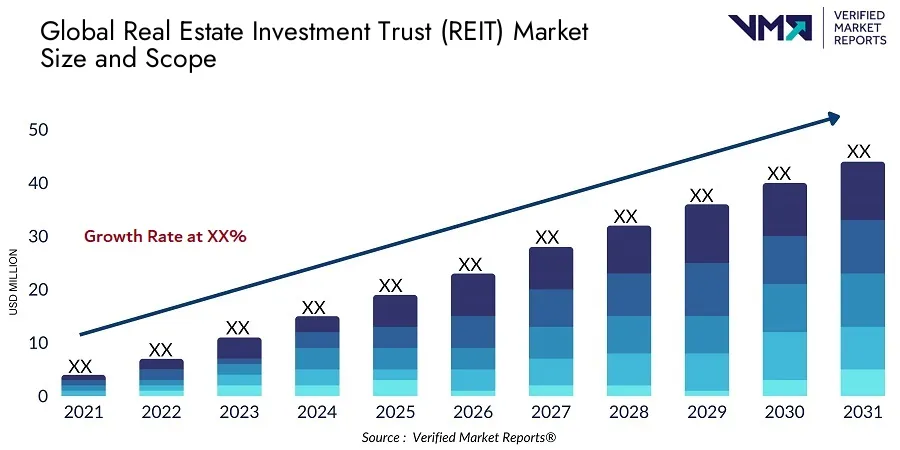

The market is expected to reach substantial size and value, driven by factors such as the proliferation of cloud computing, the Internet of Things (IoT), artificial intelligence, and 5G technology. These technological advancements are generating massive amounts of data that require efficient storage and processing capabilities, fueling the demand for data center solutions.

Industry analysts estimate that the data center market could achieve a Compound Annual Growth Rate (CAGR) of around 8-10% between 2024 and 2030. This robust growth rate reflects the increasing reliance on data centers as the backbone of the digital economy. As businesses continue to prioritize digital transformation and cloud adoption, the demand for data center services is expected to remain strong.

Unique differentiation:

Digital Realty Trust faces competition from several other major players in the data center industry. One of its primary competitors is Equinix, a global interconnection and data center company that operates a vast network of data centers worldwide. Equinix is known for its strong focus on interconnection services, which allows customers to connect to a diverse range of networks and cloud providers.

Another significant competitor is CyrusOne, a data center REIT that specializes in providing mission-critical data center solutions to enterprise customers. CyrusOne offers a range of services, including colocation, interconnection, and cloud services, and has a strong presence in key data center markets across the United States and Europe.

Other notable competitors in the data center market include CoreSite Realty, Iron Mountain, and Digital Realty’s own subsidiaries, such as Interxion and Telx. These companies compete with Digital Realty on various fronts, including geographic footprint, data center capacity, network connectivity, and service offerings. The competitive landscape in the data center industry is dynamic, with companies constantly innovating and expanding their offerings to meet the evolving needs of their customers.

Financial Strength and Innovation:

- Strong Financial Performance: Digital Realty has a solid financial track record, enabling it to invest in new technologies, expand its infrastructure, and acquire strategic assets.

- Focus on Innovation: The company actively invests in research and development to drive innovation and stay ahead of emerging trends in the data center industry.

Sustainability and Environmental Responsibility:

- Commitment to Sustainability: Digital Realty is committed to sustainable practices and has implemented initiatives to reduce its carbon footprint and improve energy efficiency.

- Green Data Centers: The company focuses on building and operating environmentally friendly data centers, attracting customers seeking sustainable solutions.

Management & Employees:

Andrew Power: Chief Executive Officer and Director. Oversees the company’s overall strategy and operations.

Gregory Wright: Chief Investment Officer. Leads the company’s investment activities, including acquisitions, dispositions, and development projects.

Jeffrey Michael Tapley: Chief Operating Officer. Responsible for the company’s day-to-day operations and execution of strategic initiatives.

Financials:

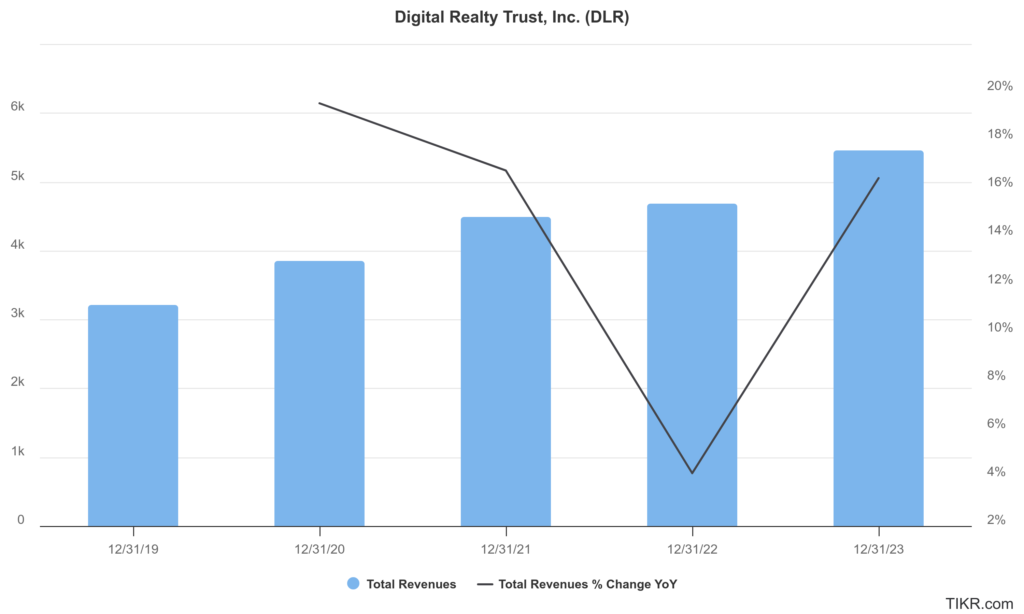

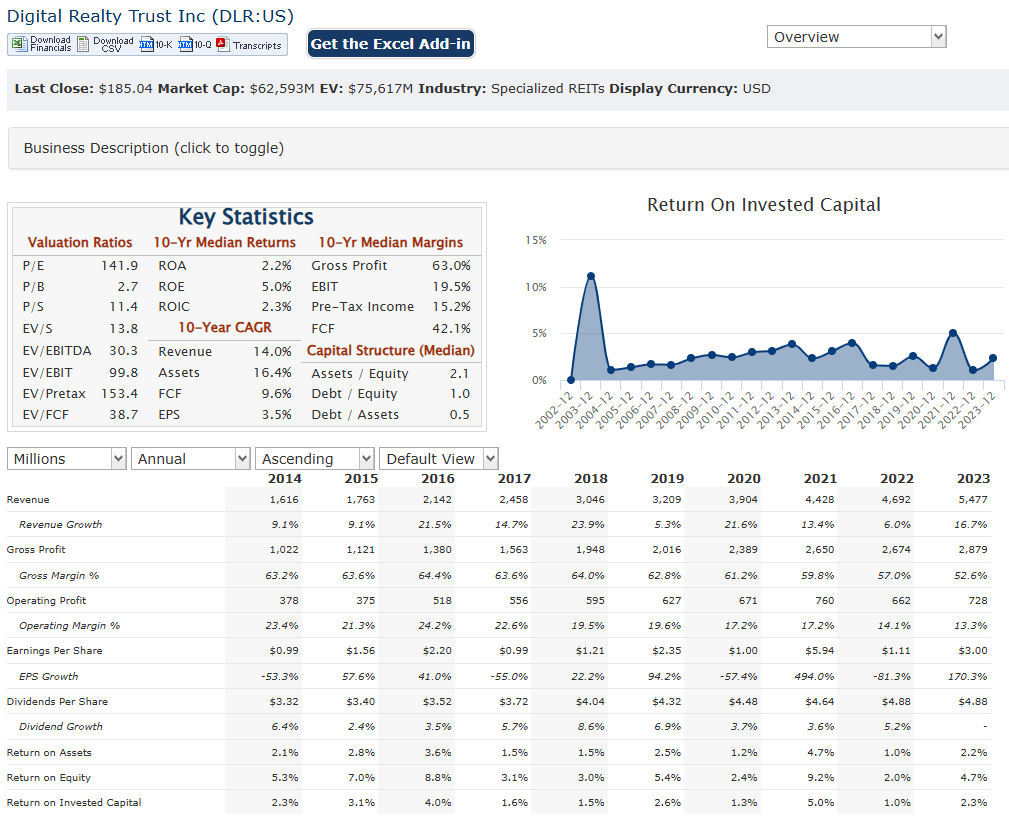

Digital Realty Trust Inc. has reported revenue increased from approximately $3.21 billion to about $5.48 billion, reflecting a compound annual growth rate (CAGR) of approximately 11% during this period. This growth trajectory was driven by the rising demand for data center services, which has been bolstered by the increasing reliance on cloud computing and digital infrastructure. The revenue growth rate varied year-on-year, with notable increases of 21.64% in 2020 and 16.74% in 2023, although growth slowed to just 5.96% in 2022 due to market adjustments and economic conditions.

Digital Realty’s net income peaked at $1.68 billion in 2021 but fell to $337 million in 2022, marking a significant decline of nearly 80%. However, net income rebounded to approximately $908 million in 2023, reflecting a year-over-year increase of about 169%. The CAGR for net income was approximately 5%, indicating challenges in maintaining profitability amid fluctuating operating conditions. The company reported a net income of $40 million for Q3 2024, from $723 million in Q3 2023, emphasizing ongoing volatility in earnings.

The company reported net debt of approximately $15.8 billion, an increase from $10 billion in 2019. This rise represents a CAGR of about 8%, indicating a strategic approach to leveraging debt for growth while managing its capital structure amid expanding operations. The company’s EBITDA margins have gradually declined from nearly 59% in 2019 to around 50% in recent years, reflecting increased operational costs and competitive pressures within the data center sector.

Digital Realty Trust Inc. is driven by strong demand for data services; however, its earnings have shown considerable volatility with fluctuations year-on-year. As Digital Realty continues to navigate these complexities, its focus on expanding service offerings and optimizing operational efficiencies will be critical for sustaining long-term growth and stability in an increasingly competitive landscape.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly chart and on a stage 2 markup on the weekly chart as well. The near term daily chart is bearish and in stage 4 consolidation, indicating a move lower to the support area of $172 range and that should be a likely reversal point. It would be a good entry point in the $166 – $170 zone for the long term.

Bull Case:

1. Strong Secular Growth in Data Center Demand:

- Digital Transformation: The ongoing digital transformation across industries is driving the need for robust data center infrastructure.

- Cloud Computing: The increasing adoption of cloud computing services requires substantial data center capacity.

- 5G and IoT: The rollout of 5G networks and the proliferation of IoT devices will generate massive amounts of data, further fueling demand.

- AI and Machine Learning: These technologies are highly data-intensive and rely heavily on data center infrastructure.

4. ESG Leadership:

- Sustainability Initiatives: Digital Realty is committed to sustainable practices, reducing its environmental impact and attracting ESG-focused investors.

- Energy Efficiency: The company invests in energy-efficient technologies to optimize its operations.

Bear Case:

Interest Rate Risk:

- As a REIT, Digital Realty is sensitive to interest rate fluctuations.

- Rising interest rates can increase borrowing costs and reduce the company’s profitability.

Operational Challenges:

- Managing a large and complex global infrastructure can be challenging, and operational issues could impact performance.

- Power outages, natural disasters, or cyberattacks could disrupt operations and damage the company’s reputation.