Executive Summary:

Palantir Technologies Inc. is an American publicly traded software company specializing in big data analytics. Founded by Peter Thiel, Stephen Cohen, Joe Lonsdale, and Alex Karp, the company is renowned for its data fusion platforms that facilitate machine-assisted and human-driven data analysis. Palantir’s software solutions, such as Palantir Gotham and Palantir Foundry, are used by various organizations, including government agencies, financial institutions, and healthcare providers, to integrate, manage, secure, and analyze vast amounts of data.

Palantir Technologies Inc. reported an EPS of $0.10. Revenue for the quarter came in at $725.52 million.

Stock Overview:

| Ticker | $PLTR | Price | $66.82 | Market Cap | $152.22B |

| 52 Week High | $67.88 | 52 Week Low | $15.66 | Shares outstanding | 2.18B |

Company background:

Palantir Technologies Inc., a prominent player in the big data analytics industry, was founded in 2003 by a visionary group of entrepreneurs: Peter Thiel, Stephen Cohen, Joe Lonsdale, and Alex Karp. The company’s name, inspired by the seeing-stones from J.R.R. Tolkien’s “The Lord of the Rings,” reflects its mission to illuminate hidden insights within vast datasets.

Palantir’s journey began with significant funding from prominent investors like Thiel and Peter Thiel’s venture capital firm, Founders Fund. Gotham, initially designed for government agencies, empowers analysts to integrate, manage, and analyze large-scale datasets to address complex challenges like counterterrorism and national security. Foundry, a more versatile platform, caters to commercial enterprises, enabling them to harness the power of data for operational efficiency, risk mitigation, and strategic decision-making.

It focus on user experience and data security has attracted a diverse clientele, including government agencies, financial institutions, healthcare organizations, and numerous other industries. While Palantir faces competition from established tech giants like Microsoft and Google, its early mover advantage and strong customer relationships have solidified its position in the market. Palantir Technologies Inc. is headquartered in Denver, Colorado.

Recent Earnings:

Palantir Technologies Inc. reported revenue for the quarter reached $725.52 million, marking a significant year-over-year increase of 30%. This robust revenue growth surpassed analyst estimates by $21.82 million, to capitalize on the increasing demand for its data analytics solutions.

Palantir reported an EPS of $0.10, surpassing analyst expectations by $0.01. This represents a substantial year-over-year growth of 100%, demonstrating the company’s ability to translate revenue growth into improved profitability.

The company’s customer base continued to expand, with a growing number of organizations leveraging its platform to derive valuable insights from their data. Palantir’s focus on innovation and product development has enabled it to maintain a competitive edge in the market.

Palantir provided positive forward guidance, raising its full-year revenue and adjusted income from operations guidance. The company expressed optimism about the continued demand for its solutions, particularly in the areas of artificial intelligence and data-driven decision-making.

The Market, Industry, and Competitors:

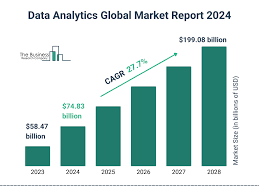

Palantir operates in the rapidly growing big data analytics market. This market is driven by the increasing volume and complexity of data generated across various industries. As organizations seek to extract valuable insights from this data to improve decision-making, demand for advanced analytics solutions like Palantir’s is on the rise.

The company’s innovative data fusion platforms and strong customer relationships give it a competitive advantage. Analysts predict that Palantir’s revenue could grow at a CAGR of 20-28% over the next five years, leading to substantial growth by 2030.

While the future looks promising, several factors could influence Palantir’s growth trajectory. These include intense competition from tech giants, economic downturns, and the company’s ability to continue innovating and adapting to evolving market dynamics. With its strong foundation and focus on strategic partnerships, Palantir is well-equipped to navigate these challenges and achieve growth.

Unique differentiation:

Cloud Service Providers: Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform offer a wide range of data analytics and machine learning tools that can be used to build custom data solutions. While these platforms provide flexibility, they often require technical expertise and investment to implement.

Traditional Data Analytics Vendors: Companies like IBM, Oracle, and SAS have been in the data analytics market for decades and offer a suite of tools for data integration, data warehousing, and advanced analytics. However, their traditional approach may not be as agile and innovative as newer solutions like Palantir’s.

Emerging Data Analytics Startups: A growing number of startups are focused on specific niches within the data analytics market, such as data visualization, data integration, and machine learning. While these startups may offer specialized solutions, they often lack the scale and resources of established players like Palantir.

1. Data Fusion Platform: Palantir’s core strength lies in its ability to integrate diverse and disparate data sources into a unified platform. This allows organizations to gain a comprehensive view of their data and identify previously unseen patterns and insights.

2. Security and Privacy: Palantir places a strong emphasis on data security and privacy. The company’s robust security measures protect sensitive information and comply with stringent regulations, making it a trusted partner for organizations handling critical data.

3. Domain Expertise: Palantir has deep domain expertise in various industries, including government, finance, healthcare, and energy. This knowledge enables the company to understand the unique challenges and opportunities faced by its clients and tailor its solutions.

Management & Employees:

Alexander Karp: CEO and Co-Founder. A visionary leader who has guided Palantir’s growth and strategic direction since its inception.

Peter Thiel: Co-Founder and Chairman. A prominent investor and entrepreneur, Thiel has been instrumental in shaping Palantir’s early development and continues to play a significant role in the company’s strategic decisions.

Stephen Cohen: Co-Founder and President. A key figure in Palantir’s founding and a driving force behind its innovative culture.

Financials:

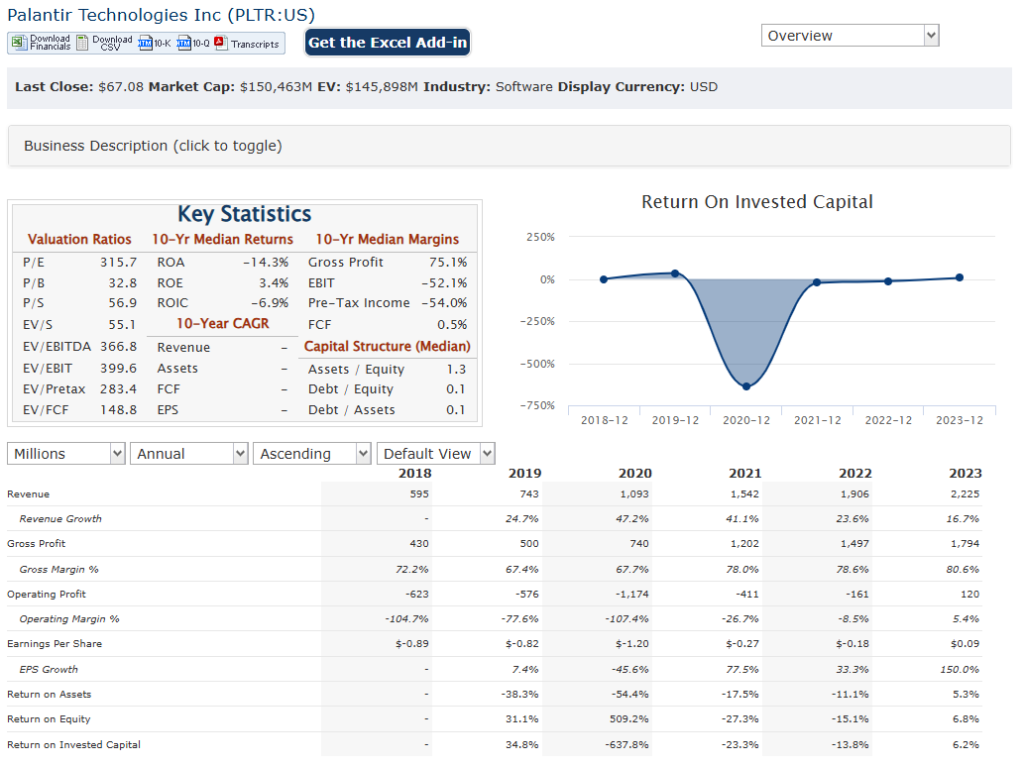

Palantir Technologies Inc. achieved a compound annual growth rate (CAGR) of approximately 23.5% in revenue, reflecting its expanding market presence and increasing demand for its data analytics platforms. Palantir reported a 30% year-over-year revenue growth, reaching $726 million. This strong performance was bolstered by a 44% increase in U.S. revenue, driven by substantial growth in both commercial and government sectors, indicating robust market penetration and customer acquisition strategies.

Earnings growth has also been impressive, with Palantir experiencing an average annual earnings growth rate of 52.4% over the past five years. This figure is significantly higher than the broader software industry average of 19.9% during the same period. Palantir reported a GAAP net income of $144 million, translating to a margin of 20%. The company’s earnings per share (EPS) grew by 100% year-over-year.

Palantir Technologies reflects a strong financial position, with approximately $4.6 billion in cash and liquid investments as of late 2024 and no outstanding debt. This liquidity provides a solid foundation for future investments and operational scaling. The company has maintained a return on equity (ROE) of 10.6%, which, while considered low compared to some peers, indicates the effective use of shareholder equity in generating profits.

The company’s strategic focus on diversifying its client base beyond government contracts into commercial sectors positions it well for sustained growth. As it capitalizes on emerging trends in artificial intelligence and data analytics, Palantir is expected to maintain its upward trajectory in both revenue and earnings growth.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on all 3 timeframes, but is very stretched and likely to fall back to the $50 zone in the next few months.

Bull Case:

1. Proven Track Record: Palantir has a proven track record of delivering strong financial performance, with consistent revenue and earnings growth. The company’s ability to exceed analyst expectations and maintain profitability is a testament to its strong business model.

2. Artificial Intelligence and Machine Learning: Palantir is actively leveraging artificial intelligence and machine learning to enhance its data analytics capabilities. This enables the company to provide more sophisticated insights and solutions to its clients, driving further growth and innovation.

3. Valuation: While Palantir’s valuation may seem high compared to some traditional metrics, it is justified by the company’s strong growth prospects, innovative technology, and significant market opportunity.

Bear Case:

1. Economic Uncertainty: Economic downturns can impact government spending and corporate budgets, potentially reducing demand for Palantir’s solutions. This could lead to slower revenue growth and lower profitability.

2. Regulatory Risks: As Palantir works with government agencies and handles sensitive data, it is subject to various regulatory risks. Changes in regulations or increased scrutiny could impact the company’s business operations and financial performance.