Executive Summary:

Ares Management Corporation is a leading global alternative investment manager, specializing in credit, private equity, and real estate. The company offers a range of investment solutions to clients worldwide, aiming to deliver strong risk-adjusted returns. With a diverse portfolio of strategies and a deep understanding of the markets, Ares Management has established itself as a trusted partner for institutions and individuals seeking investment opportunities in various asset classes.

Ares Management Corporation achieved GAAP net income of $118.5 million and earnings per share of $0.55. After-tax realized income reached $316.0 million ($0.95 per share), and fee-related earnings amounted to $339.3 million.

Stock Overview:

| Ticker | $ARES | Price | $176.87 | Market Cap | $35.09B |

| 52 Week High | $178.49 | 52 Week Low | $107.69 | Shares outstanding | 198.39M |

Company background:

Ares Management Corporation, a leading global alternative investment manager, was founded in 1997 by Michael Arougheti, Bennett Rosenthal, and David Kaplan. It offers a variety of investment products, including private equity funds, credit funds, real estate funds, and infrastructure funds. These funds invest in a wide range of assets, such as private companies, public debt, real estate properties, and infrastructure projects. The firm’s investment approach is characterized by a focus on value investing, disciplined risk management, and a long-term investment horizon.

Ares Management competes with other large alternative investment managers, such as Blackstone Group, KKR & Co., and Apollo Global Management. The firm’s headquarters is located in Los Angeles, California.

Recent Earnings:

Ares Management Corporation reported a strong third quarter, they achieved GAAP net income of $118.5 million and earnings per share of $0.55. After-tax realized income reached $316.0 million ($0.95 per share), and fee-related earnings amounted to $339.3 million. With over $64 billion in fundraising year-to-date, Ares expects 2024 to be a record year with gross commitments reaching the mid-$80 billion range. Third-quarter deployment reached nearly $30 billion. The company declared a quarterly dividend of $0.93 per share of Class A stock.

The company’s robust fundraising activity and increased deployment of capital contributed to the positive results. Fee-related earnings, a key metric for alternative asset managers, grew year-over-year, reflecting the expansion of the firm’s assets under management.

The company’s strong track record, diversified investment strategies, and experienced investment teams position it well to capitalize on future opportunities. The firm’s focus on delivering long-term value to its clients, combined with its disciplined investment approach, is expected to drive continued growth and success.

The Market, Industry, and Competitors:

Ares Management Corporation operates within the global alternative investment management sector, specializing in a variety of asset classes including credit, private equity, real estate, and infrastructure. The firm has established itself as a leader in this space, managing approximately $428 billion in assets. Ares focuses on providing flexible capital solutions that cater to both institutional and retail investors, which has become increasingly important as the demand for alternative investments continues to rise.

Ares Management is well-positioned for robust growth. Analysts forecast that the company’s stock could reach an average price of approximately $317.65 by 2030, representing an increase of about 86.32% from its current levels. This optimistic outlook is supported by the expectation of substantial inflows into alternative investments, with estimates suggesting that trillions of dollars will be allocated to this sector over the next decade. Ares has already demonstrated strong fundraising capabilities, with over $64 billion raised in 2024 alone, indicating a solid trajectory toward achieving its growth targets. The compound annual growth rate (CAGR) for Ares Management is projected to be continues to expand its product offerings and deepen relationships with clients across various markets, particularly in retail and international segments.

Unique differentiation:

Ares Management Corporation faces competition from several prominent players in the alternative investment industry. Key competitors include Blackstone Group, KKR & Co., and Apollo Global Management. These firms, like Ares, offer a wide range of investment strategies across various asset classes, including private equity, credit, real estate, and infrastructure.

Other competitors in the alternative investment space include The Carlyle Group, TPG, and Brookfield Asset Management. These firms have established strong brands, experienced investment teams, and significant assets under management. They compete with Ares Management for investor capital, deal flow, and talent.

The competitive landscape in the alternative investment industry is characterized by intense competition for deal flow, talent, and investor capital. To maintain a competitive edge, Ares Management must continue to differentiate itself through its investment strategies, risk management practices, and strong performance track record. The firm’s ability to adapt to evolving market conditions, innovate, and build strong relationships with investors will be crucial to its long-term success.

1. Diversified Investment Platform:

- Broad Range of Strategies: Ares offers a comprehensive suite of investment strategies across credit, private equity, and real estate. This diversification allows the firm to capitalize on various market opportunities and mitigate risk.

- Deep Expertise: The firm’s experienced investment teams have a deep understanding of their respective asset classes, enabling them to identify attractive investment opportunities and execute complex transactions.

2. Collaborative Culture:

- Cross-Functional Collaboration: Ares fosters a collaborative culture that encourages information sharing and idea exchange across different investment teams. This enables the firm to identify synergies, uncover new investment opportunities, and make more informed investment decisions.

3. Risk Management Focus:

- Disciplined Approach: Ares employs a rigorous risk management framework to assess and manage risk across its investment portfolio. This disciplined approach helps to protect investors’ capital and ensure long-term performance.

Management & Employees:

Michael Arougheti: Co-Founder, Chief Executive Officer, and President. Arougheti oversees the overall strategy and operations of Ares Management.

Bennett Rosenthal: Co-Founder and Executive Chairman. Rosenthal is responsible for the firm’s long-term strategic direction.

David Kaplan: Co-Founder and Executive Chairman. Kaplan plays a key role in shaping the firm’s investment philosophy and culture.

Financials:

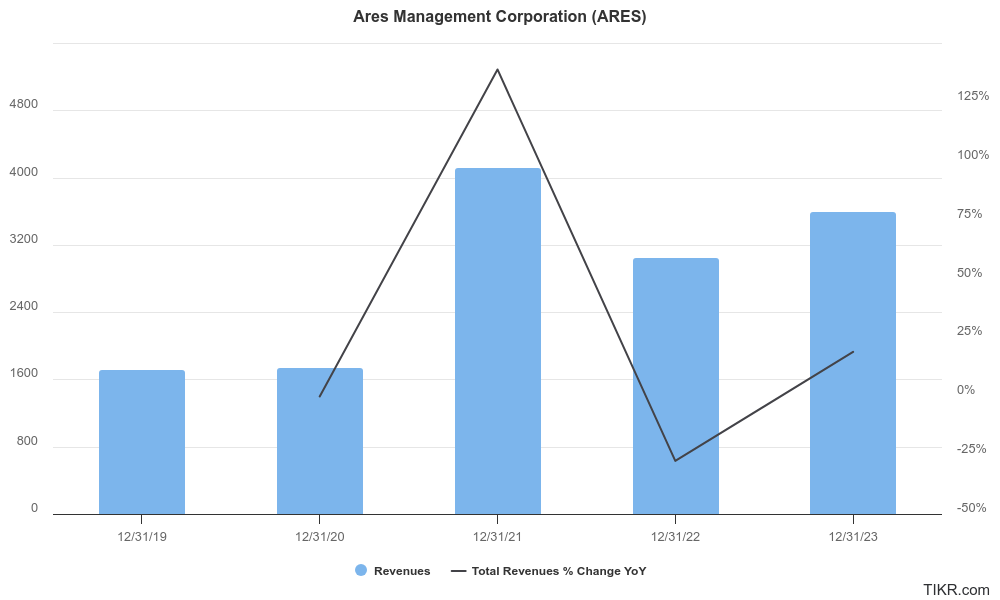

Ares Management Corporation has demonstrated revenues of approximately $3.632 billion, marking an 18.87% increase from the previous year, where revenues fell by 27.46% to $3.055 billion, largely due to market volatility and economic headwinds. The overall trend shows resilience, with substantial growth recorded in 2021 when revenues surged by 138.77% to $4.212 billion.

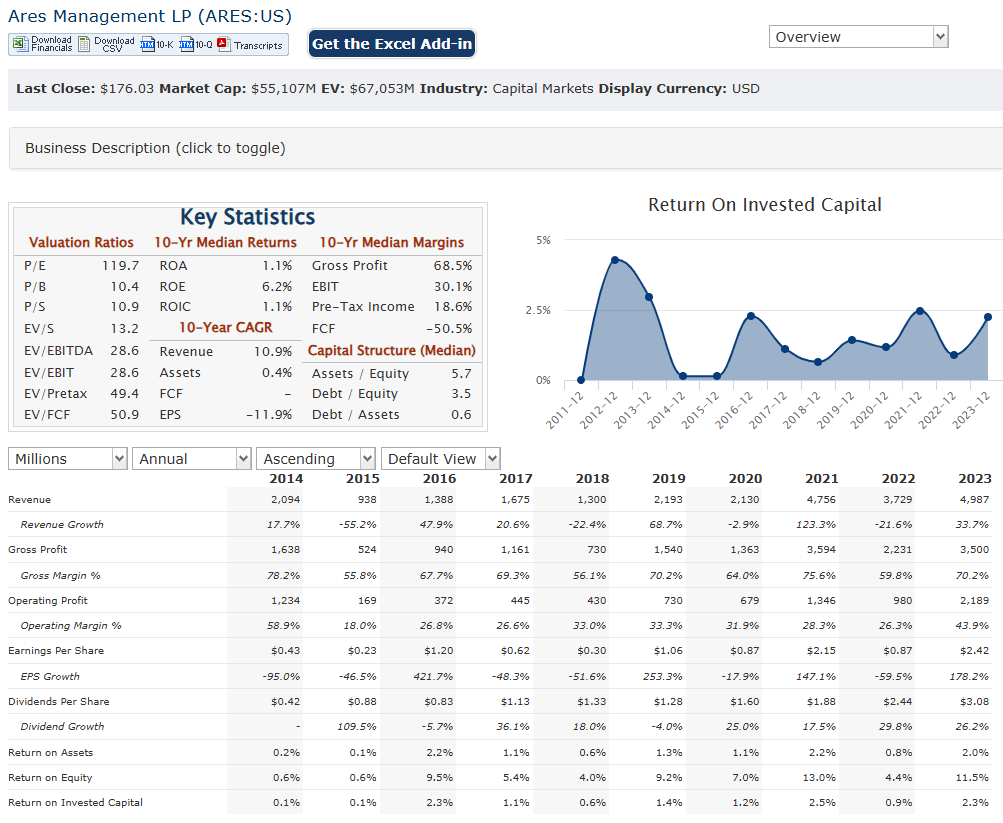

The compound annual growth rate (CAGR) for Ares Management’s revenue over the last five years stands at approximately 46%, indicating robust expansion despite fluctuations in annual performance. This growth trajectory is supported by the company’s strategic focus on alternative investments, which have gained traction among institutional and retail investors seeking diversification and higher returns. Ares has also excelled in managing fee-related earnings, which rose by 24% year-over-year in Q3 2024.

Earnings per share (EPS) have also seen substantial growth, with a CAGR of around 28% over the same period. Ares achieved an EPS of $2.18, reflecting a strong upward trend from previous years. The firm has consistently outperformed market expectations, leading to a favorable perception among investors and a high price-to-earnings (P/E) ratio of approximately 82.71.

Ares Management maintains a solid financial position with assets under management (AUM), which reached approximately $428 billion as of late 2024. This robust AUM base provides the company with ample liquidity and flexibility to pursue new investment opportunities while supporting ongoing operations. The firm’s ability to raise nearly $64 billion year-to-date in 2024 further highlights its strong fundraising capabilities and investor confidence in its strategic direction.

Technical Analysis:

The stock is on a strong stage 2 markup (bullish) on the monthly and weekly charts. The near term daily chart indicates a consolidation (stage 3 neutral) move to the $165 – $172 zone and then should head higher back to the $180 zone. This is a strong long term performer.

Bull Case:

Strong Financial Performance:

- Consistent Earnings Growth: Ares has demonstrated a consistent track record of delivering strong earnings growth, driven by its diversified investment strategies and effective asset management.

- Robust Revenue Streams: The company benefits from multiple revenue streams, including management fees, performance fees, and carried interest. This diversification helps to mitigate risks and ensure stable revenue generation.

- Strong Fundraising Capabilities: Ares has a proven ability to raise significant amounts of capital from institutional investors, enabling it to deploy capital into attractive investment opportunities.

Favorable Industry Trends:

- Growing Demand for Alternative Investments: The increasing complexity of traditional investment strategies and the need for diversification are driving investors towards alternative asset classes.

- Rising Global Wealth: The growing global wealth pool provides a significant opportunity for alternative investment managers like Ares to attract new investors.

- Favorable Regulatory Environment: A supportive regulatory environment can foster growth and innovation in the alternative investment industry.

Bear Case:

Economic Downturn:

- Reduced Deal Flow: A significant economic downturn could lead to reduced deal flow and lower investment opportunities, impacting the firm’s revenue and earnings.

- Increased Credit Risk: Economic downturns can increase credit risk, potentially leading to losses on investments.

Rising Interest Rates:

- Impact on Valuations: Rising interest rates can negatively impact the valuations of assets, particularly those with longer durations.

- Increased Cost of Capital: Higher interest rates can increase the cost of capital for Ares, impacting its ability to finance new investments.

Market Volatility:

- Market Corrections: Periods of market volatility can negatively impact the performance of the firm’s investments and lead to short-term fluctuations in its stock price.

- Investor Sentiment: Negative market sentiment can lead to investor withdrawals and increased pressure on the firm’s valuation.