Executive Summary:

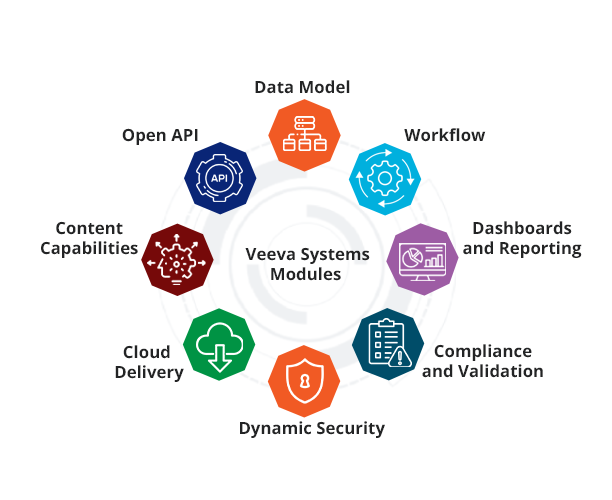

Veeva Systems Inc. is a leading cloud-based software company serving the life sciences industry. Their innovative solutions streamline critical business processes, including clinical trials, regulatory compliance, and commercial operations. Veeva empowers pharmaceutical and biotech companies to accelerate drug development, improve patient outcomes, and enhance overall efficiency.

Veeva Systems Inc. achieved total revenue of $676.2 million, marking a year-over-year increase of 15%. Subscription services revenue surged by 19% to $561.3 million.

Stock Overview:

| Ticker | $VEEV | Price | $213.37 | Market Cap | $34.55B |

| 52 Week High | $240.68 | 52 Week Low | $165.12 | Shares outstanding | 161.93M |

Company background:

Veeva Systems Inc., a leading cloud-based software company, was founded in 2007 by Peter Gassner and Matt Wallach. The company’s primary focus is on providing industry-specific cloud-based software solutions for the life sciences industry. Veeva’s solutions are designed to streamline critical business processes, including clinical trials, regulatory compliance, and commercial operations.

Veeva has innovative products and services have earned the trust of numerous pharmaceutical and biotech companies worldwide. Their key competitors in the life sciences software market include Oracle, Salesforce, and SAP. Veeva differentiates itself by offering industry-specific solutions, deep domain expertise, and a strong focus on customer success. The company’s headquarters are located in Pleasanton, California, with offices across North America, Europe, Asia, and Latin America.

Recent Earnings:

Veeva Systems Inc. reported total revenue reached $676.2 million, marking a year-over-year increase of 15%. Subscription services revenue surged by 19% to $561.3 million. Veeva’s overall performance exceeded analyst expectations, driven by robust demand for its cloud-based solutions within the life sciences industry.

The company’s focus on innovation, customer success, and strategic acquisitions has contributed to its consistent outperformance. Veeva’s expanding global footprint and increasing adoption of its cloud-based platform have further boosted its revenue growth. The company now expects total revenue to be in the range of $2.700 billion to $2.710 billion, up from its previous guidance of $2.680 billion to $2.690 billion.

The Market, Industry, and Competitors:

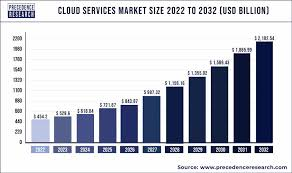

Veeva Systems Inc. operates primarily in the life sciences industry, providing cloud-based software solutions tailored for pharmaceutical, biotech, and medical device companies. The company focuses on streamlining operations related to drug development, regulatory compliance, and commercial processes. Its flagship products, such as Veeva CRM and Veeva Vault, are designed to enhance customer relationship management and content management across clinical trials and regulatory submissions. With a total addressable market estimated at $20 billion in life sciences alone, as it continues to expand its offerings within the MedTech and biopharma sectors, which together represent a market size of approximately $2 trillion.

The International Data Corporation projects a 23% compound annual growth rate (CAGR) for cloud spending in this sector through 2028, indicating a favorable environment for Veeva’s continued expansion. Veeva’s fiscal guidance suggests an 18% CAGR over the next few years, reflecting confidence in its strategic initiatives and product innovations. The company continues to penetrate its existing markets and explore new opportunities, it is well-placed to capitalize on the evolving landscape of life sciences technology.

Unique differentiation:

Oracle and SAP: These tech giants offer enterprise resource planning (ERP) and customer relationship management (CRM) solutions that can be adapted for life sciences. However, their solutions are often more generic and may not be as deeply tailored to the specific needs of the industry as Veeva’s.

Medidata Solutions: A leading provider of clinical development software, Medidata offers solutions for clinical trial management, regulatory affairs, and safety reporting. However, Veeva has gained significant market share in recent years, particularly in the commercial and regulatory segments.

Other niche players: Several other companies, such as ArisGlobal, MasterControl, and Sparta Systems, offer specialized solutions for quality management, regulatory compliance, and other specific areas within the life sciences industry. These companies may pose competition in specific segments but often lack the comprehensive suite of solutions offered by Veeva.

Cloud-Based Platform: Veeva’s cloud-based platform offers scalability, flexibility, and accessibility, enabling life sciences companies to streamline operations, improve collaboration, and accelerate time-to-market.

Data-Driven Insights: Veeva leverages data analytics and AI to provide valuable insights into clinical trials, regulatory compliance, and commercial operations. This helps life sciences companies make data-driven decisions and optimize their processes.

Management & Employees:

- Peter Gassner: Co-founder and CEO

- Matt Wallach: Co-founder and Chief Strategy Officer

- Brent Bowman: Chief Operating Officer

- Mike Leone: Chief Product Officer

Financials:

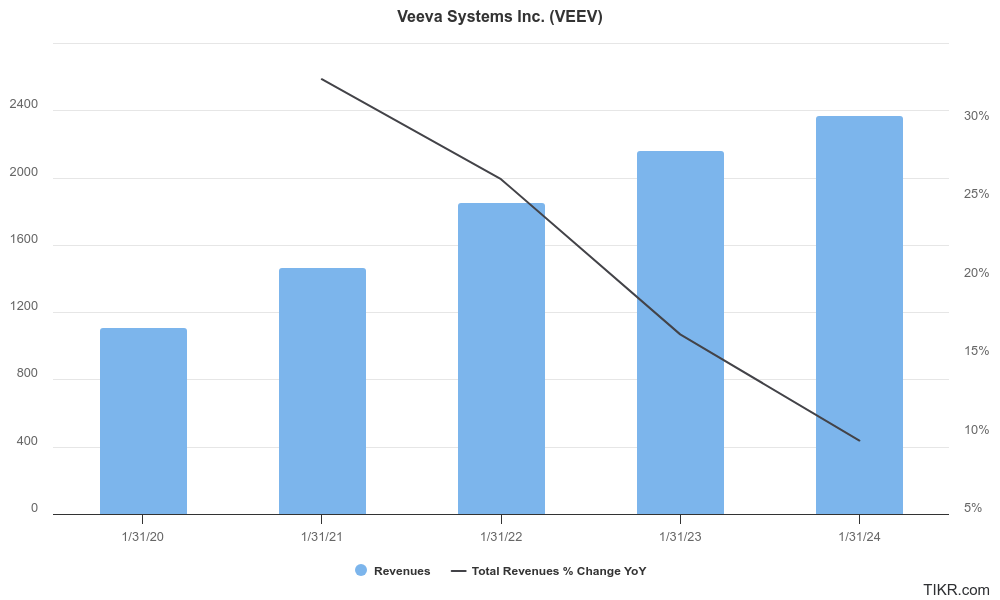

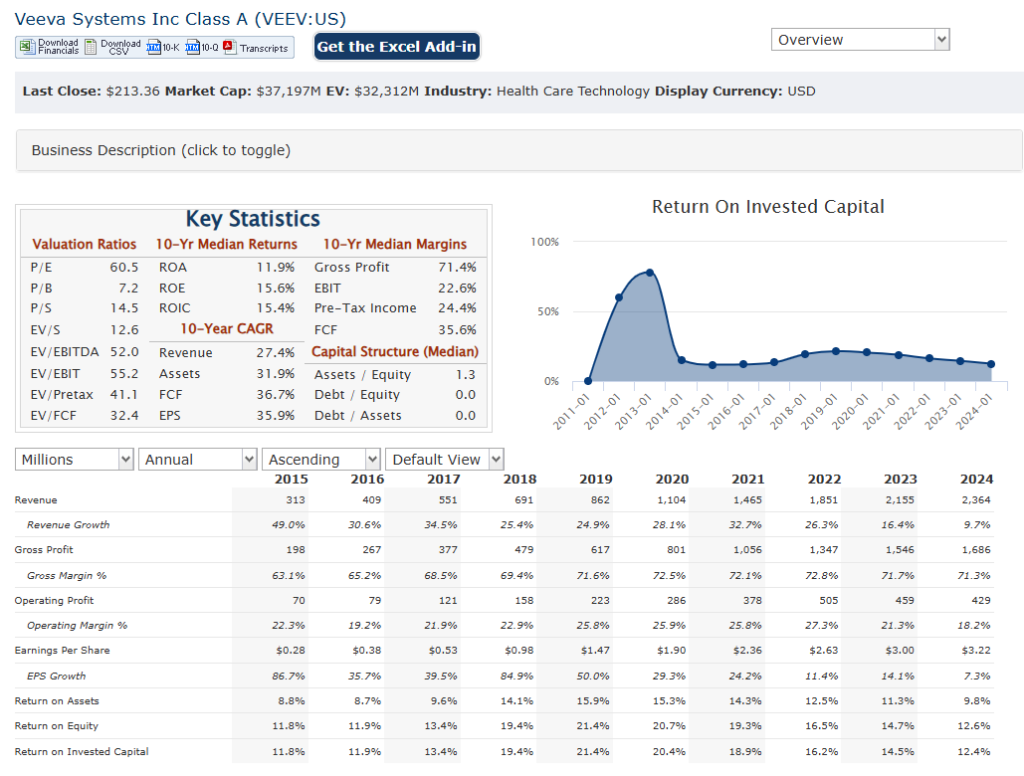

Veeva Systems Inc. has reported total revenues of $2.36 billion, reflecting a 10% increase from the previous year. This follows a notable 16% growth in fiscal 2023, where revenues reached $2.15 billion, and a substantial 26% increase in fiscal 2022, which saw revenues of $1.85 billion. The company’s revenue growth over this period illustrates a strong compound annual growth rate (CAGR) of approximately 18% from fiscal 2019 to 2024.

Earnings growth has also been significant for Veeva Systems during this timeframe. The company reported net income of approximately $525 million in fiscal 2024, up from around $488 million in fiscal 2023, marking an increase of about 8% year-over-year. This follows a more pronounced growth of 8% from fiscal 2022’s net income of $487 million. Veeva’s net income has grown at a CAGR of about 12%, reflecting not only revenue increases but also effective cost management and operational efficiencies that have bolstered profitability.

The company reported cash and cash equivalents totaling approximately $707 million, alongside total assets exceeding total liabilities, indicating a robust liquidity position. The company’s focus on innovation and strategic investments has allowed it to maintain a favorable debt-to-equity ratio, ensuring financial stability while pursuing growth opportunities in the life sciences market.

The company’s strategic initiatives and commitment to innovation position it well for future expansion as it continues to meet the evolving needs of life sciences organizations worldwide.

Technical Analysis:

The stock has been in a stage 1 consolidation zone (neutral) on the monthly chart. The weekly pattern is bullish (stage 2 markup). However the daily chart shows a stage 4 markdown (bearish) which means the stock is heading to $186 – $199 zone in the short term, then likely to test the $177 zone before a move higher. The near term outlook is negative.

Bull Case:

Strong Market Position and Growth Potential:

- High Growth Potential: The life sciences industry is characterized by increasing regulatory complexity, growing clinical trial pipelines, and the need for efficient data management. Veeva’s solutions address these challenges, driving strong demand and growth potential.

- Expanding Product Portfolio: Veeva continues to innovate and expand its product offerings, including solutions for clinical development, regulatory affairs, commercial operations, and quality management. This diversification strategy can drive sustained growth.

Long-Term Growth Opportunities:

- AI and Machine Learning Integration: The company is leveraging AI and machine learning to enhance its products and services, improving efficiency, accuracy, and decision-making.

- Strategic Acquisitions: Veeva has a history of successful acquisitions to strengthen its product portfolio and expand its market reach.

Bear Case:

Regulatory Risks:

- Changing Regulatory Landscape: Changes in regulatory requirements, particularly in areas like data privacy and security, could impact Veeva’s operations and customer relationships.

- Compliance Costs: Compliance with evolving regulations can increase operational costs and potentially impact profitability.

Economic Downturn:

- Reduced Spending: In an economic downturn, life sciences companies may reduce their IT budgets, impacting demand for Veeva’s software solutions.

- Delayed Clinical Trials: Economic uncertainty can lead to delays in clinical trials, which could negatively impact Veeva’s revenue growth.

Valuation Concerns:

- Premium Valuation: Veeva’s stock has historically traded at a premium valuation compared to other software companies. If the company fails to meet investor expectations, the stock price could decline.