Executive Summary:

ON Semiconductor Corporation is a leading provider of power and sensing solutions, focused on automotive and industrial applications. The company designs, manufactures, and markets a diverse portfolio of semiconductor components, including power management ICs, image sensors, and discrete power devices. ON Semiconductor plays a crucial role in enabling the electrification of vehicles, powering renewable energy systems, and driving advancements in various industrial sectors.

ON Semiconductor Corporation reported earnings per share (EPS) of $1.28, which exceeded analysts’ expectations of $1.25. Revenue for the quarter came in at $2.018 billion, slightly below analyst estimates of $2.02 billion.

Stock Overview:

| Ticker | $ON | Price | $67.02 | Market Cap | $28.54B |

| 52 Week High | $86.77 | 52 Week Low | $59.34 | Shares outstanding | 425.79M |

Company background:

ON Semiconductor Corporation was founded in 1999 as a spin-off from Motorola’s Semiconductor Components Group. The company initially focused on manufacturing and marketing a range of semiconductor devices, including discrete, standard analog, and standard logic components. Key founders of ON Semiconductor include individuals who played significant roles in Motorola’s semiconductor business.

Some acquisitions include Fairchild Semiconductor in 2016, which strengthened the company’s position in power management and automotive applications. ON Semiconductor’s product offerings include a wide range of power management integrated circuits (ICs), image sensors, power discrete devices, and other semiconductor components. These products are used in various applications, including automotive, industrial, consumer electronics, and communications infrastructure. Key competitors of ON Semiconductor include Texas Instruments, Infineon Technologies, STMicroelectronics, and NXP Semiconductors. ON Semiconductor is headquartered in Phoenix, Arizona, USA.

Recent Earnings:

ON Semiconductor Corporation reported earnings per share (EPS) of $1.28, which exceeded analysts’ expectations of $1.25, marking a year-over-year increase of 6.7%. Revenue for the quarter came in at $2.018 billion, slightly below analyst estimates of $2.02 billion, but still representing a 0.9% increase compared to the same period last year.

The company’s strong EPS performance and record automotive revenue of $4.3 billion, up 29% year-over-year, highlighted its continued growth and focus on the automotive market. ON Semiconductor’s gross margin for the quarter was 46.7%, and its operating margin was 30.3%. The company also generated strong cash flow, with a free cash flow of $564 million.

ON Semiconductor Corp expects revenue to be in the range of $1.85 billion to $1.95 billion, with EPS ranging from $0.95 to $1.05.

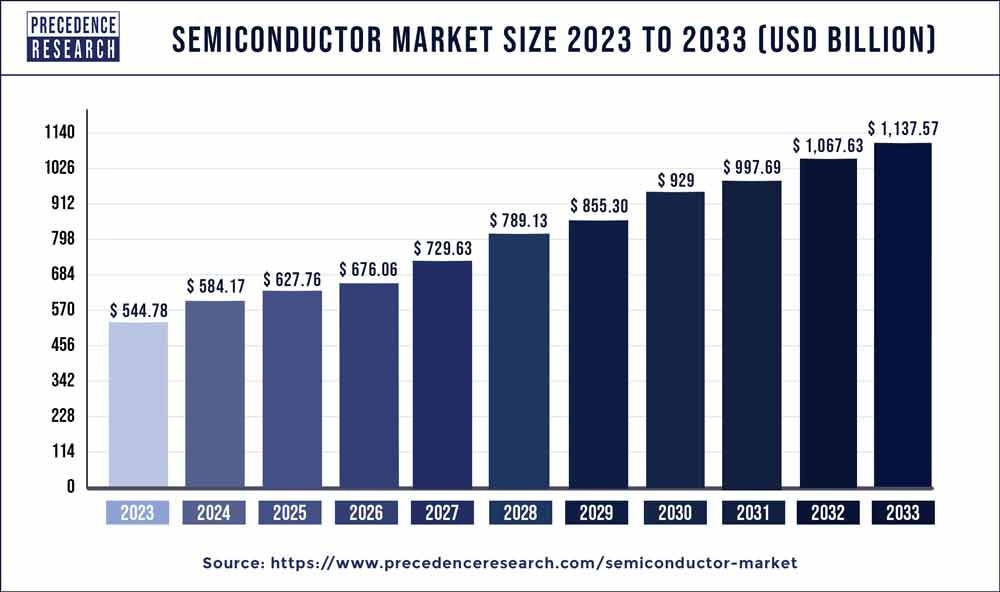

The Market, Industry, and Competitors:

ON Semiconductor Corporation operates primarily in the semiconductor market, focusing on intelligent sensing and power solutions. The company is structured into three main segments: the Power Solutions Group, the Advanced Solutions Group, and the Intelligent Sensing Group. ON Semiconductor’s products are crucial for various applications, including automotive electrification, industrial automation, and consumer electronics. The automotive sector is particularly important for ON Semiconductor, accounting for over 52% of its net sales, as the demand for electric vehicles (EVs) and advanced driver-assistance systems (ADAS) continues to rise globally. The company’s offerings include a range of semiconductor products such as analog components, power management ICs, and sensor interface devices, catering to diverse markets including industrial and mobile sectors.

The company aims to achieve a compound annual growth rate (CAGR) that is projected to be approximately twice that of the broader semiconductor market. This growth is driven by increasing demand for energy-efficient solutions and the ongoing transition towards electrification in various industries. ON Semiconductor will benefit from trends such as the expansion of renewable energy technologies, advancements in electric vehicle infrastructure, and the proliferation of smart devices that require sophisticated semiconductor solutions.

Unique differentiation:

- Texas Instruments: A leading semiconductor company known for its analog and embedded processing solutions. Texas Instruments has a strong presence in various markets, including automotive, industrial, and consumer electronics.

- Infineon Technologies: A German semiconductor company specializing in power management, automotive, and security solutions. Infineon is a major player in the automotive semiconductor market and competes directly with ON Semiconductor in this segment.

- STMicroelectronics: A global semiconductor company offering a wide range of products, including microcontrollers, analog devices, and power management ICs. STMicroelectronics has a strong presence in automotive, industrial, and consumer electronics markets.

- NXP Semiconductors: A Dutch semiconductor company focused on automotive, industrial, and IoT applications. NXP is a leader in the automotive semiconductor market and competes with ON Semiconductor in this segment.

The competitive landscape in the semiconductor industry is intense, and companies must continually invest in research and development, strategic partnerships, and acquisitions to maintain their market position.

Strong Focus on Automotive: ON Semiconductor has a strong focus on the automotive market, investing heavily in developing advanced power management and sensing solutions for electric and autonomous vehicles. This strategic focus positions the company as a leading provider of automotive semiconductor solutions.

Power Management Expertise: The company has a deep understanding of power management technologies and offers a comprehensive portfolio of power management ICs, power discrete devices, and related solutions. This expertise enables ON Semiconductor to deliver high-performance, energy-efficient solutions to its customers.

Image Sensor Capabilities: ON Semiconductor is a significant player in the image sensor market, providing a wide range of image sensors for various applications, including automotive, industrial, and consumer electronics. The company’s strong capabilities in image sensor technology allow it to differentiate itself from competitors.

Management & Employees:

Hassane El-Khoury: CEO and President

Dr. Wei-Chung Wang: EVP, Global Manufacturing and Operations

Simon Segars: Executive Chairman of the Board

Financials:

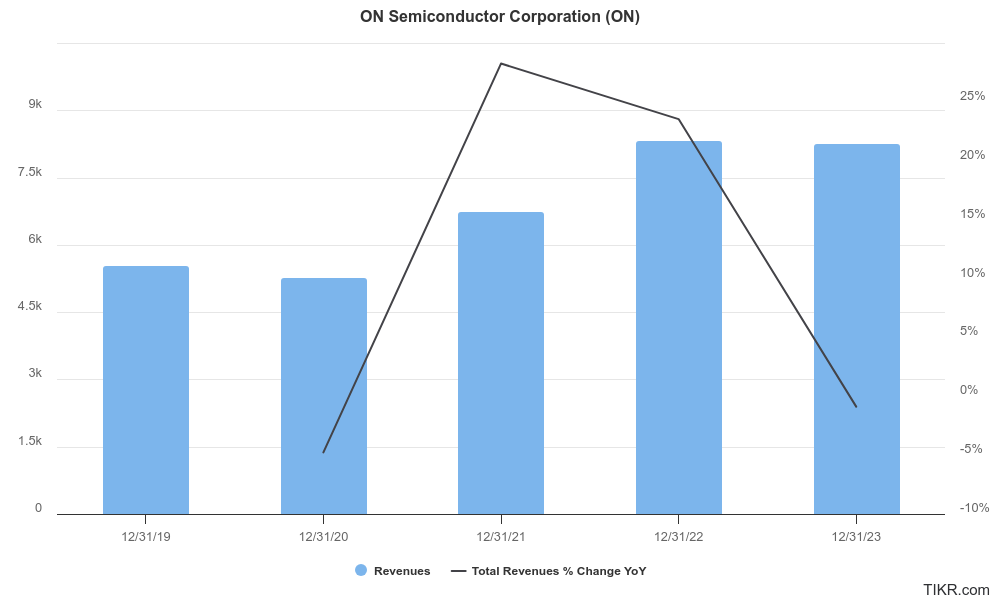

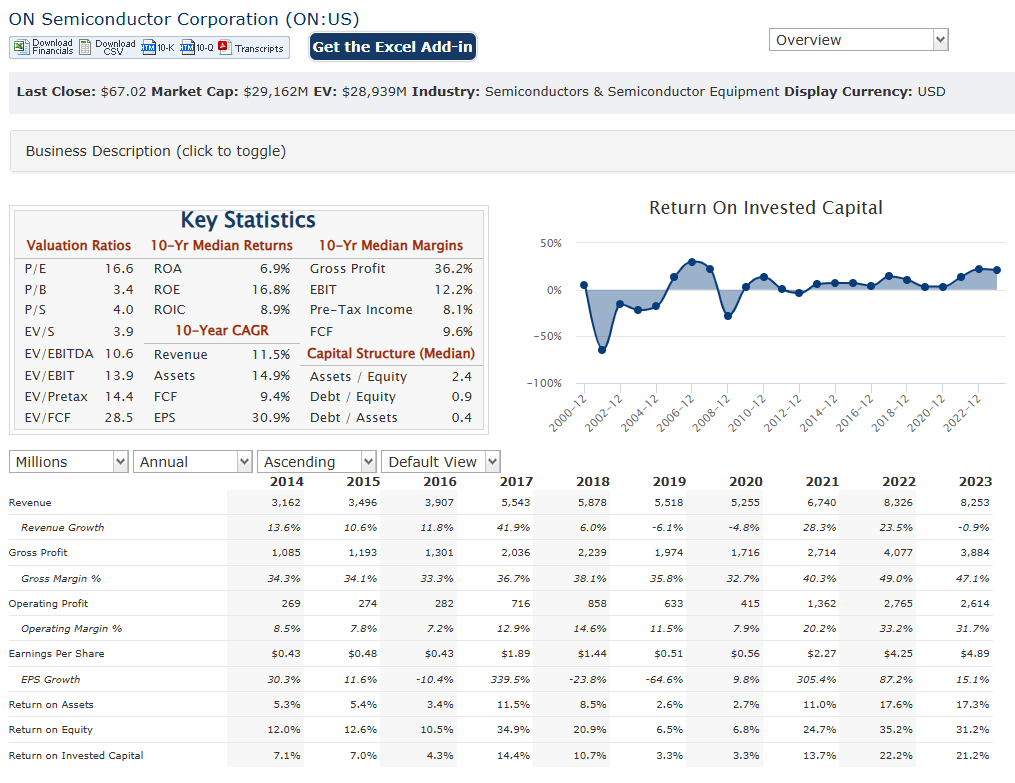

ON Semiconductor Corporation has reported a revenue increase from approximately $6.74 billion to about $8.25 billion, reflecting a compound annual growth rate (CAGR) of around 5.4%. This growth trajectory has been fueled by strong demand, in automotive and industrial applications, where the shift towards electrification and automation has driven semiconductor consumption. ON Semiconductor reported record automotive revenue of $4.3 billion, marking a 29% increase year-over-year, underscoring its strategic focus on high-growth markets.

ON Semiconductor achieved an average annual earnings growth rate of approximately 42.7% over the same period. The company’s earnings per share (EPS) rose significantly, from $1.01 in 2021 to around $2.18 in 2023, showcasing a remarkable CAGR of about 66%. ON Semiconductor’s long-term outlook remains positive due to its strong market position and innovative product offerings.

The company reported total assets of approximately $10 billion against total liabilities of about $4 billion, resulting in a debt-to-equity ratio that reflects prudent financial management. The company’s return on equity (ROE) stands at around 20.4%, indicating effective utilization of shareholder funds to generate profits. ON Semiconductor’s net margins have remained healthy at approximately 23.8%, which is indicative of its ability to translate revenue into profit efficiently.

With consistent revenue and earnings growth driven by strategic investments and market demand, the company is well-positioned for continued success as it capitalizes on emerging trends in technology and electrification across various industries.

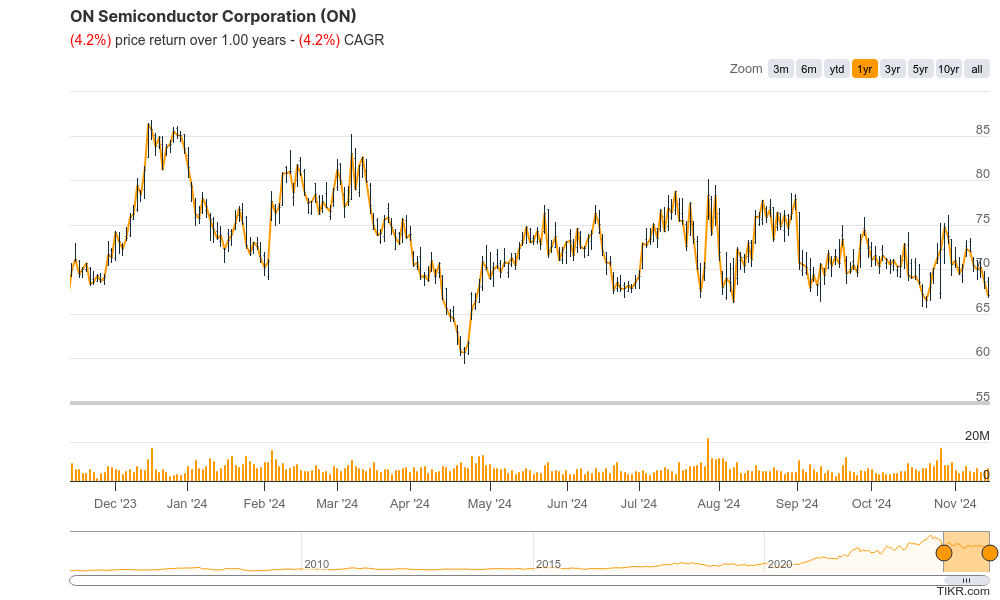

Technical Analysis:

The stock is in a stage 4 decline (bearish) on the monthly chart, with support in the $55 – $60 zone. The weekly chart shows a likely reversal at $64, which would be a reverse head and shoulders (bullish). The daily chart however, should confirm the move higher at the $64 range, at which point it will be a good short term entry to $69 zone.

Bull Case:

Diversified Product Portfolio:

- Power Management: ON Semiconductor is a leading provider of power management solutions, which are essential for a wide range of applications, including automotive, industrial, and consumer electronics.

- Image Sensors: The company’s image sensor technology is used in various applications, such as automotive cameras, industrial sensors, and mobile devices.

- Discrete Semiconductors: ON Semiconductor offers a broad range of discrete semiconductors, including power transistors and diodes.

Strong Financial Performance:

- Consistent Revenue Growth: ON Semiconductor has demonstrated consistent revenue growth over the past few years, driven by strong demand for its products.

- Profitability: The company has a solid track record of profitability and strong cash flow generation.

Bear Case:

Supply Chain Challenges:

- Geopolitical Risks: Geopolitical tensions and trade disputes could disrupt the global supply chain, impacting the availability of critical components and increasing costs.

- Manufacturing Challenges: Manufacturing complexities and capacity constraints could hinder ON Semiconductor’s ability to meet demand and control costs.

Valuation Concerns:

- High Valuation: If the company’s valuation is perceived as too high relative to its growth prospects and earnings potential, it could lead to a decline in the stock price.