Executive Summary:

The Trade Desk, Inc. is a leading technology company that specializes in programmatic advertising. It provides a platform for advertisers to buy digital advertising space in real-time auctions, allowing them to reach targeted audiences across various devices and channels. The company’s platform utilizes advanced data analytics and artificial intelligence to optimize ad campaigns, measure performance, and deliver measurable results. The Trade Desk is known for its commitment to transparency and independence, offering advertisers greater control over their campaigns and access to a wide range of inventory and data partners.

The Trade Desk Inc. reported revenue of $628 million, representing a year-over-year growth of 27%. An Adjusted EBITDA of approximately $363 million for the quarter.

Stock Overview:

| Ticker | $TTD | Price | $118.15 | Market Cap | $58.32B |

| 52 Week High | $132.65 | 52 Week Low | $61.48 | Shares outstanding | 449.65M |

Company background:

The Trade Desk, Inc., a leading technology company, was founded in 2009 by Jeff Green and David Pickles. It emerged from their shared vision to revolutionize digital advertising by leveraging advanced technology and data-driven insights.

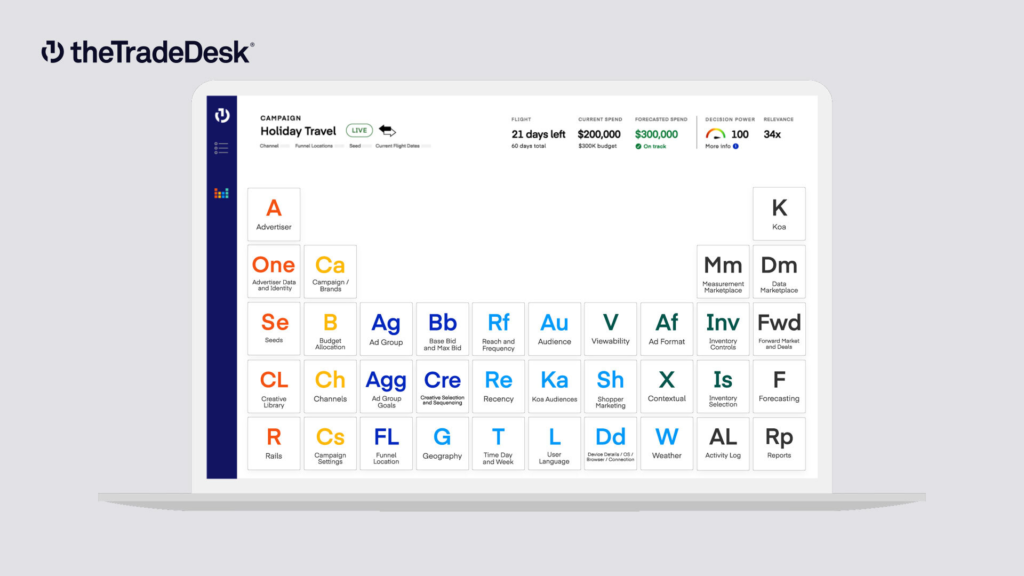

The Trade Desk’s core product is a self-service, cloud-based platform that empowers advertisers to buy digital advertising space in real-time auctions. This platform utilizes sophisticated algorithms and machine learning to optimize ad campaigns across various channels, including display, video, mobile, and connected TV. The Trade Desk has secured funding through venture capital firms and strategic investors, including Founder Collective, IA Ventures, and Ron Conway.

Key competitors in the digital advertising technology space include Google’s DV360, Magnite, and Amazon Ads. The Trade Desk distinguishes itself by its commitment to independence, transparency, and data-driven innovation. This unique approach has enabled the company to build strong relationships with advertisers, publishers, and data providers, solidifying its position as a leading player in the industry. The Trade Desk is headquartered in Ventura, California, and has offices worldwide to serve its global client base.

Recent Earnings:

The Trade Desk Inc. reported a strong third quarter and achieved revenue of $628 million, representing a year-over-year growth of 27%. It is highlighted an Adjusted EBITDA of approximately $363 million for the quarter.

The Trade Desk’s strong performance can be attributed to several factors, including increased adoption of its platform by advertisers, expansion into new markets, and strategic partnerships. The company’s focus on precision, transparency, and data-driven advertising continues to resonate with clients seeking to optimize their digital advertising campaigns.

The company expects revenue of at least $756 million and an Adjusted EBITDA of approximately $363 million. This outlook reflects the company’s confidence in its ability to capitalize on the growing demand for programmatic advertising and maintain its strong momentum. The company experienced growth in both the number of active buyers and the number of ad impressions delivered through its platform. This indicates increased engagement and utilization of the platform by advertisers.

The company’s focus on innovation, customer success, and data-driven advertising has enabled it to deliver impressive financial performance and solidify its leadership position in the market.

The Market, Industry, and Competitors:

The Trade Desk Inc. operates within the digital advertising market, specifically focusing on programmatic advertising through its demand-side platform (DSP). This platform empowers advertisers to purchase ad space across various channels, including display, video, audio, and connected TV (CTV). The company’s emphasis on data-driven media buying allows marketers to optimize their campaigns effectively by leveraging AI for decision-making and accessing a broad inventory of digital ad placements. The Trade Desk continues to position itself as a leader in facilitating more relevant advertising experiences across the open internet, catering to brands and agencies aiming to enhance their customer engagement strategies.

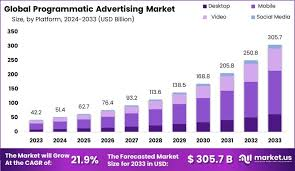

The growth expectations for The Trade Desk and the broader digital advertising market are robust. The global programmatic advertising market is projected to grow at a compound annual growth rate (CAGR) of approximately 20% to 22% from 2023 to 2030, potentially reaching a valuation of over $500 billion by the end of this period. This growth is fueled by advancements in technology, increased adoption of artificial intelligence in advertising strategies, and a shift towards more personalized marketing approaches. As advertisers seek to maximize their return on investment in an increasingly competitive landscape, platforms like The Trade Desk are poised to benefit from these trends.

Unique differentiation:

The Trade Desk faces competition from various players in the digital advertising technology landscape. One of its primary competitors is Google’s DV360, which benefits from Google’s extensive reach and data resources. The Trade Desk differentiates itself by offering a more independent and transparent platform, allowing advertisers to access a wider range of inventory and data sources.

Another notable competitor is Magnite, which combines the capabilities of former rivals The Rubicon Project and Telaria. Magnite offers a comprehensive suite of solutions for digital advertising, including programmatic advertising, video advertising, and mobile advertising. The Trade Desk’s focus on data-driven insights and advanced technology has enabled it to maintain a competitive edge.

Other competitors in the market include Amazon Ads, which leverages its vast user base and e-commerce platform to offer advertising solutions, and smaller independent platforms like StackAdapt and Simpli.fi. While these competitors offer various features and capabilities, The Trade Desk’s strong brand reputation, innovative technology, and commitment to customer success have positioned it as a leading player in the industry.

Data-Driven Innovation:

- Advanced Analytics: The Trade Desk leverages sophisticated data analytics and machine learning to optimize ad campaigns and deliver measurable results.

- Data Partnerships: The company collaborates with various data providers to enhance its data capabilities and provide advertisers with valuable insights.

Focus on Future Trends:

- Emerging Technologies: The Trade Desk actively embraces emerging technologies such as AI, machine learning, and blockchain to drive innovation and stay ahead of the curve.

- Cross-Channel Capabilities: The company offers a unified platform that enables advertisers to manage campaigns across various channels, including display, video, mobile, and connected TV.

Management & Employees:

Jeff Green: Chairman, Chief Executive Officer, and Founder. Green is the visionary leader behind The Trade Desk, driving its growth and innovation.

Tim Sims: Chief Commercial Officer. Sims leads the company’s global client services and inventory teams, driving revenue growth and customer satisfaction.

Ian Colley: Chief Marketing Officer and Executive Vice President. Colley leads the company’s marketing and communications strategy, building brand awareness and driving customer acquisition.

Samantha Jacobson: Chief Strategy Officer and Executive Vice President. Jacobson manages strategic investments and cross-functional initiatives to reinforce The Trade Desk’s position as an industry leader.

Financials:

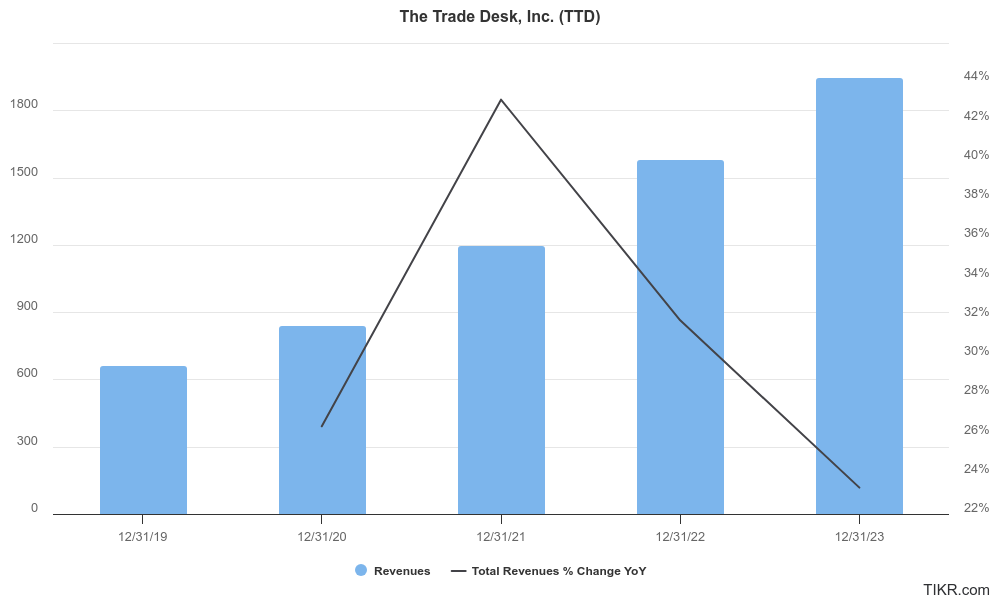

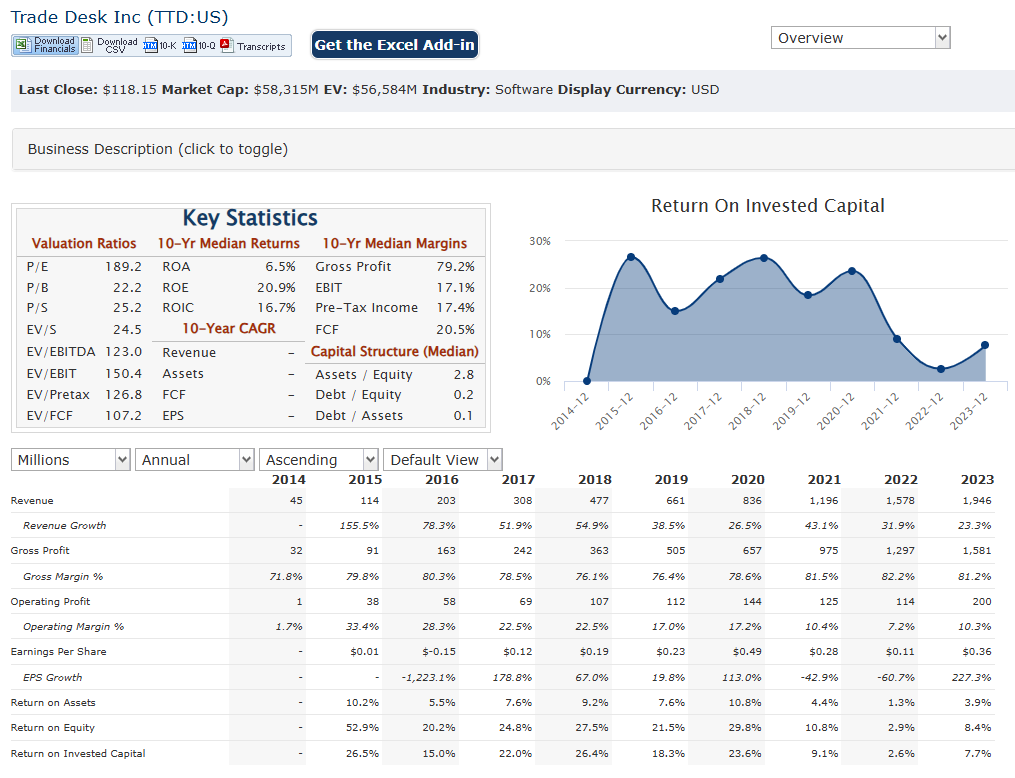

The Trade Desk Inc. has achieved an average annual revenue growth rate of approximately 32.5%, reflecting its ability to capture increasing demand for programmatic advertising solutions. The Trade Desk reported revenue of $628 million, marking a 27% increase compared to $493 million in the same quarter of the previous year. The company’s effective strategies in leveraging data-driven advertising and expanding its service offerings, particularly in connected TV (CTV) and digital audio.

With its net income soaring from $39 million in Q3 2023 to $94 million in Q3 2024, representing an impressive year-over-year increase of 141%. The Trade Desk’s net income has experienced a compound annual growth rate (CAGR) of around 46%, showcasing its operational efficiency and profitability improvements as it scales its business. The adjusted earnings per share (EPS) for Q3 2024 stood at $0.41, further highlighting the company’s financial health and commitment to returning value to shareholders.

The Trade Desk maintains a solid financial position, with a focus on sustainable growth and prudent cash management. The company has consistently invested in technology and infrastructure to enhance its platform capabilities while managing operational costs effectively. The Trade Desk had repurchased $54 million of its Class A common stock, reflecting confidence in its future prospects and a commitment to shareholder returns. With a customer retention rate exceeding 95%, the company is well-positioned to capitalize on emerging opportunities within the digital advertising space.

Technical Analysis:

The stock is on a stage 2 markup on the monthly chart, stage 3 consolidation (neutral) on the weekly chart and stage 4 markdown (bearish) on the daily chart. That usually indicates a move lower to $107 zone first and a likely move lower to $97 range, but longer term the stock is a good bet based on the monthly trend.

Bull Case:

Competitive Advantage:

- Independence and Transparency: The Trade Desk operates an independent platform, allowing advertisers to access a wide range of inventory and data sources. This transparency and flexibility are key differentiators.

- Strong Customer Relationships: The company has built strong relationships with advertisers and publishers, fostering loyalty and driving long-term growth.

Forward-Looking Vision:

- Innovation: The Trade Desk is committed to innovation, continuously developing new products and features to stay ahead of the curve.

- Strategic Partnerships: The company actively seeks strategic partnerships to expand its reach and capabilities.

Bear Case:

Valuation Concerns:

- Premium Valuation: The stock often trades at a significant premium to the broader market, which may not be justified by its growth prospects, especially if the market experiences a downturn.

- Market Sentiment: Changes in overall market sentiment, particularly in the technology sector, can impact the stock price, even if the company’s fundamentals remain strong.

Cookie Phase-out:

- Impact on Targeting: The phase-out of third-party cookies could potentially impact the effectiveness of targeted advertising, which is a core part of The Trade Desk’s business.

Future Growth:

- Sustaining Growth: Maintaining the current pace of growth may become increasingly difficult as the company matures and faces tougher competition.