Executive Summary:

Quanta Services Inc. is a leading provider of specialized contracting services to the electric power industry in North America. The company specializes in transmission, distribution, and infrastructure services, including building, upgrading, and maintaining power delivery networks. Quanta Services is known for its extensive network of operating companies, which allows it to provide a comprehensive range of services to customers.

Quanta Services Inc. reported revenue of $6.49 billion. Earnings per share (EPS) reached $1.95.

Stock Overview:

| Ticker | $PWR | Price | $330.98 | Market Cap | $48.86B |

| 52 Week High | $333.24 | 52 Week Low | $173.62 | Shares outstanding | 147.61M |

Company background:

Quanta Services Inc. is a leading provider of specialized contracting services to the electric power and pipeline industries. The company was founded in 1997 by a group of industry veterans who saw an opportunity to provide high-quality, efficient services to a growing market. Quanta Services has grown through strategic acquisitions and organic growth.

Quanta Services offers a comprehensive range of services, including transmission and distribution construction and maintenance, pipeline construction and repair, and underground utility installation. The company’s diverse service offerings enable it to cater to the evolving needs of its customers in the energy and infrastructure.

Quanta Services faces competition from a variety of companies, including both large, diversified contractors and smaller, specialized firms.

- MDU Resources Group: A diversified energy and infrastructure company with a strong presence in the electric transmission and distribution market.

- Quanta Services: A leading provider of specialized contracting services to the electric power and pipeline industries in North America.

- ITC Holdings Corp: A leading independent transmission company in the United States.

- Duke Energy: A major energy holding company with significant operations in the electric power and natural gas sectors.

Quanta Services is headquartered in Houston, Texas, and has a operational presence throughout North America. The company’s network of operating companies allows it to provide localized services to its customers while leveraging the resources and expertise of a larger organization.

Recent Earnings:

Quanta Services Inc. reported revenue of $6.49 billion, marking 15.5% increase compared to the same period in 2023. This growth was primarily driven by increased demand for infrastructure services across North America, particularly in the electric power and pipeline sectors.

Earnings per share (EPS) reached $1.95, representing a 7.6% increase year-over-year. This exceeded analyst expectations, demonstrating the company’s strong operational performance and ability to capitalize on favorable market conditions.

The company generated a free cash flow of $539.5 million, reflecting its strong financial position and efficient capital allocation. the company’s backlog reached a record high of $34.0 billion, providing visibility into future revenue and earnings growth.

Quanta Services expects continued strong performance, driven by robust demand for its services and ongoing investments in infrastructure projects. While the company did not provide specific guidance, management expressed confidence in its ability to deliver solid results and create long-term value for shareholders.

The Market, Industry, and Competitors:

Quanta Services Inc. operates primarily in the engineering and construction sector, focusing on providing comprehensive infrastructure solutions across several industries, including electric power, oil and gas, communications, and renewable energy. The company is segmented into three main areas: Electric Power, which offers services related to the construction and maintenance of power transmission and distribution systems; Renewable Energy, which supports the growing demand for sustainable energy solutions; and Underground and Infrastructure, which caters to the transportation and processing of natural resources. With a market capitalization of approximately $46 billion and a workforce of over 52,000 employees, Quanta is a significant player in the infrastructure services market, particularly in North America but also extending to international markets like Canada and Australia.

The global push for sustainable energy solutions is likely to enhance demand for Quanta’s services, especially as governments and private sectors prioritize infrastructure upgrades to meet environmental standards. Analysts project a compound annual growth rate (CAGR) of around 9% to 12% for the company through 2030, reflecting robust growth expectations as it capitalizes on the transition towards greener energy sources and modernization of existing utility infrastructures.

Unique differentiation:

MasTec: A leading infrastructure construction company providing services to the energy, communications, and broadband industries.

MDU Resources Group: A diversified energy and infrastructure company with a strong presence in the electric transmission and distribution market.

EMCOR Group: A Fortune 500 company providing mechanical and electrical construction and facilities services.

MYR Group: A specialized electrical contractor providing services to the energy and infrastructure markets.

Dycom Industries: A provider of specialty contracting services to the telecommunications industry.

1. Focus on Safety and Quality:

- Quanta Services prioritizes safety and quality in all its operations.

- This commitment to safety and quality standards enhances its reputation and attracts customers who value reliability and risk management.

2. Strategic Acquisitions:

- The company has a history of strategic acquisitions to expand its service offerings and geographic reach.

- These acquisitions enable Quanta Services to capitalize on emerging opportunities and strengthen its market position.

Management & Employees:

Duke Austin: Chief Executive Officer and President

David McClanahan: Chairman of the Board

Scot Fluharty: President, Underground Utilities & Industrial

Karl Studer: President, Electric Power

Financials:

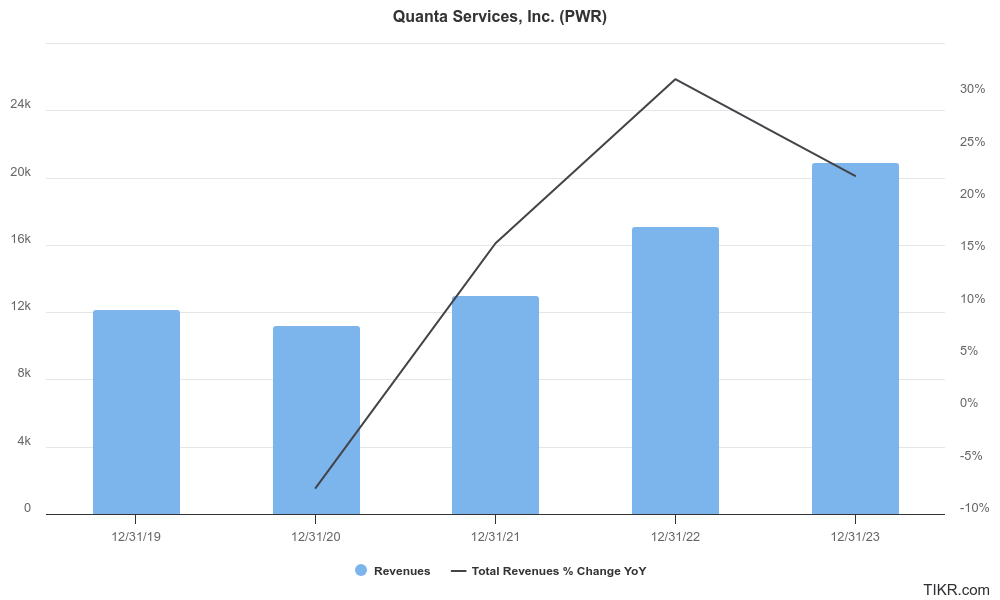

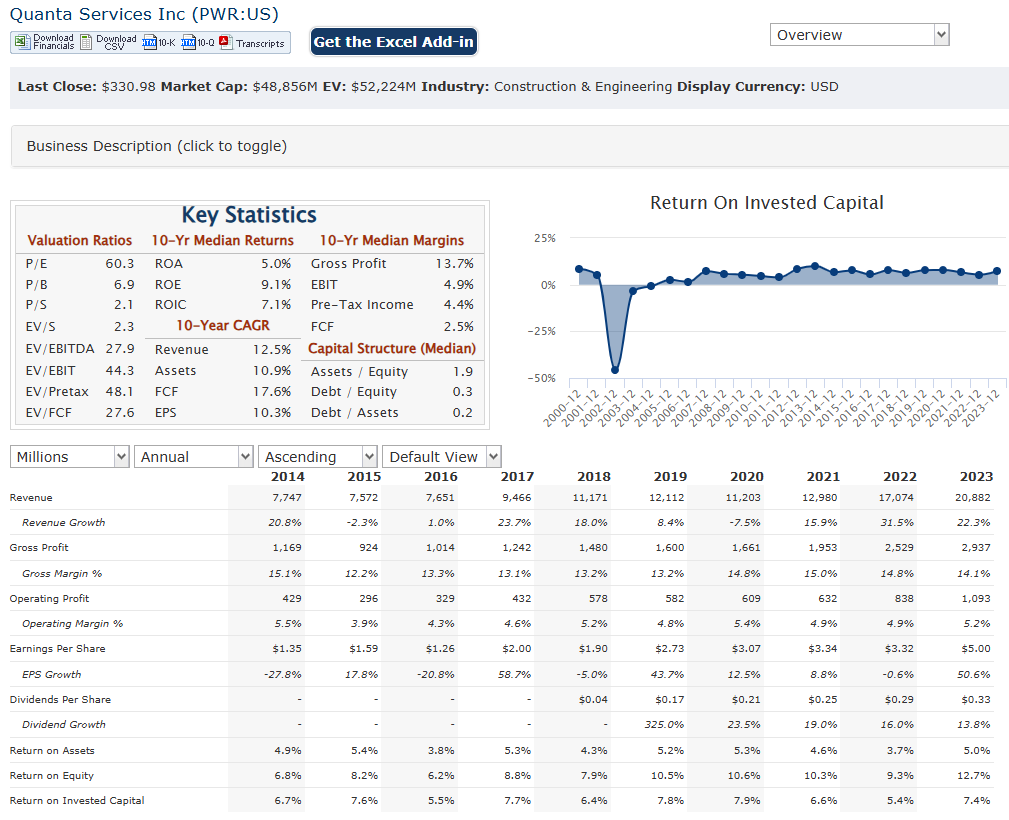

Quanta Services Inc. has reported revenue increased from approximately $10.4 billion to about $20.88 billion, reflecting a compound annual growth rate (CAGR) of around 14.7%. This growth trajectory has been driven by strong demand across its segments, particularly in electric power and renewable energy, as the company capitalizes on ongoing infrastructure investments and energy transition trends.

The net income attributable to common stock rose from about $400 million in 2019 to approximately $811 million in 2024, which translates to a CAGR of about 16.2% over the same period. The earnings per share (EPS) followed a similar upward trend, increasing from around $2.00 to $5.41, highlighting the company’s ability to enhance profitability alongside revenue growth. Quanta’s earnings growth has consistently outpaced many peers in the construction industry, indicating effective operational management and strategic positioning.

Quanta reported total assets exceeding $6 billion, supported by a solid cash position that enables continued investment in growth opportunities and strategic acquisitions. The company’s debt levels have remained manageable, allowing it to maintain a favorable debt-to-equity ratio while pursuing expansion initiatives.

Quanta Services Inc. showcases a well-executed strategy focused on growth and profitability, underpinned by a solid balance sheet that supports its ambitions in the evolving infrastructure landscape.

Technical Analysis:

The stock is on a strong stage 2 markup (bullish) on the monthly and weekly chart. The daily chart is a strong stage 2 as well, with support at $302, but the near term move is to $350 range, at which point it should head lower to retest the 100 day moving average at $300.

Bull Case:

Strong Industry Tailwinds

- Renewable Energy Boom: The increasing adoption of renewable energy sources like solar and wind power requires substantial infrastructure development, which benefits Quanta Services.

- Energy Transition: As the energy landscape shifts towards cleaner energy sources, Quanta Services is well-positioned to capitalize on the growing demand for grid modernization and new energy infrastructure.

Strategic Advantages

- Diverse Service Offerings: Quanta Services offers a wide range of services, including transmission and distribution construction and maintenance, pipeline construction and repair, and underground utility installation.

- Experienced Workforce: The company’s experienced workforce is crucial for executing complex projects efficiently and meeting stringent quality standards.

Potential for Future Growth

- Strategic Acquisitions: The company has a history of successful acquisitions to expand its service offerings and geographic reach.

- Technological Advancements: Quanta Services can leverage technological advancements to improve efficiency and reduce costs.

Bear Case:

Economic Downturn

- A significant economic downturn could lead to reduced capital expenditure by utilities, which could negatively impact Quanta Services’ revenue and profitability.

- Interest rate hikes could increase borrowing costs and reduce investment in infrastructure projects.

Regulatory Risks

- Changes in regulatory policies, such as stricter environmental regulations or changes in utility rate structures, could impact the company’s operations and profitability.

- Potential regulatory investigations or legal proceedings could divert management attention and resources.

Execution Risk

- The successful execution of large-scale projects can be challenging and subject to various risks, including weather-related delays, labor shortages, and supply chain disruptions.

- Failure to execute projects on time and within budget could negatively impact the company’s reputation and financial performance.