Executive Summary:

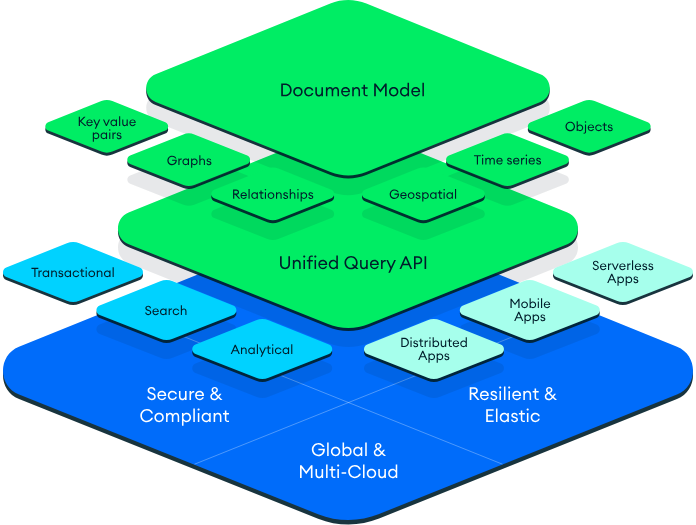

MongoDB Inc. is a leading provider of database solutions for modern applications. The company develops and supports the MongoDB database, a popular NoSQL database known for its flexibility, scalability, and ease of use. MongoDB’s database platform enables developers to build and deploy applications quickly and efficiently, handling large volumes of data and complex queries with ease. The company offers a range of products and services, including on-premise and cloud-based deployments, professional services, and developer tools, catering to a wide variety of businesses and industries.

MongoDB Inc. reported a total revenue of $478.1 million, up 13% year over year. It saw a strong performance with revenue growth of 27% year over year, contributing 71% of the total quarterly revenue.

Stock Overview:

| Ticker | $MDB | Price | $283.54 | Market Cap | $20.94B |

| 52 Week High | $506.62 | 52 Week Low | $212.74 | Shares outstanding | 73.87M |

Company background:

MongoDB Inc., founded in 2007 by Dwight Merriman, Eliot Horowitz, and Kevin Ryan, is a leading provider of database solutions for modern applications. The company was initially funded through venture capital firms like Sequoia Capital, NEA, and Google Ventures. MongoDB’s flagship product, the MongoDB database, is a popular NoSQL database known for its flexibility, scalability, and ease of use. It stores data in JSON-like documents with flexible schemas, making it well-suited for handling complex and unstructured data.

MongoDB offers a range of products and services, including MongoDB Atlas, a fully managed database-as-a-service offering, and MongoDB Enterprise Advanced, a comprehensive on-premise and private cloud solution. The company also provides professional services, developer tools, and a vibrant community to support its users.

MongoDB faces competition from various players in the database market, including traditional relational database vendors like Oracle and Microsoft and other NoSQL database providers such as Amazon DynamoDB, Apache Cassandra, and Couchbase. MongoDB’s strong focus on developer experience, ease of use, and performance has enabled it to carve out a market share and attract a large and loyal user base. MongoDB Inc. is headquartered in New York City, USA.

Recent Earnings:

MongoDB Inc. reported its second-quarter fiscal 2025 financial results. The company delivered strong revenue growth, with total revenue reaching $478.1 million, representing a 13% year-over-year increase. The company’s flagship database-as-a-service offering, which saw a 27% year-over-year increase in revenue and now accounts for 71% of the total quarterly revenue.

They highlighted continued strong customer growth with over 50,700 customers. The company’s performance exceeded expectations in key areas such as MongoDB Atlas revenue growth and customer acquisition.

MongoDB’s dollar-based net retention rate exceeded 120% for the 19th consecutive quarter. The company also generated positive free cash flow, demonstrating its ability to invest in growth initiatives while maintaining financial discipline. MongoDB expects to deliver revenue between $1.925 billion and $1.955 billion, representing a year-over-year growth rate of 19% to 20%. The company also anticipates continued strong growth in MongoDB Atlas and expects to maintain its leadership position in the database market.

The Market, Industry, and Competitors:

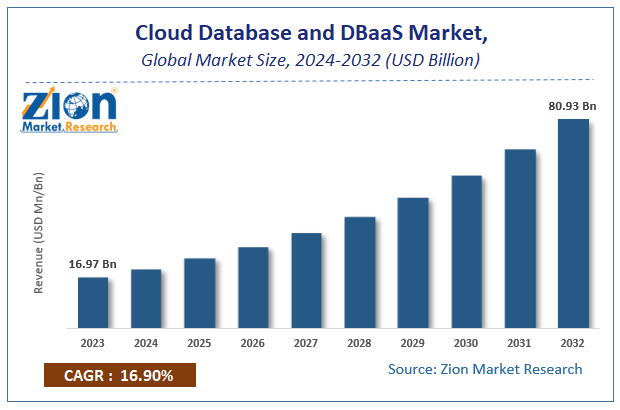

MongoDB Inc. operates primarily in the cloud database market, which is a segment of the broader cloud computing industry. MongoDB’s NoSQL database platform is particularly notable for its flexibility, scalability, and ability to handle diverse data types, making it a preferred choice for modern applications. The global cloud database market was valued at approximately $480 billion in 2022 and is projected to experience significant growth, with estimates suggesting it could reach around $2.2 trillion by 2032, reflecting a CAGR of 17% during this period.

MongoDB is expected to see substantial growth driven by increasing demand for cloud-based solutions and the rising adoption of NoSQL databases across various industries. Analysts project that MongoDB’s stock could reach an average price of $695.03 by 2030, representing a 152.97% increase from its current levels. It has continuous innovation in areas such as vector search for AI applications and real-time data analytics. As organizations increasingly recognize the benefits of cloud computing, MongoDB’s strategic initiatives position it well to capitalize on this growth trajectory.

Unique differentiation:

MongoDB, while a leading player in the NoSQL database market, faces competition from various established and emerging players. Traditional relational database vendors like Oracle and Microsoft offer robust database solutions but often lack the flexibility and scalability required for modern applications. These vendors are increasingly investing in NoSQL and cloud-based offerings to compete with MongoDB.

Other prominent NoSQL database providers include Amazon DynamoDB, Apache Cassandra, and Couchbase. Amazon DynamoDB, a fully managed NoSQL database service offered by AWS, benefits from the widespread adoption of AWS and its integration with other AWS services. Apache Cassandra, an open-source distributed NoSQL database, is known for its high scalability and fault tolerance. Couchbase, another popular NoSQL database, offers a combination of key-value and document-oriented storage, making it suitable for various use cases.

By focusing on developer experience, performance, and scalability, MongoDB aims to solidify its leadership position and capture a larger share of the growing NoSQL database market.

Flexibility and Scalability:

- Flexible Data Model: MongoDB’s document-oriented data model allows for highly flexible schema designs, making it easy to adapt to evolving data structures.

- Horizontal Scalability: MongoDB’s distributed architecture enables seamless scaling to handle increasing data volumes and user loads.

Developer Experience:

- Developer-Friendly Interface: MongoDB provides a simple and intuitive query language, making it easy for developers to work with the database.

- Rich Ecosystem: A large and active developer community, along with a wide range of tools and libraries, simplifies development and integration.

Cloud-Native and Multi-Cloud Support:

- Seamless Cloud Integration: MongoDB Atlas, the company’s fully managed cloud database service, offers easy deployment and management on major cloud platforms like AWS, Azure, and GCP.

- Hybrid and Multi-Cloud Flexibility: MongoDB supports hybrid and multi-cloud deployments, allowing organizations to leverage the best of both worlds.

Management & Employees:

Dev Ittycheria: As the President and CEO, Dev leads MongoDB’s strategic direction and overall operations. He is responsible for driving the company’s growth and innovation.

Sahir Azam: In his role as Chief Product Officer, Sahir is responsible for driving product innovation and ensuring that MongoDB’s offerings meet the evolving needs of its customers.

Harsha Jalihal: As the Chief People Officer, Harsha leads MongoDB’s human resources function, focusing on talent acquisition, employee development, and fostering a positive company culture.

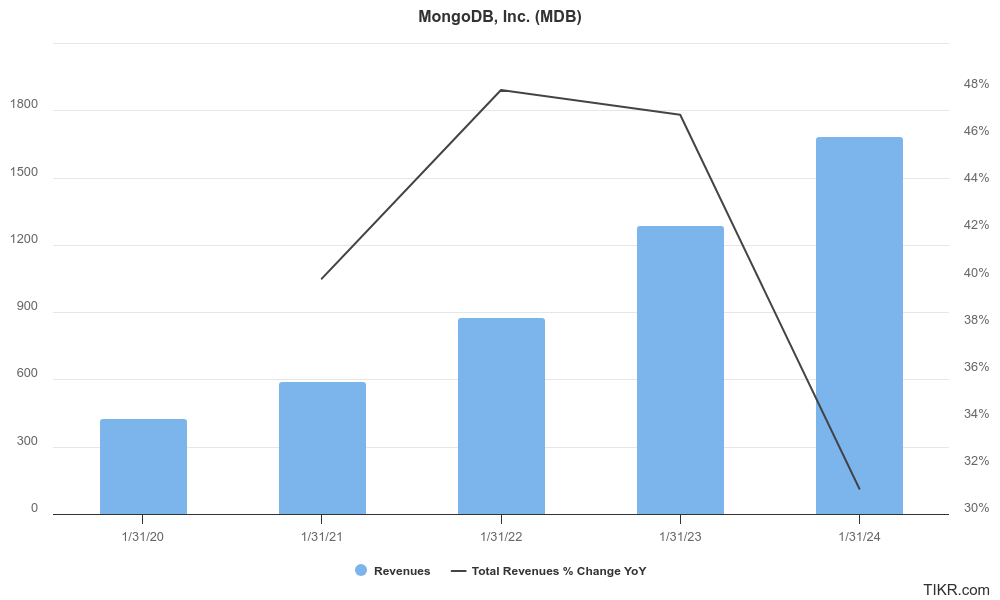

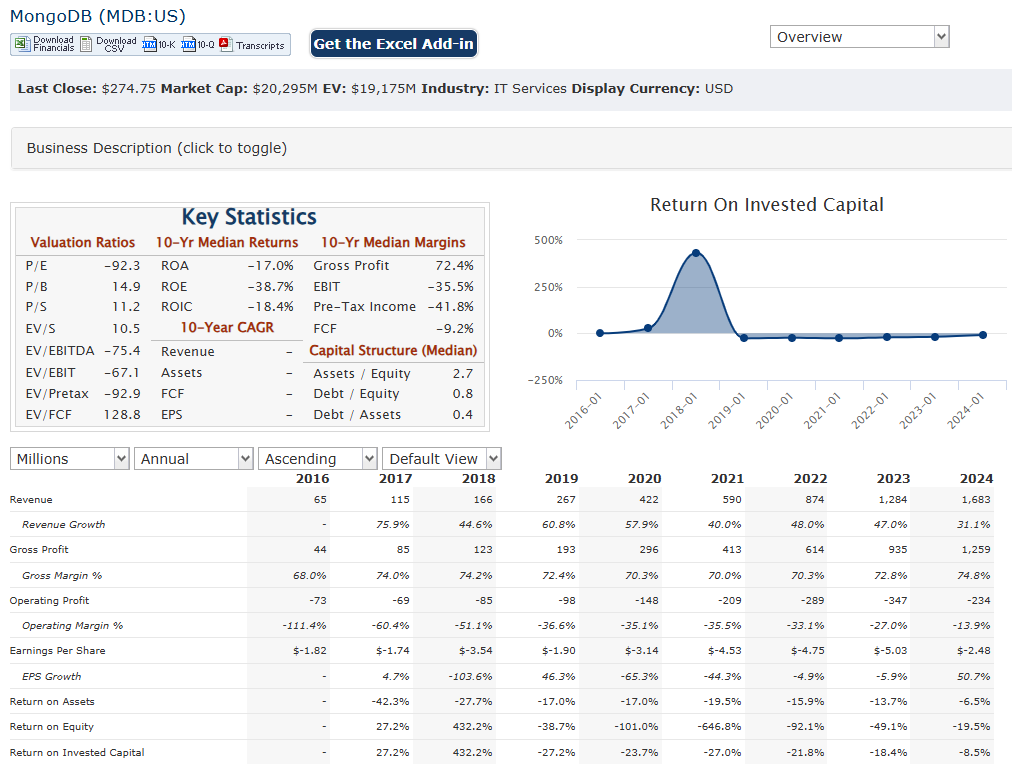

Financials:

MongoDB Inc. has reported a total revenue of $1.68 billion, reflecting a 31% increase year-over-year. This growth trajectory is impressive, with an average annual revenue growth rate (CAGR) of approximately 32.2% over the last five years. The company’s fully managed cloud database service, has become a key driver of its overall sales.

MongoDB has faced challenges, reporting a decline in earnings at an average annual rate of 5.8% during the same period. This downturn contrasts sharply with the broader IT industry, which has seen earnings growth of about 5.4% annually. MongoDB has made strides in improving its operational efficiency and cash flow management, generating $121.5 million in cash from operations for the fiscal year 2024.

It has approximately $2 billion in cash and cash equivalents as of January 2024. The company has also improved its free cash flow significantly, reporting $109.9 million for fiscal 2024 compared to negative free cash flow in previous years. This positive cash flow trend indicates that while MongoDB is not yet profitable on a net income basis, it is moving towards operational sustainability and may achieve profitability in the future as it capitalizes on its growing customer base and expanding market share.

MongoDB’s strategic focus on enhancing its product offerings and scaling its cloud services is expected to drive continued revenue growth and potentially improve earnings as the company matures in its operational model.

Technical Analysis:

A bear flag on the monthly chart is a warning sign for the stock to move lower after its resistance at $300. The weekly chart shows a stage 2 markup (Bullish) but the stock has been unable to clear $300. The daily chart shows a move in the near term to $300 with its momentum, but a move lower to retest $250 range.

Bull Case:

Innovative Product Offerings and Strong Customer Base:

- MongoDB Atlas: The company’s flagship database-as-a-service offering, MongoDB Atlas, has gained significant traction and is driving revenue growth.

- Diverse Customer Base: MongoDB caters to a wide range of industries, including technology, finance, healthcare, and retail, providing a diverse revenue stream.

Strong Financial Performance and Future Growth Prospects:

- Improving Profitability: MongoDB has made significant strides in improving its operating margins and generating positive free cash flow.

- Future Growth Opportunities: The increasing demand for modern data solutions and the growing adoption of cloud computing present significant growth opportunities for MongoDB.

Bear Case:

Economic Uncertainty:

- Economic Downturns: Economic downturns can impact technology spending, leading to reduced demand for MongoDB’s products and services.

- Macroeconomic Factors: Global economic conditions, such as interest rate hikes and inflation, can negatively impact MongoDB’s business.

Execution Risks:

- Product Development Challenges: The development of new products and features can be complex and time-consuming, and any delays or failures could impact the company’s growth.

- Customer Acquisition and Retention: Acquiring and retaining customers in a competitive market can be challenging, and any missteps could hurt the company’s revenue growth.