Executive Summary:

Dollar Tree Inc. is a leading operator of discount variety stores in North America. The company operates under the iconic brands of Dollar Tree and Family Dollar, offering a wide range of products at affordable prices. Known for its “thrill-of-the-hunt” shopping experience, Dollar Tree provides a diverse assortment of goods, including seasonal items, party supplies, crafts, snacks, cleaning supplies, and more. Dollar Tree has established itself as a popular destination for budget-conscious consumers across the United States and Canada.

Dollar Tree Inc. reported earnings per share (EPS) of $0.62. Its revenue for the quarter is $7.3 billion.

Stock Overview:

| Ticker | $DLTR | Price | $67.00 | Market Cap | $14.40B |

| 52 Week High | $151.22 | 52 Week Low | $60.82 | Shares outstanding | 214.99M |

Company background:

Dollar Tree Inc., a prominent name in the discount retail industry, traces its roots back to 1986 when it was founded by Doug Perry, Macon Brock, and Ray Compton. The company’s unique business model, offering a wide range of products at a fixed price of $1, quickly gained popularity among budget-conscious consumers.

Dollar Tree’s product assortment is diverse, encompassing everything from home goods and party supplies to food and beverages. The company’s success can be attributed to its ability to source products efficiently and negotiate favorable deals with suppliers, allowing it to maintain its low-price strategy.

In the competitive landscape of discount retail, Dollar Tree faces competition from other major players such as Dollar General and Five Below. Dollar Tree’s strong brand recognition, extensive store network, and loyal customer base have enabled it to maintain a market share.

Dollar Tree Inc. is headquartered in Chesapeake, Virginia, where it oversees its operations across the United States and Canada. With a focus on value, convenience, and a unique shopping experience, Dollar Tree continues to be a popular choice for consumers seeking affordable products.

Recent Earnings:

Dollar Tree Inc. reported revenue of $7.3 billion slightly exceeded analysts’ expectations of $7.2 billion, and its earnings per share (EPS) of $0.62 fell short of the projected $0.67. This represents a decline of 1.3% compared to the same period last year.

Dollar Tree experienced a 0.7% decrease in enterprise same-store sales, with Dollar Tree same-store sales declining by 1.3% and Family Dollar same-store sales decreasing by 0.1%. Despite these challenges, the company’s gross margin improved to 31.9% from 31.2% in the prior-year quarter, driven by higher merchandise margins.

Dollar Tree remains cautious about the economic environment and expects continued pressure on consumer spending. The company reaffirmed its full-year 2023 guidance, anticipating net sales in the range of $31.8 billion to $32.4 billion and adjusted EPS between $4.75 and $5.05. The company’s focus on value and its strong brand recognition position it well to navigate the challenging retail landscape.

The Market, Industry, and Competitors:

Dollar Tree, Inc. operates primarily in the discount retail sector, offering a wide range of products at low prices, typically around one dollar. The company has strategically shifted from its traditional single-price model to a multi-price point approach, allowing it to attract a broader customer base and compete more effectively with other discount retailers like Dollar General and Five Below. This adaptation is crucial as it enables Dollar Tree to manage rising costs while preserving profit margins and enhancing customer traffic through a more diverse product offering.

Dollar Tree is expected to continue its growth trajectory, with projections indicating an average stock price of approximately $192.06, reflecting a growth rate of about 12.5% from 2029. Analysts anticipate that the company’s investments in automation, artificial intelligence, and sustainability initiatives will significantly enhance operational efficiency and customer experience. The evolving retail landscape, characterized by changing consumer preferences and shopping habits, is likely to favor Dollar Tree’s adaptive strategies.

Unique differentiation:

Dollar Tree Inc. operates in a competitive landscape dominated by several key players. One of its primary competitors is Dollar General, which has a larger store count and a broader product assortment. Dollar General’s focus on rural areas and its strong distribution network gives it a competitive edge.

Another notable competitor is Five Below, which differentiates itself by offering trendy products at affordable prices, primarily targeting a younger demographic. Five Below’s emphasis on impulse purchases and its unique shopping experience attracts a different customer base than Dollar Tree.

Traditional retailers like Walmart and Target, with their vast product offerings and strong brand recognition, also pose competition to Dollar Tree. While these larger retailers may not specialize in the extreme value segment, they can offer competitive prices on certain products, particularly during promotional periods.

The competitive landscape for Dollar Tree is dynamic, with new players and emerging trends continually shaping the industry. The company’s ability to adapt to changing consumer preferences, maintain its low-cost advantage, and effectively compete with these rivals will be crucial to its long-term success.

Dollar Tree Inc. differentiates itself from competitors through its unique pricing strategy and curated product assortment. The company’s signature $1 price point offers a straightforward and predictable shopping experience, appealing to budget-conscious consumers. This fixed pricing model simplifies decision-making and allows customers to plan their purchases effectively.

Dollar Tree’s focus on a carefully selected assortment of products, including seasonal items, party supplies, home goods, and snacks, creates a sense of discovery and excitement for shoppers. The company’s “thrill-of-the-hunt” approach encourages customers to explore the store and find hidden gems, enhancing the overall shopping experience.

Management & Employees:

Michael Creedon Jr.: Currently serving as the Interim CEO, Creedon previously held the position of Chief Operating Officer.

Bobby Aflatooni: The Chief Information Officer, leading the company’s technology strategy.

Bruce A. Walters: The Chief Development Officer, overseeing real estate and store development.

Financials:

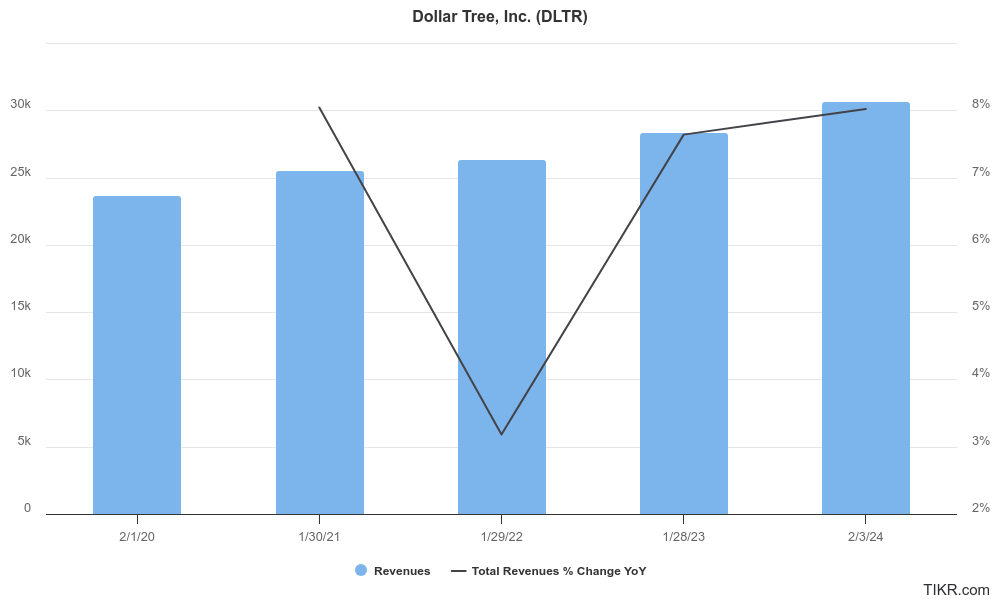

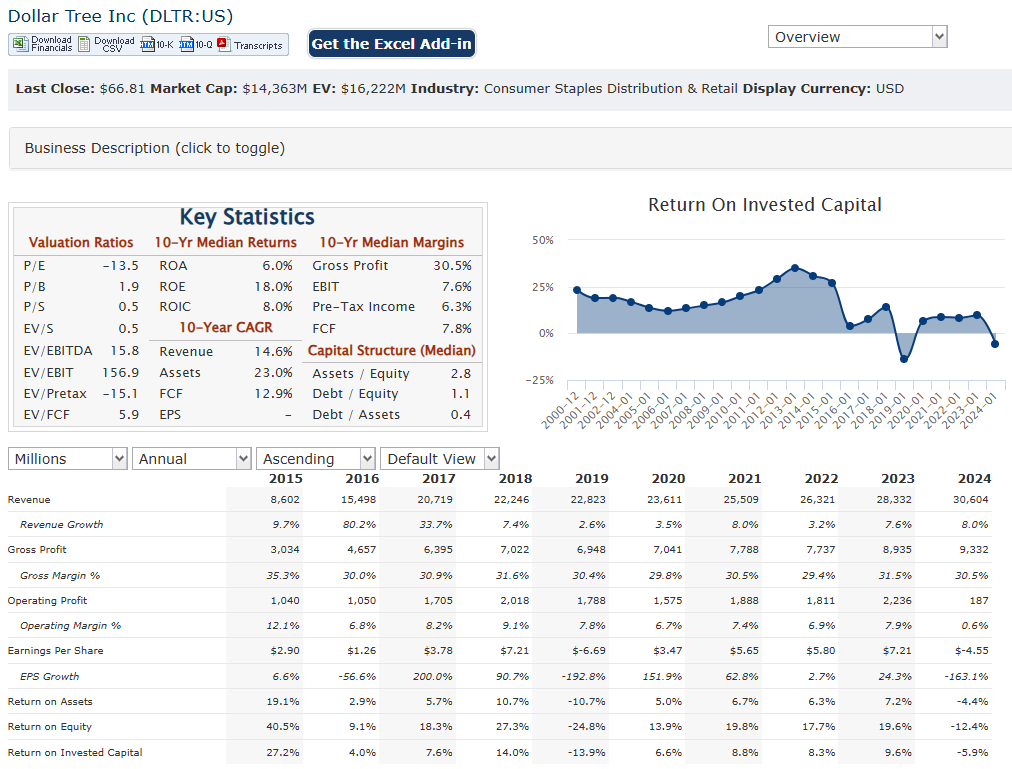

Dollar Tree, Inc. has revenue grew at an average annual rate of approximately 5.9%. This growth was largely driven by the expansion of its store base and the introduction of a multi-price point strategy, which allowed for a broader range of products and attracted more customers. Dollar Tree’s earnings growth has been lower, averaging only 1.6% annually during the same period. This underperformance in earnings relative to revenue growth reflects rising operational costs and competitive pressures within the discount retail sector.

The company’s earnings per share (EPS) growth mirrored this trend, with a modest annual increase of 1.5%. The fiscal year 2024 has seen further challenges, with Dollar Tree reporting diluted EPS of $0.62 for the second quarter, down 31.9% compared to the previous year. The net margin has also been under pressure, currently sitting at -3.4%, indicating that the company is grappling with profitability issues while trying to maintain its market position.

The company has a negative return on equity of -14.4%, reflecting its unprofitability in recent periods. Additionally, while gross profit increased by 3.7% to $2.21 billion in the latest quarter, this was accompanied by rising selling, general, and administrative expenses which accounted for 26.3% of total revenue. The company’s strategic initiatives—including store openings and conversions—aim to enhance operational efficiency and drive future growth.

The projected compound annual growth rate (CAGR) for revenue remains positive at around 5-6%, but unless it can improve its earnings performance and manage costs effectively, the outlook for sustained financial health will remain uncertain as it navigates a competitive retail landscape.

Technical Analysis:

The stock is in a stage 4 decline (bearish) markdown on all 3 time frames, with support in the $51 to $58 zone, where it could reverse, but the short and long term timeframes do not support an investment yet.

Bull Case:

Potential for Margin Expansion: As the company continues to optimize its supply chain and negotiate favorable deals with suppliers, there is potential for margin expansion. This could positively impact profitability and shareholder value.

Defensive Characteristics: Dollar Tree’s business model, focused on essential products at affordable prices, makes it somewhat defensive against economic downturns. In times of economic uncertainty, consumers may turn to discount retailers like Dollar Tree.

Bear Case:

Supply Chain Disruptions: The company’s operations are susceptible to supply chain disruptions, such as those caused by global events, natural disasters, or geopolitical tensions. These disruptions can lead to increased costs, product shortages, and reduced profitability.

Wage Inflation: Rising labor costs can negatively impact Dollar Tree’s profitability, especially considering its low-price point strategy. The company may struggle to maintain its margins if it needs to increase wages to attract and retain employees.

Limited Pricing Power: Dollar Tree has limited pricing power. The company may face challenges in passing on increased costs to consumers, which could negatively impact its margins.