Executive Summary:

Snap Inc., formerly known as Snapchat Inc., is a technology company that focuses on camera technology. Its flagship product, Snapchat, is a popular social media app that allows users to share photos and videos that disappear after a short period. Snap Inc. also produces augmented reality glasses called Spectacles and has ventured into other areas like augmented reality filters and lenses. The company’s mission is to improve the way people live and communicate through the power of the camera.

Snap Inc. reported a net loss of $153 million, a improvement from the $368 million loss in the same quarter last year. Revenue for the quarter reached $1.37 billion, marking a 15% year-over-year increase.

Stock Overview:

| Ticker | $SNAP | Price | $12.20 | Market Cap | $20.25B |

| 52 Week High | $17.90 | 52 Week Low | $8.29 | Shares outstanding | 1.40B |

Company background:

Snap Inc., formerly known as Snapchat Inc., is a technology company that was founded on September 16, 2011, by Evan Spiegel, Bobby Murphy, and Reggie Brown. The company is headquartered in Santa Monica, California. Snap Inc. is best known for its popular social media app, Snapchat, which allows users to share photos and videos that disappear after a short period. The app has gained significant popularity, especially among younger demographics, for its unique features like disappearing messages, filters, and augmented reality lenses.

Snap Inc. has received substantial funding from various investors, including venture capital firms and strategic partners. Snap Inc. has also ventured into other products and services, such as Spectacles, a line of smart glasses that capture photos and videos, and augmented reality filters for Snapchat.

Snap Inc. faces competition from various social media platforms, including Meta Platforms (formerly Facebook), TikTok, and Instagram. These companies offer similar features and target similar demographics, making the competition intense. Snap Inc. has differentiated itself by focusing on unique features like ephemeral content, augmented reality, and a strong emphasis on mobile-first experiences.

Recent Earnings:

Snap Inc. reported its third-quarter 2024 earnings on October 22, 2024, revenue for the quarter reached $1.37 billion, marking a 15% year-over-year increase. By the success of its direct response advertising business and the Snapchat+ subscription service.

While the company reported a net loss of $153 million, it was a improvement compared to the $368 million loss in the same quarter of the previous year. The net loss was slightly higher than anticipated, it did not overshadow the overall positive financial performance.

Snap Inc. reported an increase in daily active users, reaching 443 million. This growth indicates the continued popularity of the Snapchat app and its ability to attract and retain users. The company also highlighted the success of its augmented reality initiatives, with a growing number of users engaging with AR filters and lenses.

For the fourth quarter of 2024, Snap Inc. projected revenue between $1.4 billion and $1.44 billion. This guidance implies a year-over-year growth rate of 10% to 14%. The company also anticipates adjusted EBITDA to be between $100 million and $130 million for the quarter. This positive outlook reflects the company’s confidence in its future growth prospects.

The Market, Industry, and Competitors:

Snap Inc. operates primarily in the digital content creation and social media markets, focusing on its flagship product, Snapchat. The company has positioned itself uniquely within the competitive landscape of social media by emphasizing ephemeral content and augmented reality (AR) features, catering especially to younger demographics. As of 2023, Snap reported 414 million daily active users, with a portion of its growth attributed to international markets, particularly India, where it aims to capitalize on the large Gen Z population.

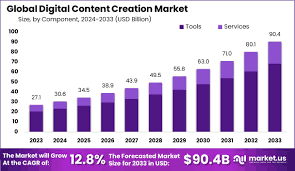

The global digital content creation market is projected to grow at a compound annual growth rate (CAGR) of 12.5 to 13.5%, reaching an estimated value of $25.6 billion in 2022. Snap Inc. is expected to benefit from this growth as digital advertising spending is forecasted to reach $1 trillion by 2026, driven by advancements in connected TV and internet advertising. Snap’s ongoing investments in AR and AI technologies are anticipated to enhance user engagement and create new monetization opportunities. The company’s efforts to expand its user base and improve platform functionality suggest a promising trajectory for revenue growth over the coming years, despite current challenges related to monetization and competition.

Unique differentiation:

Snap Inc. primarily competes with other social media platforms that target similar demographics, particularly younger users. One of the most significant competitors is Meta Platforms, which owns popular apps like Instagram and Facebook. Instagram, in particular, has aggressively adopted features similar to Snapchat, such as Stories and Reels, which directly challenge Snapchat’s core offerings.

Another major competitor is TikTok, a short-form video sharing app that has gained immense popularity, especially among younger generations. TikTok’s innovative algorithm and user-generated content have attracted a large user base, potentially diverting attention away from Snapchat.

Snap Inc. also faces competition from other emerging social media platforms and messaging apps. The competitive landscape in the social media industry is constantly evolving, and Snap Inc. must continuously innovate and adapt to maintain its position.

Ephemeral Content: Snapchat’s core feature of disappearing messages and Stories encourages authentic self-expression and reduces pressure to maintain a curated online persona. This fosters a more genuine and intimate user experience.

Augmented Reality (AR): Snap is a pioneer in AR technology, using it to create innovative filters, lenses, and games that enhance the user experience and set it apart from other social media platforms.

Mobile-First: Snap’s focus on mobile devices and its user-friendly interface cater to the preferences of younger generations who are increasingly reliant on their smartphones.

Management & Employees:

Evan Spiegel: Co-Founder and Chief Executive Officer

Bobby Murphy: Co-Founder and Chief Technology Officer

Julie Henderson: Chief Communications Officer

Jerry James Hunter: Senior Vice President of Engineering

Financials:

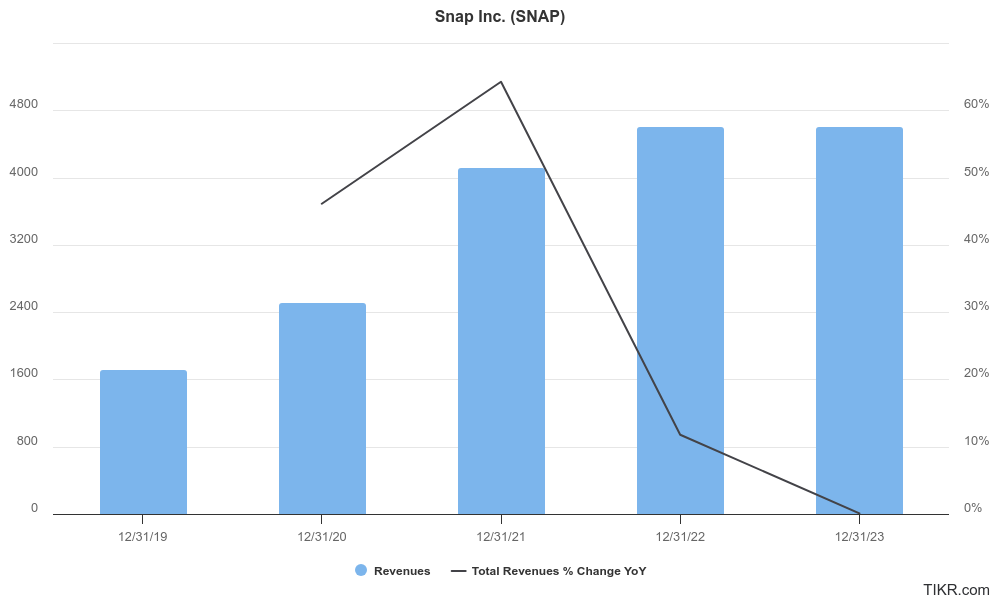

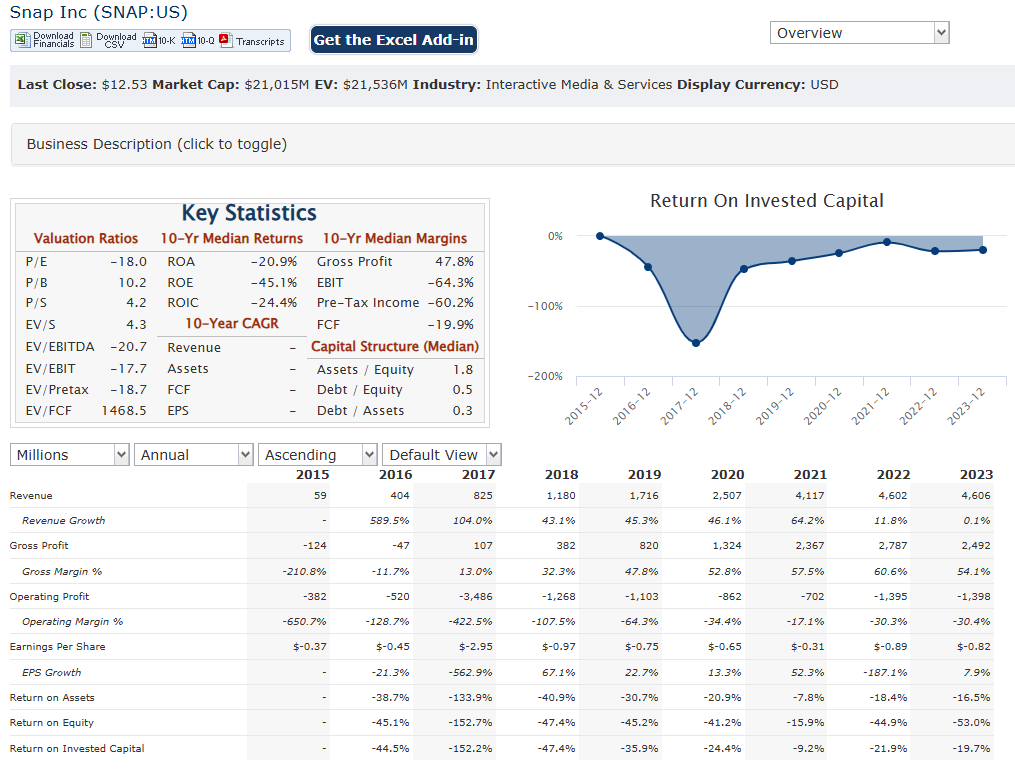

Snap Inc.’s revenue grew at a compound annual growth rate (CAGR) of approximately 22.5%, reflecting a robust demand for its advertising services and user engagement strategies. In 2023, Snap reported revenues of approximately $4.61 billion, a slight increase from $4.60 billion in 2022, indicating a stabilization after periods of more volatile growth. This growth has been largely driven by enhancements in its advertising platform and the introduction of subscription services like Snapchat+.

Snap has struggled with earnings, reporting net losses that have increased at an average annual rate of about 7% over the same period. In 2023, Snap’s net loss narrowed to approximately $1.32 billion from $1.43 billion in 2022, demonstrating some progress in controlling expenses and improving operational efficiency. The company’s adjusted EBITDA also reflected this trend, dropping to $161 million in 2023 from $377 million the previous year, indicating ongoing challenges in achieving profitability amidst heavy investments in technology and infrastructure.

Snap Inc. has maintained a relatively strong liquidity position with current assets totaling around $4.4 billion against current liabilities of about $1.1 billion as of late 2023. This gives the company a solid working capital ratio that supports its operational needs. Snap’s long-term liabilities remain significant, with total non-current liabilities exceeding $4 billion, primarily due to long-term debt obligations. The company continues to focus on managing its cash flows effectively; for instance, it generated free cash flow of approximately $111 million in Q4 2023, reflecting improved cash management practices.

Snap Inc.’s financial outlook appears cautiously optimistic as it aims to leverage its growing user base—reporting 414 million daily active users by the end of 2023—and enhance its advertising effectiveness through innovative features and partnerships. The company is poised to continue evolving its business model to adapt to changing market conditions while addressing profitability challenges through strategic cost management and investment in high-growth areas such as augmented reality and direct-response advertising solutions.

Technical Analysis:

The stock has been building a base on the monthly chart and is in stage 1 (consolidation, neutral). The weekly chart is neutral in stage 1 as well, but the daily chart has a bull flag after good earnings, which indicates a move higher to $13.4 range is likely in the short term. However, the stock has been range bound for long, which means to break the $18s barrier a strong 2-3 quarters of stock performance is needed.

Bull Case:

1. Growing Advertising Revenue:

- Snap’s advertising business has been experiencing significant growth, driven by increased demand from advertisers seeking to reach a younger audience.

- The company’s focus on innovative ad formats and targeted advertising solutions is driving higher ad revenue.

2. Cost-Cutting Measures and Improved Profitability:

- The company has implemented cost-cutting measures to improve its profitability and reduce operating expenses.

- This focus on efficiency can lead to better financial performance and increased shareholder value.

Bear Case:

1. User Growth and Engagement:

- While Snap has a loyal user base, there are concerns about its ability to sustain user growth and engagement over time.

- Competition from other platforms can lead to user attrition and reduced time spent on Snapchat.

2. Profitability and Cash Burn:

- Snap has historically struggled with profitability, and its high operating expenses can impact its financial performance.

- The company needs to continue to improve its monetization strategies and reduce costs to achieve sustainable profitability.

3. AR Monetization Challenges:

- While AR is a promising area, monetizing AR experiences can be challenging.

- Snap needs to develop effective strategies to generate revenue from its AR initiatives.