Executive Summary:

Coupang, often hailed as the “Amazon of South Korea,” is a leading e-commerce company headquartered in Seattle, Washington. Through its innovative logistics network and commitment to customer satisfaction, Coupang has revolutionized online shopping in South Korea. The company offers a wide range of products, including apparel, electronics, groceries, and more, with a focus on speedy delivery, often within hours. Coupang’s success can be attributed to its robust infrastructure, cutting-edge technology, and dedication.

Coupang, Inc. released its net revenues for the quarter reached $7.3 billion, a 25% year-over-year increase on a reported basis and 30% on an FX-neutral basis. Excluding Farfetch, the growth was 18% YoY on a reported basis and 23% YoY on an FX-neutral basis. Gross profit increased 41% YoY to $2.1 billion, with a gross profit margin of 29.3%, an improvement of 310 bps YoY.

Stock Overview:

| Ticker | $CPNG | Price | $25.57 | Market Cap | $45.86B |

| 52 Week High | $26.45 | 52 Week Low | $13.51 | Shares outstanding | 1.62B |

Company background:

Coupang, often dubbed the “Amazon of South Korea,” is a prominent e-commerce company that has reshaped online shopping in the country. Founded in 2010 by Bom Kim, a former Amazon executive. The company has secured substantial funding from various sources, including the SoftBank Vision Fund.

Coupang offers a diverse range of products, encompassing apparel, electronics, groceries, and more. Its unique selling proposition lies in its innovative logistics network, which enables swift delivery, often within hours. This commitment to speed and convenience has garnered a loyal customer base. The company’s Rocket Delivery service, in particular, has revolutionized the e-commerce landscape in South Korea.

Coupang’s primary competitors in the South Korean market include traditional retailers, online marketplaces, and other e-commerce players. As the e-commerce industry continues to evolve, Coupang is well-positioned to maintain its leadership position and expand its operations both domestically and internationally.

Recent Earnings:

Coupang, Inc. released its second-quarter earnings reported a net revenues for the quarter reached $7.3 billion, a 25% year-over-year increase on a reported basis and 30% on an FX-neutral basis. Excluding Farfetch, the growth was 18% YoY on a reported basis and 23% YoY on an FX-neutral basis.

Gross profit increased 41% YoY to $2.1 billion, with a gross profit margin of 29.3%, an improvement of 310 bps YoY. The company reported a net loss of $105 million, primarily due to the inclusion of operating losses at Farfetch and a $121 million estimated KFTC administrative fine. Net income attributable to Coupang stockholders was approximately $124 million.

Coupang’s active customer base grew 15% YoY to 19.5 million, and the repeat purchase rate increased to 84%. The company continued to invest in its logistics network and technology, leading to improved operating efficiency.

The Market, Industry, and Competitors:

Coupang Inc. operates primarily in the South Korean e-commerce market, which is characterized by rapid growth and increasing competition. Often referred to as the “Amazon of South Korea,” Coupang has established itself as a leader in this space by offering a wide range of products and services, including fast delivery options that cater to consumer demand for convenience. The South Korean e-commerce market is expected to continue expanding, driven by factors such as high internet penetration, a tech-savvy population, and increasing mobile commerce. Analysts estimate that Coupang currently holds about 24.6% of the market share, with significant opportunities for growth through potential expansions into Southeast Asian markets and the introduction of new services.

Coupang is projected to achieve a compound annual growth rate (CAGR) of around 14% to 23.5%, depending on various strategic initiatives and market conditions. This growth expectation reflects the company’s focus on leveraging technology to enhance logistics and customer experience, as well as its plans to diversify revenue streams through new offerings such as digital payment systems and potential partnerships in sectors like automotive sales. Coupang’s stock price could reach an average of $12.97 by 2030, representing a decline from current levels, other projections indicate that with the successful execution of its growth strategies.

Unique differentiation:

Naver: A leading tech conglomerate in South Korea, Naver operates a powerful search engine and e-commerce platform. It leverages its strong brand reputation and extensive user base to attract customers.

11street: A major e-commerce marketplace owned by SK Telecom, 11street offers a wide range of products and services. It has been investing heavily in technology and logistics to enhance its competitiveness.

Gmarket: A popular online marketplace owned by eBay, Gmarket offers a diverse selection of products, particularly in fashion and electronics. It benefits from eBay’s global reach and resources.

Lotte On: Backed by the Lotte Group, one of South Korea’s largest conglomerates, Lotte On leverages its offline retail network and strong brand recognition to attract customers.

Rocket Delivery: Coupang’s proprietary logistics network, Rocket Delivery, enables same-day or next-day delivery on millions of items. This rapid delivery service sets it apart from competitors and significantly enhances customer satisfaction.

Mobile-First Approach: Coupang has prioritized mobile commerce, offering a seamless and user-friendly mobile app. This strategy aligns with the increasing trend of mobile shopping and allows for a convenient shopping experience.

Data-Driven Insights: The company leverages advanced analytics and AI to optimize inventory management, personalized recommendations, and supply chain operations. This data-driven approach enables efficient operations and tailored customer experiences.

Diversified Product Offerings: Coupang offers a wide range of products, including groceries, electronics, fashion, and more. This broad product selection caters to diverse customer needs and attracts a larger customer base.

Management & Employees:

Bom Kim: As the Founder, CEO, and Chairman of the Board, Bom Kim is the driving force behind Coupang’s success. His experience in the e-commerce industry, particularly at Amazon, has been instrumental in shaping Coupang’s strategy and growth.

Hanseung Kang: As a Representative Director of Business Management, Hanseung Kang plays a key role in driving Coupang’s business operations. He oversees various aspects of the company’s business, including strategy, marketing, and operations.

Pranam Kolari: As the Vice President of Search and Recommendations, Pranam Kolari leads Coupang’s efforts in improving search and recommendation algorithms. His expertise in data science and machine learning helps enhance customer experience and drive sales.

Financials:

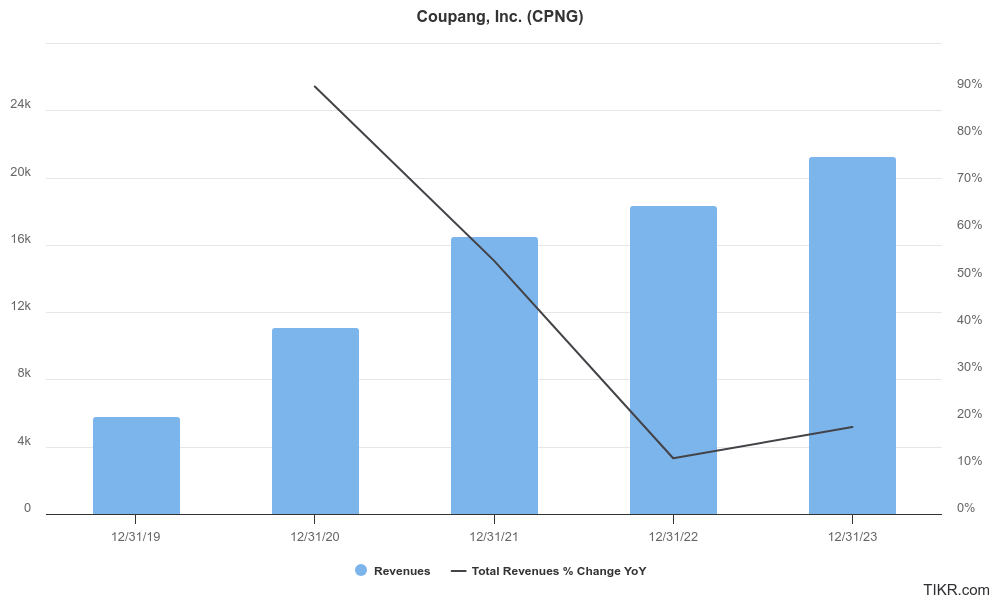

Coupang Inc. has reported a revenue has increased substantially, with an average annual growth rate of approximately 15.9% over the last five years. This growth trajectory reflects Coupang’s ability to capture market share in the competitive South Korean e-commerce landscape, driven by its innovative logistics and delivery services. The company has reported revenues reaching approximately $24.4 billion, showcasing its capacity to scale operations effectively while responding to consumer demand for rapid delivery services.

Earnings performance has also been impressive, with Coupang achieving an average annual earnings growth rate of 68% during the same period. This robust growth indicates a successful transition from operating losses to profitability, as evidenced by a net margin improvement of 3.9%. The increase in earnings is attributed to enhanced operational efficiencies and a focus on high-margin service offerings, which have allowed Coupang to improve its return on equity to 25.2%.

The company has generated considerable free cash flow, amounting to around $1.5 billion on $27 billion of revenue over the last year. This strong cash flow generation supports ongoing investments in growth initiatives and enhances financial stability. Its growth momentum while navigating the challenges of increased competition in the e-commerce sector.

Coupang’s financial outlook remains positive, with expectations for continued revenue and earnings growth driven by strategic initiatives and market expansion. As Coupang leverages its technological advancements and optimizes its supply chain operations, it is well-positioned to capitalize on the growing e-commerce market in South Korea and beyond.

Technical Analysis:

The stock is consolidating and range bound on the monthly chart and is still building a base, which is neutral in the $13 – $25 range. The weekly chart is in stage 2 markup and bullish, but the daily chart is in stage 2 as well with lot of resistance in the $26 – $29 zone, which might be the place where the stock heads lower.

Bull Case:

1. Strong Growth Potential:

- Large and Growing Market: South Korea’s e-commerce market is still in its early stages, with significant room for growth. As consumer behavior shifts towards online shopping, Coupang is well-positioned to capitalize on this trend.

- Diversified Revenue Streams: The company generates revenue from various sources, including product sales, advertising, and subscription fees, providing multiple avenues for growth.

2. Long-Term Growth Opportunities:

- Expansion into New Verticals: Coupang can explore opportunities in new verticals, such as fresh food delivery and financial services, to drive further growth.

- International Expansion: While the company is currently focused on the South Korean market, there is potential for future international expansion.

Bear Case:

1. Heavy Investments:

- Coupang continues to invest heavily in its logistics network, technology infrastructure, and marketing efforts to maintain its competitive edge.

- These significant investments can impact profitability in the short term, as the company focuses on growth over profits.

2. Regulatory Risks:

- Changes in government regulations or increased regulatory scrutiny could impact Coupang’s operations and financial performance.

- Stricter regulations could increase compliance costs and limit growth opportunities.