Executive Summary:

Cloudflare Inc. is a renowned American company specializing in content delivery network services, cybersecurity solutions, and network services. It operates a vast global network, enhancing the security, performance, and reliability of websites and applications worldwide. Cloudflare’s services include DDoS mitigation, web application firewalls, content delivery networks, and DNS services. Cloudflare optimizes website loading speeds and protects against cyber threats, making it a crucial tool for businesses.

Cloudflare Inc. reported a revenue of $401 million, marking a 30% year-over-year increase. The company’s non-GAAP income from operations reached $57 million.

Stock Overview:

| Ticker | $NET | Price | $88.02 | Market Cap | $30.07B |

| 52 Week High | $116.00 | 52 Week Low | $53.88 | Shares outstanding | 303.68M |

Company background:

Cloudflare Inc., a prominent American company, was founded in 2009 by Matthew Prince, Michelle Zatlyn, and Lee Holloway. The company secured significant funding through venture capital firms, including Andreessen Horowitz and Kleiner Perkins Caufield & Byers.

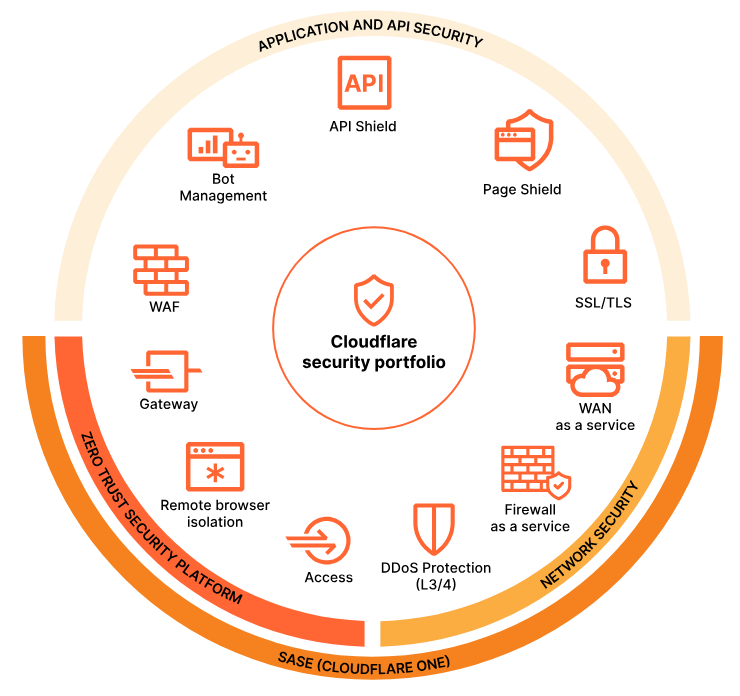

Cloudflare offers a diverse range of products designed to enhance the security, performance, and reliability of websites and applications. These products include content delivery network (CDN) services, web application firewalls (WAFs), DDoS mitigation, DNS services, and more. By leveraging a vast global network of data centers, Cloudflare optimizes website loading speeds and protects against cyber threats.

Cloudflare’s key competitors in the cybersecurity and network services market include Akamai Technologies, Imperva, and Fastly. The company’s headquarters are located in San Francisco, California.

Recent Earnings:

Cloudflare Inc., a leading provider of cybersecurity and network solutions, reported strong second-quarter earnings revenue of $401 million, marking a significant 30% year-over-year increase. Cloudflare’s non-GAAP income from operations reached $57 million.

Cloudflare’s revenue growth surpassed analysts’ expectations, demonstrating robust demand for its security, performance, and reliability solutions. This positive performance underscores the company’s ability to capitalize on the growing need for robust cybersecurity and network solutions.

The company’s gross margin expanded to 77.8%, reflecting improved operational efficiency. Cloudflare achieved record operating cash flow and free cash flow for the quarter. This strong cash flow generation positions the company well for future investments and growth initiatives.

Cloudflare expects continued strong demand for its products and services, driven by the increasing complexity of the digital landscape and the growing need for robust security solutions.

The Market, Industry, and Competitors:

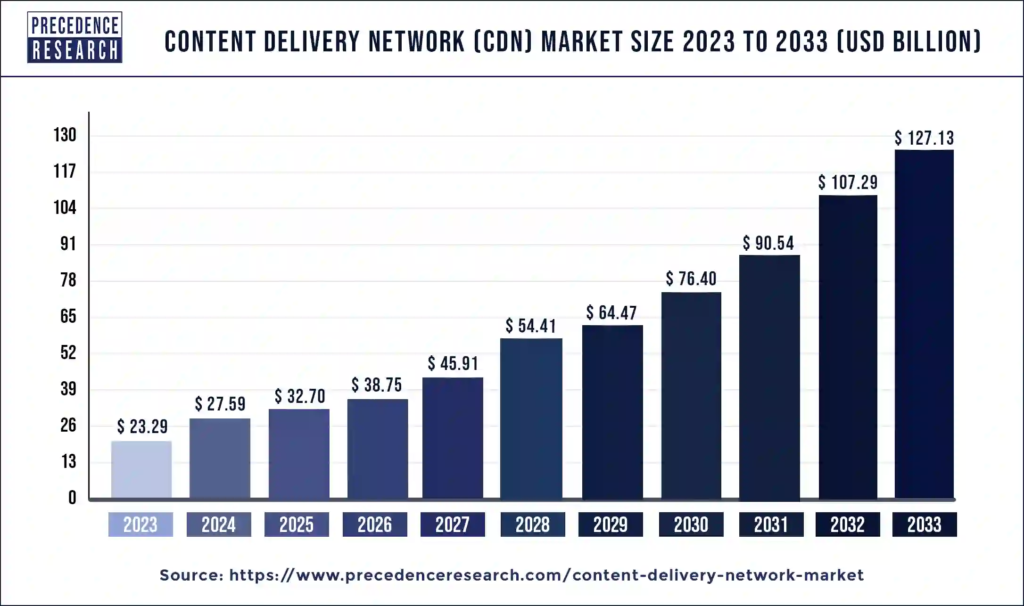

Cloudflare Inc. operates primarily in the cloud-based content delivery network (CDN) and cybersecurity markets. The CDN market alone is projected to grow at a compound annual growth rate (CAGR) of 20.4% from 2020 to 2030, driven by increasing internet penetration, rising digital media consumption, and the growing threat of cyberattacks. Cloudflare has established itself as a leader in this space, serving approximately 80% of websites that utilize CDN services. This dominance positions the company well to capitalize on the ongoing demand for faster and more secure internet services as businesses increasingly migrate to cloud-based solutions.

Cloudflare’s revenue is expected to see substantial growth, with estimates suggesting it could reach between $8.5 billion and $11.5 billion depending on various growth scenarios. Cloudflare maintains a CAGR of around 30% over the next several years, and its annual revenue could rise from its current levels, potentially achieving a market valuation of $85 billion by the end of the decade. This growth trajectory aligns with broader trends in both the CDN and cybersecurity markets, which are anticipated to continue expanding due to increased reliance on digital infrastructure and heightened security concerns across industries.

Unique differentiation:

Cloudflare faces competition from several key players in the cybersecurity and network services market. One of its primary competitors is Akamai Technologies, a well-established company with a strong global presence and a comprehensive suite of content delivery networks and security solutions. Akamai’s extensive network and robust security capabilities make it a formidable competitor to Cloudflare.

A cloud computing company that provides edge computing and content delivery network services. Fastly’s focus on edge computing and its ability to deliver dynamic content at the edge of the network makes it a strong contender in the market.

Cloudflare competes with cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. These providers offer a range of security and network services, including content delivery networks and web application firewalls, that can compete with Cloudflare’s offerings.

Innovative Technology: Cloudflare continuously innovates and introduces cutting-edge technologies to enhance its offerings. Its serverless architecture, Cloudflare Workers, empowers developers to build and deploy applications at the edge of the network, enabling faster and more efficient delivery of content. Additionally, Cloudflare’s Zero Trust security solutions provide advanced protection against modern cyber threats.

User-Friendly Approach: Cloudflare’s products are designed to be user-friendly, even for those without extensive technical expertise. Its intuitive interface and easy-to-configure settings make it accessible to a wide range of users, from small businesses to large enterprises.

Management & Employees:

Matthew Prince: As the CEO and co-founder, Prince oversees the overall direction and strategy of the company.

Michelle Zatlyn: Co-founder and COO, Zatlyn is responsible for Cloudflare’s operations and business development.

Joe Sullivan: As the Chief Security Officer, Sullivan oversees Cloudflare’s security initiatives and is responsible for protecting the company’s infrastructure and customer data.

Financials:

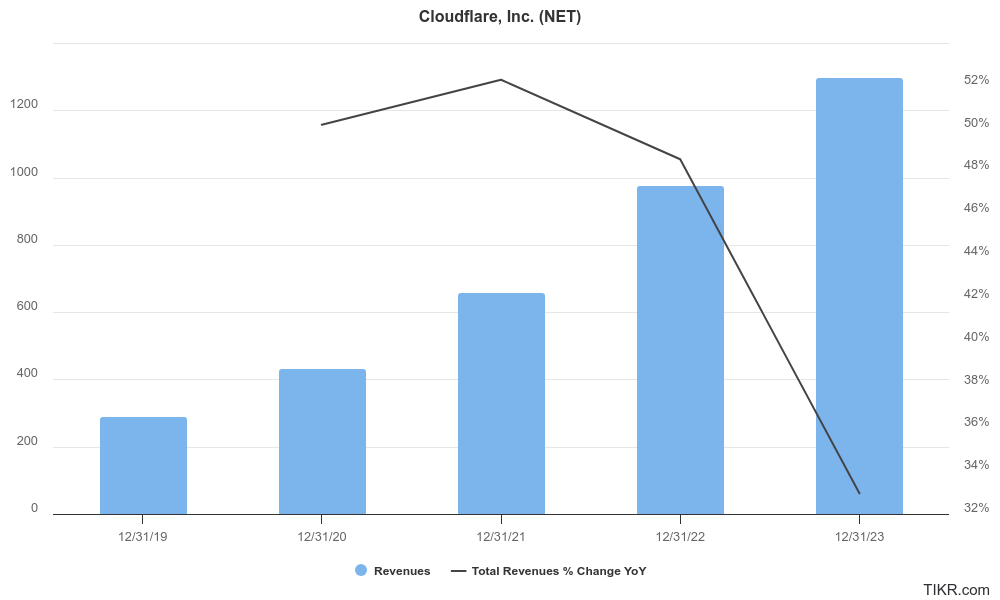

Cloudflare has consistently increased its revenue, achieving a remarkable CAGR of approximately 39% from 2019 to 2023. In 2023, the company reported an annual revenue of $1.3 billion, marking a 33% increase from the previous year. This growth has been fueled by a substantial increase in its customer base, which reached 189,000 paying customers by the end of 2023, reflecting a 16% year-over-year increase.

Cloudflare’s adjusted earnings per share (EPS) rose from $0.06 in 2022 to $0.49 in 2023, showcasing a significant improvement in profitability as the company continues to scale its operations. The non-GAAP net income for the fourth quarter of 2023 was reported at $53.5 million, compared to $21.6 million in the fourth quarter of 2022.

Cloudflare has maintained a healthy financial position with substantial liquidity. The company’s cash and cash equivalents totaled approximately $1.67 billion. The company’s operating cash flow reached $254.4 million for the full year, significantly up from $123.6 million in 2022, further underscoring its ability to generate cash from operations. Cloudflare’s balance sheet remains resilient, positioning it well for continued expansion in the competitive cloud services market.

Technical Analysis:

The stock is in a reversal and stage 1 consolidation (neutral) in the monthly chart, and a cup and handle (bullish) on the weekly chart. The daily chart shows a good bull flag. This should be a good entry in the $82 – $86 zone for a move back to $90s and $100+.

Bull Case:

Attractive Valuation: Cloudflare may still be undervalued relative to its growth potential. The company’s strong fundamentals, robust growth prospects, and innovative approach make it an attractive investment opportunity for long-term investors.

AI and Machine Learning Opportunities: Cloudflare’s strategic focus on AI and machine learning positions the company to capitalize on the growing demand for intelligent network and security solutions. By leveraging AI and ML, Cloudflare can further enhance its product offerings, improve customer experience, and drive growth.

Bear Case:

Economic Uncertainty: Economic downturns can impact businesses’ spending on technology and cybersecurity solutions. A prolonged economic slowdown could reduce demand for Cloudflare’s products and services, affecting revenue growth and profitability.

Regulatory Risks: Increased regulatory scrutiny, particularly in areas such as data privacy and cybersecurity, could impose additional costs and compliance burdens on Cloudflare.