Executive Summary:

PulteGroup Inc. is a leading national homebuilder in the United States. It offers a variety of home styles and floor plans to meet the needs of different buyers. PulteGroup is known for its commitment to quality craftsmanship and customer satisfaction. With a strong presence in multiple states, PulteGroup continues to be a significant player in the home-building industry.

PulteGroup Inc. reported its earnings per share (EPS) of $3.83, exceeding analysts’ expectations of $3.27 by $0.56. They generated revenue of $4.60 billion, surpassing the consensus estimate of $4.49 billion.

Stock Overview:

| Ticker | $PHM | Price | $146.39 | Market Cap | $30.38B |

| 52 Week High | $147.46 | 52 Week Low | $68.80 | Shares outstanding | 207.52M |

Company background:

PulteGroup Inc., a prominent player in the U.S. homebuilding industry, traces its roots back to 1950 when William J. Pulte established the company in Detroit, Michigan. The company’s journey has been marked by a legacy of innovation and a commitment to providing quality homes to families across the nation. PulteGroup has expanded its operations significantly, solidifying its position as a leading homebuilder.

It has generated substantial revenue through its successful homebuilding operations. The company’s primary product offerings encompass a diverse range of new homes, catering to various customer preferences and budgets. PulteGroup’s portfolio includes single-family homes, townhomes, condominiums, and active adult communities. These homes are designed to meet the evolving needs of homebuyers, incorporating modern amenities, energy-efficient features, and attractive floor plans.

The homebuilding industry is highly competitive, with several major players vying for market share. PulteGroup faces competition from established rivals such as Lennar Corporation, D.R. Horton, and NVR Inc. These companies also offer a wide range of new homes and compete with PulteGroup in terms of pricing, product offerings, and geographic presence.

PulteGroup has maintained a strong market position through its focus on customer satisfaction, quality craftsmanship, and strategic growth initiatives. The company’s headquarters are located in Bloomfield Hills, Michigan, where it oversees its operations across multiple states. With a nationwide presence and a reputation for building desirable communities.

Recent Earnings:

PulteGroup Inc. generated $4.60 billion in revenue, which represents a 9.8% increase compared to the same quarter last year. This growth exceeded analysts’ expectations, which had forecasted revenue of $4.49 billion. The strong demand for housing continues to drive PulteGroup’s sales, reflecting the company’s solid positioning in a competitive market.

Earnings per share (EPS), PulteGroup reported $3.83, significantly surpassing the consensus estimate of $3.27 by $0.56. This marks a robust year-over-year growth of approximately 25.67%, up from last year’s EPS of $3.07. Effective cost management but also an ability to capitalize on favorable market conditions, as the company continues to navigate through fluctuating economic environments.

The company reported an increase in home closings, which is a key indicator of operational performance, further supporting its revenue growth trajectory. PulteGroup’s backlog remained strong, suggesting sustained demand for its homes and a positive outlook for future quarters.

Analysts anticipate that the company will report EPS of around $3.10 in the upcoming third quarter, reflecting a year-over-year increase of approximately 6.9%. This positive sentiment surrounding the housing market and PulteGroup’s strategic initiatives aimed at enhancing operational efficiency and market share in the residential construction sector.

The Market, Industry, and Competitors:

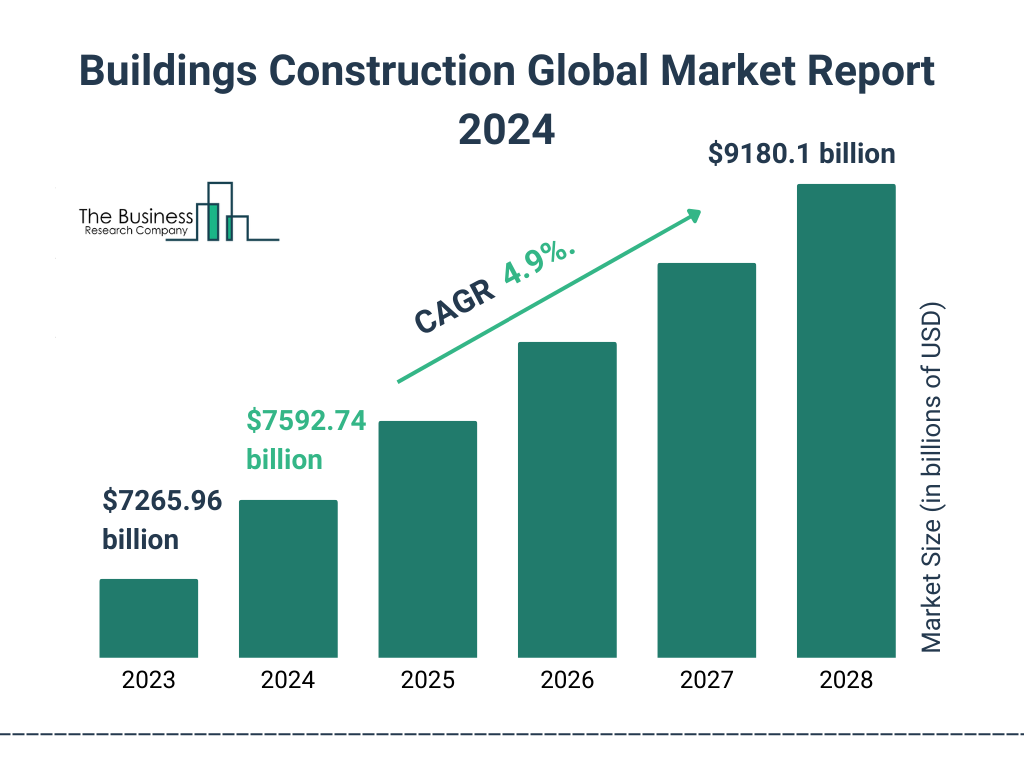

PulteGroup Inc. operates in the highly competitive U.S. homebuilding market. As one of the largest homebuilders in the country, PulteGroup benefits from a diversified brand portfolio that caters to various buyer segments, including first-time buyers, move-up buyers, and active adults. The company has strategically positioned itself across 24 states and over 40 major markets, allowing it to tap into diverse demographic trends and housing demands. The overall U.S. housing market will see a compound annual growth rate (CAGR) of approximately 5% from now until 2030, driven by factors such as population growth, urbanization, and an increasing preference for single-family homes.

PulteGroup’s growth expectations, the company has demonstrated a robust financial performance with a CAGR in net income of nearly 20% since 2015. This trajectory is expected to continue as PulteGroup invests heavily in land acquisition and development, amounting to over $17 billion in the past five years. By focusing on operational efficiency and high-return projects, PulteGroup aims to enhance its profitability while managing market risks effectively. PulteGroup could achieve revenues exceeding $19 billion by 2030.

The company’s emphasis on serving multiple buyer categories—first-time buyers (35%), move-up buyers (39%), and active adults (26%)—positions it well to capitalize on shifting market dynamics. As economic conditions improve and interest rates stabilize, PulteGroup is poised for continued success in a growing housing market, making it an attractive option for investors looking at long-term growth potential.

Unique differentiation:

Lennar Corporation: One of the largest homebuilders in the United States, Lennar offers a wide range of new homes and communities across the country. The company has a strong presence in both single-family and multifamily housing markets.

D.R. Horton: Another major competitor, D.R. Horton is known for its diverse product offerings and extensive geographic reach. The company has a strong focus on affordable housing and has been expanding its operations in various regions.

NVR Inc.: NVR Inc. is a publicly traded company that operates through its subsidiary, Ryan Homes. The company primarily focuses on building single-family homes in various markets across the United States.

Quality Craftsmanship: The company is known for its commitment to building high-quality homes with attention to detail. This reputation for quality has helped PulteGroup establish trust with homebuyers.

Strategic Geographic Presence: The company has a strategic geographic presence across the United States, allowing them to serve a diverse customer base and capitalize on regional market trends.

Management & Employees:

- Ryan Snyder: Chief Executive Officer

- John Chadwick: Chief Operating Officer

- John Schlicht: Group President

- Mark O’Brien: Executive Vice President, General Counsel and Secretary

Financials:

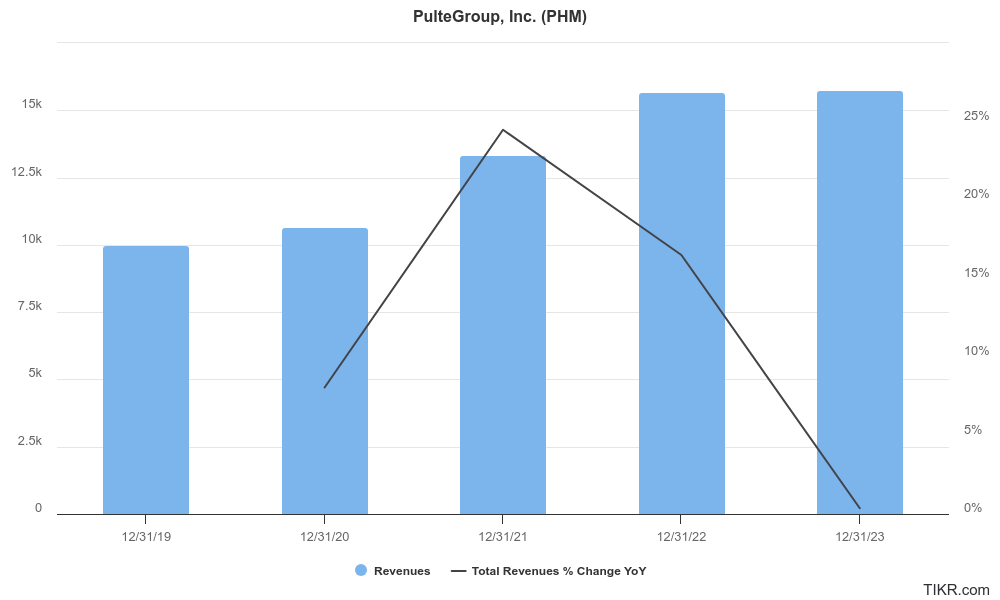

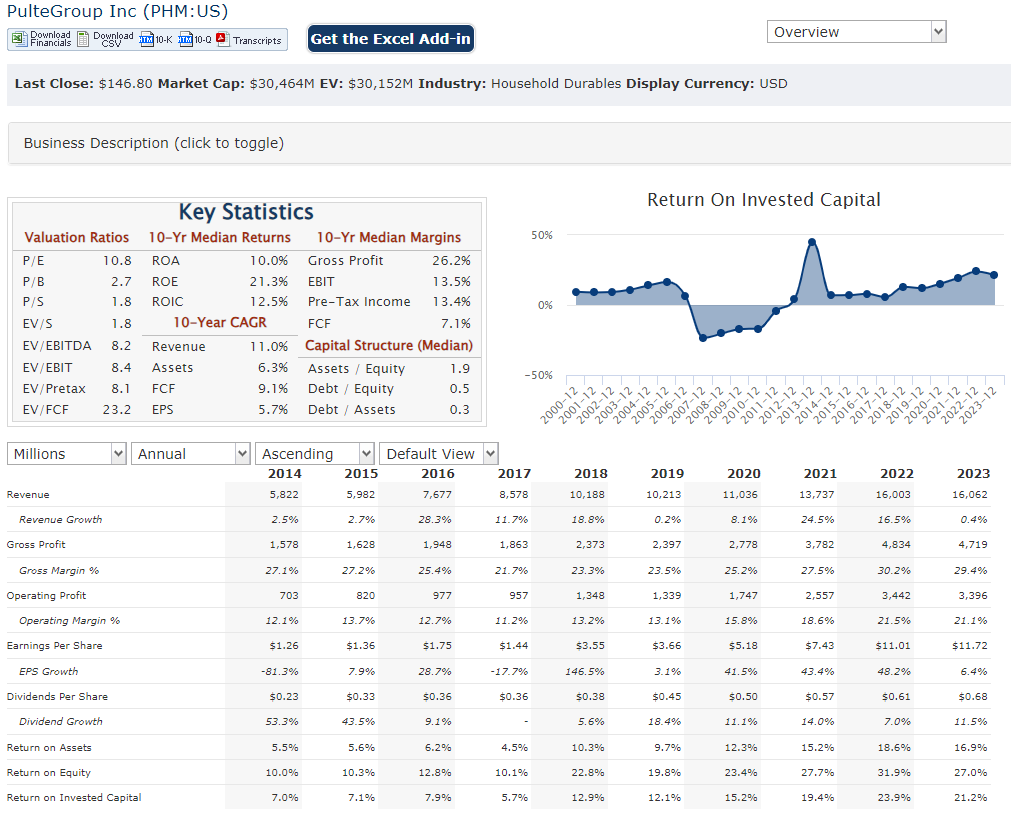

PulteGroup Inc. has achieved a compound annual growth rate (CAGR) of approximately 12.2% in revenue, reflecting a strong demand for new homes amid ongoing housing shortages. Revenue surged from around $8.5 billion in 2019 to approximately $16.8 billion in 2024, driven by strategic land acquisitions and a diversified product offering that appeals to various buyer segments, including first-time and move-up buyers.

Earnings have also shown remarkable growth, with a CAGR of about 23.3% over the same period. PulteGroup’s earnings per share (EPS) rose from $2.00 in 2019 to approximately $12.49 in 2024, illustrating the company’s ability to enhance profitability through operational efficiencies and effective cost management strategies. The net income has consistently improved, demonstrating resilience even during market fluctuations, with net margins reaching around 16.7% in recent reports.

The company has a healthy cash position and manageable debt levels. PulteGroup reported total assets of approximately $16 billion, with current assets including cash and short-term investments totaling about $1.4 billion. The debt-to-capital ratio stood at a low 15.4%, indicating prudent financial management that allows for flexibility in capital allocation and investment opportunities without over-leveraging.

PulteGroup is well-positioned for continued growth as it navigates the evolving housing market landscape. The company anticipates further increases in home closings and revenue as demand persists due to demographic trends favoring suburban living and a structural shortage of housing stock in many regions.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly, weekly and daily charts. This indicates a consolidation in the $142 zone and a move back to $150s. The stock has good momentum to $150 easily.

Bull Case:

Favorable Demographics: The millennial generation, which represents a large segment of the homebuying population, is reaching prime homeownership age. This demographic shift is expected to drive demand for new homes, benefiting PulteGroup’s business.

Product Diversification: PulteGroup offers a diverse range of home styles and floor plans, catering to various customer preferences and budgets. This product diversification helps the company mitigate risks and capture different market segments.

Operational Efficiency: PulteGroup has demonstrated strong operational efficiency, allowing it to manage costs effectively and improve margins. This efficiency can enhance the company’s profitability and competitiveness.

Bear Case:

Economic Recession: A recession could lead to job losses, reduced income, and decreased consumer confidence, which could dampen demand for new homes. This could have a significant impact on PulteGroup’s business.

Regulatory Changes: Changes in government policies or regulations related to housing, construction, or land use could create challenges for PulteGroup’s operations.

Supply Chain Disruptions: Disruptions in the supply chain, such as material shortages or increased costs, could impact PulteGroup’s ability to build homes efficiently and profitably.