Executive Summary:

Mobileye Global Inc. is a leading Israeli autonomous driving technology company. They specialize in developing advanced driver-assistance systems (ADAS) and self-driving solutions. Mobileye’s technology, which includes cameras, computer chips, and software, is used by major automakers worldwide. Their goal is to revolutionize mobility by making autonomous vehicles a reality and improving road safety.

Mobileye Global Inc. reported its earnings per share (EPS) of $0.09, surpassing analysts’ expectations of $0.08 by $0.01, represent a 12.5% positive surprise. Its revenue for the quarter was $439 million, exceeding the estimated revenue of $425.2 million and reflecting a 3% decline year-over-year.

Stock Overview:

| Ticker | $MBLY | Price | $12.26 | Market Cap | $9.94B |

| 52 Week High | $44.48 | 52 Week Low | $10.48 | Shares outstanding | 99.55M |

Company background:

Mobileye Global Inc. is a leading Israeli autonomous driving technology company founded in 1999 by Professor Amnon Shashua and Ziv Aviram. The company initially focused on developing advanced driver-assistance systems (ADAS) for the automotive industry. Mobileye’s early success led to significant funding rounds, including a major investment from Intel in 2017.

Mobileye technology enables vehicles to detect pedestrians, cyclists, and other objects on the road, as well as to maintain lane position, adapt cruise control, and even achieve fully autonomous driving capabilities. Mobileye’s products are used by major automakers worldwide, including BMW, Nissan, Volkswagen, and Ford.

Mobileye’s main competitors in the autonomous driving technology space include NVIDIA, Waymo (a subsidiary of Alphabet), and Tesla. These companies are also developing advanced systems for self-driving vehicles and compete with Mobileye for market share. Mobileye is headquartered in Jerusalem, Israel, and has offices in several other countries around the world.

Recent Earnings:

Mobileye Global Inc. reported its revenue of $439 million, which marked a 3% decrease year-over-year but an impressive 84% increase compared to the first quarter of 2024. This surge in revenue was attributed to reduced consumption of excess inventory by Tier 1 customers, indicating a recovery from previous supply chain challenges. Analysts had anticipated revenue of $425.18 million, meaning Mobileye exceeded expectations by approximately 3.25%.

Earnings per share (EPS), Mobileye posted an EPS of $0.09, surpassing analyst predictions of $0.08 by $0.01—a positive surprise of 28.6%. Where the company reported a loss per share of $0.07. The adjusted EPS reflected a decline of about 44% compared to the same quarter last year.

The adjusted gross margin fell to 69%, down from 72% year-over-year, primarily due to an increased proportion of revenue from SuperVision products, which carry different cost structures. Adjusted operating income dropped significantly by 44%, reflecting higher operating expenses despite stable revenue levels. The company reported a net loss of $86 million. The future growth opportunities stemming from design wins and ongoing engagements with customers in their SuperVision and Chauffeur development programs.

The Market, Industry, and Competitors:

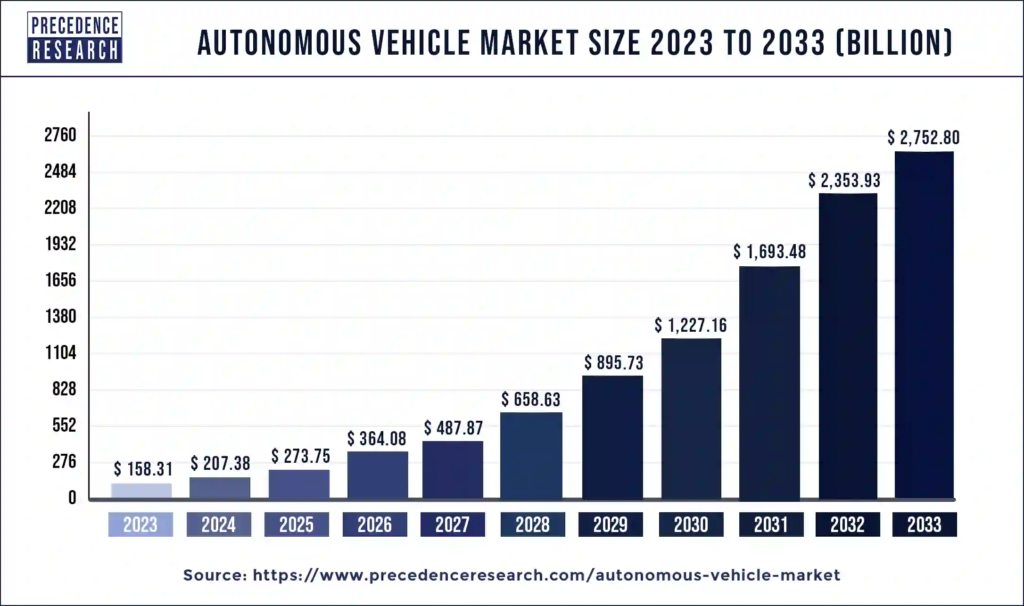

Mobileye Global Inc. operates in the rapidly growing market for autonomous driving technology. The demand for advanced driver-assistance systems (ADAS) and self-driving solutions is increasing rapidly, driven by factors such as rising safety concerns, traffic congestion, and technological advancements. The market is expected to experience significant growth in the coming years, with Mobileye well-positioned to capitalize on this trend.

The global market for ADAS and autonomous driving technology is expected to reach $150 billion by 2030, growing at a compound annual growth rate (CAGR) of over 20%. This growth is fueled by the increasing adoption of ADAS features in new vehicles, as well as the development of more advanced self-driving capabilities. Mobileye’s strong market position, coupled with its innovative technology and partnerships with leading automakers, puts the company in a prime position to benefit from this market expansion.

Unique differentiation:

NVIDIA: NVIDIA is a leading provider of graphics processing units (GPUs), which are essential for powering autonomous driving systems. The company has been investing heavily in autonomous driving technology and has formed partnerships with several automakers.

Tesla: Tesla is a leading electric vehicle manufacturer that has also been developing self-driving technology. Tesla’s vehicles are equipped with a suite of sensors and cameras that enable them to achieve partial autonomy.

Intel: Intel, which acquired Mobileye in 2017, is also a competitor in the autonomous driving space. Intel has been investing in its own self-driving technology and has formed partnerships with several automakers.

Aptiv: Aptiv is a global automotive technology company that offers a range of ADAS and autonomous driving solutions. Aptiv has formed partnerships with several automakers and has been investing in its own self-driving technology. These are just a few of the major competitors that Mobileye faces in the autonomous driving technology market. The competition is likely to intensify as more companies enter the space and the technology continues to evolve.

- Strong focus on vision-based technology: Mobileye’s primary technology is based on vision systems, which use cameras to perceive the environment. This approach is considered more reliable and cost-effective than other sensor-based systems, such as lidar and radar.

- Deep expertise in ADAS and autonomous driving: Mobileye has been a pioneer in the development of advanced driver-assistance systems (ADAS) and has a deep understanding of the challenges and opportunities associated with autonomous driving.

- Strong intellectual property portfolio: Mobileye has a significant intellectual property portfolio, which protects its technology and provides it with a competitive advantage. These differentiators have helped Mobileye establish a strong market position and position itself as a leader in the autonomous driving technology space.

Management & Employees:

Amnon Shashua: Co-founder and Chief Executive Officer (CEO) of Mobileye. Shashua is a renowned computer scientist and entrepreneur with a deep understanding of computer vision and machine learning.

Ziv Aviram: Co-founder and President of Mobileye. Aviram is a seasoned automotive executive with extensive experience in product development and business strategy.

Prof. Rajeev Kumar: Chief Technology Officer (CTO) of Mobileye. Kumar is a leading expert in computer vision and machine learning, with a focus on autonomous driving technology.

Jacob Sagi: Chief Marketing Officer (CMO) of Mobileye. Sagi is a marketing and communications expert with a focus on building brand awareness and driving customer engagement.

Financials:

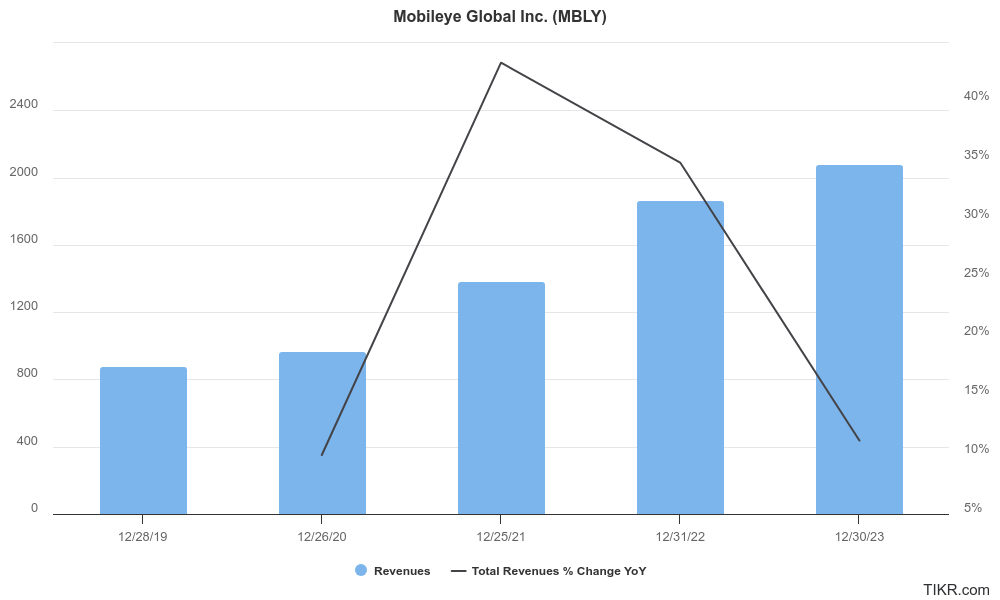

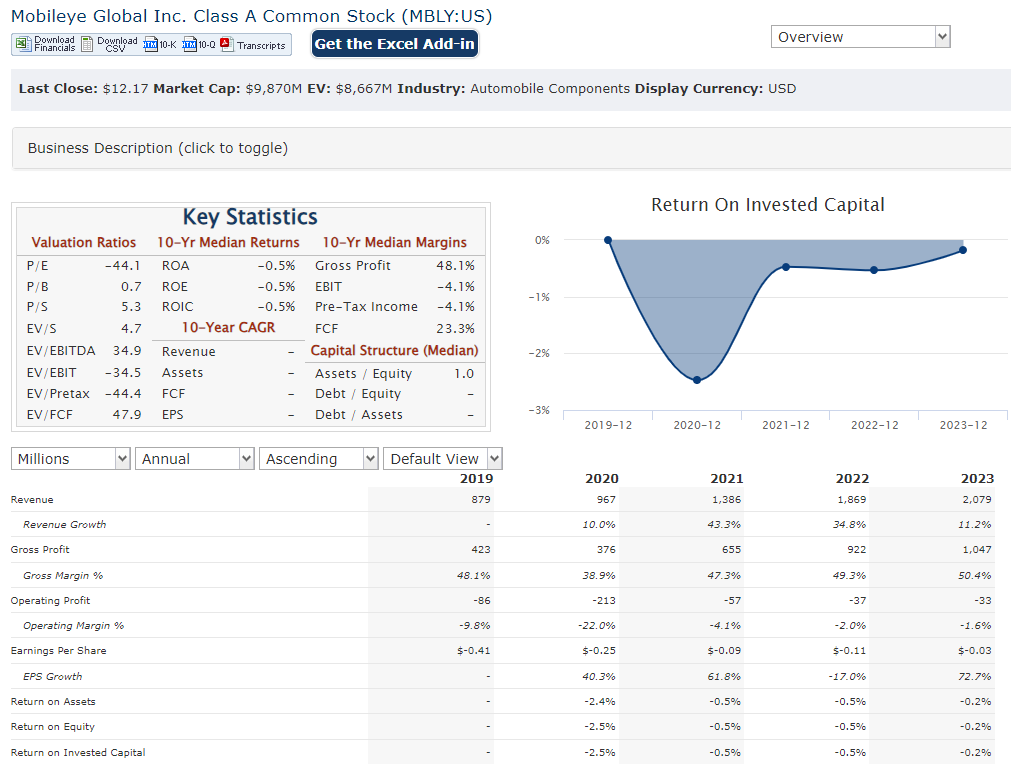

Mobileye Global Inc. revenue grew from approximately $879 million to $2.079 billion, reflecting a compound annual growth rate (CAGR) of around 31%. This growth trajectory was driven by increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, positioning Mobileye as a leader in the automotive technology sector.

The company has reported losses, with net income fluctuating significantly. The average annual earnings decline has been approximately 23%, as the company invested heavily in research and development to enhance its product offerings and expand its market presence. The earnings per share (EPS) have reflected this trend, with a CAGR of about 9.7%, indicating a gradual reduction in losses but still highlighting ongoing profitability challenges.

The company reported $1.2 billion in cash and cash equivalents with no debt. This strong liquidity position provides Mobileye with the flexibility to invest in future growth opportunities and navigate market fluctuations effectively.

The company’s operational efficiency remains a focus area, as it aims to optimize costs while scaling production to meet increasing demand. Mobileye’s future business backlog continues to grow, with design wins projected to generate substantial future revenue. The company is optimistic about its ability to achieve normalization of revenue in the latter as it addresses inventory challenges and capitalizes on ongoing customer engagements.

Technical Analysis:

The stock is on a stage 4 decline on the monthly chart (bearish) but a reversal off the lows is seen on the weekly chart at $10.6 range. While early, the daily chart shows a move back to retest the $10.62 range (bearish) and we don’t see an immediate need to buy or hold the stock.

Bull Case:

Synergy with Intel: Mobileye’s acquisition by Intel in 2017 has provided it with significant strategic advantages, including access to Intel’s vast resources and expertise in semiconductors and computing technology.

Focus on safety: Mobileye has a strong commitment to safety and has developed a robust safety framework that ensures the reliability and integrity of its technology. This focus on safety is likely to be a key differentiator in the highly competitive autonomous driving market.

Valuation: While Mobileye’s stock may appear to be richly valued based on traditional metrics, the company’s growth prospects and strong market position justify a premium valuation.

Bear Case:

Economic risks: The global economy faces various risks, such as a recession or geopolitical tensions, which could negatively impact the demand for new vehicles and, consequently, Mobileye’s products.

Cybersecurity risks: Autonomous driving systems are vulnerable to cybersecurity attacks, which could compromise their safety and reliability. If Mobileye were to experience a major cybersecurity breach, it could damage its reputation and lead to financial losses.