Executive Summary:

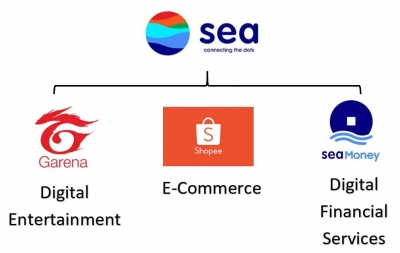

Sea Limited is a global technology company headquartered in Singapore. It operates in three main segments: digital entertainment, e-commerce, and digital financial services. The company’s digital entertainment segment, Garena, is known for its popular online games like Free Fire. SeaMoney provides digital financial services, including mobile payments and credit, to consumers and businesses.

Sea Limited reported a 23% year-over-year increase in total revenue, reaching $3.8 billion. Earnings per share (EPS) came in at $0.14.

Stock Overview:

| Ticker | $SE | Price | $100.19 | Market Cap | $57.02B |

| 52 Week High | $101.01 | 52 Week Low | $34.35 | Shares outstanding | 528.81M |

Company background:

Sea Limited, a prominent global technology conglomerate, was founded in 2009 by Forrest Li in Singapore. Initially established as Garena, a game development and publishing company, Sea Limited underwent a rebranding in 2017, aligning with its expanded operations. The company has garnered significant funding through various rounds, including a substantial $6 billion equity and convertible bond sale in 2021, solidifying its position as a leading tech firm in Southeast Asia.

Sea Limited operates across three core segments: digital entertainment, e-commerce, and digital financial services. Its digital entertainment arm, Garena, is renowned for its popular online games like Free Fire, attracting a massive user base. Shopee, its e-commerce platform, has emerged as a dominant online marketplace in Southeast Asia, offering a wide range of products and services.

Sea Limited faces competition from established players in each of its operating segments. In the digital entertainment space, Tencent and NetEase are major rivals. In e-commerce, Lazada and Tokopedia are key competitors in Southeast Asia. Grab and Gojek pose competition in the digital financial services sector. Despite the competitive landscape, Sea Limited’s strong product offerings, strategic acquisitions, and focus on innovation.

Recent Earnings:

Sea Limited. total revenue surged by 23% year-over-year to $3.8 billion, exceeding analyst expectations. While earnings per share (EPS) came in at $0.14, the company’s strong top-line growth and operational efficiency were evident.

The e-commerce segment, led by Shopee, continued its impressive trajectory, with gross merchandise value (GMV) reaching $23.3 billion, up 29.1% year-on-year. The digital financial services segment also exhibited robust growth, with revenue increasing by 21.4% to $519.3 million. The digital entertainment segment, while facing some headwinds, still contributed to overall growth with bookings totaling $536.8 million.

Sea Limited’s management expressed optimism about the company’s future prospects, citing ongoing investments in technology, product innovation, and user experience as key drivers of growth. They focus on strengthening its market position in Southeast Asia and exploring opportunities in other regions.

The Market, Industry, and Competitors:

Sea Limited operates in the dynamic and rapidly growing Southeast Asian market, a region characterized by a large and young population with increasing internet penetration and smartphone adoption. This favorable demographic landscape presents significant opportunities for Sea Limited’s core businesses, including digital entertainment, e-commerce, and digital financial services.

The company’s growth focuses on expanding its user base, product offerings, and geographical reach. Sea Limited aims to capitalize on the rising disposable income and changing consumer behavior in Southeast Asia, leveraging its strong brand recognition and technological capabilities. Analysts project a CAGR (Compound Annual Growth Rate) of 20-25% for Sea Limited’s revenue and earnings over the next few years.

Unique differentiation:

Sea Limited faces competition from various established players in each of its core segments. In the digital entertainment space, Tencent and NetEase are major rivals, particularly in China and other Asian markets. In e-commerce, Lazada and Tokopedia are key competitors in Southeast Asia, vying for market share through their extensive product offerings and logistics networks. Additionally, Grab and Gojek, ride-hailing and digital payments companies, also compete with Sea Limited’s SeaMoney in the digital financial services sector.

Sea Limited’s unique differentiation lies in its ability to offer a comprehensive ecosystem of digital services across multiple segments. They provide a seamless user experience by integrating digital entertainment, e-commerce, and digital financial services. This integrated approach allows the company to cross-sell products and services, drive customer loyalty, and generate synergies between different business lines.

Sea Limited has demonstrated a strong focus on innovation and adaptability. The company has been able to quickly identify market trends and introduce new products and features to meet the evolving needs of its customers. This agility has enabled Sea Limited to stay ahead of competitors and maintain its competitive edge.

Management & Employees:

- Forrest Li: Co-Founder and Group CEO

- David Moin: Co-Founder and Group President, responsible for the company’s e-commerce business.

- Gan Zhiwen: Group COO, overseeing operations and corporate development.

Financials:

Sea Limited revenue surged from approximately $2.18 billion to $13.08 billion, marking a remarkable compound annual growth rate (CAGR) of about 43.7%. This growth trajectory reflects Sea Limited’s successful expansion of its gaming and e-commerce segments, particularly through its flagship platforms such as Garena and Shopee. The company’s revenue growth has been driven by increased user engagement and a broader market reach, capitalizing on the digital transformation trends in the region.

The net income has losses widening from $1.36 billion in 2019 to around $1.52 billion in 2022 before showing signs of improvement in 2023 with a net income of approximately $563 million. The CAGR for net income over this period is approximately -10.5%, indicating ongoing operational challenges as the company invests heavily in growth initiatives while navigating competitive pressures and market dynamics.

Sea Limited reflects its aggressive growth strategy, characterized by substantial investments in technology and infrastructure. The Total assets were reported at approximately $18.88 billion, supported by a robust cash position of around $6.60 billion. Total liabilities also increased significantly over the years, reaching about $11.19 billion, which includes long-term debt obligations that have risen as the company funds its expansion efforts. This leverage indicates a strategic choice to finance growth through debt while maintaining liquidity for operational flexibility.

The company’s ability to manage its balance sheet effectively while continuing to invest in its core business segments will be crucial for sustaining its competitive edge and achieving long-term profitability in an evolving digital landscape.

Technical Analysis:

The stock has formed a strong base on the monthly chart, moving up over 100% from the $40s to $97 in less than 3 months. The weekly chart has a stage 2 markup (bullish), but the daily chart is showing fatigue and a move back to $90s which would be a great entry for a 3-6 month hold to $110 range.

Bull Case:

Integrated Ecosystem: Sea Limited’s unique ability to offer a comprehensive ecosystem of digital services provides a significant competitive advantage. By integrating digital entertainment, e-commerce, and digital financial services, the company can cross-sell products and services, drive customer loyalty, and generate synergies between different business lines.

Favorable Regulatory Environment: The Southeast Asian governments have generally been supportive of the growth of the digital economy, creating a favorable regulatory environment for companies like Sea Limited. This supportive regulatory framework provides a positive backdrop for the company’s operations.

Bear Case:

Regulatory Risks: The regulatory landscape for technology companies in Southeast Asia can be complex and subject to change. Increased regulatory scrutiny or unfavorable regulations could pose challenges for Sea Limited’s operations.

Economic Downturns: Economic downturns or recessions can impact consumer spending and advertising budgets, which could negatively affect Sea Limited’s revenue.

Valuation Concerns: Sea Limited’s stock has experienced significant growth in recent years, raising concerns about its valuation. If the company fails to meet investor expectations or if the broader market experiences a correction, the stock could be vulnerable to a decline.