Executive Summary:

Tradeweb Markets Inc. is a leading global provider of electronic trading platforms for a wide range of financial instruments, including bonds, interest rate derivatives, equities, and exchange-traded funds. The company operates in multiple markets worldwide and offers a variety of trading solutions to institutional investors, such as buy-side firms, sell-side firms, and hedge funds. Tradeweb’s platform provides clients with access to a large pool of liquidity, efficient execution, and transparent pricing information.

Tradeweb Markets Inc. recently reported its earnings per share (EPS) of $1.73, which surpassed analysts’ expectations of $1.71. The company’s revenue for the quarter was $1.34 billion, reflecting a growth of 8% compared to the same period last year.

Stock Overview:

| Ticker | $TW | Price | $133.53 | Market Cap | $31.55B |

| 52 Week High | $134.44 | 52 Week Low | $80.95 | Shares outstanding | 116.29M |

Company background:

Tradeweb Markets Inc. is a leading global provider of electronic trading platforms for a wide range of financial instruments, including bonds, interest rate derivatives, equities, and exchange-traded funds (ETFs). Founded in 1996 by Bill Ahearn, Stephen Bartels, and Christopher Walsh, Tradeweb pioneered the use of electronic trading in the fixed income market. The company initially focused on trading U.S. Treasury bonds but has since expanded its offerings to include a diverse array of financial instruments.

Tradeweb has a strong track record of innovation and growth. It has also expanded its geographic reach, establishing operations in key financial centers around the world. Tradeweb also offers data and analytics services to help clients make informed trading decisions. They face competition from other electronic trading platforms, including Bloomberg, E*TRADE, and Interactive Brokers. Tradeweb has a strong market position and a reputation for innovation, which gives it a competitive advantage.

Tradeweb Markets Inc. is headquartered in New York City, with offices in London, Singapore, Sydney, Tokyo, and other major financial centers.

Recent Earnings:

Tradeweb Markets Inc. reported a revenue of $1.34 billion, which marks a growth of approximately 8% from the previous year. They had forecasted revenue of around $1.30 billion. The consistent growth in revenue can be attributed to Tradeweb’s expanding client base and its ability to enhance trading technology across various asset classes, particularly in fixed income and derivatives.

Earnings per share (EPS) reported of $1.73, surpassing analysts’ projections of $1.71. This represents an increase of about 15% compared to the prior year’s EPS of $1.50. The growth in earnings is indicative of the company’s operational efficiency and strategic investments that have bolstered its profitability. Tradeweb’s focus on improving its platforms and expanding its product offerings has resonated well with clients, contributing to this upward trend in earnings.

Tradeweb’s effectiveness in managing costs while driving revenue growth. The company reported an operating income margin of approximately 37%, showcasing its ability to maintain profitability amidst rising operational expenses. Its liquidity position remains strong, with cash and cash equivalents increasing, allowing for continued investment in technology and infrastructure to support future growth.

Analysts expect the company to maintain a robust CAGR of around 10-12% over the next few years as it capitalizes on the digital transformation within financial markets. With a solid balance sheet and a commitment to innovation.

The Market, Industry, and Competitors:

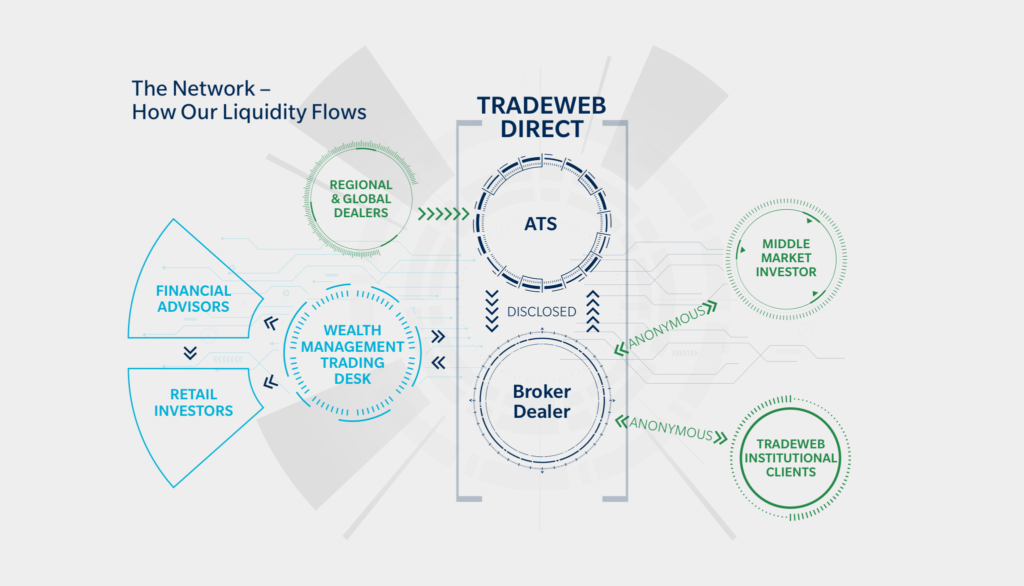

Tradeweb Markets Inc. operates in the electronic trading market, focusing on over-the-counter (OTC) marketplaces for various financial instruments, including fixed-income products, ETFs, and derivatives. The company serves a diverse clientele, including banks, asset managers, central banks, and insurance companies, providing them with advanced trading technology and liquidity solutions. Tradeweb’s platforms facilitate trading across multiple asset classes such as rates, credit, equities, and money markets, positioning it as a leader in the rapidly evolving fintech landscape.

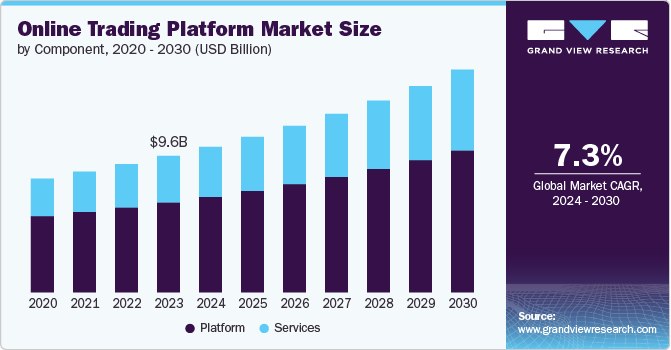

The electronic trading market is anticipated to experience significant growth. Analysts project a compound annual growth rate (CAGR) of approximately 7–10% from 2024 to 2030, fueled by advancements in technology and an increasing number of institutional investors embracing electronic platforms. Factors contributing to this growth include the rise of algorithmic trading, enhanced regulatory frameworks promoting transparency, and the ongoing digitization of financial services. Tradeweb’s strategic initiatives and continuous innovation in its trading solutions are expected to capitalize on these trends, further solidifying its market position as a key player in the future of electronic trading.

Unique differentiation:

Tradeweb Markets Inc. faces competition from a range of other electronic trading platforms, including Bloomberg, ETRADE, and Interactive Brokers. These competitors offer similar services to Tradeweb, such as providing clients with access to a variety of financial instruments and facilitating electronic trading. Bloomberg is a well-established financial data and software company that also offers an electronic trading platform. ETRADE is a popular online brokerage firm that caters to both retail and institutional investors. Interactive Brokers is a global online brokerage firm that offers a wide range of trading products and services.

Tradeweb also faces competition from specialized trading platforms that focus on specific asset classes or regions. These specialized platforms may have a deeper understanding of their specific markets and offer more tailored solutions to clients.

Deep Liquidity: Tradeweb offers access to a vast pool of liquidity, connecting clients with a wide range of market participants, including buy-side firms, sell-side firms, and hedge funds. This deep liquidity enhances price discovery and execution efficiency.

Broad Product Range: Tradeweb provides a comprehensive suite of trading solutions for a diverse range of financial instruments, including bonds, interest rate derivatives, equities, and exchange-traded funds. This breadth of offerings caters to the diverse needs of institutional investors.

Advanced Technology: Tradeweb leverages cutting-edge technology to deliver a robust and efficient trading platform. The company’s platform incorporates advanced features such as algorithmic trading, pre-trade analytics, and post-trade processing, empowering clients with sophisticated tools for informed decision-making.

Management & Employees:

Lee Odell: CEO

Alexander L. Pack: President and Chief Operating Officer

Kevin P. McPartland: Chief Technology Officer

Christopher G. Walsh: Co-Founder and Executive Chairman

Financials:

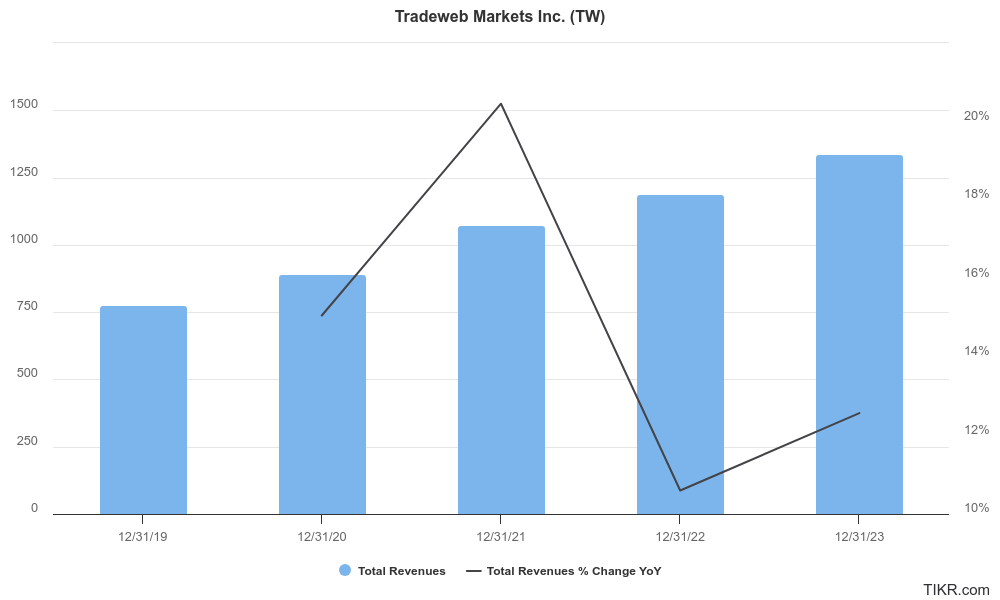

Tradeweb Markets Inc. has reported revenues of approximately $775.6 million, which increased to $1.34 billion by 2023, representing a compound annual growth rate (CAGR) of around 12.5%. This growth can be attributed to Tradeweb’s strategic expansion in electronic trading across various asset classes, as well as its ability to capture increasing market share amid a shift toward digital platforms in the financial services industry.

The net income rose from $225.3 million in 2019 to $547.9 million in 2023, reflecting a CAGR of approximately 16.3%. The earnings per share (EPS) followed a similar trajectory, increasing from $1.17 in 2019 to $1.73 in 2023. This consistent earnings growth underscores Tradeweb’s operational efficiency and its successful implementation of technology-driven solutions that enhance trading experiences for its clients.

Tradeweb has maintained a solid financial position with total assets growing from about $4.5 billion in 2019 to approximately $7 billion in 2023. The company’s liquidity remains strong, with cash and cash equivalents increasing significantly over the years, allowing for strategic investments and acquisitions to bolster its market position. Tradeweb has effectively managed its liabilities, ensuring that its debt levels remain manageable relative to its equity and cash flow.

Tradeweb Markets Inc. reflects a well-executed growth strategy that leverages technological advancements and market trends toward electronic trading. It is well-positioned for future growth in an increasingly digital financial landscape.

Technical Analysis:

This is one of the strongest stocks in the market for the short to medium term, with a move to the $150 range by earnings. The monthly, weekly and daily charts are all bullish and positive. The best move is to wait for a entry at the $128 range and hold to $150s

Bull Case:

Robust Financial Performance: Tradeweb has a strong track record of financial performance, with consistent revenue and earnings growth. The company’s balance sheet is also healthy, providing it with the financial flexibility to invest in growth initiatives.

Diversified Revenue Streams: Tradeweb’s revenue is generated from a variety of financial instruments, reducing its reliance on any single product or market. This diversification helps to mitigate risk and ensure stable growth.

Bear Case:

Regulatory Risks: The financial services industry is subject to a complex regulatory environment. Changes in regulations could impact Tradeweb’s business model, increase compliance costs, and limit its ability to innovate.

Technological Disruption: The rapid pace of technological change could disrupt the electronic trading industry. New technologies or disruptive business models could challenge Tradeweb’s existing products and services.

Valuation Concerns: Tradeweb’s stock price may be subject to fluctuations based on market sentiment and investor expectations. If the company’s valuation becomes stretched relative to its growth prospects, there may be a risk of a correction.