Executive Summary:

Akamai Technologies Inc. is a global content delivery network (CDN) provider that delivers content and applications to users worldwide. The company’s network spans thousands of servers across multiple countries, ensuring fast and reliable delivery of digital content. Akamai’s services are used by various industries, including e-commerce, media streaming, gaming, and enterprise applications. Through its advanced technology and extensive network, Akamai helps businesses improve their website performance, enhance user experiences, and protect against cyber threats.

Akamai Technologies reported revenue reaching $980 million, a 5% increase year-over-year. Earnings per share (EPS) also exceeded forecasts, reaching $0.86.

Stock Overview:

| Ticker | $AKAM | Price | $100.78 | Market Cap | $15.27B |

| 52 Week High | $129.17 | 52 Week Low | $87.59 | Shares outstanding | 151.53M |

Company background:

Akamai Technologies Inc. was founded in 1998 by Daniel Lewin, Tom Leighton, and Matthew Stone. The company’s mission was to create a global platform for delivering content and applications to users worldwide. In 1999, Akamai received $12 million in funding from venture capital firms, including Charles River Ventures and Benchmark Capital. This funding enabled the company to build and expand its content delivery network (CDN).

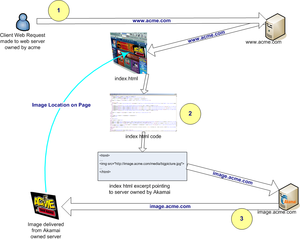

Akamai’s primary product is its CDN, which consists of thousands of servers strategically located across the globe. This network allows Akamai to deliver content and applications to users quickly and reliably, regardless of their geographic location.

Akamai also offers a suite of security solutions, including DDoS protection, web application firewall (WAF), and bot management. These solutions help businesses protect their websites and applications from cyber threats. Akamai provides performance optimization services, which help businesses improve the speed and reliability of their websites and applications.

Akamai’s key competitors include Cloudflare, Fastly, and Limelight Networks. These companies also offer CDN and security solutions, and they compete with Akamai for market share. Akamai’s headquarters are located in Cambridge, Massachusetts, United States.

Recent Earnings:

Akamai Technologies reported revenue for the quarter reached $980 million, a 5% increase year-over-year. This growth was driven by increased demand for Akamai’s content delivery network (CDN) and security solutions. EPS also exceeded forecasts, coming in at $0.86. The company’s ability to consistently outperform analyst expectations demonstrates its strong market position and execution capabilities.

The company’s customer base continued to expand, with a growing number of businesses relying on Akamai’s solutions to improve their digital experiences. Akamai’s network infrastructure remained robust, ensuring reliable and high-performance content delivery.

Akamai’s management expressed confidence in the company’s future prospects. The company expects continued growth in its core businesses, driven by increasing demand for digital content and the growing importance of cybersecurity.

The Market, Industry, and Competitors:

Akamai Technologies operates in the global content delivery network (CDN) and cybersecurity market. The CDN market is increasing demand for digital content, the proliferation of mobile devices, and the growing importance of cloud computing. The global CDN market is projected to reach $43.73 billion by 2030, registering a compound annual growth rate (CAGR) of 16.2% during the forecast period (2023-2030).

Akamai is well-positioned to benefit from the growth of the CDN market. The company’s extensive network infrastructure and advanced technology enable it to deliver content and applications to users quickly and reliably. Akamai’s security solutions help businesses protect their websites and applications from cyber threats, which is becoming increasingly important as the digital landscape evolves.

Unique differentiation:

Cloudflare: Cloudflare is a global cloud platform that offers a range of services, including CDN, DDoS protection, and web application firewall (WAF). The company has experienced rapid growth in recent years and is considered a major competitor to Akamai.

Fastly: Fastly is another CDN provider that offers a variety of services, including edge computing and video streaming. The company has a strong focus on performance and scalability and is gaining market share in the CDN market.

Limelight Networks: Limelight Networks is a global CDN and cloud services provider that offers a range of solutions for content delivery, video streaming, and edge computing. The company has a strong presence in the media and entertainment industry.

Advanced Technology and Innovation: Akamai invests heavily in research and development to stay ahead of the curve. Its proprietary technologies, such as Intelligent Platform Edge (IPE), enable it to deliver dynamic content, optimize performance, and provide advanced security features.

Deep Domain Expertise: With years of experience in the CDN and cybersecurity industries, Akamai has developed a deep understanding of the unique challenges faced by businesses. This expertise allows it to offer tailored solutions and provide expert guidance.

Comprehensive Security Suite: In addition to its CDN services, Akamai offers a comprehensive suite of security solutions, including DDoS protection, web application firewall (WAF), and bot management. This enables businesses to protect their websites and applications from a wide range of cyber threats.

Management & Employees:

Tom Leighton: Co-Founder, Chairman, and Chief Executive Officer

George Partridge: President and Chief Operating Officer

Michael O’Brien: Chief Technology Officer

Ed McLaughlin: Chief Marketing Officer

Financials:

Akamai Technologies Inc. has reported revenue of approximately $2.89 billion, which increased to about $3.81 billion in 2023, reflecting a compound annual growth rate (CAGR) of approximately 9.4%. This growth can be attributed to Akamai’s strategic investments in its cloud services and security solutions, which have become increasingly vital as digital transformation accelerates across industries.

Net income rose from about $532 million in 2019 to approximately $653 million in 2023, resulting in a CAGR of around 4.4%. This increase in profitability is indicative of Akamai’s effective cost management strategies and operational efficiencies, despite fluctuations in operating expenses. The company’s earnings per share (EPS) improved from $2.94 to $3.59 over the same timeframe, underscoring its commitment to delivering shareholder value.

Akamai has maintained a robust financial position. Total assets were approximately $9.9 billion, with total liabilities of about $4.5 billion, resulting in a solid equity base that supports ongoing investments and growth initiatives. The company’s cash and cash equivalents stood at around $489 million, providing ample liquidity for operational needs and potential acquisitions. The company’s strategic focus on enhancing its service offerings and expanding its market presence positions it well for continued success in the competitive technology landscape.

Technical Analysis:

The monthly chart is moderately bullish in a stage 2 (markup) as is the weekly chart, with support at $87 and resistance at $109. The daily chart shows a lot of resistance in the $103 range, where it might fall to the $96 area. Short term this stock is not a good option to go long.

Bull Case:

Growing Demand for Digital Content: The increasing consumption of digital content, driven by factors such as the rise of streaming services, e-commerce, and mobile devices, is expected to drive demand for Akamai’s services.

Importance of Cybersecurity: As cyber threats become more sophisticated, businesses are investing heavily in security solutions. Akamai’s comprehensive security offerings can help protect organizations from attacks.

Favorable Industry Trends: The CDN market is expected to experience significant growth in the coming years, driven by factors such as the increasing demand for digital content and the growing importance of cloud computing.

Bear Case:

Technological Disruption: Rapid technological advancements could render Akamai’s current products and services obsolete. The emergence of new technologies or disruptive business models could pose a threat to the company’s competitive position.

Economic Downturn: A global economic downturn could lead to reduced spending on technology, impacting Akamai’s revenue and profitability.

Regulatory Challenges: Changes in regulatory policies, such as data privacy laws or internet governance, could create additional challenges for Akamai’s operations.