Executive Summary:

Samsara Inc. is a leading provider of connected operations technology, offering software and insights for physical operations. The company connects physical operations data to its cloud platform, providing valuable insights for businesses across various industries. With a focus on safety, efficiency, and sustainability, Samsara’s solutions help organizations optimize their operations and make data-driven decisions.

Samsara Inc. reported revenue reaching $270.9 million, up 29% year-over-year. Earnings per share (EPS) came in at -$0.04.

Stock Overview:

| Ticker | $IOT | Price | $49.75 | Market Cap | $27.62B |

| 52 Week High | $49.81 | 52 Week Low | $21.48 | Shares outstanding | 224.05M |

Company background:

Samsara Inc., a leading provider of connected operations technology, was founded in 2015 by Sanjit Biswas and John Bicket. Prior to Samsara, Biswas and Bicket co-founded Meraki, a successful cloud networking company that was acquired by Cisco Systems in 2012. Samsara has raised significant funding, including a Series E round in 2021 that valued the company at over $11 billion.

Samsara offers a comprehensive suite of products designed to improve the safety, efficiency, and sustainability of physical operations. The company’s flagship product is the Samsara Connected Operations Cloud, which collects and analyzes data from various sensors and devices to provide actionable insights. Samsara’s solutions are used by businesses across a wide range of industries, including transportation and logistics, construction, field services, manufacturing, retail, and the public sector.

Key competitors of Samsara include Verizon Connect, Geotab, and Fleetmatics. Samsara’s competitive advantages include its focus on data-driven insights, its strong customer relationships, and its innovative product roadmap. The company is headquartered in San Francisco, California, with offices around the world.

Recent Earnings:

Samsara Inc. reported revenue for the quarter reached $270.9 million, up 29% year-over-year, driven by strong customer growth and increased adoption of its connected operations platform. Earnings per share (EPS) came in at -$0.04, slightly missing estimates but reflecting continued investments in growth initiatives.

- Customer growth: Samsara added over 3,200 new customers, bringing its total customer base to approximately 37,700.

- Subscription revenue growth: Subscription revenue, which accounted for 92% of total revenue, grew 32% year-over-year.

Samsara reaffirmed its full-year fiscal 2025 guidance, projecting revenue from $1.075 billion to $1.095 billion, representing year-over-year growth of 28% to 30%.

The Market, Industry, and Competitors:

Samsara Inc. operates in the rapidly growing market for connected operations technology. This market is driven by the increasing adoption of Internet of Things (IoT) devices, advancements in data analytics, and the growing need for businesses to improve their operational efficiency and safety. The connected operations market is expected to experience significant growth in the coming years, driven by factors such as the increasing adoption of digital technologies, the growing focus on sustainability, and the rising demand for real-time data and analytics.

The connected operations market is expected to grow at a Compound Annual Growth Rate (CAGR) of 15-20% between 2024 and 2030. This growth is expected to be driven by several factors, including the increasing adoption of IoT devices, the growing demand for data-driven insights, and the rising focus on safety and sustainability. Samsara is well-positioned to capitalize on the growth opportunities in the connected operations market, thanks to its strong product portfolio, its focus on innovation, and its deep domain expertise.

Unique differentiation:

Verizon Connect: Verizon Connect is a leading provider of connected vehicle solutions, offering a wide range of products for fleet management, driver safety, and mobile workforce management.

Geotab: Geotab is a global leader in connected transportation and fleet management solutions, offering a variety of products for tracking, monitoring, and optimizing fleets.

Fleetmatics: Fleetmatics is a provider of fleet management solutions, offering products for tracking, monitoring, and improving the efficiency of fleets

Samsara’s competitors also include a number of smaller companies that offer specialized fleet management solutions. These companies may have a narrower focus than Samsara, but they can still be competitive in certain markets.

Samsara’s competitive advantages include its focus on data-driven insights, its strong customer relationships, and its innovative product roadmap.

Samsara Inc. differentiates itself from its competitors through its focus on data-driven insights. Its platform is designed to collect and analyze vast amounts of data from various sensors and devices, providing businesses with actionable insights that can help them improve their operations. This focus on data analytics gives Samsara a competitive edge by enabling its customers to make more informed decisions and optimize their operations.

Management & Employees:

- Sanjit Biswas serves as the CEO and co-founder, overseeing the overall direction and strategy of the company.

- John Bicket is the CTO and co-founder, responsible for Samsara’s innovative technology and product development.

- Kiren Sekar: Chief Product Officer.

- Ben Calderon: CTO, Hardware, Operations & Supply Chain.

- Meagen Eisenberg: Chief Marketing Officer.

Financials:

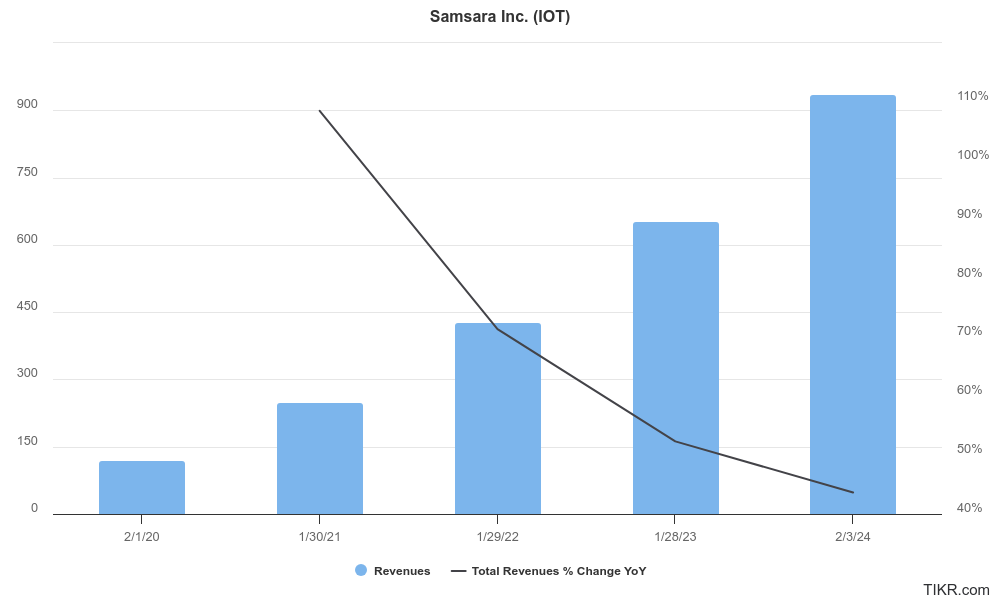

Samsara Inc., a leader in IoT solutions, has reported revenues of approximately $119.9 million. They surged to around $937.4 million by January 31, 2024, reflecting a compound annual growth rate (CAGR) of approximately 51.6%. This impressive growth trajectory highlights Samsara’s ability to capitalize on the increasing demand for IoT technologies across various industries, particularly in fleet management and environmental monitoring.

The company reported with net loss of about $224.9 million in 2020, narrowing to approximately $286.7 million by 2024. The CAGR for net income over this period is negative, indicating ongoing operational challenges as the company invests heavily in research and development and sales expansion to capture market share.

Samsara’s balance sheet reflects its growth strategy, with total assets increasing significantly from around $631 million in 2020 to approximately $1.74 billion in 2024. This increase is primarily driven by cash and cash equivalents, which rose from about $201 million to over $135 million, alongside substantial investments in property and equipment. The company’s liabilities have also grown, with total liabilities reaching approximately $915 million by 2024, up from about $539 million in 2020.

The growing debt levels raise questions about financial sustainability as the company continues to operate at a loss. While Samsara Inc. demonstrates robust revenue growth and a solid market position in the IoT sector, its financial performance is tempered by ongoing net losses and increasing liabilities.

Technical Analysis:

The stock is on a stage 2 markup on the monthly and daily chart. On the daily chart it is looking to consolidate in this$46 -$48 zone and likely would be a good entry in the $38-$42 zone for the long term. The near term outlook is for the stock to go lower before it heads higher.

Bull Case:

Product Innovation: Samsara has a history of product innovation, consistently introducing new features and capabilities to its connected operations platform. This innovation helps the company stay ahead of its competitors and attract new customers.

Data-Driven Insights: Samsara’s platform is designed to provide businesses with valuable data-driven insights that can help them improve their operations. This focus on analytics differentiates the company from its competitors and offers a compelling value proposition to customers.

Scalability: Samsara’s business model is highly scalable, allowing the company to efficiently serve a large number of customers without significantly increasing costs. This scalability can contribute to strong profitability as the company’s customer base grows.

Bear Case:

Economic Downturns: Economic downturns can impact customer spending and demand for connected operations technology. If the economy weakens, businesses may reduce their investments in technology, which could negatively impact Samsara’s revenue growth.

Regulatory Risks: The regulatory environment for connected operations technology is evolving, and changes in regulations could impact Samsara’s business operations. For example, new privacy regulations or data security requirements could impose additional costs or restrictions on the company.

Execution Risk: Samsara’s success depends on its ability to execute on its growth strategy. If the company fails to effectively scale its operations, develop new products, or attract and retain top talent, it could face challenges in achieving its financial goals.