Executive Summary:

First Solar Inc. is a global leader in solar technology, specializing in the production of thin-film photovoltaic (PV) modules. The company is committed to providing sustainable and efficient solar energy solutions to combat climate change. First Solar’s modules offer a competitive alternative to traditional crystalline silicon panels.

First Solar Inc. reported earnings per share (EPS) of $3.25. Revenue for the quarter reached $1.01 billion.

Stock Overview:

| Ticker | $FSLR | Price | $246.26 | Market Cap | $26.36B |

| 52 Week High | $306.77 | 52 Week Low | $129.22 | Shares outstanding | 107.05M |

Company background:

First Solar Inc. was founded in 1988 by Harold McMaster, Paul Allen, and Robert Swanson. The company initially focused on research and development of thin-film solar technology. In 1999, First Solar secured significant funding from Kleiner Perkins Caufield & Byers, which played a crucial role in scaling up its operations and commercializing its technology.

First Solar’s primary product is thin-film photovoltaic (PV) modules. These modules are made from cadmium telluride (CdTe) material, known for its high efficiency and durability. First Solar’s manufacturing facilities are located in the United States, contributing to domestic economic growth and energy independence.

The solar energy industry is highly competitive, with several major players vying for market share. Key competitors of First Solar include JinkoSolar, Trina Solar, Canadian Solar, and Hanwha Q CELLS. These companies offer a variety of solar products, including crystalline silicon modules, which compete directly with First Solar’s thin-film technology. First Solar has established a strong reputation for its innovative technology and high-quality products, positioning itself as a leading player in the industry.

First Solar’s headquarters is located in Tempe, Arizona, United States. The company maintains a global presence with offices and manufacturing facilities in various regions.

Recent Earnings:

First Solar Inc. reported revenue of $1.01 billion, representing a substantial increase compared to the previous year. This growth was driven by higher module shipments and increased average selling prices. Earnings per share (EPS) reached $3.25, surpassing market forecasts by a significant margin. First Solar’s operational metrics were also impressive, with the company achieving a record-high quarterly module production capacity.

The company’s performance was fueled by robust demand for its high-quality thin-film solar modules. The ongoing transition to cleaner energy sources and favorable government policies supporting renewable energy initiatives have created a favorable environment for First Solar’s growth. First Solar’s strong financial position, technological leadership, and strategic focus on sustainable energy solutions position it well for continued success.

The Market, Industry, and Competitors:

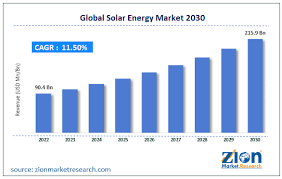

First Solar operates in the global solar energy market, a rapidly growing industry driven by increasing demand for clean and sustainable energy sources. The market is characterized by a diverse range of players, including module manufacturers, system integrators, and developers. Government policies, technological advancements, and rising energy costs are key factors driving the growth of the solar energy market.

Global solar energy capacity is expected to expand substantially, driven by factors such as increasing government incentives, falling costs, and growing awareness of the environmental benefits of solar power. The global solar power station market was valued at approximately $139.49 billion in 2022 and is projected to reach $383.82 billion by 2030, reflecting a robust CAGR of 11.00% – 13.68% from 2023 to 2030. As the company’s high-quality thin-film modules are well-positioned to meet the growing demand for solar energy solutions. First Solar’s strong brand, technological leadership, and commitment to sustainable energy solutions provide it with a competitive advantage.

Unique differentiation:

First Solar faces competition from several major players in the solar energy industry. Key competitors include JinkoSolar, Trina Solar, Canadian Solar, and Hanwha Q CELLS. These companies offer a variety of solar products, including crystalline silicon modules, which compete directly with First Solar’s thin-film technology. JinkoSolar and Trina Solar are among the largest solar module manufacturers globally, known for their extensive product portfolios and strong market presence. Canadian Solar and Hanwha Q CELLS are also significant players with a focus on both crystalline silicon and thin-film technologies.

The competitive landscape in the solar energy industry is dynamic, with new players and technologies emerging regularly. First Solar’s ability to differentiate itself through its innovative thin-film technology, high-quality products, and strong manufacturing capabilities is crucial for maintaining its market position and competing effectively against established rivals.

Higher efficiency: CdTe modules can achieve higher energy conversion rates compared to traditional crystalline silicon modules, resulting in more energy production per unit area.

Lower temperature sensitivity: CdTe modules are less affected by high temperatures, allowing them to maintain performance in hotter climates.

Reduced manufacturing costs: The manufacturing process for CdTe modules is generally less complex and energy-intensive than that of crystalline silicon modules, leading to lower production costs.

Flexibility: CdTe modules can be produced in various sizes and shapes, making them suitable for a wider range of applications.

Management & Employees:

- Mark Widmar: Chief Executive Officer and Director

- Jason Dymbort: Executive Vice President

- Kuntal Verma: Chief Manufacturing Officer

- Richard Romero: Vice President of Investor Relations and Treasurer

Financials:

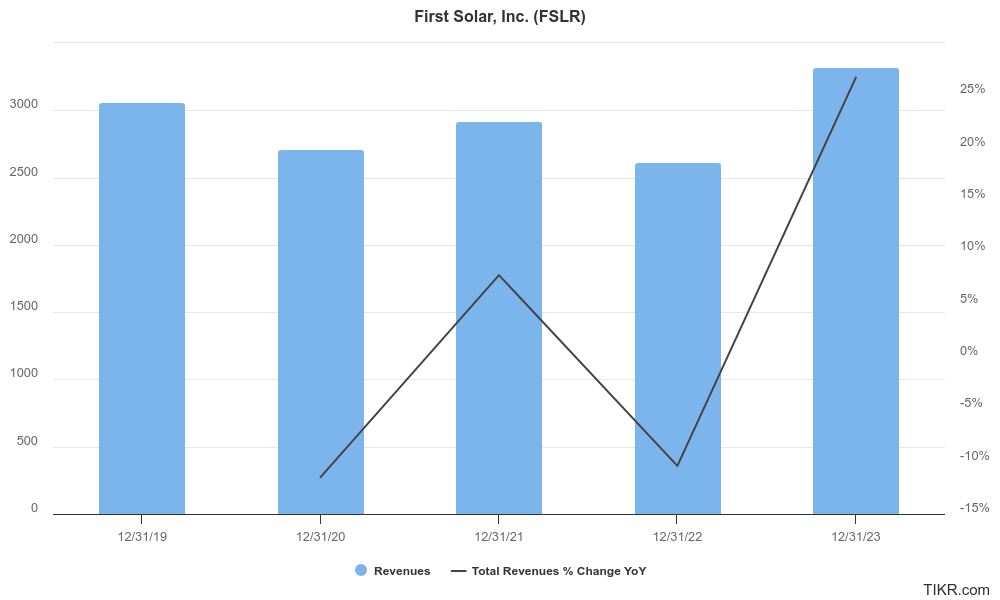

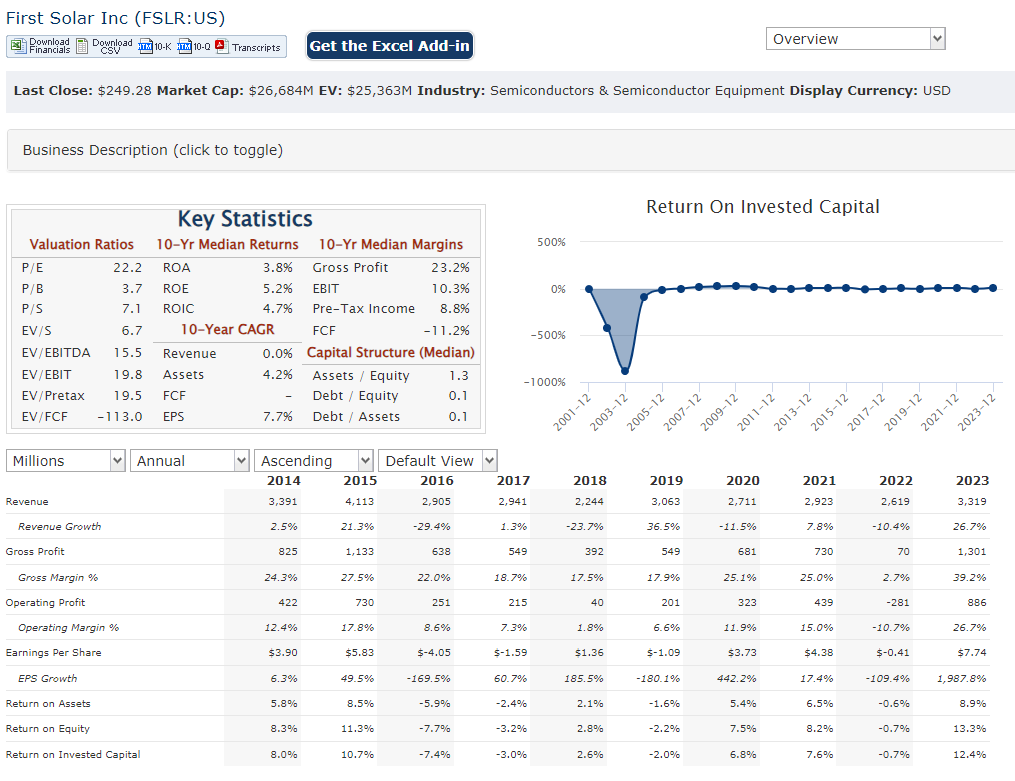

First Solar Inc. revenue grew at an average annual rate of approximately 4.3%, influenced by various factors including market demand, production capacity, and external economic conditions. They reported revenues of approximately $3.32 billion.

First Solar’s performance has been more impressive, with earnings before interest, taxes, depreciation, and amortization (EBITDA) growing at an average annual rate of 35% over the same period. This substantial increase highlights the company’s ability to enhance operational efficiency and reduce production costs effectively. Their net income surged to around $831 million as a strong positioning in the renewable energy sector. Analysts forecast continued growth in earnings, with estimates suggesting a CAGR of 27% for earnings through 2030.

First Solar has maintained a solid financial position characterized by strong liquidity and manageable debt levels. As of mid-2024, the company reported total assets of approximately $5.1 billion, with a current ratio indicating healthy short-term financial stability. With ongoing projects and a backlog extending through 2030, First Solar is well-positioned to capitalize on the increasing demand for solar energy solutions.

First Solar’s growth potential remains promising as it continues to adapt to market dynamics and invest in new technologies. With expectations for revenue growth accelerating to around 17.1% annually and earnings per share projected to grow by 26.5%, the company is poised to benefit from macroeconomic trends favoring renewable energy adoption.

Technical Analysis:

The stock has built a strong and large inconsistent base on the monthly chart. It is a very volatile stock and the phase 3 consolidation seems bearish, but on the weekly chart it is on a stage 2 (bullish) markup. The daily chart is pointing a move down to the 100 day Moving average at $223, which will be a good point to enter the stock for a long term move back to $283 zone.

Bull Case:

Technological leadership: First Solar’s focus on thin-film technology offers unique advantages over traditional crystalline silicon modules, including higher efficiency, lower temperature sensitivity, and reduced manufacturing costs. This technological edge positions the company to maintain a competitive advantage in the market.

Operational excellence: First Solar has demonstrated a strong track record of operational efficiency and cost management. The company’s manufacturing facilities are highly productive, enabling it to produce high-quality modules at competitive costs.

Bear Case:

Supply chain disruptions: The solar energy industry relies on a complex supply chain, involving various materials and components. Disruptions in the supply chain, such as shortages of raw materials or manufacturing capacity constraints, could impact First Solar’s production and profitability.

Regulatory risks: Government policies and regulations play a significant role in the solar energy market. Changes in government incentives, tariffs, or trade policies could create uncertainty and potentially impact First Solar’s business.

Execution risks: Successfully executing on growth strategies, managing operational challenges, and navigating a rapidly changing market environment can be complex. If First Solar faces execution difficulties, it could impact its financial performance.