Executive Summary:

Textron Inc. is a global industrial conglomerate with a diversified portfolio of businesses. From aircraft and defense to specialized vehicles and turf care, Textron offers innovative products and services worldwide. . Textron’s commitment to excellence, innovation, and customer satisfaction has propelled it to the forefront of the global market.

Textron Inc. revenue reached $ 3.4 billion for the quarter, a 9% increase compared to the same period last year. Earnings per share (EPS) came in at $1.07.

Stock Overview:

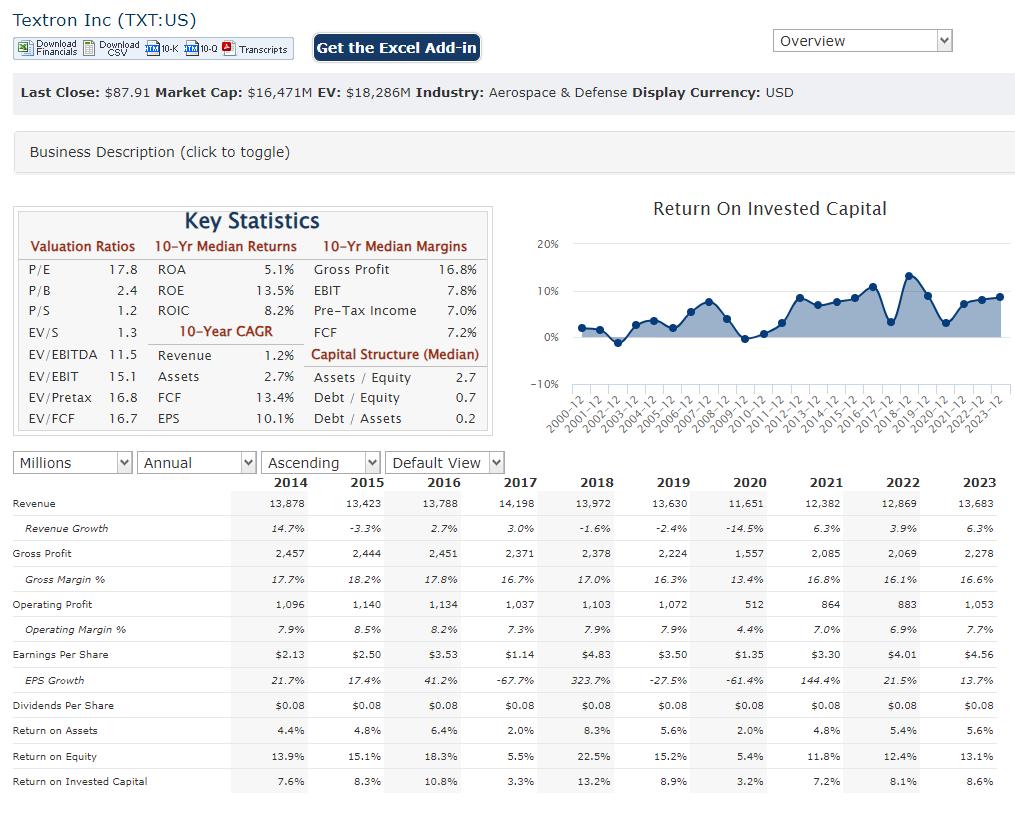

| Ticker | $TXT | Price | $87.26 | Market Cap | $16.35B |

| 52 Week High | $97.34 | 52 Week Low | $74.13 | Shares outstanding | 187.36M |

Company background:

Textron Inc., a global industrial conglomerate, traces its roots back to 1923 when Royal Little founded the Special Yarns Company in Boston. Through strategic acquisitions and organic growth, Textron has expanded into a diversified portfolio of businesses operating across aerospace, defense, specialized vehicles, and turf care. The company’s journey has been marked by significant milestones, including the acquisition of Bell Helicopter in 1960 and Cessna Aircraft in 1985.

Textron’s diverse product offerings span a wide range, from military helicopters and fighter jets to business aircraft, armored vehicles, and golf carts. The company’s well-known brands, such as Bell, Cessna, Beechcraft, E-Z-GO, and Arctic Cat, are synonymous with innovation and quality. With a strong focus on research and development, Textron continuously invests in cutting-edge technologies to meet the evolving needs of its customers.

Headquartered in Providence, Rhode Island, Textron has a global presence with operations in over 25 countries. The company competes with other major industrial conglomerates, including General Dynamics, Lockheed Martin, and Northrop Grumman, in the aerospace and defense sectors. In the specialized vehicles market, Textron faces competition from Polaris Industries and Yamaha Motor Company.

Recent Earnings:

Textron Inc. recently reported revenue reached $3.4 billion for the quarter, representing a 9% increase compared to the same period last year. This growth was driven by strong performance across all business segments, with particular strength in aviation and defense. Earnings per share (EPS) came in at $1.07, exceeding market estimates by $0.02.

The company’s segments remained healthy, indicating continued demand for Textron’s products and services. The company’s operating margin expanded to 11.1%, reflecting improved efficiency and cost management. Free cash flow was strong at $311 million.

Textron expressed confidence in its ability to deliver continued growth and profitability. The projected revenue is in the range of $13.2 billion to $13.6 billion and EPS is between $3.85 and $4.05.

The Market, Industry, and Competitors:

Textron Inc. operates in a diverse range of markets, including aerospace and defense, specialized vehicles, and turf care. The company’s products and services are used by various customers, from military and government agencies to businesses and individual consumers. The markets in which Textron operates are characterized by a mix of steady growth, technological advancements, and increasing global competition.

The low-speed vehicle market, which includes golf carts, recreational and utility vehicles, and light vehicles, is projected to grow from USD 11.1 billion in 2024 to USD 16.3 billion by 2030, at a CAGR of 6.6%. Textron’s E-Z-GO brand has been at the forefront of this market, recently launching a street-legal low-speed vehicle that meets all National Highway Traffic Safety Administration standards.

Textron is a key player, offering products such as the Bell helicopter and Textron Systems’ defense and aerospace solutions. The global military aviation market size was valued at USD 31.56 billion in 2022 and is projected to reach USD 45.40 billion by 2030, growing at a CAGR of 5.30% from 2023 to 2030.

Unique differentiation:

Textron Inc. faces competition from a variety of companies across its different business segments. In the aerospace and defense sector, major competitors include General Dynamics, Lockheed Martin, and Northrop Grumman. These companies offer a wide range of products and services, including military aircraft, missiles, and electronic systems. Textron also competes with smaller regional aircraft manufacturers, such as Embraer and Bombardier.

Textron competes with Polaris Industries and Yamaha Motor Company. These companies offer a range of products, including ATVs, side-by-sides, and snowmobiles. In the turf care market, Textron’s E-Z-GO brand competes with John Deere and Club Car. These companies offer golf carts, utility vehicles, and other turf care equipment.

Textron Inc.’s unique differentiation lies in its diverse portfolio of businesses and strong brand recognition. Textron’s ability to offer a wide range of products and services across multiple industries provides it with a competitive advantage.

Textron’s strong brand equity, particularly in the aerospace and defense sectors, gives it a reputation for quality, reliability, and innovation.

Management & Employees:

- Scott Donnelly: Chief Executive Officer and Chairman of the Board

- Mark Papa: President, Textron Aviation

- Dave Jones: President, Textron Specialized Vehicles

- Rick Huebner: President, Textron Industrial Solutions

Financials:

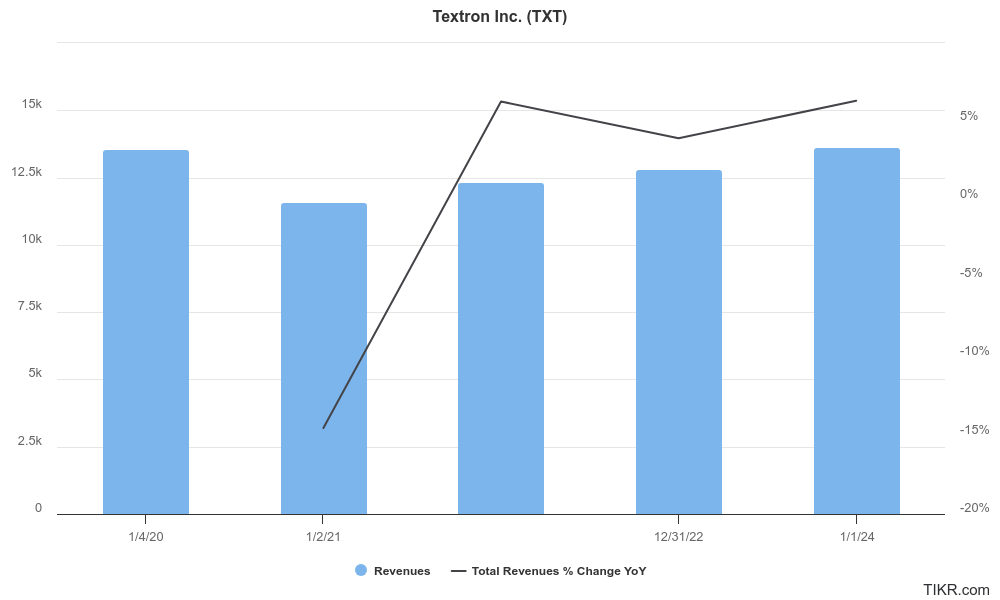

Textron Inc. revenue has exhibited a consistent upward trend, driven by robust demand in its key markets, such as aerospace and defense. This growth has been accompanied by a healthy compound annual growth rate $13.6 billion to $14.2 billion, representing a compound annual growth rate (CAGR) of 4.4% in revenue, indicating a sustainable trajectory. Textron’s core business segments, including Aviation, Bell, Textron Systems, and Industrial. Textron’s earnings growth has also been impressive, with net income rising from $767 million in 2019 to $927 million in 2023, a CAGR of 6.5%.

Textron has maintained a current assets of $7.4 billion and non-current assets of $9 billion as of 2023. The company’s cash and short-term investments stood at $1.3 billion, providing ample liquidity to fund growth initiatives and weather economic challenges. Textron’s long-term debt of $3.2 billion is manageable, and its strong cash flow generation allows it to maintain a healthy financial position. The company has consistently managed its debt levels, ensuring a manageable debt-to-equity ratio.

The company is well-positioned to capitalize on growth opportunities in its key markets, such as low-speed vehicles, military aviation, and ultralight and light aircraft. The company’s commitment to innovation and its global reach position it as a leader in these industries. Analysts project Textron’s stock to reach an average price of $184.54 by 2035, representing a 112.29% increasel.

Technical Analysis:

A stage 4 decline on the monthly chart and lots of resistance at the $97 range, with more decline in the weekly chart as well. The daily chart shows a slow decline in stage 4 to the $80 range. We would not be buyers here.

Bull Case:

Strong Brand Equity: The company’s well-established brands, such as Bell, Cessna, Beechcraft, E-Z-GO, and Arctic Cat, have a strong reputation for quality and innovation. This brand recognition enhances customer loyalty and provides a competitive advantage.

Growth Prospects in Key Markets: The aerospace and defense industries are expected to continue growing, driven by geopolitical factors, technological advancements, and increasing defense budgets. Textron’s position in these markets positions it for long-term growth.

Financial Strength: Textron has a solid financial foundation, with a strong balance sheet and consistent profitability. This financial strength provides the company with the resources to invest in growth initiatives and weather economic downturns.

Bear Case:

Geopolitical Risks: Increased geopolitical tensions or conflicts could lead to defense budget cuts or changes in procurement priorities, affecting Textron’s aerospace and defense businesses.

Supply Chain Disruptions: Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, could impact Textron’s manufacturing operations and lead to increased costs.

Technological Disruptions: Rapid advancements in technology could disrupt traditional business models or render certain products obsolete, requiring Textron to adapt quickly to stay competitive.